Market Definition

The market encompasses the production, of insulation materials designed to manage temperatures below -150°C (-238°F). These materials are essential for the safe storage and transport of cryogenic liquids, including liquefied natural gas (LNG), liquid oxygen (LOX), liquid nitrogen (LIN), and by minimizing heat transfer, ensuring stability, and enhancing energy efficiency.

Cryogenic Insulation Market Overview

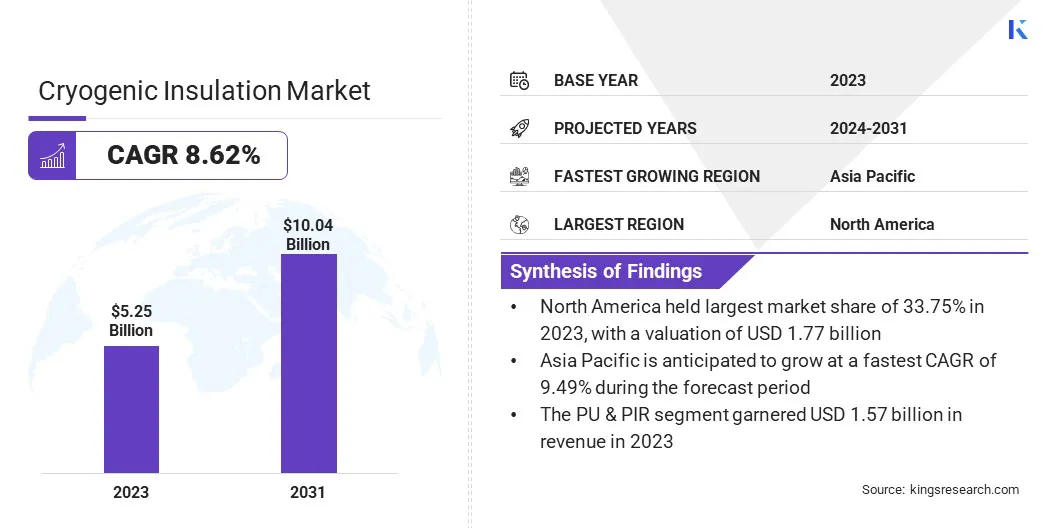

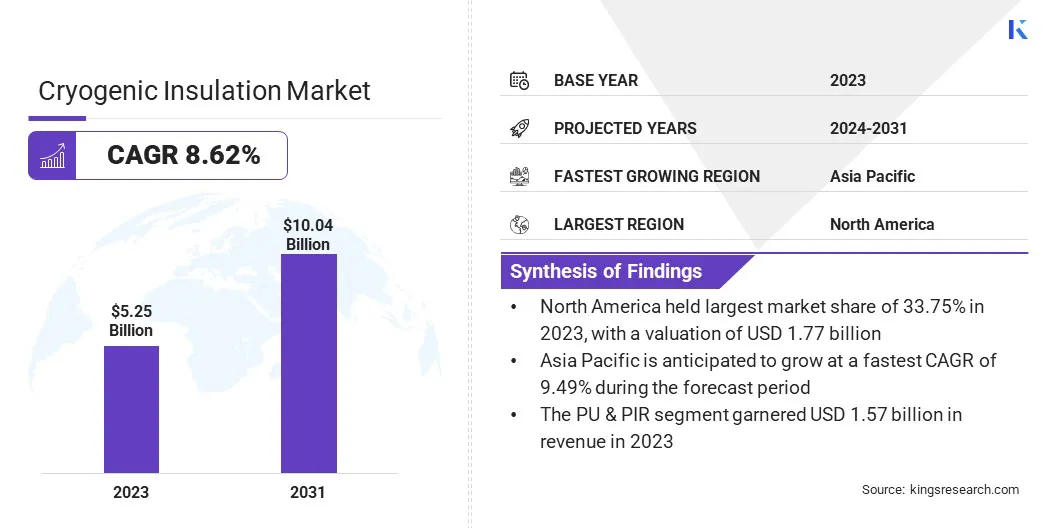

Global cryogenic insulation market size was valued at USD 5.25 billion in 2023, which is estimated to be valued at USD 5.63 billion in 2024 and reach USD 10.04 billion by 2031, growing at a CAGR of 8.62% from 2024 to 2031.

The expansion of space exploration programs is creating a strong demand for cryogenic insulation materials to store and transport rocket propellants at ultra-low temperatures, advancing space technology and mission capabilities.

Major companies operating in the cryogenic insulation industry are Armacell, Lydall, Inc., BASF SE, Cabot Corporation, Röchling, Johns Manville, Aspen Aerogels, Inc., DUNMORE, Saint-Gobain Group, KAEFER, Imerys, LALBHAI GROUP, Technifab Products, Inc, Aerospace Fabrication & Materials, LLC., Advanced Industrial Services., and others.

Market expansion is further fueled by the rising need for renewable energy storage, particularly in wind and solar systems. As renewable energy sources require efficient energy storage solutions, the need for cryogenic insulation to maintain ultra-low temperatures for liquefied gases such as hydrogen and natural gas is increasing.

- In December 2023, Kawasaki demonstrated the superior thermal insulation of its liquefied hydrogen storage tanks in a NEDO pilot project. Deployed on the SUISO FRONTIER and Hy touch Kobe, these tanks effectively maintained cryogenic temperatures of -253°C with minimal heat ingress, ensuring stable long-term hydrogen storage.

These materials enhance storage efficiency, reduce energy loss, and facilitate the transition to cleaner, sustainable energy systems, increasing demand for advanced cryogenic insulation technologies across industries.

Key Highlights:

- The cryogenic insulation inustry size was recorded at USD 5.25 billion in 2023.

- The market is projected to grow at a CAGR of 8.62% from 2024 to 2031.

- North America held a share of 33.75% in 2023, with a valuation of USD 1.77 billion.

- The PU & PIR technology segment garnered USD 1.57 billion in revenue in 2023.

- The LPG/LNG transport & storage segment is expected to reach USD 2.69 billion by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 9.49% over the forecast period.

Market Driver

"Space Exploration Advancements"

With the expansion of space programs, the need for efficient cryogenic insulation to store and transport rocket propellants at ultra-low temperatures is becoming increasingly critical.

- According to the Space Foundation, 259 spacecraft launches took place in 2024, with an average launch every 34 hours, five hours faster than in 2023.

Cryogenic insulation ensures that propellants such as liquid oxygen and liquid hydrogen remain at stable temperatures during storage and transport, preventing energy loss and maintaining safety.

With increasing space exploration missions to the Moon, Mars, and beyond, demand for high-performance cryogenic insulation materials is growing, fueling market expansion.

- In November 2023, Aerospace Fabrication & Materials (AFM) rebranded its SpaceWrap product line as AstraWrap, focusing on advanced thermal control solutions for space applications. This initiative aims to provide innovative materials for storing and transporting cryogenic propellants.

Market Challenge

"Temperature Control"

A key challenge hampering the growth of the cryogenic insulation market is ensuring consistent and reliable temperature control in extreme conditions, particularly during the transportation and storage of liquefied gases.

Fluctuations in temperature can lead to energy inefficiencies and risks of leakage. To address this challenge, advanced cryogenic insulation materials with high thermal resistance, improved sealing techniques, and robust design structures are being developed to minimize heat transfer and enhance the performance of storage systems under demanding environments.

Market Trend

"Advancement in Materials"

The cryogenic insulation material market is witnessing a notable shift toward advanced materials that provide enhanced thermal resistance, flexibility, and durability. These materials help industries maintain ultra-low temperatures while reducing energy loss, improving safety, and minimizing operational costs.

The adoption of advanced, high-performance insulation solutions is rising across sectors facing extreme temperature conditions. Additionally, there is a growing focus on materials that are lightweight, easy to install, and environmentally sustainable, aligning with the industry's focus on efficiency and long-term sustainability.

- In February 2025, Huamei Energy-saving Technology Group launched its Cryogenic Rubber Foam, engineered for extreme cold environments as low as -200°C. This advanced material enhances thermal insulation, energy efficiency, and safety across industries such as energy, aerospace, medical, and cryogenic storage.

Cryogenic Insulation Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

PU & PIR, Cellular Glass, Polystyrene, Fiberglass, Perlite, Others

|

|

By Application

|

LPG/LNG Transport & Storage, Chemicals, Energy & Power, Metallurgical, Shipping, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (PU & PIR, Cellular Glass, Polystyrene, Fiberglass, Perlite, and Others): The PU & PIR segment earned USD 1.57 billion in 2023 due to growing demand in cryogenic insulation applications.

- By Application (LPG/LNG Transport & Storage, Chemicals, Energy & Power, Metallurgical, Shipping, and Others): The LPG/LNG transport & storage segment held a share of 26.74% in 2023, fueled by the increasing need for efficient cryogenic storage solutions.

Cryogenic Insulation Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America cryogenic insulation market share stood at around 33.75% in 2023, valued at USD 1.77 billion. This dominance is reinforced by its well-established industrial base and robust demand from sectors such as aerospace, energy, and manufacturing.

The regional market further benefits from continuous technological advancements, particularly in cryogenic fuel storage and transportation. The growing adoption of LNG infrastructure, along with government incentives for clean energy solutions, boosts the demand for advanced insulation materials. North America's focus on research, development, and innovation in cryogenic technologies fosters regional market expansion.

Asia Pacific cryogenic insulation industry is estimated to grow at a CAGR of 9.49% over the forecast period. This growth is stimulated by its rapid industrialization and expansion of energy, aerospace, and transportation sectors.

The increasing demand for liquefied natural gas (LNG), liquid hydrogen storage, and growing investments in renewable energy and space exploration further contribute to this trend.

Additionally, the region's robust infrastructure development and government initiatives supporting clean energy are boosting the adoption of advanced insulation solutions.

- In March 2024, 3M and HD Hyundai KSOE, based in South Korea, announced a collaboration to develop advanced cryogenic insulation systems for liquid hydrogen storage tanks. The collaboration aims to utilize high-performance Glass Bubbles to enhance thermal efficiency, durability, and support the growing hydrogen economy.

Regulatory Frameworks

- In the U.S., the Occupational Safety and Health Administration (OSHA) enforce safety standards for cryogenic systems, including the handling, storage, and insulation of cryogenic liquids.

- In the EU, REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulates the chemical safety and environmental impact of insulation materials used in cryogenic applications to protect human health and the environment.

- In India, the Petroleum and Explosives Safety Organization (PESO) regulates the storage, transportation, and handling of cryogenic liquids and materials, ensuring compliance with safety protocols for cryogenic systems and infrastructure.

Competitive Landscape

Companies in the cryogenic insulation industry are expanding their product offerings and enhancing insulation efficiency using advanced materials such as aerogels and flexible foams.

They are also increasing production capacities and exploring new applications across the energy, aerospace, and industrial sectors. These efforts aim to meet the growing demand for energy efficiency, safety, and durability in cryogenic environments.

- In September 2024, Armacell acquired all shares of JIOS in their joint venture, Armacell JIOS Aerogels Limited, strenghthening its aerogel production capabilities for high-temperature and cryogenic insulation, and expanding its presence in the energy and industrial sectors.

List of Key Companies in Cryogenic Insulation Market:

- Armacell

- Lydall, Inc.

- BASF SE

- Cabot Corporation

- Röchling

- Johns Manville

- Aspen Aerogels, Inc.

- DUNMORE

- Saint-Gobain Group

- KAEFER

- Imerys

- LALBHAI GROUP

- Technifab Products, Inc

- Aerospace Fabrication & Materials, LLC.

- Advanced Industrial Services.

Recent Developments (Approval/Partnership)

- In January 2025, DNV granted an Approval in Principle (AiP) to HD Korea Shipbuilding & Offshore Engineering for its innovative vacuum-insulated large-scale liquefied hydrogen tank technology, advancing efficient cryogenic storage solutions for hydrogen.

- In January 2025, Taylor-Wharton and GenH2 partnered to develop zero-loss liquid hydrogen storage systems using cryogenic refrigeration technology, significantly enhancing storage efficiency by reducing hydrogen loss during transfer.