Market Definition

Dermatological drugs are used to treat diseases and disorders related to the skin, hair, and nails. These include creams, ointments, gels, tablets, or injections to manage conditions like acne, psoriasis, eczema, infections, and skin cancers.

The market involves the research, production, distribution, and sale of medications for skin-related conditions. It consists pharmaceutical companies, dermatology clinics, and drugstores that offer treatments for acne, eczema, psoriasis, and other skin disorders.

Dermatological Drugs Market Overview

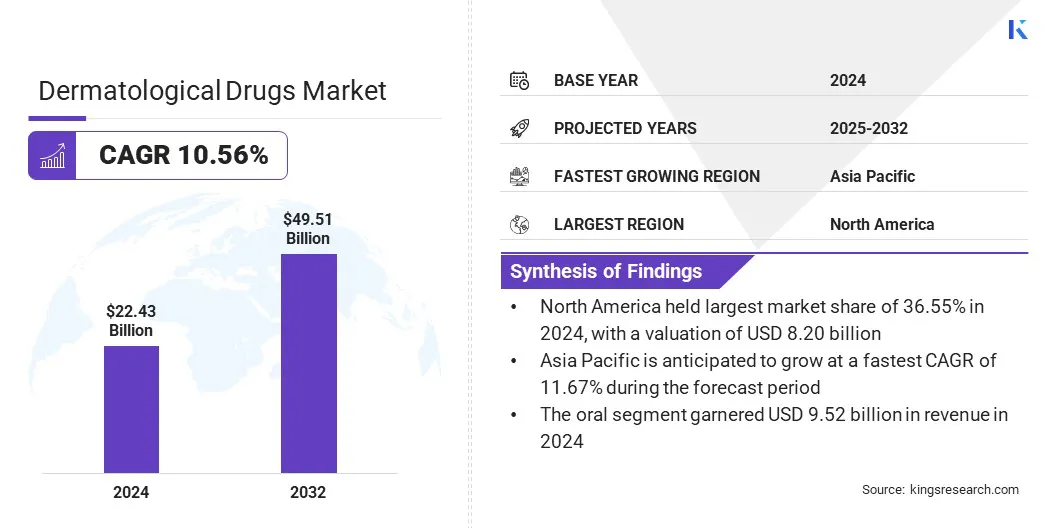

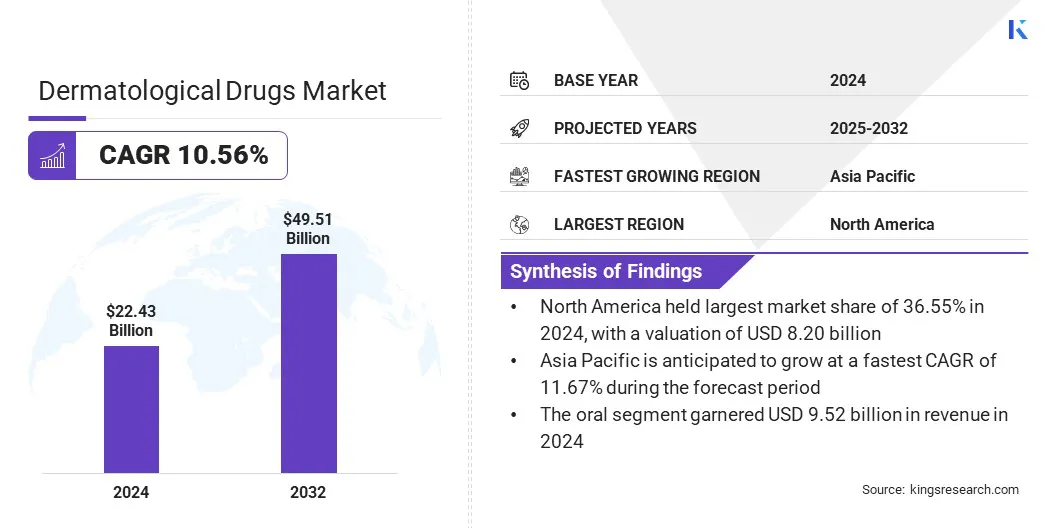

The global dermatological drugs market size was valued at USD 22.43 billion in 2024, which is estimated to be USD 24.51 billion in 2025 and reach USD 49.51 billion by 2032, growing at a CAGR of 10.56% from 2025 to 2032. The market is driven by the increased awareness and early diagnosis of skin infections.

Improved access to healthcare services, especially in emerging economies, is allowing more patients to seek timely medication, thereby boosting the demand for effective dermatological treatments.

Key Market Highlights:

- The dermatological drugs industry size was valued at USD 22.43 billion in 2024.

- The market is projected to grow at a CAGR of 10.56% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 8.20 billion.

- The corticosteroids segment garnered USD 7.32 billion in revenue in 2024.

- The psoriasis segment is expected to reach USD 17.66 billion by 2032.

- The oral segment held a market share of 42.45% in 2024.

- The e-commerce segment is anticipated to register a CAGR of 13.79% during the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 11.67% during the forecast period.

Major companies operating in the dermatological drugs market are AbbVie Inc., Pfizer Inc., GSK, Sun Pharmaceutical Industries Ltd., Galderma, Amgen Inc., Johnson & Johnson Services, Inc., Novartis AG, Eli Lilly and Company, Almirall, S.A, Bausch Health Companies Inc., Arcutis Biotherapeutics, Inc., Cutis Derma Care, Cipla, and Dr. Reddy’s Laboratories Ltd.

The dermatological drugs market is witnessing robust growth, due to the rising incidences of skin disorders, increased awareness of skin health, and advancements in treatment options. According to the American Academy of Dermatology Association, acne is the most common skin condition in the U.S., which affects up to 50 million Americans annually.

Additionally, atopic dermatitis impacts nearly 1 in 10 Americans of all ages, and is especially prevalent among children, affecting up to 1 in 5 individuals aged under 18 years. These high prevalence rates highlight the growing need for effective dermatological treatments and innovations in skin care therapeutics.

- In January 2024, Pfizer partnered with Glenmark to launch abrocitinib in India for treating moderate-to-severe atopic dermatitis. This oral, once-daily JAK1 inhibitor marketed as CIBINQO by Pfizer and JABRYUS by Glenmark, aims to provide faster symptom relief and long-term skin improvement for patients suffering from this chronic inflammatory skin condition.

The aging population, environmental factors, and lifestyle changes are contributing to the higher prevalence of conditions like eczema, psoriasis, and acne.

This expanding access to healthcare, growing demand for esthetic dermatology, and continuous innovation in drug formulations and biologics are further propelling the market, making it a significant segment within the global pharmaceutical industry.

Market Driver

Increased Awareness and Diagnosis

The market is driven by the rising awareness about skin health and the importance of early treatment. Campaigns by health organizations, digital health platforms, and government initiatives have contributed to better education and understanding of conditions like bacterial skin infections, acne, and eczema.

This has led to increased doctor consultations and earlier diagnoses. With healthcare infrastructure improving in rural and semi-urban areas, more individuals are able to access medical care, leading to higher demand for prescription and over-the-counter dermatological therapies, thereby propelling the market.

- In August 2024, Sun Pharma launched STARIZO (Tedizolid Phosphate) in India to treat acute bacterial skin and skin structure infections (ABSSSI). This once-daily oral therapy combats drug-resistant bacteria like Methicillin-resistant Staphylococcus aureus (MRSA), offering shorter treatment duration, broad gram-positive coverage, and no dose adjustments for elderly or renal-impaired patients, enhancing treatment convenience and outcomes.

Market Challenge

Side Effects and Drug Resistance

A key challenge witnessed by the dermatological drugs market is the side effects and drug resistance associated with treatments. These issues can reduce patient compliance and limit the effectiveness of therapies over time.

Pharmaceutical companies are developing targeted therapies with improved safety profiles and minimal adverse effects to address hese challenges.

Additionally, promoting rational prescribing practices, regular monitoring, and patient education on proper drug usage can help mitigate resistance and improve treatment adherence, enhancing long-term clinical outcomes.

Market Trend

Strategic Acquisitions and Partnerships

A significant trend in the market is the rise of strategic acquisitions and partnerships, where major pharmaceutical companies are acquiring innovative biotech firms to strengthen their pipelines.

These collaborations enable faster access to advanced dermatological therapies, especially in areas like onco-dermatology.

By integrating cutting-edge research and development capabilities, companies can introduce novel treatments more efficiently, address unmet clinical needs, and expand their global reach, ultimately enhancing patient access to advanced and targeted skin disease solutions.

- In March 2025, Sun Pharma acquired Checkpoint Therapeutics, expanding into the market, particularly in the onco-dermatology segment. The deal adds UNLOXCYT (cosibelimab-ipdl) the first FDA-approved anti-PD-L1 treatment for advanced cutaneous squamous cell carcinoma (cSCC) to its portfolio. Valued at USD 355 million, the acquisition enhances Sun Pharma’s global presence in dermatological immunotherapy and aims to accelerate patient access to innovative treatments for serious skin cancers across key markets.

Dermatological Drugs Market Report Snapshot

|

Segmentation

|

Details

|

|

By Drug Class

|

Corticosteroids, Retinoids, Anti-infectives, Biologics, Calcineurin Inhibitors, Others

|

|

By Indication

|

Acne, Psoriasis, Rosacea, Eczema, Others

|

|

By Route of Administration

|

Oral, Parenteral, Topical

|

|

By Distribution Channel

|

Hospital Pharmacies, Retail Pharmacies, E-commerce, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Drug Class (Corticosteroids, Retinoids, Anti-infectives, Biologics, Calcineurin Inhibitors, and Others): The corticosteroids segment earned USD 7.32 billion in 2024, due to their widespread use in treating inflammatory skin conditions like eczema and psoriasis, offering rapid symptom relief and broad accessibility.

- By Indication (Acne, Psoriasis, Rosacea, Eczema, and Others): The psoriasis segment held 34.23% share of the market in 2024, driven by rising global prevalence, increasing awareness, and ongoing innovation in biologics and topical therapies targeting chronic autoimmune skin disorders.

- By Route of Administration (Oral, Parenteral, and Topical): The oral segment is projected to reach USD 21.08 billion by 2032, owing to growing patient preferences for convenient and systemic treatments for severe skin conditions including acne and atopic dermatitis.

- By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, E-commerce, and Others): The e-commerce segment is anticipated to register a CAGR of 13.79% during the forecast period, supported by rising digital health adoption, online pharmacy platforms, and consumer demand for discreet and home-delivered dermatological treatments.

Dermatological Drugs Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America accounted for a market share of around 36.55% in 2024, with a valuation of USD 8.20 billion. It remains the dominant region in the dermatological drugs market, supported by advanced healthcare infrastructure, high awareness levels, and significant R&D investment in innovative therapies.

The presence of major pharmaceutical companies, favorable regulatory pathways, and strong reimbursement frameworks contribute to the early adoption of new treatments.

The rising prevalence of chronic skin conditions, increasing demand for biologics, and growing access to dermatologists continue to drive the market in the region, solidifying its leadership position globally.

- In September 2024, the FDA approved Lilly’s EBGLYSS (lebrikizumab-lbkz), a first-line biologic for moderate-to-severe atopic dermatitis in patients aged 12 years and above. EBGLYSS delivers rapid and long-lasting relief, with significant skin clearance and itch reduction. This strengthens Lilly’s dermatology portfolio and expands treatment options for eczema patients.

The dermatological drugs industry in Asia Pacific is poised for significant growth at a CAGR of 11.67% over the forecast period. The region is emerging as the fastest-growing market for dermatological drugs, driven by the rising prevalence of skin disorders, growing healthcare awareness, and increasing access to dermatological care.

Expanding middle-class populations, urbanization, and lifestyle changes have contributed to higher incidences of conditions like acne, eczema, and psoriasis.

Government initiatives to improve healthcare infrastructure, coupled with the rapid adoption of e-commerce and tele dermatology, are further propelling the market across key countries like India, China, and those in Southeast Asia.

Regulatory Frameworks

- In India, the Drugs and Cosmetics Act 1940 regulates the import, manufacture, distribution, and sale of drugs and cosmetics to ensure their safety, efficacy, and quality for public use.

- In the European Union (EU), Regulation (EC) No 726/2004 establishes centralized procedures for the authorization and supervision of medicinal products for human and veterinary use.

- In the U.S., the Federal Food, Drug, and Cosmetic Act (FD&C Act) governs the safety, efficacy, and labeling of drugs, including dermatological products, under Title 21 of the United States Code.

Competitive Landscape

Companies in the dermatological drugs market are focusing on innovation, digital transformation, and strategic collaborations to enhance treatment outcomes and expand their portfolios. Efforts include the use of artificial intelligence, investing in R&D for biologics and immunotherapies, and optimizing clinical trial efficiency.

Firms are working to improve patient engagement, streamline drug development pipelines, and ensure regulatory compliance across global markets. These initiatives aim to address unmet clinical needs and offer more targeted and effective solutions for a wide range of dermatological conditions.

- In January 2024, Almirall partnered with Microsoft on a three‑year digital‑transformation initiative to accelerate medical dermatology innovation. A joint Digital Office will use generative AI, advanced analytics, and a unified data platform to discover novel therapeutic targets, design synthesizable molecules, and optimize operations. The partnership aims to deliver next‑generation, personalized dermatology drugs for patients while strengthening data governance and security.

Key Companies in Dermatological Drugs Market:

- AbbVie Inc.

- Pfizer Inc.

- GSK

- Sun Pharmaceutical Industries Ltd.

- Galderma

- Amgen Inc.

- Johnson & Johnson Services, Inc.

- Novartis AG

- Eli Lilly and Company

- Almirall, S.A

- Bausch Health Companies Inc.

- Arcutis Biotherapeutics, Inc.

- Cutis Derma Care

- Cipla

- Reddy’s Laboratories Ltd

Recent Developments (M&A/Approval/Collaboration)

- In May 2024, Johnson & Johnson acquired Proteologix, strengthening its dermatology pipeline with novel bispecific antibodies for moderate to severe atopic dermatitis and asthma. This move reflects a strategic effort to target multiple disease pathways, aiming to deliver high efficacy, infrequent dosing, and symptom-free remission for diverse patient populations.

- In June 2023, Pfizer received FDA approval for LITFULO (ritlecitinib), the first and only once-daily oral treatment for severe alopecia areata in individuals aged 12 years and above. LITFULO is the only FDA-approved therapy for adolescents with this autoimmune condition, offering renewed hope for substantial hair regrowth. Its approval followed the success of the ALLEGRO Phase 2b/3 clinical trial, showcasing strong efficacy and safety.

- In January 2023, Amgen collaborated with Kyowa Kirin to initiate a global clinical trial program for evaluating rocatinlimab, a first-in-class anti-OX40 monoclonal antibody, for moderate to severe atopic dermatitis. This investigational therapy targets T-cell-driven inflammation, aiming to break the chronic inflammatory cycle. The Phase 3 ROCKET program spans seven studies and includes diverse patients, including adolescents and adults, with varying treatment histories. The program aims to develop a disease-modifying therapy that can significantly improve outcomes for patients suffering from this burdensome skin condition.