Content Intelligence Market Size

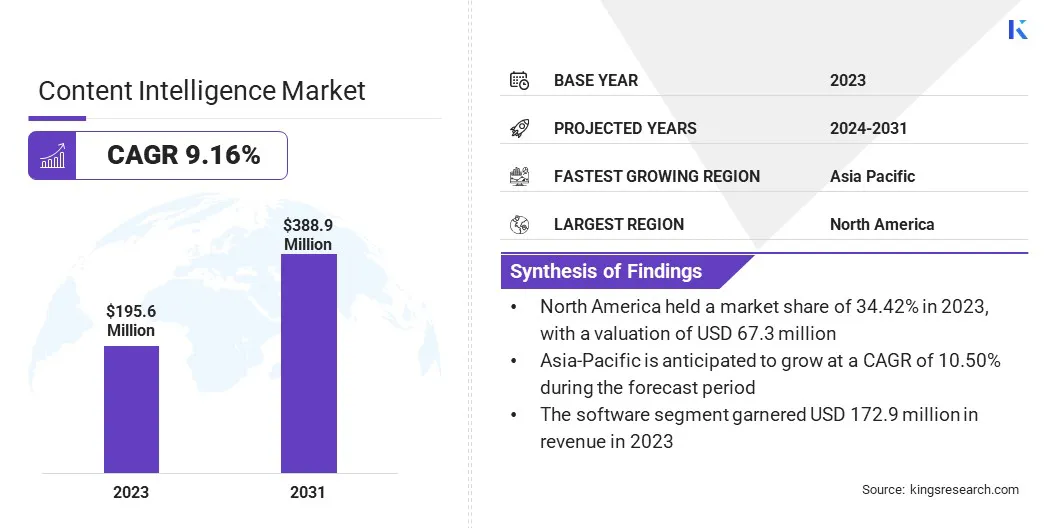

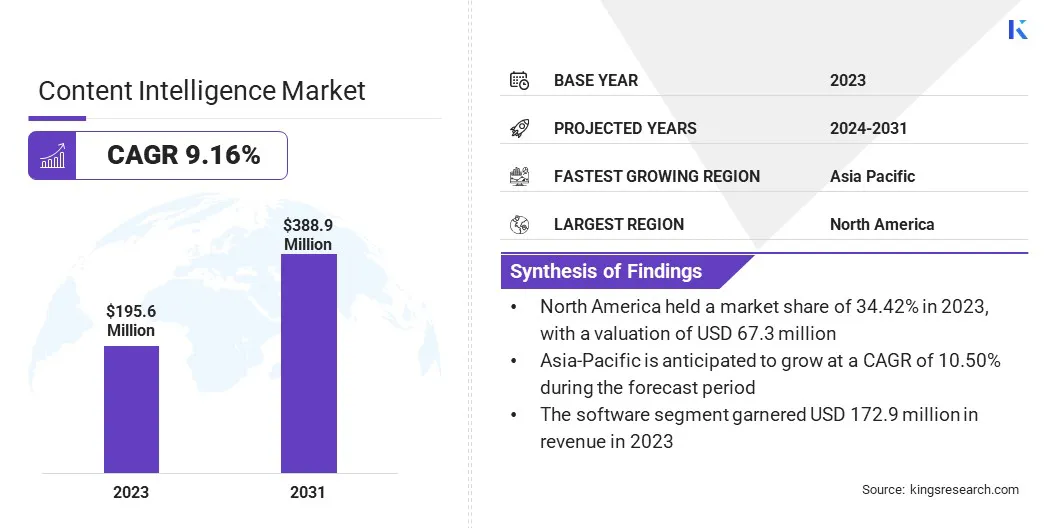

The global Content Intelligence Market size was valued at USD 195.6 million in 2023 and is projected to grow from USD 210.6 million in 2024 to USD 388.9 million by 2031, exhibiting a CAGR of 9.16% during the forecast period. The market is expanding rapidly, driven by advancements in AI and automation, increased demand for personalized content, and significant government investments.

This growth is further bolstered by the integration of natural language processing (NLP), rising adoption across various industries, and strategic partnerships that enhance content strategies and operational efficiency.

In the scope of work, the report includes solutions offered by companies such as ABBYY, Adobe., M-Files Corporation, Curata, Inc., Emplifi Inc., Smartlogic, Open Text Corporation., Atomic Reach Inc., Scoop.it, Onespot (Seabird Apps, Inc.), and others.

The content intelligence market is experiencing robust growth, mainly due to the rising demand for personalized content strategies across industries.

- According to the International Telecommunication Union, there were over 5.3 billion internet users worldwide in 2022, offering businesses a vast pool of data.

Content intelligence tools use this data to analyze consumer behavior, optimize content strategies, and improve user experiences. As sectors such as e-commerce, media, and healthcare focus on enhancing customer engagement, the adoption of AI-powered content intelligence platforms is expanding.

Technologies such as natural language processing (NLP) and machine learning are refining content analysis, while integration with CRM platforms and automation are reducing operational costs, fueling market expansion.

Content intelligence refers to the use of advanced technologies, such as artificial intelligence (AI) and machine learning, to analyze, optimize, and manage content across various digital platforms. It involves leveraging data-driven insights to understand audience behavior, preferences, and engagement patterns.

This enables businesses to create more targeted, personalized, and effective content strategies. By integrating natural language processing and other analytical tools, content intelligence helps organizations improve content relevance, enhance user experiences, and achieve better marketing outcomes. It further streamlines content management processes, automates repetitive tasks, and provides actionable insights for optimizing content performance.

Analyst’s Review

Favorable government initiatives and increased investments are propelling the growth of the content intelligence market by providing financial support and resources for businesses to adopt advanced technologies. These efforts promote widespread adoption, enabling companies to enhance content strategies and improve overall market competitiveness.

- The U.S. Small Business Administration's 2022 Digital Transformation Initiative awarded USD 2 billion in grants, enabled small and medium-sized enterprises (SMEs) to adopt advanced content intelligence technologies, resulting in a 30% increase in adoption by 2024.

Companies are utilizing these platforms to improve content effectiveness and boost ROI. Automating content tasks saves time and resources, allowing for targeted, personalized content that improves overall marketing efficiency.

Content Intelligence Market Growth Factors

Companies are increasingly leveraging content intelligence to enhance personalized user experiences, which is fostering market growth. The rising consumer demand for customized interactions is prompting businesses to adopt AI-driven content intelligence solutions.

- In September 2022, Messagepoint launched Semantex, a new division dedicated to offering an AI-driven content intelligence platform. Designed to help developers tackle complex content-related challenges, Semantex utilizes AI, machine learning, and natural language processing. It enables developers to assess text-based content fragments through API calls, delivering a robust solution for content analysis and comprehension.

These tools utilize advanced machine learning algorithms to analyze vast amounts of user data, including behavior, preferences, and trends, facilitating businesses to deliver highly targeted content.

This personalization improves customer engagement and retention, thereby boosting business performance. The growing reliance of sectors such as e-commerce, media, and healthcare increasingly on AI-powered insights is fueling the demand for content intelligence platforms, augmenting significant market growth.

A significant challenge hampering the expansion of the content intelligence market is ensuring data privacy and security while leveraging advanced analytics. As companies collect and analyze large volumes of user data, they must comply with stringent regulations and address concerns regarding data breaches and misuse.

Key players are addressing these challenges by implementing robust data protection measures and adhering to industry standards and regulations. They are investing heavily in advanced encryption technologies and secure data storage solutions to safeguard sensitive information.

Additionally, companies are enhancing transparency and providing users with control over their data to build trust. These measures help mitigate privacy and security risks while fostering a safer environment for content intelligence operations.

Content Intelligence Industry Trends

The integration of natural language processing (NLP) in content intelligence platforms is emerging as a key market trend. Incorporating NLP allows businesses to analyze and interpret the sentiment, tone, and context of customer communications more effectively. This deep level of content analysis helps companies create more relevant, engaging, and personalized content tailored to audience preferences.

Improved customer engagement strategies lead to enhanced loyalty and higher conversion rates for businesses. This growing reliance on NLP-driven insights is fostering the adoption of content intelligence tools across industries, thereby supporting market growth.

With the surge in internet traffic, marketers are shifting toward personalized content strategies, which is augmenting the growth of the content intelligence market. Rather than relying solely on location or demographics, businesses are increasingly leveraging content intelligence tools to analyze user behavior and social media activity for more advanced insights.

- In February 2023, Adobe Experience Cloud introduced enhanced AI capabilities to personalize digital interactions. The new Adobe Sensei GenAI acts as a copilot for marketers and customer experience teams, offering advanced support across various Adobe Experience Cloud applications. It facilitates asset creation and personalizes the customer journey through multiple use cases.

This shift allows for more targeted content creation, enhancing user engagement. For instance, media streaming platforms, including YouTube, Amazon Prime, and Netflix, utilize content personalization to boost viewer interaction. Additionally, the increasing adoption of CRM platforms such as Salesforce Desk and Zoho CRM, combined with AI integration, is fueling market growth by enabling more effective customer relationship management and data-driven content strategies.

Segmentation Analysis

The global market has been segmented based on component, deployment, enterprise size, and geography.

By Component

Based on component, the market has been categorized into software and services. The software segment garnered the highest revenue of USD 172.9 million in 2023. This segment encompasses platforms that provide robust analytics, automation, and optimization capabilities for content management and creation.

The expansion of the segment is largely attributed to the surging demand for personalized content, the necessity for streamlined content operations, and the growing emphasis on data-driven marketing strategies. The integration of natural language processing (NLP) and advanced automation features is further augmenting segmental expansion.

With businesses increasingly leveraging data to gain a competitive edge, the software segment is expected to witness rapid growth in the foreseeable future.

By Deployment

Based on deployment, the market has been categorized into cloud and on-premises. The cloud segment captured the largest content intelligence market share of 65.92% in 2023. Cloud platforms offer scalability, flexibility, and cost-efficiency, enabling businesses to manage large volumes of content and data seamlessly.

Key factors fueling this growth include the rising demand for remote access, collaborative content creation, and real-time data processing. Additionally, advancements in cloud technology, such as enhanced security features and integration capabilities, are boosting segmental expansion. As companies prioritize digital transformation and cloud adoption, the cloud segment is set to experience robust growth, supported by ongoing technological advancements and rising demand.

By Enterprise Size

Based on enterprise size, the market has been categorized into SMEs and large enterprise. The large enterprise segment is projected to garner the highest revenue of USD 241.6 million by 2031.

Large enterprises are adopting content intelligence tools to streamline operations, enhance content personalization, and improve decision-making processes. Major growth factors include the rising volume of content, complex data requirements, and the need for advanced analytics to gain competitive insights.

These organizations are investing heavily in scalable and robust content intelligence platforms that offer integrated AI and machine learning capabilities. With the rising focus of large enterprises on digital transformation and data-driven strategies, the segment is poised to witness continued expansion.

Content Intelligence Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America content intelligence market accounted for the largest market share of 34.42% in 2023, with a valuation of USD 67.3 million. The regional market benefits from a high concentration of leading content intelligence providers, significant research and development activities, and a strong emphasis on digital transformation across industries.

- In February 2023, M-Files, a U.S.-based company, acquired Ment, a no-code document automation firm, thereby enhancing its content intelligence capabilities. This integration offers a comprehensive solution for document management and collaboration.

Additionally, in March 2024, IBM Watson partnered with the Canadian government to provide AI-powered solutions to federal agencies, projecting a 50% increase in public sector revenue. Furthermore, Salesforce reported that 70% of its new content intelligence customers in Q1 2024 were from North America, highlighting the region's sustained market dominance.

Asia-Pacific is anticipated to witness the fastest growth at a robust CAGR of 10.50% over the forecast period. This growth is largely attributed to rapid digital transformation and increasing internet penetration. This expansion is further bolstered by the region's expanding digital economies and substantial investments in technology infrastructure.

- The Asian Development Bank reported a 20% annual growth in digital economies in Southeast Asia from 2020 to 2023, reaching USD 300 billion.

- Additionally, China’s National Bureau of Statistics revealed that the digital economy accounted for 40% of its GDP in 2023, up from 36% in 2021.

This growth is further supported by regional investments in advanced content technologies. For instance, companies across Asia-Pacific are adopting sophisticated content intelligence solutions to enhance digital capabilities and operational efficiency, which is expected to stimulate regional market growth.

Competitive Landscape

The global content intelligence market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Content Intelligence Market

- ABBYY

- Adobe.

- M-Files Corporation

- Curata, Inc.

- Emplifi Inc.

- Smartlogic

- Open Text Corporation.

- Atomic Reach Inc.

- Scoop.it

- Onespot (Seabird Apps, Inc.)

Key Industry Developments

- May 2024 (Partnership): IBM and Salesforce announced an expanded strategic partnership. This collaboration brought together IBM's watsonx AI and Data Platform capabilities with the Salesforce Einstein 1 Platform. The goal was to provide customers with greater choice and flexibility in AI and data deployment, empowering teams to make data-driven decisions and take actions directly within their workflow.

- March 2024 (Collaboration): Adobe and Microsoft announced plans to integrate Adobe Experience Cloud workflows and insights with Microsoft Copilot for Microsoft 365. This collaboration aimed to help marketers overcome application and data silos while managing everyday workflows more efficiently. The new integrated capabilities brought relevant marketing insights and workflows from Adobe Experience Cloud and Microsoft Dynamics 365 to Microsoft Copilot, assisting marketers in tools like Outlook, Microsoft Teams, and Word to develop creative briefs, manage content approvals, and deliver experiences.

The global content intelligence market is segmented as:

By Component

By Deployment

By Enterprise Size

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America