Market Definition

The market involves the development and production of antibodies tailored to specific research, diagnostic, or therapeutic needs. These antibodies are used extensively in biomedical research, disease diagnostics, drug discovery, and targeted therapy development.

This market includes products and services offered by biotech companies and research organizations specializing in antibody customization. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping industry growth.

Custom Antibody Market Overview

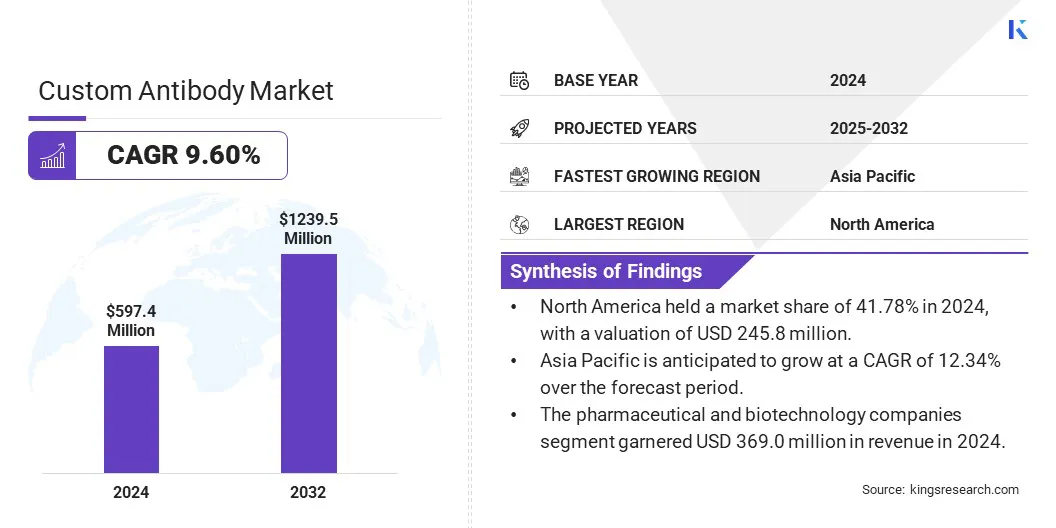

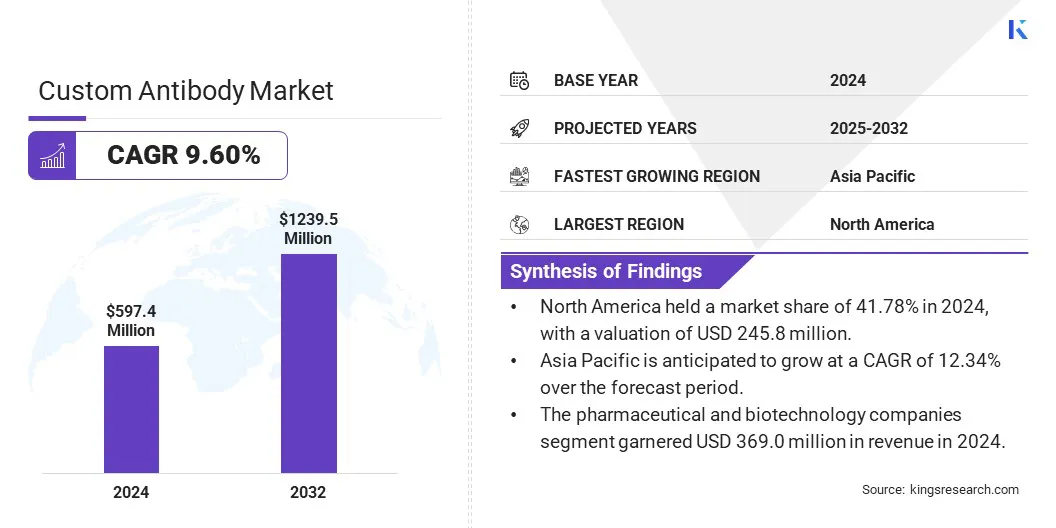

The global custom antibody market size was valued at USD 597.4 million in 2024 and is projected to grow from USD 652.5 million in 2025 to USD 1,239.5 million by 2032, exhibiting a CAGR of 9.60% during the forecast period.

Rising demand for novel and bispecific therapeutic antibodies is accelerating the development of targeted treatments. Advances in antibody discovery technologies, such as high-throughput screening and engineering, are enhancing efficiency and enabling the creation of more effective and precise therapies.

Major companies operating in the custom antibody industry are Merck, Thermo Fisher Scientific Inc., GenScript, Bio-Rad Laboratories, Inc., Meridian Bioscience, Inc., ACROBiosystems, Inotiv, Biointron Biologics, Pacific Immunology, Creative Diagnostics, IMGENEX INDIA Pvt. Ltd., OriGene Technologies, Inc., Cell Signaling Technology, Inc., ACROBiosystems, RayBiotech, Inc., and others.

The biopharmaceutical industry is experiencing increased demand for precise and reliable monitoring of therapeutic antibodies during development and manufacturing. Advanced immunogenicity testing methods, such as dual-step affinity chromatography, are becoming essential to accurately quantify anti-drug antibodies (ADAs) and reduce false positives.

This growing emphasis on quality control and testing sensitivity is fueling the adoption of innovative analytical technologies. Companies that offer high-precision antibody purification and detection solutions are well-positioned to benefit from this rising demand.

- In December 2024, BioGenes advanced immunogenicity testing by introducing dual-step affinity chromatography to isolate specific anti-idiotypic antibodies while depleting human IgGs. This approach enhances specificity, reduces background, and improves quantification for biopharma monitoring.

Key Highlights:

- The custom antibody market size was recorded at USD 597.4 million in 2024.

- The market is projected to grow at a CAGR of 9.60% from 2025 to 2032.

- North America held a market share of 41.78% in 2024, with a valuation of USD 245.8 million.

- The antibody development segment garnered USD 250.8 million in revenue in 2024.

- The monoclonal antibodies segment is expected to reach USD 634.3 million by 2032.

- The mice segment secured the largest revenue share of 61.64% in 2024.

- The oncology segment is estimated to register a CAGR of 11.92% through the forecast period.

- The pharmaceutical and biotechnology companies segment garnered USD 369.0 million in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 12.34% over the forecast period.

Market Driver

Rising Demand for Novel and Bispecific Therapeutic Antibodies

The growth of the market is driven by increasing demand for novel therapeutic antibodies, including bispecific antibodies. These antibodies offer enhanced specificity and efficacy for treating complex diseases such as cancer and autoimmune disorders.

Biopharmaceutical companies are increasingly investing in custom antibody development to meet the need for targeted therapies. Advances in antibody engineering and screening technologies support faster discovery and production of these antibodies.

- In July 2024, Bio-Rad Laboratories expanded its Pioneer Antibody Discovery Platform by introducing fast generation and screening of bispecific antibodies using its proprietary SpyLock Technology. This new service enables faster indentification of effective antibody combinations for development.

Market Challenge

Safety and Stability Challenges

A major challenge hindering the expansion of the custom antibody market is ensuring the safety and stability. Antibodies are susceptible to degradation and reduced efficacy if not properly stored or handled. Additionally, they may trigger unintended immune responses in patients.

To mitigate these issues, companies are adopting advanced technologies to enhance antibodies robustness, along with rigorous testing to ensure safety and efficacy. Advanced formulation techniques and stabilizing agents are used to preserve antibody integrity during transport and storage. Regulatory compliance and stringent quality control procedures further support product reliability.

Market Trend

Advancements in Antibody Discovery Technologies

A notable trend in the market is the integration of antibody discovery platforms incorporating microfluidics, genetic engineering, and proprietary screening technologies.

These platforms enable faster generation of fully human and bispecific antibodies from diverse B-cell populations. This reduce development time and increase the quality of antibody candidates. Consequently, therapeutic development is accelerated, enhancing the targeting of complex diseases.

- In March 2025, Biointron launched a high-throughput, fully humanized antibody discovery platform integrating AbDrop and Cyagen HUGO-Ab. This novel approach combines microfluidic technology for single B cell antibody discovery and fully human antibody mice using TurboKnockout ES technology, offering a safer and more efficient approach for fully human antibody discovery.

Custom Antibody Market Report Snapshot

|

Segmentation

|

Details

|

|

By Service

|

Antibody Development (Antibody Characterization, Antigen Prepration, Immunization and Hybridoma Production), Antibody Production and Purification, Antibody Fragmentation and Labeling

|

|

By Type

|

Monoclonal Antibodies, Polyclonal Antibodies, Recombinant Antibodies, Others

|

|

By Source

|

Mice, Rabbits, Others

|

|

By Application

|

Oncology, Infectious Diseases, Immunology, Neurobiology, Cardiovascular Diseases, Others

|

|

By End User

|

Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, Contract Research Organizations

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Service (Antibody Development, Antibody Production and Purification, and Antibody Fragmentation and Labeling): The antibody development segment earned USD 250.8 million in 2024 due to increasing demand for customized research and therapeutic antibodies.

- By Type (Monoclonal Antibodies, Polyclonal Antibodies, Recombinant Antibodies, and Others): The monoclonal antibodies segment held a share of 49.55% in 2024, fueled by their high specificity and widespread use in diagnostics and therapeutics.

- By Source (Mice, Rabbits, and Others): The mice segment is projected to reach USD 674.1 million by 2032, propelled by their reliability and widespread use in producing high-affinity antibodies.

- By Application (Oncology, Infectious Diseases, Immunology, Neurobiology, Cardiovascular Diseases, and Others). The oncology segment is estimated to grow at a CAGR of 11.92% through the forecast period, largely attributed to increasing cancer prevalence and rising demand for targeted antibody therapies.

- By End User (Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, and Contract Research Organizations): The pharmaceutical and biotechnology companies segment earned USD 369.0 million in 2024 due to rising investment in antibody-based drug development and personalized medicine.

Custom Antibody Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America custom antibody market share stood at around 41.78% in 2024, valued at USD 245.8 million. This dominance is reinforced by a strong biotechnology and pharmaceutical industry with significant investment in antibody research and development. This growth is further supported by advanced research infrastructure, leading universities, and government-funded biomedical programs.

The Asia Pacific custom antibody industry is estimated to grow at a robust CAGR of 12.34% over the forecast period. This growth is stimulated by the rising demand for targeted therapies, such as degrader-antibody conjugates (DACs), which require highly specific and tailored monoclonal antibodies for effective treatment.

Additionally, robust R&D activity and innovation, particularly in countries such as South Korea and China, are accelerating the development of novel antibody-based therapies. This is fueling investments and collaborations, positioning Asia Pacific as a key market for custom antibodies.

- According to a GlobalData study published in April 2025, South Korea and China lead in degrader-antibody conjugate (DAC) development. DACs combine a proteolysis targeting chimera (PROTAC) payload with an antibody via a chemical linker, addressing limitations of antibody-drug conjugates (ADCs) and highlighting the role of monoclonal antibodies in targeted protein degradation.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulations mandate that custom antibodies for clinical use comply with safety, efficacy, and manufacturing standards, directly affecting their market approval and commercialization.

- In the Europe, the European Medicines Agency (EMA) is responsible for authorising and monitoring medicines. It grants a single marketing authorisation, allowing companies to market therapeutic antibodies across all EU and EEA member states

Competitive Landscape

Key players in the custom antibody market are expanding through mergers, acquisitions, and strategic collaborations to enhance antibody development capabilities. Investments in high-throughput platforms and advanced discovery technologies are accelerating innovation.

Partnerships with biotech and pharma firms support therapeutic co-development, while expansions in manufacturing and R&D infrastructure address rising demand in diagnostics and precision medicine.

- In March 2024, Sino Biological partnered with Rapid Novor to promote Rapid Novor’s proprietary monoclonal antibody sequencing service in combination with its own custom mAb development and production services, enabling clients to optimize antibody engineering strategies and enhance drug discovery.

List of Key Companies in Custom Antibody Market:

- Merck

- Thermo Fisher Scientific Inc.

- GenScript

- Bio-Rad Laboratories, Inc

- Meridian Bioscience, Inc.

- ACROBiosystems.

- Inotiv.

- Biointron Biologics.

- Pacific Immunology

- Creative Diagnostics

- IMGENEX INDIA Pvt. Ltd.

- OriGene Technologies, Inc.

- Cell Signaling Technology, Inc.

- ACROBiosystems.

- RayBiotech, Inc.

Recent Developments (Partnerships/ Launches)

- In April 2025, Antibody Solutions launched single plasma B-cell services through its Cellestive discovery platform, completing its suite of B-cell discovery pathways that includes activated, memory, and plasma. This new capability enables clients to analyze single plasma B-cells, simultaneously screen antibodies against soluble antigens and target cells, and recover paired heavy and light chain sequences to faciliatate novel antibody therapeutic discovery.

- In March 2025, Proteintech introduced enhanced product characterization through 3D Epitope Mapping, designed to enhance the efficiency and accuracy of antibody-related selection. The mapping uses peptide scanning, microbial display, and AI modeling to provide an interactive 3D view of antibody binding sites.

- In December 2024, Merck announced FDA acceptance of the Biologics License Application for clesrovimab (MK-1654), an investigational prophylactic long-acting monoclonal antibody designed to protect infants from respiratory syncytial virus (RSV) disease during their first RSV season. Clesrovimab aims to be the first and only singl- dose immunization for infants regardless of weight.

- In October 2024, SeromYx Systems and ACROBiosystems announced the release of their joint study on the comprehensive functional profiling of approved anti-CD20 monoclonal antibodies. The collaboration leverages SeromYx’s advanced biophysical and cellular Fc-effector function platform and ACROBiosystems’ recombinant human full-length CD20 virus-like particles to provide new insights into factors influencing therapeutic safety and efficacy.