Market Definition

The market includes a wide range of plastic films used in various construction applications. This includes insulation, moisture barriers, weatherproofing, and energy efficiency solutions.

These films enhance the durability and performance of buildings by providing protective layers that help regulate temperature, prevent moisture penetration, and reduce energy consumption.

The market includes products such as polyethylene films, polyvinyl chloride (PVC) films, and other polymer-based films used in roofing, flooring, wall insulation, and windows. This report provides a comprehensive analysis of the key market drivers, emerging trends, and competitive landscape, shaping the future of the market.

Construction Films Market Overview

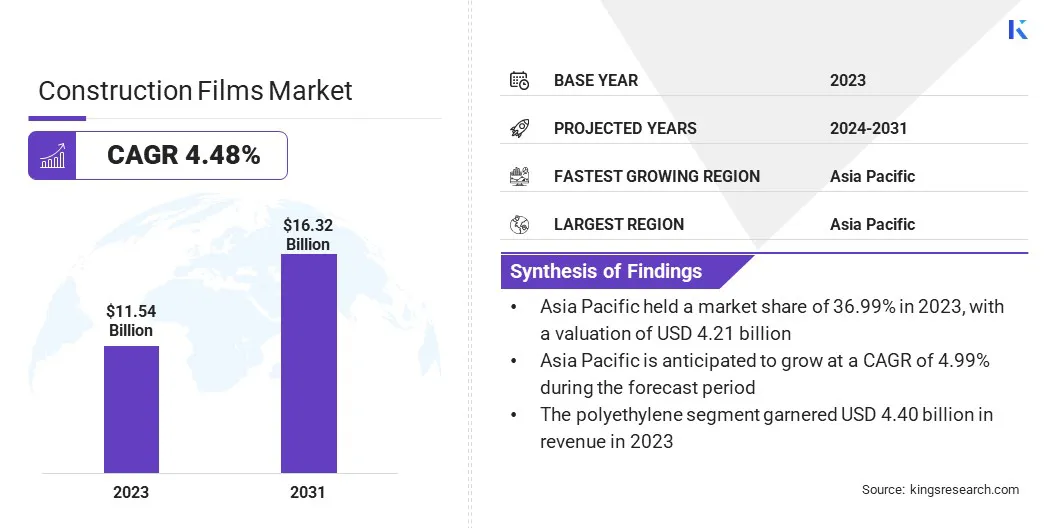

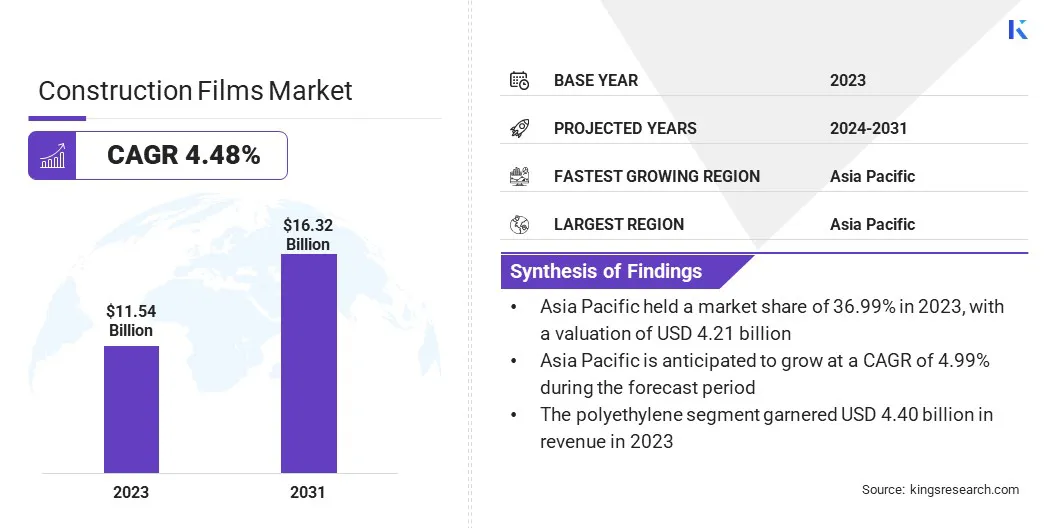

The global construction films market size was valued at USD 11.54 billion in 2023 and is projected to grow from USD 12.00 billion in 2024 to USD 16.32 billion by 2031, exhibiting a CAGR of 4.48% during the forecast period.

The market is experiencing significant growth due to the increasing demand for energy-efficient, durable, and sustainable building materials. Advancements in film technology, such as multi-layered and smart films, are further improving the functionality and performance of construction films.

Major companies operating in the construction films industry are Saint-Gobain, Carlisle Companies Incorporated, Heidelberg Materials, Hyosung Chemical, China State Construction Engineering Corporation (CSCEC), Mitsubishi Chemical Group Corporation, DuPont de Nemours, Inc., Polifilm Extrusion GmbH, Berry Global, Inc., RKW SE, Polyplex Corporation Ltd., KURARAY CO., LTD., Qenos Pty Ltd., Eastman Chemical Company, and Coveris.

Rapid urbanization and infrastructure development, especially in emerging economies, are driving the demand for construction films. Additionally, the need for energy-efficient buildings and sustainable construction practices is boosting the use of advanced polymer-based films like polyethylene and PVC across residential, commercial, and industrial projects.

- In August 2024, construction commenced on the Nishi-Azabu 3-chome Northeast District Urban Redevelopment project in Tokyo, Japan. This large-scale mixed-use development, features a 54-story residential and commercial complex.

Such developments are driving the demand for advanced construction materials, including protective films, to support energy-efficient and sustainable building practices.

Key Highlights

- The construction films industry size was recorded at USD 11.54 billion in 2023.

- The market is projected to grow at a CAGR of 4.48% from 2024 to 2031.

- Asia Pacific held a market share of 36.44% in 2023, with a valuation of USD 4.21 billion.

- The polyethylene (PE) segment garnered USD 4.40 billion in revenue in 2023.

- The protective films segment is expected to reach USD 6.08 billion by 2031.

- The commercial segment secured the largest revenue share of 45.01% in 2023.

- North America is anticipated to grow at a CAGR of 4.53% during the forecast period.

Market Driver

"Rapid Urbanization and Infrastructure Development"

The construction films market is experiencing significant growth, propelled by rapid urbanization and extensive infrastructure development, particularly in emerging economies.

As urban populations expand, there is an increasing need for energy-efficient and durable residential, commercial, and industrial buildings. Vapor barriers and insulation films play a crucial role in enhancing building performance by providing moisture control and thermal insulation.

- For instance, in July 2024, the Government of India announced a substantial infrastructure investment for fiscal years 2024 to 2030. Through this investment, the government wants to promote infrastructure development of roads, power, and urban facilities.

Such large-scale projects are expected to drive the demand for advanced construction materials, including high-performance construction films, to meet the evolving requirements of modern infrastructure.

Market Challenge

"Environmental Concerns and Regulatory Pressure"

A key challenge in the construction films market is the environmental impact associated with plastic-based materials. Most construction films are derived from non-biodegradable polymers such as polyethylene and PVC, which can cause long-term plastic waste accumulation.

To address these challenges, key players are investing in sustainable product innovation and developing eco-friendly, recyclable construction films at par with environmental regulations. Major manufacturers are adopting bio-based polymers and reducing hazardous additives to comply with emission and disposal norms.

Market Trend

"Growing Adoption of Sustainable and Energy-Efficient Construction Films"

A key trend in the construction films market is the increasing adoption of sustainable and energy-efficient materials. With the construction industry facing pressure to reduce carbon footprints and comply with environmental regulations, there is a growing shift toward energy-efficient and sustainable films.

These films offer improved thermal insulation, reduced energy consumption, and enhanced durability, promoting green buildings and sustainable construction practices.

- In March 2024, a report by the Global Alliance for Buildings and Construction (GABC) stated that over 70% of new construction projects in Europe are integrating energy-efficient and environmentally friendly materials.

Construction Films Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material Type

|

Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Others

|

|

By Application

|

Vapor Barriers, Protective Films, Window Films, Concrete Curing, Others

|

|

By End-Use

|

Residential, Commercial, Industrial, Infrastructure

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material Type (Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), and Others): The polyethylene (PE) segment earned USD 4.40 billion in 2023 due to its superior flexibility, cost-effectiveness, and excellent moisture barrier properties.

- By Application (Vapor Barriers, Protective Films, Window Films, Concrete Curing, and Others): The protective films segment held 34.95% of the market in 2023, due to its ability to shield surfaces from moisture, abrasion, and chemical exposure.

- By End-Use (Residential, Commercial, Industrial, and Infrastructure): The commercial segment is projected to reach USD 7.96 billion by 2031, owing to the increasing demand for large-scale infrastructure projects such as ports, bridges, and underwater tunnels.

Construction Films Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific construction films market share stood at 36.44% in 2023 in the global market, with a valuation of USD 4.21 billion. Asia Pacific is the dominant region in the market, driven by rapid urbanization, increasing infrastructure development, and growing demand for energy-efficient and sustainable building materials.

China, India, Japan, and South Korea are leading in terms of construction activity, fueled by robust government initiatives and ongoing expansion of urban areas.

- In 2023, the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP) reported that the urban population in the Asia-Pacific region grew by over 725 million people between 2000 and 2015, with an additional 688 million expected by 2030.

This rapid urbanization is fueling the demand for construction films, as growing cities require advanced materials for insulation, weatherproofing, and energy efficiency to accommodate expanding infrastructure needs.

North America is poised for significant growth at a CAGR of 4.53% over the forecast period. North America is emerging as one of the fastest-growing regions in the market, fueled by ongoing infrastructure modernization, rising demand for green building materials, and increasing adoption of protective construction solutions.

The U.S. and Canada are witnessing a surge in residential, commercial, and public infrastructure projects, which is boosting the adoption of advanced construction films for moisture barriers, vapor retarders, and UV protection.

North America’s strong manufacturing base and technological advancements in film production such as multi-layer co-extrusion, recyclable polyethylene, and flame-retardant coatings are promoting high-performance products tailored to local building requirements.

- In April 2023, Berry Global Group, Inc., a U.S.-based packaging and engineered materials company, announced a 25,000-square-foot expansion of its stretch film manufacturing facility in Lewisburg, U.S.. The project aimed to meet the rising demand for high-performance and sustainable stretch films acrossconstruction and logistics.

Regulatory Frameworks

- In the U.S., construction films are regulated under the International Building Code (IBC), specifically Chapter 26, which sets standards for plastic materials used in construction, including requirements for fire resistance and structural performance. Additionally, the International Residential Code (IRC) provides guidelines for moisture protection in residential buildings, impacting the use of vapor barriers and plastic sheeting.

- In the UK, construction films must comply with the Building Regulations 2010, which encompass requirements for fire safety, energy efficiency, and material performance.The use of plastic films in construction is also influenced by standards set by the British Standards Institution (BSI), ensuring quality and safety.

- Japan's Building Standards Law sets the framework for construction materials, including plastic films, emphasizing safety, durability, and environmental considerations. Standards developed by organizations like ASTM International are also referenced to ensure quality and performance

Competitive Landscape

The construction films industry is highly competitive characterized by a mix of multinational corporations and regional manufacturers competing based on product innovation, pricing, and application-specific offerings.

Key players are focusing on enhancing film performance characteristics such as tensile strength, UV resistance, puncture resistance, and recyclability to cater to diverse construction needs including moisture barriers, insulation backing, temporary enclosures, and surface protection.

Companies are also developing specialty films with anti-static, flame-retardant, and weatherproofing properties to address the needs of complex construction environments.

- In July 2023, Berry Global launched an enhanced version of its NorDiVent Form-Fill-Seal (FFS) film, incorporating up to 50% recycled plastic content. This film offers waterproof protection, dust-free air release, and high tear resistance.

List of Key Companies in Construction Films Market:

- Saint-Gobain

- Carlisle Companies Incorporated

- Heidelberg Materials

- Hyosung Chemical

- China State Construction Engineering Corporation (CSCEC)

- Mitsubishi Chemical Group Corporation

- DuPont de Nemours, Inc.

- Polifilm Extrusion GmbH

- Berry Global, Inc.

- RKW SE

- Polyplex Corporation Ltd.

- KURARAY CO., LTD.

- Qenos Pty Ltd.

- Eastman Chemical Company

- Coveris

Recent Developments (Product Launch)

- In March 2024, Raven Industries introduced a new line of high-performance vapor barrier films to enhance moisture resistance and thermal insulation.

- In October 2023, Berry Global Inc. launched a biodegradable construction film made from renewable materials to help reduce construction waste.

- In July 2023, DuPont expanded its high-performance barrier film portfolio with a new moisture-resistant film to improve building durability. This product is designed to boost energy efficiency and provide better vapor protection in eco-friendly construction projects.