Market Definition

Data wrangling refers to the process of cleaning, transforming, and organizing raw data into a structured and usable format for analysis. It involves tasks such as handling missing values, correcting inconsistencies, merging datasets, and reformatting data to enhance its quality and accessibility.

The market encompasses software tools, platforms, and services designed to automate these tasks, catering to businesses, data scientists, and analysts requiring efficient data preparation for analytics, machine learning, and decision-making.

Data Wrangling Market Overview

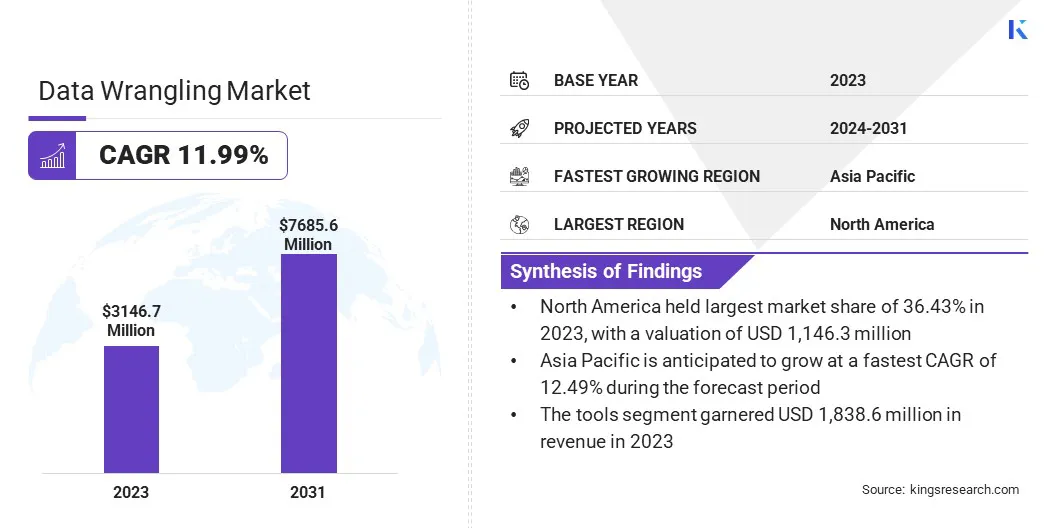

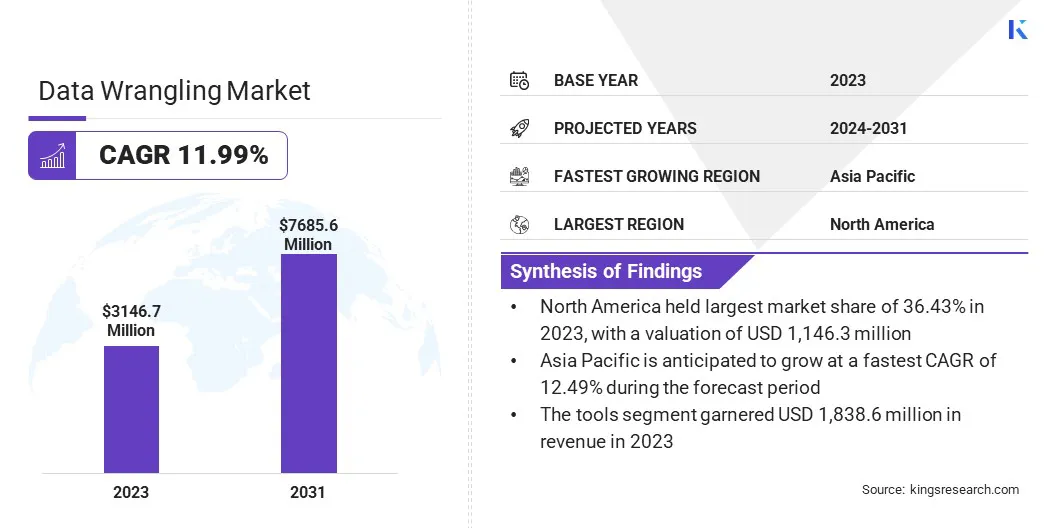

The global data wrangling market size was valued at USD 3,146.7 million in 2023 and is projected to grow from USD 3,478.8 million in 2024 to USD 7,685.6 million by 2031, exhibiting a CAGR of 11.99% during the forecast period. This growth is largely propelled by the increasing adoption of big data analytics, artificial intelligence, and machine learning across industries.

Businesses are leveraging data wrangling solutions to enhance data quality, improve decision-making, and accelerate time-to-insight. The rising demand for cloud-based data wrangling tools is further fueling market expansion as organizations seek scalable and flexible solutions to handle large volumes of structured and unstructured data.

Major companies operating in the data wrangling industry are Alteryx, Inc., Oracle, Teradata, SAS Institute Inc., Altair Engineering Inc., SAP, Amazon.com, Inc., Talend, Inc., QlikTech International AB, Microsoft, Salesforce, Inc., DataRobot, Inc., Precisely, Informatica Inc., Databricks, and others.

Additionally, the integration of automation and AI-driven capabilities in data wrangling platforms is enhancing efficiency by reducing manual efforts and streamlining workflows.

Growing emphasis on regulatory compliance and data governance is further increasing investment in advanced data preparation solutions. As industries such as healthcare, finance, retail, and telecommunications prioritize data-driven strategies, demand for data wrangling tools and services is expected to rise steadily.

- In June 2024, Datavant signed a multi-year Strategic Collaboration Agreement with Amazon Web Services (AWS) to enhance cloud-first healthcare data discovery and assessment. The partnership aims to improve data usability across healthcare and life sciences by leveraging AWS Clean Rooms for secure data collaboration and Datavant Connect tokenization technology.

Key Highlights

- The data wrangling industry size was valued at USD 3,146.7 million in 2023.

- The market is projected to grow at a CAGR of 11.99% from 2024 to 2031.

- North America held a share of 36.43% in 2023, valued at USD 1,146.3 million.

- The tools segment garnered USD 1,838.6 million in revenue in 2023.

- The cloud-based segment is expected to reach USD 4,650.5 million by 2031.

- The large enterprises segment is likely to reach USD 4,266.4 million by 2031.

- The banking, financial services, and insurance (BFSI) segment is estimated to generate a revenue of USD 3,159.6 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 12.49% over the forecast period.

Market Driver

"Automation and Data Quality Enhancement"

The data wrangling market is experiencing rapid growth, mainly due to the increasing demand for AI and machine learning-ready data and the expansion of self-service data preparation tools.

As organizations adopt AI and ML, the demand for high-quality, structured, and well-prepared data is critical. Data wrangling solutions automate data transformation, improve accuracy, and enhance usability, enabling efficient extraction of meaningful insights.

Additionally, the rising adoption of self-service data preparation tools is propelling market expansion. Businesses are shifting toward intuitive platforms that allow analysts and non-technical users to prepare, clean, and analyze data independently.

This shift improves operational efficiency, reduces manual data handling, and accelerates data-driven decision-making, solidifying data wrangling technologies as a key component of modern data management strategies.

- In May 2024, J.P. Morgan launched Containerized Data, an enhanced data normalization solution for institutional investors. This end-to-end service tandardizes data from multiple sources, ensuring consistency and interoperability across business services. By leveraging a common semantic layer and cloud-native access channels such as APIs, Jupyter notebooks, Snowflake, and Databricks, it enables seamless AI and ML integration.

Market Challenge

"Complexity of Data Integration and Quality Assurance"

Integrating diverse and complex data sources while ensuring high data quality presents a major challenge to the expansion of the data wrangling market. Organizations aggregate structured and unstructured data from multiple sources, including cloud storage, legacy systems, IoT devices, and third-party platfroms.

Variations in format, structure, and completeness often lead to inconsistencies, redundancies, and missing values. Additionally, as businesses scale, increasing data volume and velocity make manual data wrangling inefficient, error-prone, and resource-intensive. Poor data quality integration can compromise analytics, inaccurate business intelligence, and decision-making.

To address this challenge, advanced AI-powered automation and machine learning-driven data transformation tools are being integrated into data wrangling solutions. These technologies enhance data profiling, anomaly detection, and schema matching, significantly reducing manual intervention and improving data accuracy.

Market Trend

"AI-Driven Automation and Self-Service Solutions"

The data wrangling market is witnessing notable expansion, driven by AI-powered automation and the increasing demand for self-service data wrangling solutions. AI enhances data preparation by enabling advanced capabilities such as intelligent data cleansing, pattern recognition, and anomaly detection.

These AI-driven tools minimize manual intervention, reduce human errors, and enhance processing speed, making data preparation more efficient and accurate. As organizations deal with vast and complex datasets, AI-powered automation is becoming essential for streamlining workflows and ensuring high-quality data for analytics and decision-making.

Furthemore, there is a growing shift toward self-service data wrangling solutions that empower business users and analysts to handle data preparation without relying on IT or data engineering teams.

These intuitive platforms offer user-friendly interfaces, drag-and-drop functionality, and automated recommendations, enabling non-technical users to clean, transform, and structure data independently.

By reducing dependency on specialized technical expertise, self-service data wrangling enhances agility, accelerates insights, and improves overall operational efficiency.

- In September 2024, Microsoft launched the Python Data Science Extension Pack for Visual Studio Code. This pack integrates essential tools for data science, including Python, Jupyter, GitHub Copilot, and Data Wrangler. The extension pack streamlines data preparation, analysis, and machine learning workflows, with Data Wrangler specifically designed to facilitate data exploration, visualization, and cleaning within VS Code.

Data wrangling Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Tools, Services

|

|

By Deployment Model

|

On-Premises, Cloud-Based

|

|

By Organization Size

|

Small and Medium-Sized Enterprises (SMEs), Large Enterprises

|

|

By Industry Vertical

|

Banking, Financial Services, and Insurance (BFSI), IT and Telecommunications, Retail and E-commerce, Healthcare, Others (Government, Manufacturing)

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Tools and Services): The tools segment earned USD 1,838.6 million in 2023 due to the growing adoption of advanced data preparation solutions for improving data quality and analytics efficiency.

- By Deployment Model (On-premises and Cloud-based): The cloud-based segment held a share of 57.69% in 2023, fueled by the increasing demand for scalable and cost-effective data wrangling solutions.

- By Organization Size (Small and Medium-Sized Enterprises (SMEs) and Large Enterprises): The large enterprises segment is projected to reach USD 4,266.4 million by 2031 owing to the rising need for automated data management and compliance solutions.

- By Industry Vertical (Banking, Financial Services, and Insurance (BFSI), IT and Telecommunications, Retail and E-commerce, Healthcare, and Others): The banking, financial services, and insurance (BFSI) segment is projected to reach USD 3,159.6 million by 2031, on account of the sector’s increasing reliance on data-driven decision-making and risk management.

Data wrangling Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America data wrangling market accounted for a substantial share of 36.43% in 2023, valued at USD 1,146.3 million. This dominance is primarily attributed to its advanced technological infrastructure and strong focus on data-driven decision-making.

The region has a well-established ecosystem of enterprises investing in big data analytics, automation, and AI-powered solutions to enhance business intelligence and operational efficiency.

The increasing adoption of business intelligence (BI) tools, automation in data processing, and real-time insights in industries such as healthcare, retail, and telecommunications is stimulating regional market expansion.

Additionally, the rising emphasis on data accuracy, security, and governance has prompted organizations to invest in structured data management solutions to improve compliance and operational efficiency.

The growing need for cybersecurity measures, fraud detection, and financial risk management in the BFSI sector is leading to increased demand for advanced data wrangling tools in North America.

Furthermore, strong venture capital funding and corporate investments in AI-driven data analytics startups are supporting innovation in data preparation technologies, further solidifying the region’s market dominance.

Asia Pacific data wrangling industry is expected to register the fastest CAGR of 12.49% over the forecast period. The region's expanding e-commerce industry, supported by platforms such as Alibaba, Flipkart, and Shopee, is generating massive amounts of transactional and customer data, requiring efficient data wrangling solutions for analytics and personalization.

Moreover, the expansion of 5G networks and the rise of IoT applications in smart cities and manufacturing industries are creating new opportunities for data preparation tools.

Moreover, countries such as China, India, and Japan are heavily investing in AI-driven analytics, boosting the demand for data wrangling solutions. The growing emphasis on enhancing customer experience through data-driven insights in industries such as retail, telecommunications, and manufacturing is generating demand for advanced data preparation tools.

Moreover, the expansion of multinational technology companies, along with strategic collaborations between global and local firms, is fostering the development and adoption of innovative data wrangling solutions in Asia Pacific.

Regulatory Frameworks

- In the United States, data wrangling must comply with regulatory frameworks such as the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA) to ensure transparency, security, and lawful processing of personal and healthcare data.

- In Europe, the European Data Protection Board (EDPB) enforces GDPR and the Law Enforcement Directive, mandating strict data processing guidelines, including accuracy, security, and compliance.

Competitive Landscape

The data wrangling industry is characterized by rapid innovation and a focus on enhancing data quality through advanced analytics and automation. Organizations are prioritizing seamless integration with AI-driven analytics platforms, cloud ecosystems, and real-time data processing tools to stay competitive.

Companies are continuously improving their offerings by developing user-friendly interfaces, automation-driven data transformation capabilities, and enhanced scalability to cater to enterprises of all sizes.

Furthermore, collaborations with cloud service providers and AI solution developers are expanding product offerings and market reach. Collaborations with academic institutions and government agencies are fostering advancements in quantum cryptography and network infrastructure.

Additionally, firms are forming alliances with telecommunications providers to integrate quantum security solutions into existing network frameworks. Expansion into global markets through joint ventures, pilot projects, and public-private partnerships is another critical strategy.

With increasing demand for ultra-secure communication in sectors such as defense, finance, and critical infrastructure, companies are focusing on scaling quantum networks and improving interoperability with classical communication systems to drive commercial viability and market adoption.

- In November 2024, enGen and Abacus Insights collaborated to enhance payer solutions through advanced data transformation capabilities. The partnership integrates Abacus Insights’ data models and connectors into enGen’s platform, enabling real-time, on-demand, and interoperable data access for health plans.

List of Key Companies in Data Wrangling Market:

- Alteryx, Inc.

- Oracle

- Teradata

- SAS Institute Inc.

- Altair Engineering Inc.

- SAP

- Amazon.com, Inc.

- Talend, Inc.

- QlikTech International AB

- Microsoft

- Salesforce, Inc.

- DataRobot, Inc.

- Precisely

- Informatica Inc.

- Databricks

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In November 2024, Alteryx, Inc. announced its Fall 2024 release, featuring new data connectors, enhanced Analytic Apps support, and AI-powered Magic Reports. The update also introduced LiveQuery, enabling direct cloud data warehouse interaction to improve data privacy and processing efficiency.

- In September 2024, Gestalt Tech secured a USD 5.9 million seed round to advance its AI-powered data organization software for lenders. Its data warehouse automates data mapping and anomaly detection, reducing manual data wrangling.

- In June 2024, Cloudera introduced three new AI-driven assistants—SQL AI Assistant, AI Chatbot in Cloudera Data Visualization, and Cloudera Copilot for Cloudera Machine Learning. These tools streamline data access, query generation, and machine learning deployment, enhancing data analytics and AI development.