Market Definition

Contact adhesives are solvent or water-based formulations designed to bond surfaces instantly upon contact, forming strong and flexible connections. These high-performance adhesives deliver rapid tack and immediate bond strength, eliminating the need for prolonged clamping.

Their use covers industries such as footwear, laminate flooring, automotive interiors and industrial assembly. Manufacturers and assemblers rely on contact adhesives to ensure efficient production, durable adhesion and consistent performance in demanding applications.

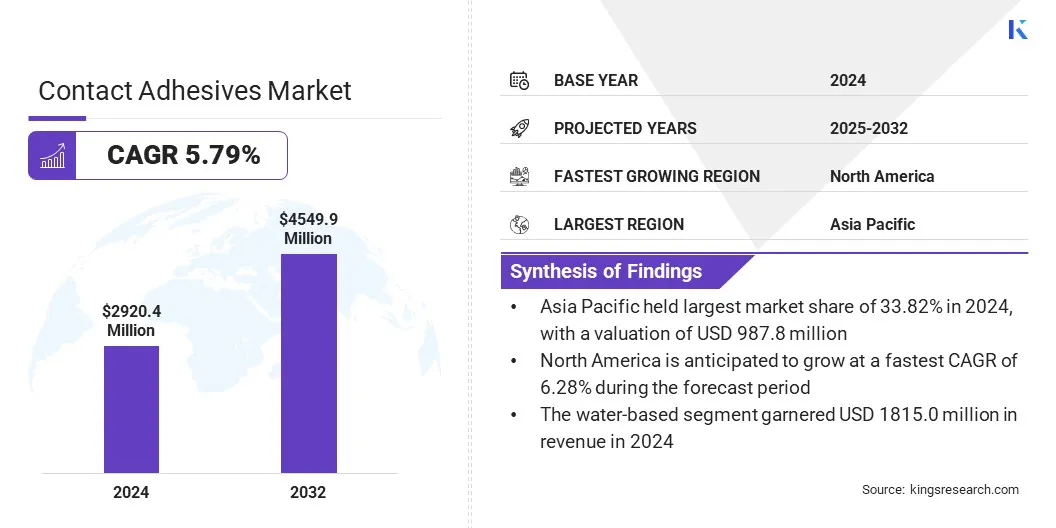

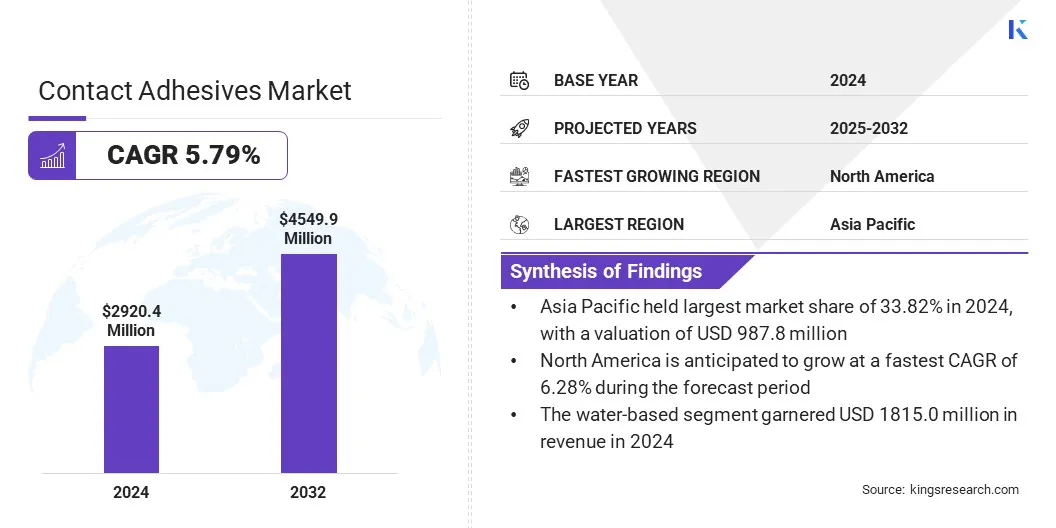

The contact adhesives market size was valued at USD 2920.4 million in 2024 and is projected to grow from USD 3068.4 million in 2025 to USD 4549.9 million by 2032, exhibiting a CAGR of 5.79% during the forecast period.

The market driven by increased demand for the furniture, DIY, and industrial sectors. Rising production of modular furniture, DIY home improvement trends, and automation in industries like automotive and electronics are fueling the need for reliable, high-performance bonding solutions.

Key Highlights:

- The contact adhesives industry size was recorded at USD 2920.4 million in 2024.

- The market is projected to grow at a CAGR of 5.79% from 2025 to 2032.

- Asia Pacific held a market share of 33.82% in 2024, with a valuation of USD 987.8 million.

- The water-based segment garnered USD 1815.0 million in revenue in 2024.

- The neoprene segment is expected to reach USD 1243.7 million by 2032.

- The construction segment is anticipated to witness fastest CAGR of 6.31% during the forecast period

- North America is anticipated to grow at a CAGR of 6.28% during the forecast period.

Major companies operating in the contact adhesives market are 3M, H.B. Fuller Company, Henkel AG & Co. KGaA, Bostik, Sika AG, Jowat Corporation, AVERY DENNISON CORPORATION, Pidilite Industries Limited, MAPEI, Ashland, Permabond, Chemique Adhesives & Sealants Ltd., Wacker Chemie AG, Huntsman International LLC, and Mactac.

The market is registering growth by the rising demand for the furniture and woodworking sector. Increasing production of modular and ready-to-assemble furniture, especially in emerging markets, is boosting the need for reliable bonding solutions.

The market is registering growth by the rising demand for the furniture and woodworking sector. Increasing production of modular and ready-to-assemble furniture, especially in emerging markets, is boosting the need for reliable bonding solutions.

Contact adhesives are preferred for their strong tack, flexibility, and ease of use in bonding laminates, veneers, and foam. Expanding residential and commercial construction, along with evolving consumer preferences, further supports the market expansion.

- In December 2024, Arkema completed the acquisition of Dow’s flexible packaging laminating adhesives business. The acquisition strengthens Arkema’s position in the flexible packaging industry, expands its global footprint across North America and Europe, and enhances its portfolio in food, medical, and industrial lamination applications through cutting-edge technologies and established brands.

Market Driver

Increase in DIY and Home Improvement Activities

The contact adhesives market is registering significant growth, due to the increasing popularity of DIY and home improvement activities. Consumers are seeking easy-to-use, reliable adhesive solutions for decorating, repairing, and renovating their homes.

Products offering high initial tack, easy application, and removability, such as those suitable for various surfaces including tile, glass, and PVC, are particularly in demand. This shift highlights the growing preference for cost-effective, flexible solutions for home projects.

- In September 2024, Henkel introduced Pattex No More Nails Stick & Peel, a novel, high-performance removable construction adhesive targeting the Do It Yourself (DIY) industry. This innovative product offers strong initial tack, holding up to six kilograms on surfaces like tile, glass, and Polyvinyl Chloride (PVC), while allowing easy removal without damage. Its water-resistant properties make it ideal for use in kitchens and bathrooms, offering a simple, clean, and damage-free solution for home decoration and re-decoration.

Market Challenge

Health and Safety Issues

Health and safety concerns present a significant challenge in the contact adhesives market, particularly with solvent-based products containing volatile organic compounds (VOCs). These chemicals can pose health risks to both consumers and workers, prompting stricter regulations.

To address this challenge, manufacturers are focusing on developing low-VOC, water-based, and non-toxic alternatives, aligning with environmental standards. Additionally, providing clear safety instructions and promoting safer application methods can mitigate health risks, ensuring that products comply with evolving safety regulations and meet consumer expectations for sustainability.

Market Trend

Increased Automation in Industrial Applications

The contact adhesives market is registering a growing shift toward automation and precision in industrial applications. With manufacturers increasingly adopting automated adhesive dispensing systems, the demand for consistent and high-quality bonding in large-scale production environments is rising.

This trend highlights the need for efficient, reliable, and precise adhesive applications, particularly in industries such as automotive and electronics, where product performance, durability, and integrity are critical. The focus on automation ensures enhanced productivity while maintaining superior adhesive performance.

- In October 2024, LG Chem announced its plans to strengthen its position in the global mobility industry by supplying thermally conductive adhesives to North American automakers. These adhesives, crucial for bonding battery cells to modules or packs, support thermal management and performance maintenance with high thermal conductivity and electrical insulation, driving growth in its automotive adhesive business.

|

Segmentation

|

Details

|

|

By Technology

|

Water-Based, Solvent-Based

|

|

By Type

|

Neoprene, Polyurethane, Acrylic, SBC, Others

|

|

By End Use Industry

|

Construction, Automotive, Woodworking, Leather & Footwear, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Water-Based, Solvent-Based): The water-based segment earned USD 1815.0 million in 2024 due to its increasing adoption driven by rising consumer preference for eco-friendly, low-VOC, and safer adhesive solutions across various industries.

- By Type (Neoprene, Polyurethane, Acrylic, and SBC): The neoprene 27.30% of the market in 2024, due to its superior bonding strength, versatility, and resistance to heat, oil, and chemicals, making it a preferred choice across multiple industrial applications.

- By End Use Industry (Construction, Automotive, Woodworking, and Leather & Footwear, Others): The automotive segment is projected to reach USD 1250.0 million by 2032, owing to the increasing demand for durable, high-performance adhesives for lightweight materials and enhanced vehicle manufacturing processes.

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific contact adhesives market share stood at around 33.82% in 2024 in the global market, with a valuation of USD 987.8 million. Asia Pacific is emerging as a dominant region in the market, fueled by significant investments in local production and innovation. The establishment of advanced manufacturing facilities enhances regional self-sufficiency, reduces supply chain dependencies, and improves product accessibility.

Asia Pacific contact adhesives market share stood at around 33.82% in 2024 in the global market, with a valuation of USD 987.8 million. Asia Pacific is emerging as a dominant region in the market, fueled by significant investments in local production and innovation. The establishment of advanced manufacturing facilities enhances regional self-sufficiency, reduces supply chain dependencies, and improves product accessibility.

Furthermore, the region's rapidly growing industrial sectors, rising demand for eco-friendly solutions, and expanding customer base contribute to its leadership in the global market, establishing it as a key hub for innovation and growth.

- In February 2025, Henkel strengthened its footprint in India by inaugurating an Application Engineering Centre in Chennai and an adhesive manufacturing facility in Kurkumbh. This expansion boosted local production, fostered innovation, and reinforced the market in India, contributing to greater self-sufficiency and enhanced supply chain resilience.

North America contact adhesives industry is poised for significant growth at a robust CAGR of 6.28% over the forecast period. The market in North America is driven by strong demand across diverse industries, including automotive, construction, and packaging. Technological advancements in adhesive formulations, particularly eco-friendly and high-performance solutions, are meeting the needs for sustainability and regulatory compliance.

Additionally, North America's well-established manufacturing infrastructure, strategic mergers, and acquisitions, coupled with increasing construction activities and automotive innovations, create a favorable environment for market expansion.

Regulatory Framework

- In the U.S., the Food and Drug Administration (FDA) oversees the regulation of adhesives, including contact adhesives, used in food packaging to ensure safety and compliance with health standards.

- In India, the Bureau of Indian Standards (BIS) oversees the regulation of contact adhesives, establishing Indian Standards (IS) to ensure the quality, safety, and compliance of adhesives, including contact adhesives, within the market.

- In Japan, the regulation of contact adhesives is primarily managed by the Ministry of Health, Labour and Welfare (MHLW) and the Japan Industrial Standards (JIS), which establish safety, environmental, and quality standards for adhesive products.

- In Europe, the market is regulated by the European Chemicals Agency (ECHA) under the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation, along with industry-specific standards set by organizations such as the European Committee for Standardization (CEN).

Competitive Landscape

The contact adhesives industry is characterized by a large number of participants, including both established corporations and rising organizations. Key players are employing various strategies, including mergers and acquisitions, along with product launches, to drive growth in the market. These approaches enable firms to expand their market reach, enhance product offerings, and capitalize on emerging trends in sustainability and innovation.

Leveraging strategic partnerships and advancing technological capabilities, companies are positioning themselves to meet the increasing demand for high-performance, eco-friendly adhesive solutions, thereby solidifying their competitive edge and fostering long-term market growth.

- In November 2024, Henkel and Celanese partnered to enhance circularity in emulsion production by utilizing captured CO2 emissions. Henkel will produce water-based adhesives from these emissions, offering packaging and consumer goods industries an opportunity to increase renewable content. These Carbon Capture and Utilization (CCU) based adhesives support sustainability efforts, particularly benefiting the paper & board, E-commerce, labeling, and tissue & towel sectors in response to the growing environmental demands.

Key Companies in Contact Adhesives Market:

- 3M

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Bostik

- Sika AG

- Jowat Corporation

- AVERY DENNISON CORPORATION

- Pidilite Industries Limited

- MAPEI

- Ashland

- Permabond

- Chemique Adhesives & Sealants Ltd.

- Wacker Chemie AG

- Huntsman International LLC

- Mactac

Recent Developments

- In March 2024, Jowat inaugurated a new adhesive manufacturing facility in Zhejiang, China, highlighting its commitment to global customer engagement and expanding innovation capabilities. The 11,000-square-meter plant will produce 9,000 tonnes of customized adhesives annually, focusing on water-based dispersions and solutions for the consumer electronics sector, supported by advanced R&D facilities and robust production capabilities.

- In April 2024, Toyo Ink India, a subsidiary of the Artience Group, significantly expanded its Gujarat plant, boosting the production capacity of solvent-based adhesives by 3.5 times. This expansion enhances its market presence and supports the growth of the market in India.

The market is registering growth by the rising demand for the furniture and woodworking sector. Increasing production of modular and ready-to-assemble furniture, especially in emerging markets, is boosting the need for reliable bonding solutions.

The market is registering growth by the rising demand for the furniture and woodworking sector. Increasing production of modular and ready-to-assemble furniture, especially in emerging markets, is boosting the need for reliable bonding solutions. Asia Pacific contact adhesives market share stood at around 33.82% in 2024 in the global market, with a valuation of USD 987.8 million. Asia Pacific is emerging as a dominant region in the market, fueled by significant investments in local production and innovation. The establishment of advanced manufacturing facilities enhances regional self-sufficiency, reduces supply chain dependencies, and improves product accessibility.

Asia Pacific contact adhesives market share stood at around 33.82% in 2024 in the global market, with a valuation of USD 987.8 million. Asia Pacific is emerging as a dominant region in the market, fueled by significant investments in local production and innovation. The establishment of advanced manufacturing facilities enhances regional self-sufficiency, reduces supply chain dependencies, and improves product accessibility.