Market Definition

The connected car market encompasses vehicles interated with advanced digital technologies and internet connectivity, enabling communication with external devices, infrastructure, and other vehicles.

These vehicles utilize wireless networks such as cellular, Wi-Fi, Bluetooth, and satellite technologies to deliver a wide array of features and services, including real-time navigation, entertainment, vehicle diagnostics, and safety enhancements.

Connected Car Market Overview

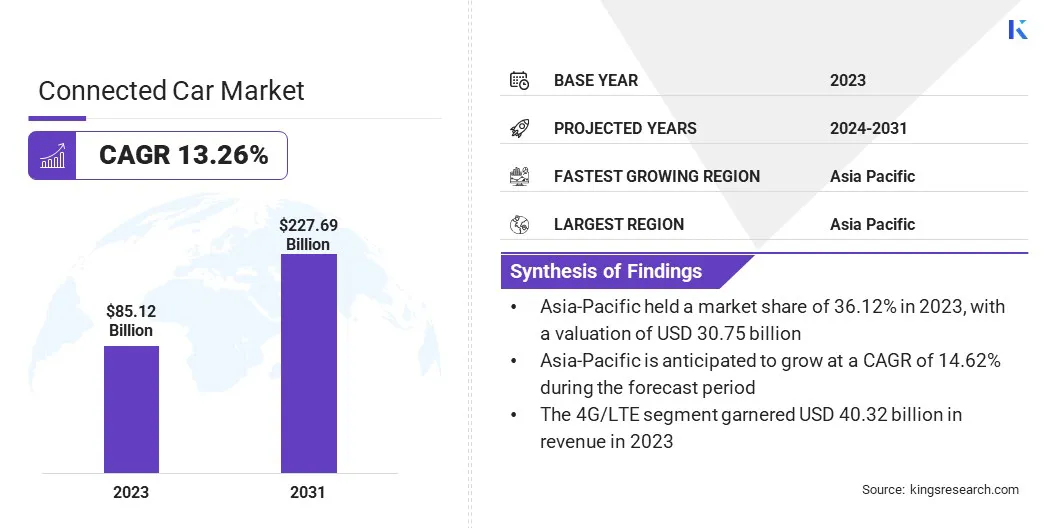

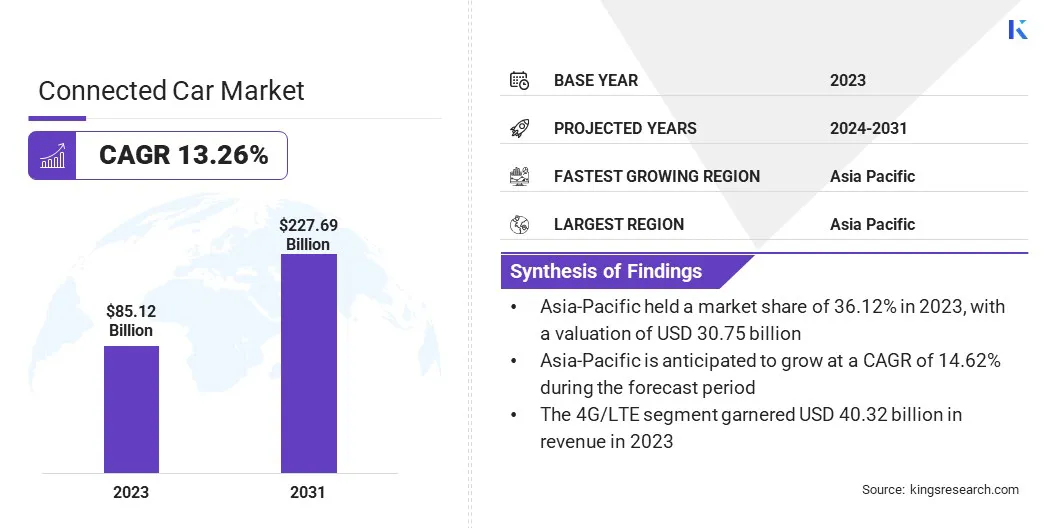

The global connected car market size was valued at USD 85.12 billion in 2023 and is projected to grow from USD 95.22 billion in 2024 to USD 227.69 billion by 2031, exhibiting a CAGR of 13.26% during the forecast period.

This growth is primarily driven by the increasing consumer demand for enhanced in-vehicle experiences, advancements in wireless communication technologies, and a rising focus on vehicle safety, efficiency, and convenience.

The integration of Internet of Things (IoT) solutions, the emergence of autonomous driving technologies, and the development of intelligent transportation infrastructure are key factors contributing to market expansion.

Major companies operating in the global connected car Industry are AUDI AG, Ford Motor Company, Robert Bosch GmbH, AT&T, Continental AG, Tesla, HARMAN International, Mercedes-Benz Group AG., Aptiv, BMW AG, General Motors, Qualcomm Technologies, Inc., TomTom International BV., Intellias, and Volvo Car Corporation.

The growing adoption of cloud computing, artificial intelligence (AI), and over-the-air (OTA) updates in connected vehicles are expected to boost market growth. As the automotive sector undergoes digital transformation, the market is poised to redefine mobility by enabling real-time traffic updates, remote diagnostics, personalized infotainment, and enhanced safety features.

- In December 2024, Charité Berlin and BMW Group teamed up to develop innovative solutions that integrate health technology into vehicles. Leveraging advancements in artificial intelligence, connected vehicles, and digital healthcare, this collaboration explores new possibilities at the intersection of the automotive and medical industries.

Key Highlights

- The global connected car market size was recorded at USD 85.12 billion in 2023.

- The market is projected to grow at a CAGR of 13.26% from 2024 to 2031.

- Asia-Pacific held a share of 36.12% in 2023, valued at USD 30.75 billion.

- The 4G/LTE segment garnered USD 40.32 billion in revenue in 2023.

- The integrated segment is expected to reach USD 100.55 billion by 2031.

- The vehicle management segment is anticipated to witness fastest CAGR of 15.46% over the forecast period

- Europe is anticipated to grow at a CAGR of 12.63% through the projection period.

Market Driver

"Ongoing Technological Advancements"

The deployment of 5G networks provides faster speeds and lower latency, facilitating real-time communication for vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) systems while supporting autonomous driving and safety features. Internet of Things (IoT) technology enables seamless connectivity, facilitating predictive maintenance, remote diagnostics, and over-the-air updates.

AI and ML power autonomous systems and advanced driver assistance systems (ADAS) by processing data from sensors and cameras. Cloud computing supports data storage and real-time analytics, while edge computing reduces latency for critical vehicle functions. The integration of advanced sensors and the growing use of blockchain for enhanced cybersecurity are further shaping the connected car market.

- In February 2024, Harman and Qualcomm partnered to introduce the Ready Connect 5G TCU (Telematics Control Unit), a next-gen telematics solution enhancing 5G connectivity in connected cars. This technology supports real-time navigation, V2X communication, autonomous driving, and ADAS.

Market Challenge

"Cybersecurity and Data Protection"

Connected cars generate significant amounts of sensitive data, including real-time location, driving patterns, and personal preferences, which are stored on cloud servers. This poses cybersecurity risks, as unauthorized access to could compromise critical vehicle functions such as steering, braking, and navigation.

Over-the-air (OTA) updates, essential for remote software upgrades and bug fixes, or feature enhancements also present vulnerabilities, if not adequately secured, potentially enabling the introduction of malicious software.

Additionally, tThe vast amount of data collected by connected cars raises serious privacy concerns, as it may be used for targeted marketing, insurance profiling, or surveillance without explicit user consent or adequate safeguards.

Implementing robust encryption protocols for data transmission and storage, along with multi-factor authentication, is essential to prevent unauthorized access. Regular OTA software updates are crucial to ensure that vulnerabilities are promptly identified and mitigated, thereby maintaining the security of connected systems.

Adopting secure communication protocols, such as V2X standards, safeguards data exchanges between vehicles, infrastructure, and external devices. Data privacy can be reinforced by anonymizing user information and obtaining explicit user consent prior to the collection, storage, or sharing of personal data, ensuring compliance with regulations such as the GDPR.

A robust cybersecurity framework, including regular penetration testing and comprehensive risk assessments, facilitates the proactive identification and resolution of security threats.

Market Trend

"Enhanced In-Vehicle Connectivity and Infotainment"

Enhanced in-vehicle connectivity and infotainment are influencing the connected car market, supported by rising consumer demand for seamless integration of technology. Modern infotainment systems now feature cloud-based services, voice assistants, and real-time navigation, offering drivers and passengers access to apps, music, and streaming services.

Connectivity also extends to Wi-Fi hotspots, ensuring passengers remain connected, and the rollout of 5G networks improves data transfer speeds for streaming and updates.

Vehicles increasingly feature vehicle-to-cloud communication for remote diagnostics, OTA updates, and predictive maintenance, enhancing both user experience and vehicle efficiency. This trend is transforming driving by making vehicles smarter, more integrated, and more personalized.

- In February 2024, Cisco and TELUS introduced new 5G capabilities in North America to enhance connected car experiences and expand revenue opportunities for automakers. This initiative supports IoT applications across various industry verticals, with a primary focus on connected cars.

Connected Car Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

3G, 4G/LTE, 5G

|

|

By Connectivity

|

Integrated, Embedded, Tethered

|

|

By Service

|

Driver Assistance, Safety, Vehicle management, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Technology (3G, 4G/LTE, and 5G): The 4G/LTE segment earned USD 40.32 billion in 2023 due to its widespread adoption in connected vehicles, offering reliable and high-speed internet connectivity for navigation, infotainment, and real-time data communication.

- By Connectivity (Integrated, Embedded, and Tethered): The integrated segment held a share of 41.53% in 2023, attributed to its seamless incorporation into vehicle hardware and software, offering enhanced user experiences and real-time functionalities.

- By Service (Driver Assistance, Safety, Vehicle management, and Others): The driver assistance segment is projected to generate a revenue of USD 97.04 billion by 2031, mainly propelled by the increasing demand for advanced safety features such as lane-keeping assist, adaptive cruise control, and automated parking, which enhance driver safety and convenience in connected vehicles.

Connected Car Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific connected car market captured a share of around 36.12% in 2023, valued at USD 30.75 billion. This dominanceis reinforced by rapid technological advancements, strong demand for advanced automotive features, and the increasing adoption of connected car technologies in key countries such as China, Japan, and South Korea.

The region's significant automotive production and a growing consumer base seeking enhanced in-vehicle experiences further contribute to regional market growth. The expansion of 5G networks, government initiatives promoting smart cities, and the rise of electric vehicles (EVs) with connected features are expected to boost the adoption of connected cars in the Asia Pacific region.

- In January 2025, Jaguar Land Rover (JLR) and Tata Communications expanded their partnership to enhance connected car technologies. JLR will enhance next-generation vehicle connectivity using Tata Communications MOVE, aligning with its broader innovation strategy to ensure universal connectivity and deliver AI-driven digital features and services.

Europe connected car Industry is set to grow at a robust CAGR of 12.63% over the forecast period, supported by increasing investments in autonomous vehicle technologies and the widespread deployment of 5G infrastructure.

The region’s emphasis on sustainability, along with stringent regulatory frameworks that promote vehicle safety and reduce emissions, is further accelerating the adoption of connected car solutions.

The rising demand for enhanced infotainment systems, real-time traffic management, and vehicle-to-everything (V2X) communication is expected to further bolster regional market growth.

- In October 2024, GSMA and the Automotive Edge Computing Consortium (AECC) signed a formal agreement to accelate the deployment of connected vehicle services by leveraging the full capabilities of 5G mobile networks.

Regulatory Frameworks

- The UNECE World Forum for Harmonization of Vehicle Regulations (WP.29) develops global vehicle regulations, including Regulation No. 155 on cybersecurity and software updates, V2X communication standards, and safety requirements for autonomous driving.

- The National Highway Traffic Safety Administration (NHTSA) is responsible for setting vehicle safety standards, regulating Vehicle-to-Vehicle (V2V) communication, cybersecurity, and data privacy in connected cars. It also oversees the safe testing and deployment of autonomous vehicles.

- ISO/SAE 21434, an international standard developed by ISO and SAE, outlines cybersecutiy guidelines for road vehicles, covering risk management, secure design, testing, and incident response to mittigate cyber threats throughout a vehicle's lifecycle.

- The FCC's Notice of Proposed Rulemaking (FNPRM) aims to enhance security in connected vehicles by preventing misuse for stalking, particularly in cases of domestic violence. The proposal focuses on enhancing privacy, safety, and emergency response capabilities.

Competitive Landscape

The global connected car market is characterized by a number of participants, including both established corporations and emerging players. Prominent participants include major automotive manufacturers, technology firms, and telecommunications providers, all competing to deliver innovative solutions for in-vehicle connectivity, safety, and autonomous driving.

Automotive companies are increasingly investing in smart vehicle systems, while technology firms are advancing the development of software, AI, and cloud-based solutions.

Telecommunications providers are essential in delivering 5G and IoT infrastructure for connected vehicle services. The competitive landscape is dynamic, with continuous efforts to develop integrated, secure, and advanced solutions, fostering innovation in the connected car ecosystem.

- In January 2023, EPAM introduced its new vehicle-to-cloud platform, AOSEdge, designed to enable seamless software delivery and updates for connected cars. The platform allows automakers to efficiently manage and deploy over-the-air (OTA) updates, ensuring vehicles remain up-to-date with the latest software and features.

List of Key Companies in Connected Car Market:

- AUDI AG

- Ford Motor Company

- Robert Bosch GmbH

- AT&T

- Continental AG

- Tesla

- HARMAN International

- Mercedes-Benz Group AG.

- Aptiv

- BMW AG

- General Motors

- Qualcomm Technologies, Inc.

- TomTom International BV.

- Intellias

- Volvo Car Corporation

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In January 2025, Sony Honda Mobility partnered with HERE Technologies to enhance connected electric vehicles (EVs) and software-defined vehicles (SDVs). This collaboration integrates HERE’s unified mapping architecture into AFEELA , enabling advanced art visualization and augmented reality capabilities.

- In September 2024, Volvo Cars expanded its collaboration with NVIDIA to enhance in-car experience by integrating AI and machine learning capabilities through NVIDIA's cutting-edge technology.

- In January 2024, Samsung announced a strategic partnership with Hyundai Motor Group to to connect smart homes with vehicles, enabling seamless Home-to-Car communication and integrated home energy management .

- In January 2023, Hitachi Astemo, Ltd., Trend Micro Inc. and VicOne Inc. expanded their collaboration to provide security solutions for connected cars. By 2025, they aim to commercialize a system combining Hitachi Astemo's Edge-SIEM*3 security solution with Trend Micro and VicOne's xCarbon*4 embedded security, enhancing protection against cyber threats in connected cars.