Cosmetic Chemicals Market Size

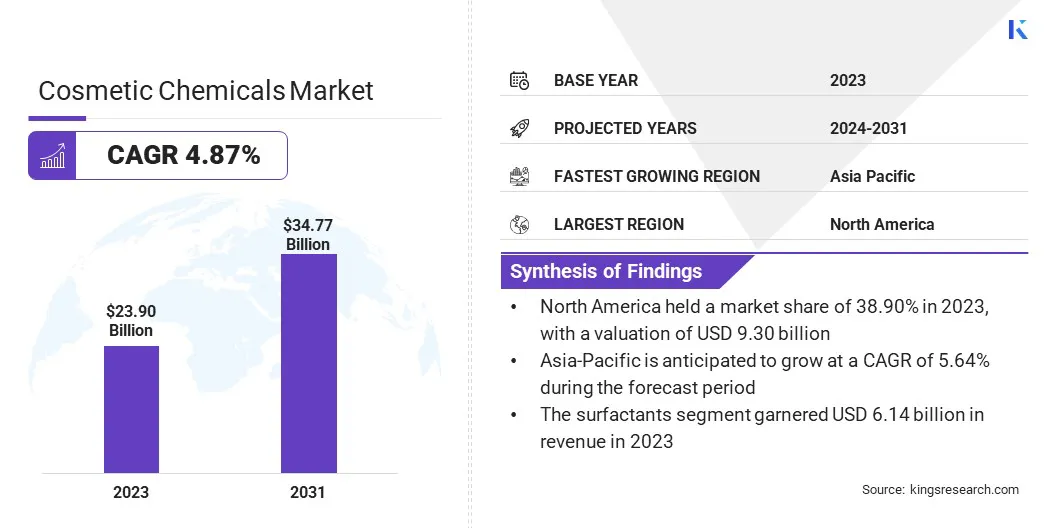

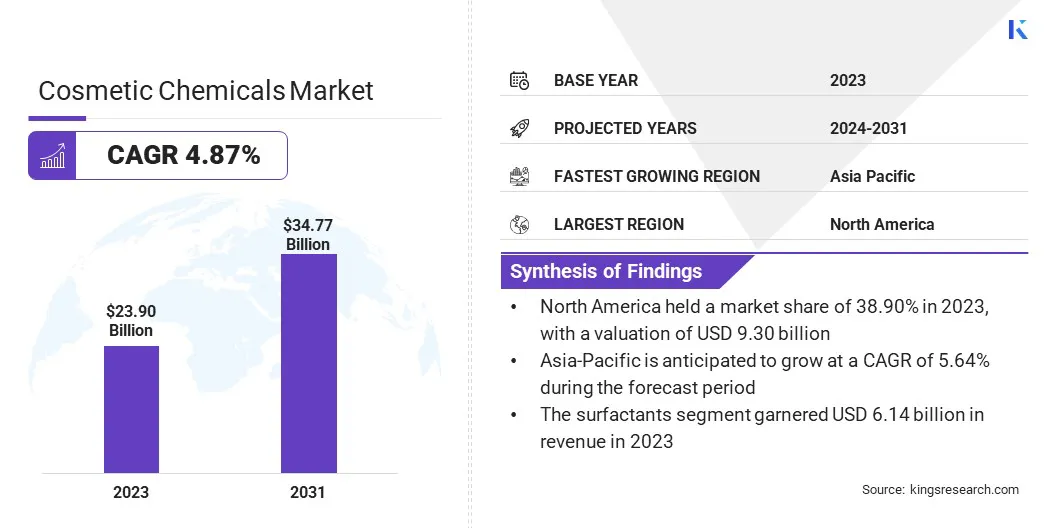

The global Cosmetic Chemicals Market size was valued at USD 23.90 billion in 2023 and is projected to grow from USD 24.91 billion in 2024 to USD 34.77 billion by 2031, exhibiting a CAGR of 4.87% during the forecast period. The market is expanding due to the rising consumer interest in multifunctional and personalized products.

Companies are investing in cutting-edge technologies and research to enhance product performance and meet specific consumer needs. Additionally, the sector is witnessing increased focus on regulatory compliance and safety standards, which is driving market dynamics and competitive growth.

In the scope of work, the report includes products offered by companies such as Solvay, Croda International Plc, Evonik Industries AG, Stepan Company, BASF, Ashland, Dow, Lanxess, Eastman Chemical Company, Lonza, and others.

The cosmetic chemicals market is governed by the increasing consumer demand for innovative, effective, and sustainable products. New developments in cosmetic chemistry in the form of multifunctional ingredients and advanced delivery systems, are enabling manufacturers to create solutions tailored to the diverse consumer requirements. Skincare and haircare cosmetics are also contributing to the market growth by offering targeted benefits for specific concerns.

- According to the Korea Customs Service in 2022, skincare cosmetics remained the largest import category, representing 41.8%, totalling USD 711 million, of the overall cosmetic imports. Fragrances and haircare products was the second-largest import categories, indicating significant demand.

Surging R&D investments by companies to stay competitive in the market is driving new product launches and collaborations, resulting in a high growth and better market opportunities globally.

Cosmetic chemicals are used in personal care and beauty formulations to enhance or alter their appearance, texture, and fragrance. They include a wide range of ingredients such as active agents, preservatives, emulsifiers, colorants, and fragrances. These chemicals help in achieving desired product efficacy, stability, and safety.

They can be either formulated to meet specific regulatory standards or consumer preferences, ensuring effectiveness while minimizing potential risks. Cosmetic chemicals play a central role in creating products for skincare, haircare, and makeup, which ensures the overall product performance and consumer satisfaction.

Analyst’s Review

The increasing availability of advanced digital tools for ingredient transparency is enabling developers to access detailed information about cosmetic formulations. This enhanced transparency ensures informed decision-making, promotes customization, and aligns with the rising demand for sustainability and regulatory compliance during product development.

- For instance, in April 2024, during the in-cosmetics Global event in Paris, BASF introduced its advanced digital service, “Ingredients Revealed.” This new offering would allow developers of personal care products to efficiently identify ingredients and formulations based on specific criteria such as sustainability information, standards, and labels, thereby enhancing transparency and customization in product development.

By increasig access detailed and relevant information manufacturers are able to meet consumer demands in line with sustainability and compliance requirements and develop customized and high-performance products. This is poised to accelerate industry expansion and drive sustained growth.

Cosmetic Chemicals Market Growth Factors

The growing consumer preference for natural and organic cosmetic products is significantly driving the demand for cosmetic chemicals sourced from natural ingredients.

- According to TheRoundup report in 2023, 78% of consumers proritize sustainability and nearly 55% express a willingness to pay a premium for eco-friendly brands.

This shift is rooted in the increasing awareness about the potential health risks of synthetic chemicals, such as long-term exposure to harmful substances like parabens, phthalates, and sulfates.

As consumers increasingly prioritize safety, sustainability, and transparency, companies are investing in research and development to create high-quality, effective natural ingredients that meet these demands. This has led to a surge in new product launches and increased competition among brands, which is expected to fuel this market over the forecast period.

However, a significant challenge in the cosmetic chemicals market is the growing demand for sustainable and eco-friendly products. This is leading companies to come up with formulations that meet these standards while maintaining performance and affordability.

Additionally, regulatory complexities and varying global standards are adding to the difficulty of scaling these sustainable solutions. To mitigate these challenges, key players are heavily investing in research and development to innovate sustainable ingredients and packaging that do not compromise on quality or effectiveness.

Companies are also forming strategic partnerships and alliances to share resources and expertise, enabling them to navigate regulatory landscapes more efficiently. By adopting green chemistry practices and improving supply chain transparency, industry leaders are looking to enhance their sustainability credentials while staying competitive.

Cosmetic Chemicals Market Trends

The cosmetic industry is increasingly prioritizing sustainability, with a strong focus on eco-friendly ingredients and sustainable packaging solutions. This trend is driving the development of biodegradable cosmetic chemicals and the adoption of green chemistry practices, which minimize environmental impact and meet the evolving consumer preferences.

- In June 2023, Solvay, a global leader in naturally-derived polymers for beauty care formulations, launched Naternal, a new brand of bio-based polymers designed for hair and skincare solutions. This brand represents Solvay’s commitment to regenerative beauty, prioritizing sustainability and care for all stakeholders, including the planet, farming communities, brands, and consumers.

Such developments are driving the cosmetic chemicals market growth by attracting environmentally conscious consumers, enhancing brand reputation, and opening new revenue streams in the rapidly expanding segment of sustainable cosmetics.

Innovations in cosmetic chemistry are driving market growth. Advanced delivery systems and multifunctional ingredients. are being used to create more effective, long-lasting, and tailored cosmetics. Additionally, the ability to combine multiple benefits in a single product is increasing consumer loyalty and willingness to invest in premium offerings. This trend is accelerating market expansion and offering a competitive edge to the market players.

Segmentation Analysis

The global market has been segmented based on category, application, nature, type, and geography.

By Category

Based on category, the cosmetic chemicals market has been categorized into surfactants, film-formers, colorants & pigments, preservatives, emulsifying & thickening agents, single-use additives, and fragrances. The surfactants segment accounted for the highest revenue of USD 6.14 billion in 2023.

Consumer preference for sustainable and biodegradable products is prompting manufacturers to invest in research and development and fueling the development of eco-friendly surfactant formulations. Additionally, the expansion of emerging markets and the increasing penetration of surfactants in new product formulations are further contributing to the segment's growth.

As industries prioritize sustainability and performance, this segment is poised for continued expansion, with companies focusing on developing advanced solutions to meet consumer demand.

By Application

Based on application, the market has been categorized into skin care, hair care, makeup, oral care, and others. The skin care segment captured the largest cosmetic chemicals market share of 36.89% in 2023, mainly driven by a focus on skin health and growing demand for products to address aging, hydration, and sensitivity.

The rise of clean beauty and natural and organic products is further propelling segment growth, as consumers become more conscious of the formulations they use. Additionally, technological advancements and personalized and multifunctional products are attracting a broader consumer base. With continuous innovation and a focus on efficacy, the skincare segment is poised for sustained growth over the forecast period.

By Nature

Based on nature, the market has been categorized into organic and conventional segments. The conventional segment is expected to account for the highest revenue of USD 24.82 billion by 2031. Despite the increasing popularity of natural and organic products, conventional cosmetics continue to dominate due to their affordability, extensive range, and well-established brand loyalty.

This segment is also benefiting from ongoing innovation, with manufacturers enhancing formulations to improve efficacy, safety, and user experience. The development of advanced synthetic ingredients and new technologies are expected to help conventional products remain competitive over the forecast period.

Cosmetic Chemicals Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America cosmetic chemicals market share stood at 38.90% in 2023, in the global market with a valuation of USD 9.30 billion. Improved product formulations and a rising interest in multifunctional and personalized solutions are key growth drivers, especially in the U.S.

The market is also witnessing a significant shift toward clean beauty, with increasing consumer preference for natural, organic, and cruelty-free products. Regulatory emphasis on product safety and transparency is further influencing growth trends. With major industry players investing in R&D, the North America market is expected to witness continued growth

Asia-Pacific is anticipated to witness the fastest growth at a CAGR of 5.64% over the forecast period. Consumers increasingly adopting beauty and personal care routines is adding to the demand for skincare, color cosmetics, and innovative beauty products. The market is particularly dynamic in countries like China, Japan, and South Korea, where beauty trends such as K-beauty and J-beauty are relatively pronounced.

Additionally, the expansion of e-commerce platforms and social media marketing is boosting product accessibility and awareness. With a strong focus on innovation and localized product offerings, the market is poised for significant expansion in the region.

- In October, 2023, Dow announced its participation at in-cosmetics Asia 2023 in Bangkok, Thailand, from November 7-9. At booth K30, Dow presented its latest innovative ingredients, including the debut of the Beauty Rebalanced 2.0 Concepts Collection and Sustainable Hair Care Collection, showcasing one of the industry's largest portfolios focused on sustainable and high-performance products.

Competitive Landscape

The global cosmetic chemicals market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategies, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Cosmetic Chemicals Market

Key Industry Developments

- March 2024 (Partnership): Eastman and ChemSpec Ltd. entered into a strategic agreement to efficiently distribute cosmetic ingredients in the U.S. markets. This partnership is designed to enhance distribution capabilities and better serve the growing demand for cosmetic products in the region.

The global cosmetic chemicals market has been segmented:

By Category

- Surfactants

- Film-Formers

- Colorants & Pigments

- Preservatives

- Emulsifying & Thickening Agents

- Single-Use Additives

- Fragrances

By Type

- Skin Care

- Hair Care

- Makeup

- Oral Care

- Others

By Nature

By Type

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America