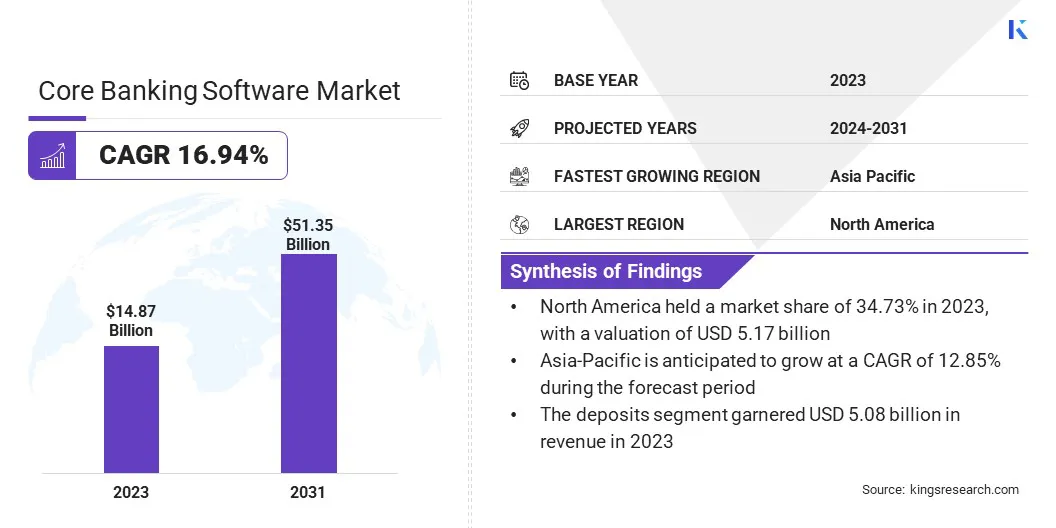

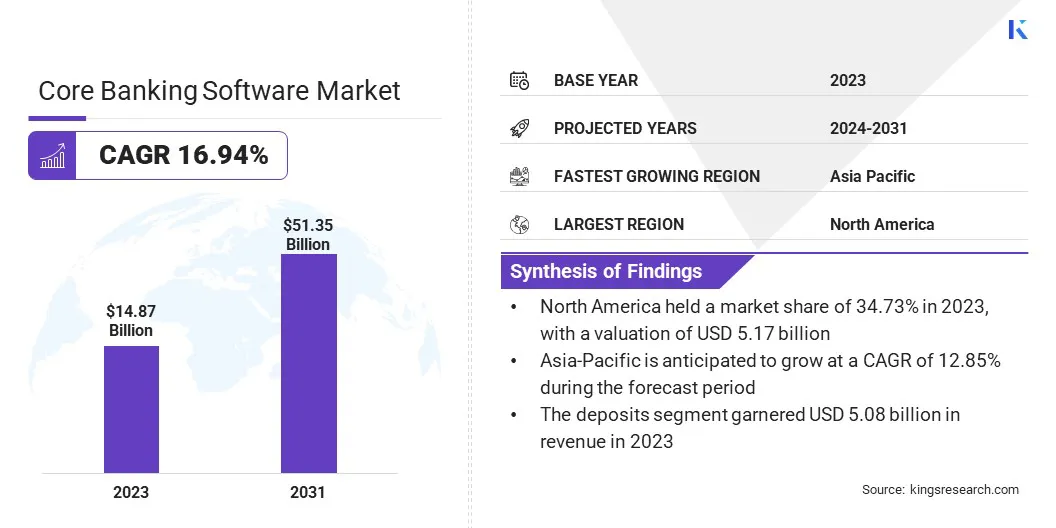

Core Banking Software Market Size

The global Core Banking Software Market size was valued at USD 14.87 billion in 2023 and is projected to grow from USD 17.17 billion in 2024 to USD 51.35 billion by 2031, exhibiting a CAGR of 16.94% during the forecast period. The banking sector is rapidly adopting digital technologies to enhance efficiency, streamline operations, and improve customer experiences.

Core banking software helps in this regard by enabling banks migrate from outdated legacy systems to automation and digital services. In the scope of work, the report includes services and solutions offered by companies such as Oracle, Temenos Headquarters SA, Fiserv, Inc., SAP SE, Finastra, Infosys Limited (Infosys Finacle), Tata Consultancy Services (TCS), Jack Henry & Associates, Inc., FIS, Mambu, and others.

Moreover, the steadily growing global economy influences the expansion of the banking sector. Increasing demand for financial services pushes banks to enhance their technological infrastructure. Core banking software is essential for managing larger transaction volumes, scaling operations, and efficiently serving growing customer bases across multiple regions.

- The International Monetary Fund's 2024 World Economic Outlook reports global real GDP growth at 4.2%, an increase from 4.1% recorded in 2022.

Additionally, the growing globalization of trade and finance necessitates efficient management of cross-border payments, foreign exchange, and international transactions. Banks rely on core banking software to handle these complex operations, enabling them to serve international customers and manage financial operations across multiple markets.

Core banking software is a comprehensive, centralized system designed to manage a bank’s fundamental operations and services. It handles key functions such as account management, transaction processing, loan servicing, and deposit tracking.

By integrating various banking processes into a unified platform, core banking software facilitates real-time transaction processing and data management, allowing for consistent and efficient service delivery across multiple branches and digital channels.

This software enables banks to automate routine tasks, increase compliance with regulatory requirements, and enhance customer experiences through seamless access to banking services and information.

Analyst’s Review

Government regulations and policy initiatives play a pivotal role in shaping the global market. Financial institutions are under increasing pressure to comply with stringent regulatory standards related to data security, risk management, and transparency. Core banking software helps banks meet these regulatory requirements by automating compliance processes, improving data accuracy, and enabling comprehensive reporting.

Additionally, several governments are actively promoting digitization in the banking sector, offering incentives for the adoption of modern technologies. These policy-driven efforts to enhance security, efficiency, and financial inclusion are driving significant growth in the core banking software market worldwide.

- The DigiDhan Mission, established by India’s Ministry of Electronics and Information Technology (MeitY), aims to promote a less cash-dependent economy and ensure a seamless digital payment experience for all citizens. Various initiatives launched under the DigiDhan Mission include setting digital payment transaction targets for banks and expanding payment infrastructure. These efforts have led to a dramatic rise in digital transaction volumes, growing from 246.5 million in 2017-18 to 1602 million in 2022-23. In the current financial year, as of January 2024, 1771.7 million transactions have been recorded.

Moreover, strict regulatory requirements and increased scrutiny from regulatory bodies increasingly impact the market. Core banking systems play a crucial role in ensuring compliance by automating reporting, fraud detection, and risk management processes.

These systems help banks adhere to legal standards, manage financial risks effectively, and avoid regulatory penalties. The need for compliance and risk management drives the adoption of advanced core banking software in the banking sector.

Core Banking Software Market Growth Factors

The widespread adoption of online and mobile banking drives the need for robust core banking software. With the growing use of smartphones and the internet, customers expect seamless access to banking services across various digital platforms.

Core banking systems facilitate this by allowing banks to deliver consistent and efficient services through integration with online and mobile banking channels. This integration helps banks attract and retain clients while adapting to their digital preferences.

- According to the International Telecommunication Union (ITU), approximately 67% of the global population, equating to 5.4 billion people, were internet users in 2023. This marks a growth of 4.7% from 2022, surpassing the 3.5% increase recorded between 2021 and 2022.

The demand for real-time processing of transactions and updates significantly influences the core banking software market. Customers expect immediate access to their financial data and swift transaction processing. Core banking systems address this need by offering a centralized platform that ensures real-time transaction handling and up-to-date account information.

This capability is crucial for maintaining operational efficiency and enhancing customer satisfaction, prompting banks to invest in advanced core banking solutions.

However, data privacy and security concerns are significant factors restraining the growth of the market. The risks associated with data loss, hacking, and non-compliance with strict data protection regulations raise skepticism among financial institutions when adopting new software solutions.

To address these concerns, companies deploy advanced encryption, cloud-based security solutions, and global data protection standards. Additionally, they use AI and machine learning for real-time threat detection. These measures help secure data, reduce risks, and sustain market growth by building trust and ensuring regulatory compliance.

Core Banking Software Market Trends

The adoption of cloud-based core banking solutions is transforming the banking industry. Cloud technology provides scalability, flexibility, and cost-efficiency, making it an attractive option for banks looking to modernize their infrastructure.

Cloud-based core banking systems enable faster deployment, easier updates, and reduced IT costs. These benefits drive the shift toward cloud-based solutions as banks seek to enhance their operational efficiency and agility.

- In June 2024, Dineo Credito, a Madrid-based microlender, transitioned from its in-house core system to Mambu’s cloud-based core banking platform. This move aligns with the company's strategy to introduce innovative lending products tailored to its expanding customer base in Spain. The transition is anticipated to facilitate the growth of its lending portfolio, incorporating a broader range of traditional lending products featuring higher loan amounts and extended terms.

Additionally, the collaboration between traditional banks and fintech companies is expanding the scope of core banking software. Integration with fintech solutions and third-party services, such as payment processors and digital wallets, is becoming increasingly important.

Core banking systems provide the necessary infrastructure for banks to incorporate these innovative services, enabling them to offer a broader range of financial products and enhance their competitive position in the market.

Segmentation Analysis

The global market has been segmented based on solution, service, deployment, end use and geography.

By Solution

Based on solution, the market has been segmented into deposits, loans, enterprise customer solutions, and others. The deposits segment led the core banking software market in 2023, reaching the valuation of USD 5.08 billion. Deposits form the backbone of a bank’s funding and liquidity management, making efficient handling of deposit accounts essential for day-to-day banking.

Moreover, the growing demand for digital banking services has intensified the need for seamless deposit management, enabling real-time processing, better customer engagement, and secure transactions. The deposits segment’s strong impact on profitability and customer retention will likely drive significant investment in advanced core banking solutions.

By Service

Based on service, the market has been bifurcated into professional service and managed service. The professional service segment secured the largest revenue share of 68.08% in 2023 due to the complexity and expertise required in implementing, integrating, and maintaining advanced banking solutions. Financial institutions often rely on professional services to ensure seamless deployment of core banking software solutions.

It minimizes disruptions and ensures that the system aligns with regulatory requirements and operational needs. Additionally, professional services such as consulting, training, and support are critical for banks transitioning from legacy systems to modern platforms. The need for ongoing technical support, system upgrades, and customization is also expected to drive the demand for these services.

By Deployment

Based on deployment, the core banking software market has been divided into cloud and on-premise. The cloud segment is expected to secure the largest revenue share of 65.45% in 2031. Cloud-based solutions enable financial institutions to quickly scale operations and manage increasing transaction volumes without significant capital expenditure on infrastructure.

This agility is critical in today’s competitive and dynamic banking environment, where the ability to adapt is crucial. Additionally, cloud platforms offer enhanced data security, real-time updates, and seamless integration with fintech services, ensuring compliance with regulatory requirements while improving operational efficiency.

By End Use

Based on end use, the market has been divided into banks, financial institutions, and others. The financial institutions segment is poised for significant growth at a robust CAGR of 16.77% over the forecast period. This is attributed to the sector's continuous drive toward digital transformation and operational efficiency.

As banks and other financial entities face increasing competition and regulatory pressures, they are adopting advanced core banking solutions to streamline processes, improve customer service, and reduce operational costs. Moreover, financial institutions are rapidly expanding their digital service offerings to meet evolving customer expectations for seamless, 24/7 banking experiences.

Core Banking Software Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America core banking software market share stood at around 34.73% in 2023 in the global market, with a valuation of USD 5.17 billion. The increasing adoption of digital banking solutions within the U.S. healthcare industry is significantly influencing the market's growth in North America.

Healthcare organizations are progressively modernizing their financial operations to enhance efficiency and streamline processes. Digital banking platforms play a crucial role by improving the management of patient transactions, insurance reimbursements, and electronic funds transfers.

- In June 2024, Bank Midwest, serving a diverse range of consumer and commercial banking needs across Iowa, Minnesota, and South Dakota, partnered with global financial software provider, Finastra, to introduce a new digital banking platform, OnePlace.bank. This venture aims to offer specialized business banking and loan services tailored to dental, medical, and veterinary practices. Additionally, OnePlace.bank is expected to support a wide range of services, including deposit management, treasury services, and various ancillary banking functions.

Moreover, the demand for seamless omnichannel banking experiences is growing in North America. This growth is driven by customers that expect consistent and convenient access to financial services across various platforms.

Core banking software enables banks to integrate their services across digital and physical channels, providing a unified experience for customers. This capability is crucial for meeting customer expectations and driving the adoption of advanced core banking solutions.

Asia Pacific is poised for significant growth at a robust CAGR of 12.85% over the forecast period from 2024 to 2031. The rapid proliferation of smartphones and increased internet penetration in Asia-Pacific has led to a surge in mobile and internet banking. Customers increasingly expect convenient and efficient banking services through their digital devices.

Core banking software supports this trend by integrating with mobile and online banking platforms, allowing banks to offer a unified and responsive banking experience. The rise in mobile and internet banking is a key factor driving the expansion of core banking software in the region.

- According to the GSM Association in 2023, China is set to become the first market to reach 1 billion 5G connections by 2025. By 2030, 5G connections in China are expected to soar to 1.6 billion, representing nearly one-third of the global total. China's 5G adoption rate is expected to significantly surpass the global average of 54%. Additionally, by 2030, China is projected to add 300 million new smartphone connections, bringing the total to 1.73 billion.

Additionally, increasing complexity and variety of financial products offered in Asia-Pacific are driving the need for sophisticated core banking solutions. Banks are expanding their product portfolios to include a range of offerings, such as wealth management, insurance, and investment services.

Core banking software supports this diversification by providing the necessary infrastructure to manage complex financial products and services effectively in the region.

Competitive Landscape

The global core banking software market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Core Banking Software Market

Key Industry Developments

- June 2024 (Partnership): Centenary Bank, one of Uganda’s largest banks, partnered with Oracle FS to implement a comprehensive suite of solutions, including the flagship Flexcube core banking system. This new platform will enhance a broad spectrum of the bank’s operations, covering everything from core banking and payments to digital services for retail and corporate clients. It will also support branch operations, origination, leasing, fraud detection, and regulatory compliance.

- May 2024 (Technological Advancement): Arab National Bank (ANB) upgraded its long-standing core banking system, Infosys Finacle, to the latest version, 11x, marking a significant milestone in its banking evolution. The upgrade involved a seamless migration of millions of records and a smooth transition from legacy systems that had been in place for over 14 years, signaling a new era of advanced banking capabilities at ANB.

The global core banking software market has been segmented as below:

By Solution

- Deposits

- Loans

- Enterprise Customer Solutions

- Others

By Service

- Professional Service

- Managed Service

By Deployment

By End Use

- Banks

- Financial Institutions

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America