Market Definition

Control towers are centralized digital platforms that provide end-to-end visibility, coordination, and real-time decision-making across complex supply chain networks. The market encompasses software solutions and integrated services that leverage technologies such as AI, machine learning, cloud computing, and advanced analytics to monitor, predict, and optimize supply chain performance.

It includes operational, analytical, and predictive control towers deployed across transportation, logistics, inventory, procurement, and manufacturing functions.

These solutions are widely used by enterprises to enhance responsiveness, reduce disruptions, and improve collaboration across stakeholders, positioning control towers as critical enablers of agile and resilient supply chain ecosystems.

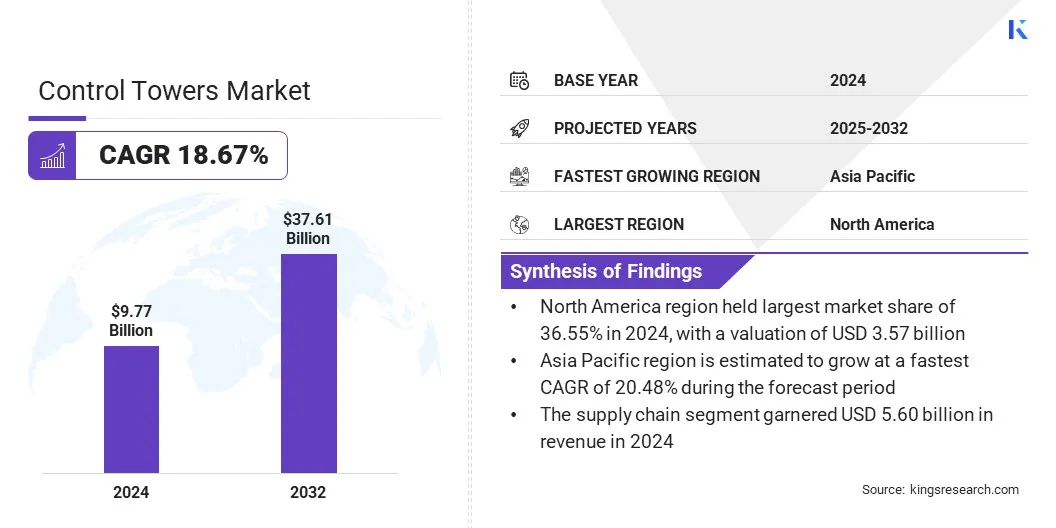

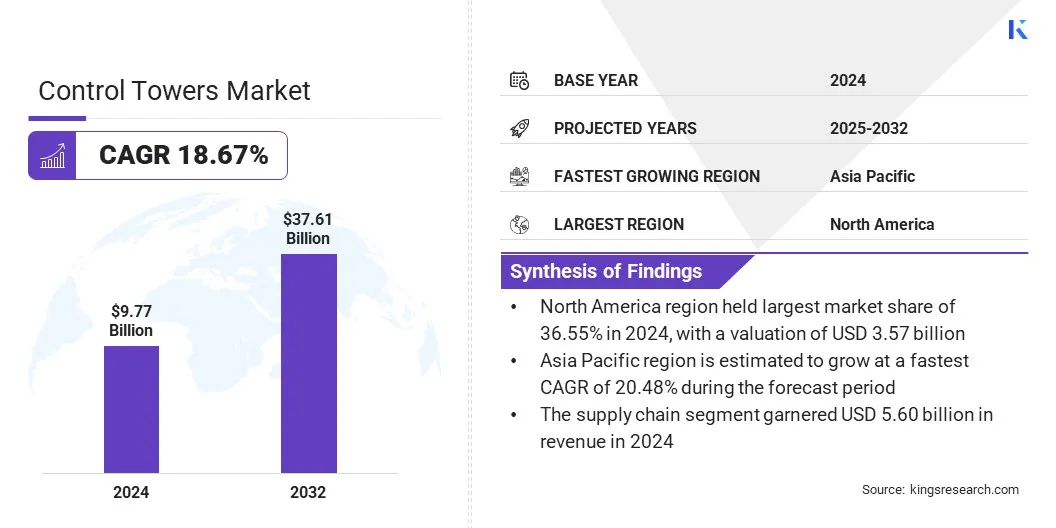

The global control towers market size was valued at USD 9.77 billion in 2024 and is projected to grow from USD 11.35 billion in 2025 to USD 37.61 billion by 2032, exhibiting a CAGR of 18.67% during the forecast period.

The growth is driven by the rapid expansion of e-commerce, which is increasing the demand for real-time coordination and end-to-end visibility across complex supply chain networks. Enterprises are adopting cloud-based control tower platforms to streamline operations, improve decision-making, and enhance responsiveness to disruptions.

Key Market Highlights:

- The control towers industry size was recorded at USD 9.77 billion in 2024.

- The market is projected to grow at a CAGR of 18.67% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 3.57 billion.

- The operational segment garnered USD 5.51 billion in revenue in 2024.

- The supply chain segment is expected to reach USD 20.52 billion by 2032.

- The retail & consumer goods segment is anticipated to witness the fastest CAGR of 22.06% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 20.48% during the forecast period.

Major companies operating in the control towers market are Accenture, Blue Yonder Group, Inc., e2open, LLC., Infor, Kinaxis Inc., Coupa, SAP SE, Siemens, Viewlocity Technologies Pty Ltd., IBM, Capgemini, PwC, TATA Consultancy Services Limited, Resilinc Corporation, and ORTEC.

Control Towers Market Report Scope

|

Segmentation

|

Details

|

|

By Type

|

Operational, Analytical

|

|

By Application

|

Supply Chain, Transportation

|

|

By End-Use Industry

|

Manufacturing, Retail & Consumer Goods, Healthcare, Aerospace & Defense, Chemicals

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Control Towers Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America control towers market share stood at 36.55% in 2024 in the global market, with a valuation of USD 3.57 billion. This dominance is attributed to high investment in digital supply chain transformation by major industries across North America.

Companies across manufacturing, retail, and logistics are allocating significant capital toward upgrading legacy infrastructure and adopting advanced digital platforms. These investments focus on deploying artificial intelligence, machine learning, and cloud-based control towers to optimize supply chain performance.

The shift toward these technologies is enabling real-time data integration, predictive analytics, and automation across operations. As a result, the region maintains a strong lead in control tower adoption and market share.

- In April 2024, Blue Yonder showcased its AI-powered supply chain platform at ICON 2024, highlighting the strategic acquisitions of Flexis AG and One Network Enterprises, with a combined investment of USD 839 million in 2023. These acquisitions enhance Blue Yonder’s capabilities in real-time planning, logistics execution, and multi-enterprise collaboration, positioning the company to meet rising demand for connected supply chain solutions.

Asia Pacific is poised for a significant CAGR of 20.48% over the forecast period. This growth is driven by the expansion of manufacturing and export hubs in China, Vietnam, and India, which is driving demand for advanced supply chain coordination.

These countries are experiencing rapid industrial growth, increasing production volumes, and rising cross-border trade. This growth is creating the need for real-time visibility, efficient logistics, and synchronized operations.

Enterprises are deploying control tower solutions to manage complex supply chains. As a result, Asia Pacific is emerging as the fastest growing region in the global market.

Control Towers Market Overview

Rising demand for end-to-end supply chain visibility and real-time decision-making is significantly driving the control towers market. Global supply chains are increasingly complex and interconnected, prompting businesses to seek accurate, real-time insights across all operational functions to improve responsiveness and service levels.

Continuous data monitoring, predictive alerts, and AI-driven recommendations enable informed decision-making and faster disruption management. Manufacturers are integrating control tower capabilities across logistics, inventory, and production workflows to enhance coordination and minimize delays.

These developments are accelerating the adoption of advanced control tower solutions across retail, automotive, healthcare, and consumer goods.

Market Driver

E-Commerce Expansion

The rapid expansion of e-commerce is a major driver of the global market, as online retail operations require faster order fulfillment, adaptive inventory management, and logistics coordination.

To meet escalating customer expectations, retailers and logistics providers need continuous visibility across order processing, warehousing, and last-mile delivery. This increasing dependence on real-time control and integrated visibility is accelerating the adoption of control tower solutions across the e-commerce supply chain.

Moreover, providers are developing scalable, cloud-based control towers tailored to high-velocity retail operations and aligning production and distribution systems with digital platforms to enhance alignment and operational agility. As a result, the market is expanding rapidly across e-commerce-intensive sectors.

- In January 2025, Prologis reported a sharp rise in Q4 2024 leasing activity, driven by strong demand for e-commerce-ready warehouse space. Leases commenced on 46.5 million square feet, with occupancy reaching 95.6%, underscoring the continued expansion of e-commerce and its impact on logistics infrastructure requirements.

Market Challenge

Integration Challenges with Legacy Infrastructure

One of the key challenges in the control towers market is the complexity of integrating these platforms with existing legacy systems across supply chain functions.

Many organizations face data silos, inconsistent formats, and limited interoperability, which restrict real-time visibility and delay decision-making. This lack of seamless integration reduces the overall effectiveness of control tower deployments and limits scalability across diverse operations.

To address this issue, market players are adopting modular architectures and API-driven frameworks that support easier connectivity with legacy infrastructure. Moreover, manufacturers are investing in phased integration models and unified data layers to ensure smoother system alignment.

These measures are enabling gradual modernization while preserving core systems, allowing wider adoption of control tower capabilities across supply chains.

Market Trend

Adoption of Cloud-Based Control Towers

The market is experiencing a shift from traditional on-premise systems to cloud-based solutions that deliver scalability, flexibility, and reduced infrastructure costs. This is due to the growing need for faster deployment, real-time data access, and simplified system management across global supply chains.

Cloud platforms enable seamless integration, remote accessibility, and efficient resource use. As a result, the transition to cloud-based solutions is enhancing operational agility and supporting the adoption of cloud-based control towers.

- In April 2025, Grid Dynamics launched its Internet of Things (IoT) Control Tower, a cloud-based analytics platform developed for the manufacturing and energy sectors. The solution leverages machine learning (ML) and artificial intelligence (AI) to process data from distributed devices and enhance system uptime and responsiveness. This development supports the ongoing shift toward cloud-based control tower solutions for improved scalability, operational flexibility, and reduced infrastructure costs.

Market Segmentation:

- By Type (Operational and Analytical): The operational segment earned USD 5.51 billion in 2024 due to its critical role in enabling real-time monitoring, execution, and coordination of day-to-day supply chain activities across logistics, inventory, and transportation functions.

- By Application (Supply Chain and Transportation): The supply chain segment held 57.32% of the market in 2024, due to growing enterprise demand for end-to-end visibility, coordination, and responsiveness across procurement, production, distribution, and fulfillment operations.

- By End-Use Industry (Manufacturing, Retail & Consumer Goods, Healthcare, Aerospace & Defense, and Chemicals): The retail & consumer goods segment is projected to reach USD 13.29 billion by 2032, owing to the rising need for real-time inventory visibility, demand forecasting, and agile distribution to meet high consumer expectations and rapid order fulfillment requirements.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) enforces regulations on business practices and competition, ensuring supply chain technology providers comply with data privacy standards and avoid anti-competitive behavior.

- In China, the Ministry of Transport and Cyberspace Administration regulates freight operations and data governance, influencing control towers reliant on logistics coordination and compliant cross-border data integration.

Competitive Landscape

The control towers market exhibits a dynamic competitive landscape, marked by frequent solution launches focused on advanced functionality and system integration. Key vendors are introducing platforms that incorporate AI capabilities, real-time monitoring, and automation features.

Providers are also upgrading cloud-based infrastructure to enhance performance and interoperability to expand market presence and address complex enterprise requirements across logistics, manufacturing, and distribution environments.

- In January 2025, FourKites launched the Intelligent Control Tower,. powered by a new digital workforce of AI agents, Intelligent Control Tower can take autonomous action across complex supply chain workflows, surface insights, assess risk, and make prescriptive recommendations.

Key Companies in Control Towers Market:

- Accenture

- Blue Yonder Group, Inc.

- e2open, LLC.

- Infor

- Kinaxis Inc.

- Coupa

- SAP SE

- Siemens

- Viewlocity Technologies Pty Ltd.

- IBM

- Capgemini

- PwC

- TATA Consultancy Services Limited

- Resilinc Corporation

- ORTEC

Recent Developments (Product Launch)

- In May 2025, ServiceNow introduced AI Control Tower, a centralized command center designed to govern, manage, secure, and extract value from any AI agent, model, or workflow. The platform optimizes AI investments and supports seamless, responsible integration into enterprise strategies.

- In February 2024, One Network Enterprises announced that Bayer Crop Science, a division of Bayer Corporation, had selected the company to deliver its Supply Chain Control Tower. Bayer joined the Digital Supply Chain Network to leverage its expanding ecosystem and enhance efficiency, reliability, agility, and predictability across global supply chain operations.