Data Center Power Market Size

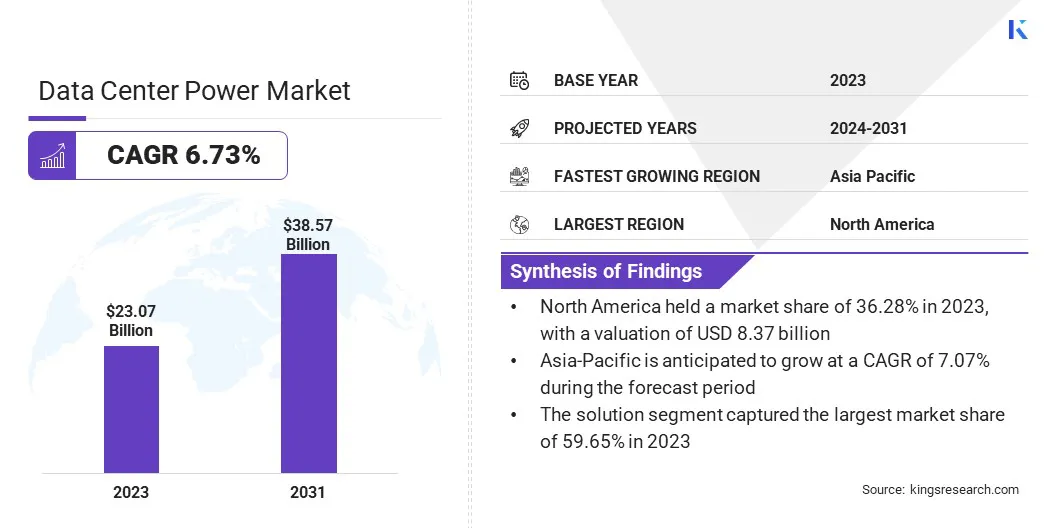

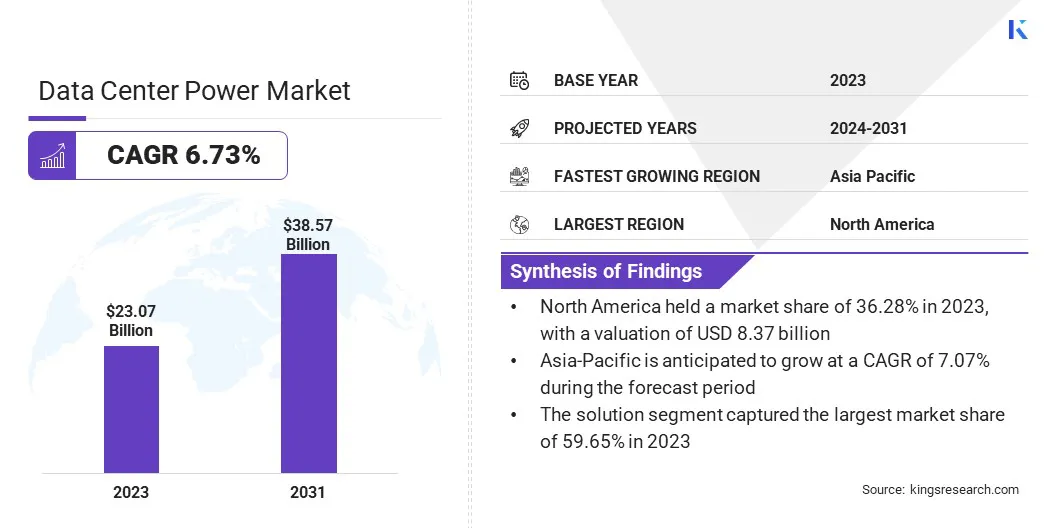

The global Data Center Power Market size was valued at USD 23.07 billion in 2023 and is projected to grow from USD 24.44 billion in 2024 to USD 38.57 billion by 2031, exhibiting a CAGR of 6.73% during the forecast period. In the scope of work, the report includes solutions offered by companies such as Cummins Inc., Danfoss A/S, Eaton, Fujitsu, General Electric, Huawei Technologies Co., Ltd., Microsoft, Mitsubishi Electric Corporation, Schneider Electric, NTT DATA, Inc., ABB, Delta Electronics, Inc. and others.

Escalating volumes of data generated by IoT, AI, and cloud computing and the growing shift toward renewable energy are driving the data center power market progress. Hybrid power solutions present compelling growth opportunities in the data center sector by integrating grid power with renewable sources and energy storage systems. This approach addresses two critical needs: reliability and sustainability.

By harnessing renewable energy such as through solar and wind power, data centers can reduce their carbon footprint and dependency on fossil fuels, aligning with global sustainability goals. Energy storage systems, such as batteries and advanced energy management technologies, enhance the reliability of these solutions by providing backup during grid outages and optimizing energy use based on demand fluctuations.

Moreover, hybrid solutions offer cost efficiencies over time, as renewable energy costs continue to decrease and energy storage technologies advance. This makes them increasingly attractive to data center operators looking to manage operational costs while meeting stringent environmental regulations.

The scalability of these solutions also supports the expansion of data center capacities without proportional increases in carbon emissions or energy consumption. As the demand for data centers grows globally, particularly in regions with variable grid reliability or high energy costs, hybrid power solutions emerge as a strategic investment for sustainable growth and operational resilience.

Data center power refers to the infrastructure and technologies used to supply electricity to data centers, supporting their operations including computing, networking, and storage. These power solutions encompass a range of equipment and systems designed for reliability, efficiency, and scalability. Key components include uninterruptible power supplies (UPS), power distribution units (PDUs), generators, and cooling systems optimized for energy efficiency.

The applications of data center power solutions are crucial across various industries that rely on digital infrastructure for mission-critical operations. They ensure continuous uptime and data integrity, supporting cloud services, e-commerce platforms, financial transactions, and telecommunications networks. Modern data center power solutions integrate advanced monitoring and management capabilities to optimize energy use and reduce environmental impact. They often incorporate renewable energy sources and energy storage to enhance sustainability and resilience against power disruptions. As data volumes continue to grow exponentially, driven by trends like IoT and AI, the demand for robust, scalable, and efficient data center power solutions remains paramount to support evolving digital ecosystems.

Analyst’s Review

In the dynamic landscape of the data center power market, key players are navigating strategic imperatives centered on innovation, sustainability, and operational efficiency. Companies are increasingly focusing on developing integrated solutions that combine advanced power management technologies with renewable energy integration and energy storage capabilities. This approach enhances their competitive edge addresses growing customer demands for sustainable data center operations. The growth of the data center power market is fueled by rising data volumes globally, driven by cloud computing adoption and digital transformation initiatives across industries. Key players are expanding their market footprint through strategic partnerships, acquisitions, and investments in R&D to develop next-generation power solutions. Imperatives for these players include regulatory compliance, particularly in regions emphasizing energy efficiency and carbon reduction targets, which shape product development and market strategies.

Data Center Power Market Growth Factors

The proliferation of IoT devices, accelerated adoption of AI applications, and the shift toward cloud computing are collectively driving an unprecedented surge in global data volumes. This exponential growth is placing immense pressure on data center infrastructure, particularly in terms of power consumption and reliability. IoT devices continuously generate streams of data from various endpoints, necessitating real-time processing and storage capabilities in data centers. AI applications, powered by machine learning and deep learning algorithms, require vast computational resources, thereby increasing the load on data center servers and systems.

Simultaneously, enterprises are increasingly migrating their IT workloads to cloud platforms to leverage scalability and cost efficiencies, further contributing to the demand for robust data center power solutions. These trends underscore the critical need for data centers to deploy advanced power infrastructure, including high-capacity UPS systems, efficient cooling solutions, and optimized power distribution networks. Such investments ensure uninterrupted operation, which enables data centers to manage the escalating energy demands while adhering to stringent performance and reliability standards.

One of the significant challenges facing the data center power market is the high cost associated with the installation and maintenance of advanced power infrastructure. Data centers require robust power solutions to ensure uninterrupted operation and support mission-critical applications. The initial installation costs for equipment such as UPS systems, generators, and specialized cooling systems can be substantial, particularly for large-scale facilities or those requiring high redundancy levels for fault tolerance.

Moreover, ongoing operational expenses related to maintenance, upgrades, and energy consumption further add to the total cost of ownership. Data center operators need to manage these costs while maintaining optimal performance and efficiency. Investments in energy-efficient technologies and renewable energy sources can mitigate operational expenses over time, but the upfront capital expenditure remains a significant barrier, especially for smaller operators or those entering emerging markets.

Additionally, rapid technological advancements necessitate regular upgrades to keep pace with evolving industry standards and regulatory requirements, adding complexity and additional costs to the operational budget. Addressing the high cost of installation and maintenance requires strategic planning, leveraging economies of scale, and exploring innovative financing models such as leasing or partnerships. Despite these challenges, the ongoing digital transformation and increasing data demands are driving investments in robust data center power solutions worldwide.

Data Center Power Market Trends

A notable trend in the data center power market is the accelerating shift toward renewable energy sources such as solar, wind, and hydroelectric power. This transition is driven by mounting global concerns over environmental sustainability and carbon emissions reduction. Data centers, known for their substantial energy consumption, are increasingly adopting renewable energy to mitigate their environmental impact and comply with stringent regulatory frameworks. Renewable energy offers data center operators several benefits beyond environmental stewardship.

It provides a stable, long-term cost-effective energy source, shielding operators from volatile fossil fuel prices. Additionally, advancements in renewable energy technologies, coupled with government incentives and corporate sustainability initiatives, have made renewable energy integration more economically viable.

- For instance, in 2023, the International Energy Agency (IEA) reported that electricity usage from AI, data centers, and the cryptocurrency sector constituted approximately 2% of global electricity consumption, with projections indicating potential doubling by 2026. Additionally, the AI industry is forecast to grow tenfold in electricity demand by 2026 compared to 2023 levels.

Moreover, the integration of renewable energy into data center operations supports corporate social responsibility (CSR) goals, enhancing brand reputation and attracting environmentally conscious clients. Despite the initial challenges of intermittency and grid integration, innovations in energy storage solutions and microgrid technologies are overcoming these barriers, ensuring reliable power supply for data centers.

Segmentation Analysis

The global market is segmented based on component, organization size, end user, and geography.

By Component

Based on component, the market is categorized into solution and services. The solution segment captured the largest data center power market share of 59.65% in 2023, mainly attributed to the increasing complexity and scale of data center operations globally, which necessitates robust and integrated power solutions. The solution is further classified into power distribution, power monitoring, power backup, and cabling infrastructure. Data centers require reliable power infrastructure to ensure continuous operations, manage energy efficiency, and support the growing demands of digital transformation initiatives such as cloud computing, IoT, and AI.

- For instance, in May 2024, Eaton finalized a substantial strategic investment in NordicEPOD AS, previously a wholly-owned subsidiary of CTS Nordics. NordicEPOD AS specializes in designing and assembling standardized power modules for data centers in the Nordic region.

Advancements in technology have driven innovation in data center power solutions, offering efficient UPS systems, intelligent power distribution units (PDUs), and cooling solutions tailored to the specific needs of modern data centers. These solutions optimize energy consumption enhance operational reliability and scalability, thereby driving their adoption among data center operators.

By Organization Size

Based on organization size, the data center power market is classified into large enterprises and small and medium-sized enterprises. The small and medium-sized enterprises segment is poised to record a staggering CAGR of 7.51% through the forecast period. SMEs are increasingly recognizing the strategic importance of robust data center power solutions to support their digital operations. As these enterprises expand their online presence, adopt cloud computing, and engage in digital transformation initiatives, the demand for reliable and scalable data center infrastructure grows.

Advancements in technology have made sophisticated data center power solutions more accessible and cost-effective for SMEs. Cloud-based services and managed hosting solutions enable SMEs to leverage enterprise-grade infrastructure without the need for large upfront investments in on-premises data centers. Moreover, the increasing awareness of cybersecurity threats and data privacy regulations is prompting SMEs to enhance their data management practices, driving demand for secure and reliable data center power solutions.

By End-User

Based on end-user, the data center power market is divided into IT & telecommunications, healthcare, retail, BFSI, and others. The IT & telecommunications segment garnered the highest revenue of USD 7.49 billion in 2023. The IT & telecommunications industry is at the forefront of digital transformation, with increasing reliance on data-intensive applications, cloud computing services, and high-speed telecommunications networks. These technologies require robust and scalable data center infrastructure supported by advanced power solutions to ensure uninterrupted operation and data integrity.

The proliferation of mobile devices, IoT devices, and digital services has driven exponential growth in data traffic volumes within the IT & telecommunications sector. This surge in data consumption necessitates data centers with high-performance computing capabilities and efficient power management systems to handle peak workloads and ensure optimal service delivery.

Data Center Power Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America data center power market share stood at 36.28% and was valued at USD 8.37 billion in 2023. North America is home to a robust digital economy characterized by a high concentration of large-scale enterprises, cloud service providers, and technology firms that heavily rely on advanced data center infrastructure. The region's mature IT ecosystem and early adoption of cloud computing, IoT, and AI technologies are driving substantial demand for efficient and scalable data center power solutions.

- For instance, in April 2024, Cummins Power Generation introduced two new generator set models, expanding its CentumTM Series powered by Cummins Inc.’s QSK78 engine. The new models, C2750D6E and C3000D6EB, deliver 2750kW and 3000kW of power respectively, catering to critical applications like data centers, healthcare facilities, and wastewater treatment plants in response to strong market demand.

Moreover, stringent regulatory standards and industry certifications in North America emphasize energy efficiency, reliability, and sustainability in data center operations. This regulatory environment encourages investments in state-of-the-art power infrastructure that complies with environmental guidelines and operational standards.

Additionally, the region's infrastructural readiness, including reliable power grids and access to renewable energy sources, supports the deployment of resilient data center facilities. Investments in renewable energy integration and energy-efficient technologies further bolster North America's position as a leader in sustainable data center operations.

The Asia-Pacific data center power market is slated to grow at the highest CAGR of 7.07% in the forthcoming years due to the rapid urbanization and industrialization across Asia-Pacific economies, which are fueling exponential growth in digital transformation initiatives, cloud adoption, and data consumption. This surge in digital activities necessitates scalable and efficient data center infrastructure supported by advanced power solutions to meet escalating consumer demand. The region's expanding population and increasing internet penetration rates are driving the proliferation of mobile devices, IoT applications, and e-commerce platforms, thereby amplifying data traffic volumes and reinforcing the need for robust data center power capabilities.

- For instance, in June 2024, ST Engineering advanced its Singapore data center project, a seven-story facility slated for completion in 2026. This expansion is intended to increase the Group’s IT capacity to over 30MW across four Singapore locations. With a planned capex of approximately USD 120 million over three years, the data center is designed to support high-power-density AI and GPU-based workloads exceeding 20KW per rack. It aims for future adaptability through partnerships with GPU industry leaders and will feature diverse cooling systems, including ST Engineering’s Airbitat DC Cooling System, liquid cooling, and immersion cooling. Additionally, the facility is set to install 2,400 sqm of solar panels to enhance sustainability and reduce grid dependence.

Moreover, government initiatives and investments in digital infrastructure, coupled with supportive regulatory frameworks, are facilitating the development of new data center facilities across Asia-Pacific. Countries such as China, India, Singapore, and Japan are emerging as key hubs for data center expansion, attracting substantial investments from global technology firms and cloud service providers.

Competitive Landscape

The global data center power market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Data Center Power Market

- Cummins Inc.

- Danfoss A/S

- Eaton

- Fujitsu

- General Electric

- Huawei Technologies Co., Ltd.

- Microsoft

- Mitsubishi Electric Corporation

- Schneider Electric

- NTT DATA, Inc.

- ABB

- Delta Electronics, Inc.

Key Industry Developments

- June 2024 (Launch): Cisco unveiled a transformative AI cluster solution in collaboration with NVIDIA for data centers, revolutionizing infrastructure and software management. The Cisco Nexus HyperFabric AI cluster integrates AI-native networking, NVIDIA accelerated computing, AI software, and a robust VAST data store, empowering customers to prioritize AI-driven innovation and business growth over IT administration.

- June 2024 (Collaboration): Hewlett Packard Enterprise (HPE) and Danfoss partnered to launch HPE IT Sustainability Services – Data Center Heat Recovery. This solution offers an off-the-shelf module for organizations to efficiently manage and leverage excess heat, supporting their move toward sustainable IT operations.

The global data center power market is segmented as:

By Component

- Solution

- Power Distribution

- Power Monitoring

- Power Backup

- Cabling Infrastructure

- Services

- Managed services

- Professional Services

By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises

By End-User

- IT & Telecommunications

- Healthcare

- Retail

- BFSI

- Others

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America