Market Definition

The market covers a range of products used to manage pests, diseases, and weeds that affect agricultural productivity. These chemicals include herbicides, insecticides, and fungicides, formulated in liquid, powder, or granular forms for various application methods such as spraying or soil treatment.

Used in both traditional and modern farming, these products support crop health across cereals, fruits, vegetables, and plantation crops. The market involves advanced chemical processes to ensure product stability, effectiveness, and minimal environmental impact. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the market growth.

Crop Protection Chemicals Market Overview

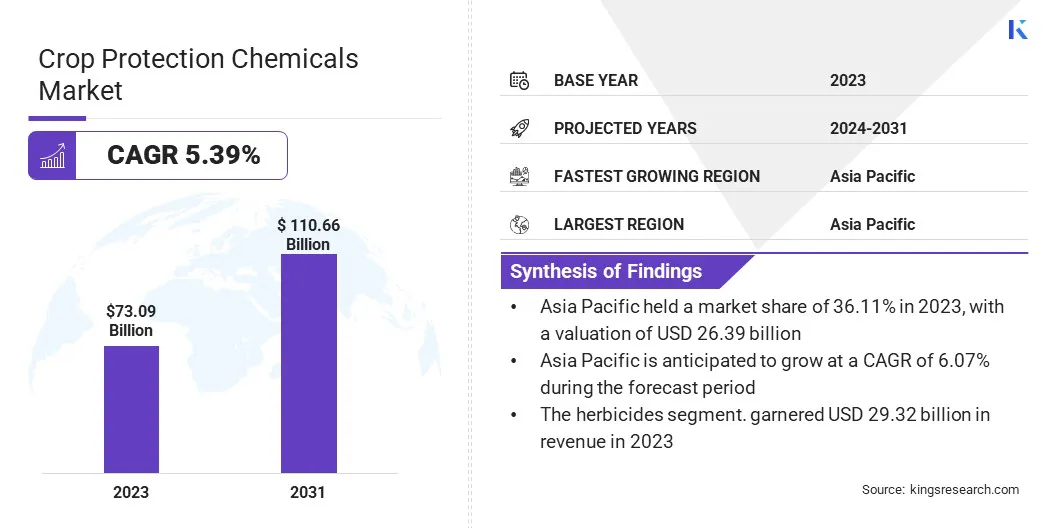

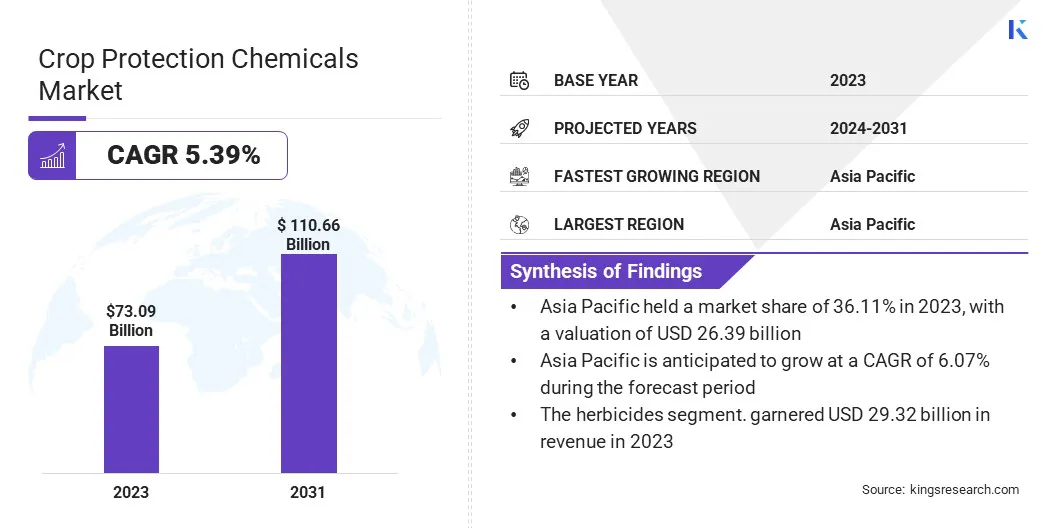

The global crop protection chemicals market size was valued at USD 73.09 billion in 2023 and is projected to grow from USD 76.61 billion in 2024 to USD 110.66 billion by 2031, exhibiting a CAGR of 5.39% during the forecast period.

The market is registering steady growth, driven by the integration of precision agriculture practices that enhance targeted application and reduce wastage. Additionally, advancements in chemical formulation technologies are improving product efficacy and environmental safety, encouraging broader adoption among farmers aiming for higher yield and sustainable farming.

Major companies operating in the crop protection chemicals industry are BASF, Bayer AG, FMC Corporation, Syngenta Group, Corteva, UPL, Nufarm, Sumitomo Chemical Co., Ltd, Albaugh LLC, Koppert, Gowan Company, American Vanguard Corporation, Kumiai Chemical Industry Co., Ltd, PI Industries, and Chr. Hansen Holding A/S.

Climate variability and global trade have led to the spread of invasive pests and diseases, affecting crop health across geographies. According to the Food and Agriculture Organization (FAO), plant pests and diseases are responsible for the loss of up to 40% of food crops each year.

Farmers are turning to crop protection chemicals to control infestations that reduce crop quality and quantity. The rising threat from crop-damaging organisms is creating continuous demand for efficient formulations, contributing to the growth of the market globally.

Key Highlights:

- The crop protection chemicals industry size was valued at USD 73.09 billion in 2023.

- The market is projected to grow at a CAGR of 5.39% from 2024 to 2031.

- Asia Pacific held a market share of 36.11% in 2023, with a valuation of USD 26.39 billion.

- The herbicides segment garnered USD 29.32 billion in revenue in 2023.

- The synthetic chemicals segment is expected to reach USD 81.95 billion by 2031.

- The cereals & grains segment secured the largest revenue share of 34.07% in 2023.

- The soil treatment segment is poised for a robust CAGR of 7.70% through the forecast period.

- The market in Europe is anticipated to grow at a CAGR of 6.02% during the forecast period.

Market Driver

Integration of Precision Agriculture Practices

Precision farming techniques, including the use of sensors, drones, and GPS-based tools, are enabling the accurate application of crop protection chemicals. These methods help reduce overuse, ensure better pest control, and lower environmental impact.

The integration of precision agriculture has increased the operational efficiency of chemical use, supporting the growth of the crop protection chemicals market by aligning with sustainable and cost-effective farming practices.

In March 2025, researchers at the Massachusetts Institute of Technology (MIT) developed a system aimed at minimizing the use of agricultural sprays such as fertilizers, pesticides, and herbicides. This innovation could significantly reduce polluting runoff into the environment.

The technology works by applying a thin coating to droplets during spraying, which helps them adhere to plant leaves rather than bouncing off and being wasted on the ground.

Market Challenge

Regulatory Pressure and Environmental Concerns

Growing regulatory pressure, due to environmental and health concerns, poses a major challenge to the market growth. Many countries are tightening rules around chemical usage, especially for products linked to soil degradation or water contamination.

In response, companies are shifting focus toward bio-based alternatives and low-toxicity formulations. They are also increasing investments in research to develop targeted solutions that break down quickly and leave minimal residue.

Collaborations with regulatory bodies and farmers help ensure that new products meet safety standards without compromising performance, supporting both environmental protection and agricultural productivity.

Market Trend

Advancements in Chemical Formulation Technologies

Ongoing innovations in chemical engineering have led to the development of more targeted, residue-efficient, and environment-friendly pesticides. These advanced formulations provide greater crop safety while addressing strict regulatory requirements.

New-generation products offer enhanced efficacy at lower dosages, making them economically viable for large and small-scale farming. These improvements in formulation technologies are significantly driving the market.

- In March 2025, Syngenta introduced NETURE, a biological insecticide developed to help farmers enhance insect control in soybean and corn cultivation. This bioproduct is noted for its strong efficacy and long-lasting control of challenging sap-sucking pests, including corn leafhoppers, stink bugs, whiteflies, and sugarcane leafhoppers. Derived from the bacteria Pseudomonas chlororaphis and Pseudomonas fluorescens, NETURE offers multiple modes of action, targeting pests through direct contact and affecting their digestive and nervous systems upon ingestion.

Crop Protection Chemicals Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Herbicides, Insecticides, Fungicides, Others

|

|

By Origin

|

Synthetic Chemicals, Biopesticides

|

|

By Crop Type

|

Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Others

|

|

By Mode of Application

|

Foliar Spray, Seed Treatment, Soil Treatment, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Herbicides, Insecticides, Fungicides, and Others): The herbicides segment earned USD 29.32 billion in 2023, due to its high demand for effective weed control, which directly influences crop yield and reduces competition for nutrients, water, and sunlight.

- By Origin (Synthetic Chemicals, and Biopesticides): The synthetic chemicals segment held 76.09% share of the market in 2023, due to its broad-spectrum efficacy, cost-effectiveness, and consistent performance, making it a preferred choice for large-scale farming operations.

- By Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, and Others): The cereals & grains segment is projected to reach USD 33.26 billion by 2031, owing to their large-scale cultivation and high global demand, which drives consistent use of protective solutions to ensure yield stability and food security.

- By Mode of Application (Foliar Spray, Seed Treatment, Soil Treatment, and Others): The soil treatment segment is poised for significant growth at a CAGR of 7.70% through the forecast period, due to its crucial role in enhancing soil health and preventing early-stage pest and disease outbreaks.

Crop Protection Chemicals Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for 36.11% share of the crop protection chemicals market in 2023, with a valuation of USD 26.39 billion. The increasing focus on producing export-quality crops has led to the rise of commercial farming practices across the region. Growers are integrating crop protection chemicals into routine farming activities to meet international quality and safety standards.

This shift toward export-ready production is pushing the demand for regulated and effective chemical solutions, boosting the market. Moreover, several companies in the region are expanding production capacities and investing in R&D to serve local demand efficiently. The growth of regional production facilities is playing a crucial role in strengthening the market.

- In January 2024, Hikal Ltd signed a Memorandum of Understanding (MoU) with the Government of Gujarat for an investment of USD 60 million. As per the agreement, the investment will be directed toward enhancing Hikal’s existing fine chemical facility in Panoli, Gujarat. This site is unique, as it integrates all three of Hikal’s business segments, Pharma, Crop Protection, and Animal Health. The Gujarat government has pledged support in securing the required approvals, registrations, and clearances from relevant state authorities.

The crop protection chemicals industry in Europe is poised for significant growth at a robust CAGR of 6.02% over the forecast period. The increasing use of precision farming technologies such as drones, smart sensors, and satellite mapping has enabled the efficient application of crop protection chemicals.

This shift toward data-driven agriculture is supporting the demand for formulations compatible with modern equipment and variable-rate application systems, boosting the market.

Furthermore, programs under the Common Agricultural Policy (CAP) in the European Union (EU) continue to offer funding and guidance for plant protection and sustainable crop health practices. These include subsidies for precision application tools and eco-compliant chemical products, propelling the market.

Regulatory Frameworks

- The U.S. regulates crop protection chemicals under the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), overseen by the Environmental Protection Agency (EPA). All pesticides must be registered and evaluated for health and environmental safety. The EPA also sets residue limits through the Food Quality Protection Act to protect consumer safety.

- The EU enforces strict regulations under Regulation (EC) No 1107/2009 and the Sustainable Use Directive, focusing on human and environmental safety. All active substances must undergo rigorous scientific evaluation by the European Food Safety Authority (EFSA) before approval. Member states implement Integrated Pest Management (IPM) and monitor use through the pesticide reduction targets set in the Farm to Fork strategy.

- China regulates pesticides under the Regulation on Pesticide Administration (RPA), with oversight from the Ministry of Agriculture and Rural Affairs (MARA). The law mandates registration, residue testing, and risk assessments for new products. China has also increased its focus on green pesticides and sustainable use to reduce overuse and contamination risks.

- India’s crop protection chemicals are governed by the Insecticides Act, 1968, and managed by the Central Insecticides Board and Registration Committee (CIBRC). Products must meet efficacy, toxicity, and residue standards. India is gradually moving toward banning certain hazardous pesticides and promoting bio-based alternatives to support safer agricultural practices.

Competitive Landscape

Market players are increasingly focusing on R&D to create insecticide active ingredients tailored for specific crops. This strategy helps address unique pest challenges and enhances crop protection. Developing targeted solutions aids companies in improving the effectiveness and sustainability of their products, which directly contributes to the growth of the market.

- In February 2025, BASF initiated the registration process for Prexio Active, a newly developed insecticide active ingredient tailored to target all four rice hopper species. The product offers effectiveness and long-lasting control across all harmful life stages of brown planthoppers, white-backed planthoppers, small brown planthoppers, and rice green leafhoppers.

List of Key Companies in Crop Protection Chemicals Market:

- BASF

- Bayer AG

- FMC Corporation

- Syngenta Group

- Corteva

- UPL

- Nufarm

- Sumitomo Chemical Co., Ltd

- Albaugh LLC

- Koppert

- Gowan Company

- American Vanguard Corporation

- Kumiai Chemical Industry Co., Ltd

- PI Industries

- Hansen Holding A/S

Recent Developments (Partnerships/Product Launches)

- In October 2024, FMC introduced Ambriva herbicide for in-season use on wheat crops. The herbicide contains Isoflex active, a Group 13 compound that brings a novel mode of action to cereal crop protection. This innovation offers Indian farmers a valuable solution for managing herbicide resistance effectively during the growing season.

- In May 2024, FMC partnered with Optibrium, a key provider of software and AI tools for small molecule discovery. FMC aims to accelerate the development of innovative crop protection solutions by integrating Optibrium’s advanced Augmented Chemistry AI technologies into its discovery process. The collaboration leverages ML to identify and refine compounds, supporting FMC’s commitment to sustainability.

- In February 2024, Syngenta and Lavie Bio Ltd. announced a partnership aimed at discovering and developing innovative biological insecticidal solutions. This collaboration will combine Lavie Bio's distinctive technology platform to swiftly identify and refine bio-insecticide candidates, alongside Syngenta's vast global expertise in research, development, and commercialization.