Market Definition

The market refers to the industry focused on providing products, services, and solutions that help businesses modernize, optimize, and evolve their data center infrastructure. Market growth is driven by the increasing demand for efficient and agile IT environments.

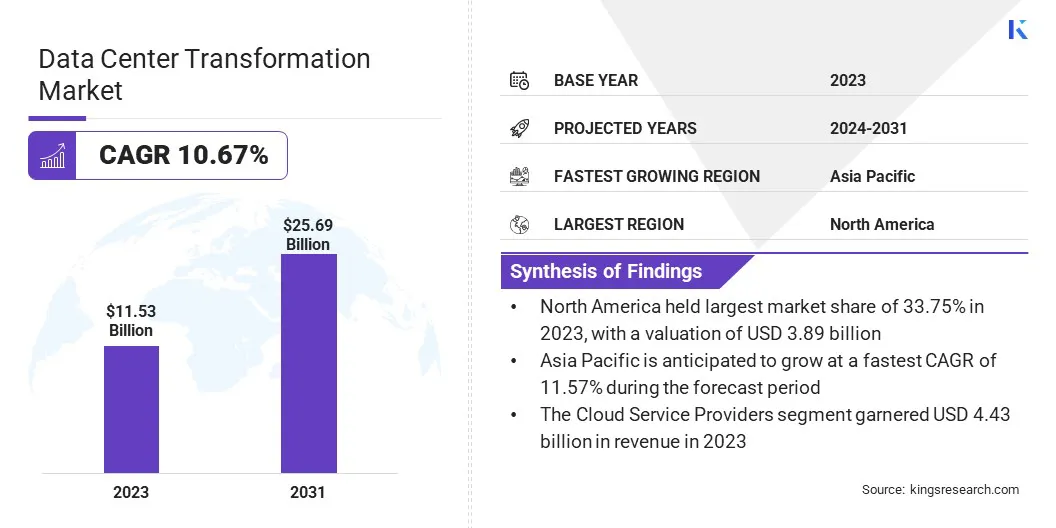

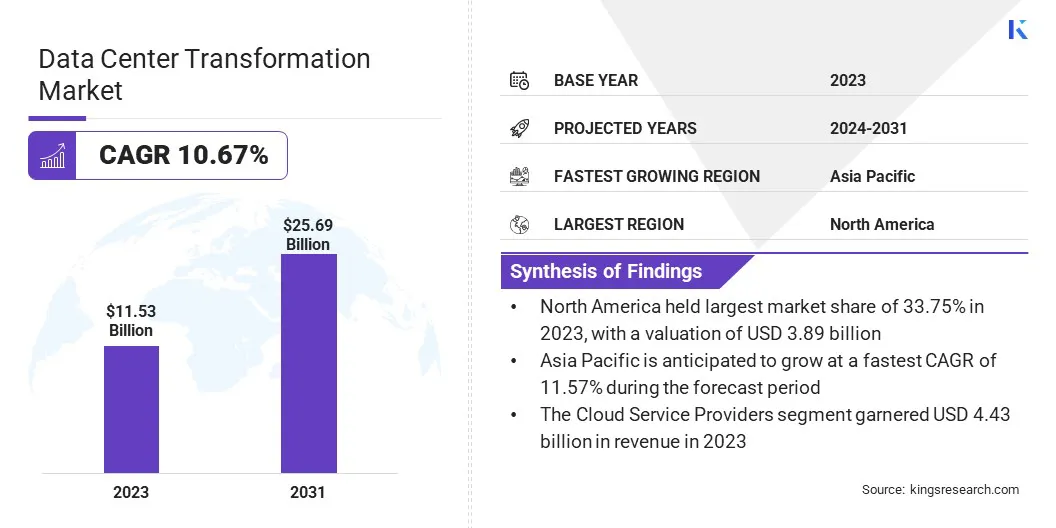

Global data center transformation market size was USD 11.53 billion in 2023, which is estimated to be valued at USD 12.63 billion in 2024 and reach USD 25.69 billion by 2031, growing at a CAGR of 10.67% from 2024 to 2031.

The adoption of hybrid and multi-cloud environments is prompting businesses to modernize data centers, enhancing flexibility, scalability, and cost efficiency. This shift necessitates infrastructure upgrades to support seamless cloud integration and management.

Major companies operating in the data center transformation industry are Dell Inc., IBM, Schneider Electric, Cisco Systems, Inc., NTT DATA Inc., HCL Technologies Limited, Accenture, Cognizant, Google LLC, Wipro, Atos SE, TATA Consultancy Services Limited, HITACHI, Mindteck, Bytes, and others.

The market focuses on the modernization of IT infrastructure to improve efficiency, scalability, and agility. It involves the integration of advanced technologies like cloud computing, virtualization, edge computing, and automation into traditional data centers.

Several companies are adopting new solutions to reduce operational costs, enhance security, and meet the growing demands of data management. Key areas include colocation services, hybrid cloud environments, and energy-efficient infrastructure. As digital transformation accelerates, businesses are increasingly investing in modernized data center solutions for optimized operations.

- In July 2024, Microsoft and Lumen Technologies partnered to expand network capacity and AI capabilities, advancing digital transformation. This collaboration strengthens data center infrastructure to support AI-driven innovations, addressing the growing demand for modernized solutions.

Key Highlights:

- The data center transformation industry size was recorded at USD 53 billion in 2023.

- The market is projected to grow at a CAGR of 10.67% from 2024 to 2031.

- North America held a share of 33.75% in 2023, valued at USD 3.89 billion.

- The consolidation services segment garnered USD 3.67 billion in revenue in 2023.

- The cloud service providers segment is expected to reach USD 9.89 billion by 2031.

- The energy segment is anticipated to witness the fastest CAGR of 10.96% over the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 11.57% through the proejction period.

Market Driver

"Increased Adoption of Cloud Computing"

The surging adoption of hybrid and multi-cloud environments is bolstering the growth of the data center transformation market. Seamless integration between on-premises infrastructure and cloud services necessitates flexible, scalable, and efficient solutions.

By adopting cloud services, organizations can reduce operational costs, enhance agility, and adapt to changing business requirements. Consequently, data centers must evolve to support dynamic cloud platforms, highlighting the need for transformation solutions.

- In September 2024, Oracle introduced the Zettascale cloud computing cluster, leveraging NVIDIA GPUs to support large-scale AI workloads. This advanced infrastructure accelerates cloud and data center transformation with scalable, high-performance computing.

Market Challenge

"Legacy Systems Integration"

Integrating modern technologies with existing legacy infrastructure is a significant challenge to the growth of the data center transformation market. Legacy systems often lack compatibility with newer technologies, making integration complex and resource-intensive.

This can lead to operational disruptions, increased costs, and delays. This challenge can be addressed through adopting hybrid IT environments, which combine on-premises infrastructure with cloud-based services, allowing businesses to gradually transition to modern systems without fully replacing legacy systems.

Market Trend

"5G Connectivity"

The rollout of 5G networks is emerging as a significant trend in the data center transformation market. As 5G technology enables faster, high-performance, and low-latency mobile and edge-based applications, the demand for advanced data centers has surged.

To accommodate real-time data processing and IoT, data centers are evolving with improved traffic management, lower latency, and enhanced connectivity. This shift is spurring innovations in edge computing and network optimization for seamless 5G integration.

- In August 2024, Singtel and Hitachi expanded their collaboration to enhance data centers with AI and 5G connectivity. By integrating Singtel’s Paragon platform, which combines 5G, edge computing, and cloud solutions, the partnership aims to boost AI adoption and accelerate digital transformation across data centers in Asia Pacific.

"Data Center Transformation Market Report Snapshot"

|

Segmentation

|

Details

|

|

By Service

|

Consolidation Services, Optimization Services, Automation Services, Infrastructure Management Services

|

|

By End Use

|

Cloud Service Providers, Colocation Providers, Enterprises

|

|

By Vertical

|

BFSI, IT and Telecommunications, Government and Defense, Energy, Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Service (Consolidation Services, Optimization Services, Automation Services, and Infrastructure Management Services): The consolidation services segment earned USD 3.67 billion in 2023 due to increasing demand for efficient infrastructure integration and cost-effective data center operations.

- By End Use (Cloud Service Providers, Colocation Providers, and Enterprises): The cloud service providers segment held a share of 38.45% in 2023, fueled by the rapid adoption of cloud computing and demand for scalable data storage solutions.

- By Vertical (BFSI, IT and Telecommunications, Government and Defense, Energy, Manufacturing, and Others): The BFSI segment is projected to reach USD 6.88 billion by 2031, largely attributed to the increasing need for secure, high-performance infrastructure to support financial data transactions and analytics.

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America data center transformation market share stood at around 33.75% in 2023, valued at USD 3.89 billion. This dominance is reinforced by the high adoption of advanced technologies such as AI, 5G, and cloud computing.

The presence of leading cloud service providers, major tech firms, and substantial infrastructure investments further support regional market growth. Additionally, the region's North America's focus on energy-efficient and sustainable data centers reinforces its leading position,

- In February 2025, Carrier Global Corporation introduced QuantumLeap, a suite of energy-efficient solutions for data center thermal management. Integrating AI-driven cooling, liquid cooling, and predictive maintenance, it addresses the growing demand for sustainable, high-performance data center infrastructure.

Asia Pacific data center transformation industry is estimated to grow at a robust CAGR of 11.57% over the forecast period. This growth is fostered by rapid digitalization and increasing demand for cloud and AI services.

Countries such as China, Japan, and India are witnessing significant investments in data center infrastructure to address growing enterprise needs. The expansion of 5G networks, coupled with rising data consumption, fuels regional market growth. Additionally, the growing number of data center projects and the shift toward green energy solutions is supporting this growth.

- In March 2025, Saudi Telecom Company (stc) expanded 5G services across 75 cities in Saudi Arabia using Juniper Networks' advanced core network solutions. This collaboration enahnces network capacity and performance while reducing energy consumption and modernizing data centers, aligning with stc's digital transformation goals.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) enforces regulations promoting sustainability in the market, focusing on energy efficiency, carbon reduction, and reducing environmental impacts.

- In India, the Draft Digital Personal Data Protection Rules (2025) focus on safeguarding citizens' digital data, empowering individuals with control over their information. These rules ensure compliance, innovation, and balance, driving data protection alongside economic growth in the rapidly evolving digital landscape.

- In the EU, the General Data Protection Regulation (GDPR) governs the processing and transfer of personal data, enforcing strict data privacy standards for companies operating within the region.

Competitive Landscape

Companies in the data center transformation industry are investing heavily in advanced infrastructure, including high-performance data centers and enhanced connectivity solutions.

They are focusing on scalability, sustainability, and energy efficiency to meet the increasing demand for data processing. Additionally, companies are incorporating AI, renewable energy, and next-gen cooling technologies to foster innovation and optimize operations.

- In March 2025, NTT DATA announced a five-year, USD 59 billion investment to accelerate digital transformation. Key initiatives include launching India’s largest data center campus, deploying the MIST submarine cable for enhanced connectivity, and expanding AI infrastructure to strenghthen its global data center capabilities.

List of Key Companies in Data Center Transformation Market:

- Dell Inc.

- IBM

- Schneider Electric

- Cisco Systems, Inc.

- NTT DATA Inc.

- HCL Technologies Limited

- Accenture

- Cognizant

- Google LLC

- Wipro

- Atos SE

- TATA Consultancy Services Limited

- HITACHI

- Mindteck

- Bytes

Recent Developments (Partnerships/New Product Launch)

- In December 2024, Kyndryl expanded its partnership with Nokia to offer advanced data center networking solutions, enhancing scalability, security, and performance. This collaboration aids enterprises in modernizing infrastructure to meet digital transformation demands.

- In May 2024, Microsoft launched its first hyperscale cloud data center in Mexico, driving digital transformation through secure, scalable cloud services. This initiative aims to promote sustainability while addressing global data center infrastructure needs.

- In March 2024, Digital Realty launched NRT12, its second data center in Japan’s NRT campus, enhancing AI-ready infrastructure to support high-performance computing, AI, machine learning, and hybrid IT solutions in metropolitan Tokyo.

- In January 2024, Vodafone and Microsoft announced a 10-year strategic partnership aimed at transforming business experiences through generative AI, expanding IoT connectivity, scaling M-Pesa for financial inclusion in Africa, and accelerating digital adoption through cloud services and Azure.