Market Definition

Concrete repair mortars are specialized construction materials designed to repair damaged concrete, ensuring strength, durability, and appearance. They are formulated with cementitious, polymer-modified, or epoxy-based components to provide strong adhesion, crack resistance, and substrate compatibility.

These mortars are commonly applied in structural rehabilitation, maintenance, and protection of infrastructure such as bridges, buildings, tunnels, and industrial facilities, addressing issues caused by mechanical stress, chemical exposure, corrosion, or environmental conditions.

Concrete Repair Mortars Market Overview

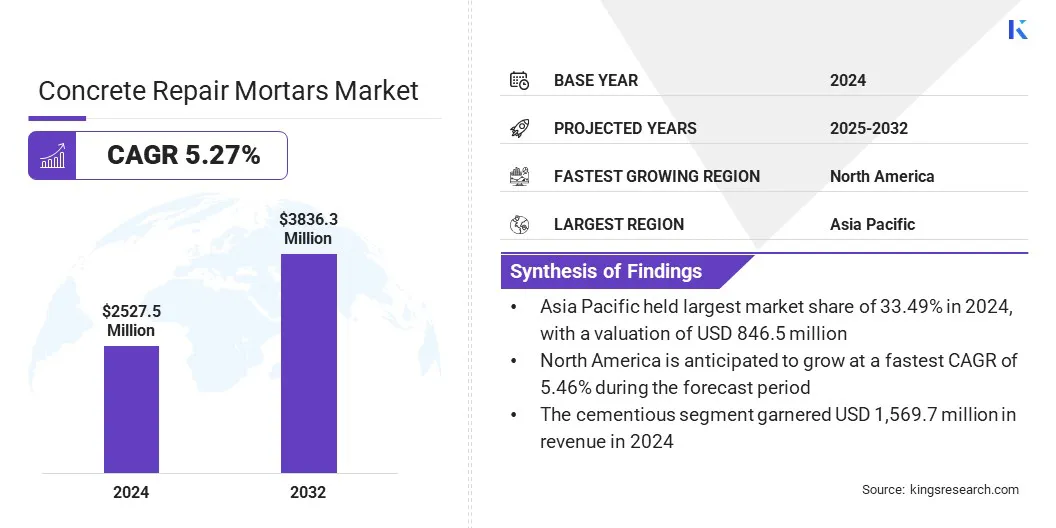

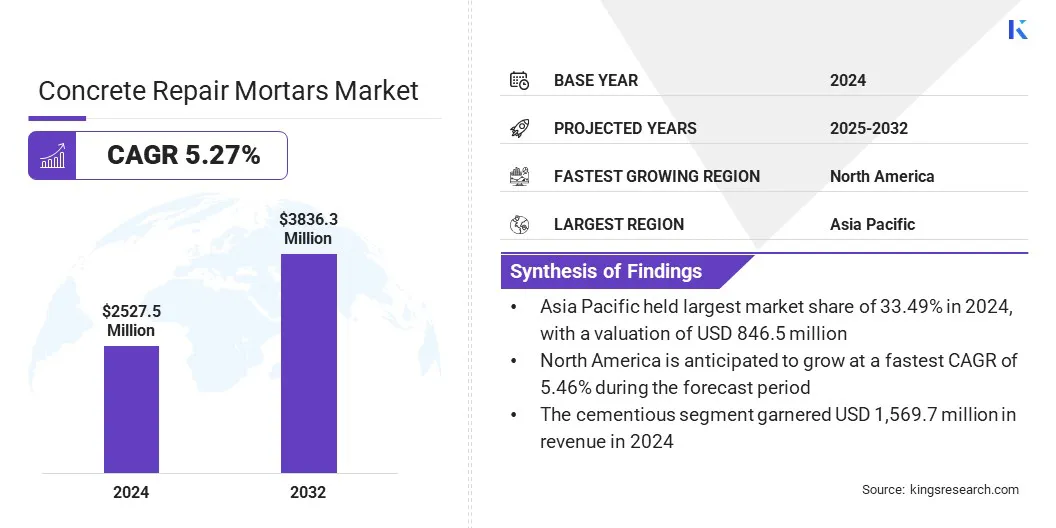

The global concrete repair mortars market size was valued at USD 2,527.5 million in 2024 and is projected to grow from USD 2,651.3 million in 2025 to USD 3,836.3 million by 2032, exhibiting a CAGR of 5.27% during the forecast period.

This growth is driven by the increasing rehabilitation of aging bridges, tunnels, and public infrastructure. Rising investments in renovation projects across residential and commercial sectors further fuel demand for durable repair mortars.

Key Highlights:

- The concrete repair mortars industry was recorded at USD 2,527.5 million in 2024.

- The market is projected to grow at a CAGR of 5.27% from 2025 to 2032.

- Asia Pacific held a share of 33.49% in 2024, valued at USD 846.5 million.

- The cementitious segment garnered USD 1,569.7 million in revenue in 2024.

- The structural segment is expected to reach USD 2,184.0 million by 2032.

- The commercial segment is anticipated to witness the fastest CAGR of 5.30% over the forecast period.

- North America is anticipated to grow at a CAGR of 5.46% through the projection period.

Major companies operating in the concrete repair mortars market are Sika AG, BASF SE, MAPEI Corporation, Saint-Gobain Weber, Fosroc International Limited, Ardex Group, Holcim Ltd, One Pidilite PWA, TCC Materials, CEMEX S.A.B de C.V, RPM International Inc., SCHOMBURG GmbH & Co. KG, Normet Group, Kryton International Inc., and Remmers GmbH.

Rising adoption of AI-optimized concrete mixes is propelling market expansion by enhancing material formulation and performance. Artificial intelligence tools analyze raw material properties, environmental conditions, and structural requirements to create optimized mortar blends. This approach improves strength, durability, and compatibility with existing structures while minimizing waste and material costs.

Market growth is further supported by expanding infrastructure rehabilitation and renovation projects, where AI-driven solutions address the growing need for efficient and long-lasting repair applications.

- In July 2025, Amrize and Meta collaborated to develop an AI-optimized concrete mix for Meta’s Rosemount data center. The solution enhances strength, controls set-time, lowers carbon load, and supports Meta’s performance, speed, and sustainability goals using advanced material engineering and AI models.

Market Driver

Increasing Investments in Commercial and Residential Construction

Growing investments in commercial and residential construction are boosting demand for concrete repair mortars, as expanding building activities require durable materials for long-term performance. Rapid urbanization, rising population, and evolving infrastructure needs are facilitating large-scale projects across developed and emerging markets.

Developers and governments are allocating higher budgets toward residential housing, office spaces, and mixed-use developments, which is creating consistent demand for repair and maintenance solutions. Market growth is driven by increasing investments in commercial and residential construction, creating consistent demand for effective mortar applications across new developments and existing structures.

- In April 2025, CBRE invested approximately USD 750 million in residential construction. During Q1 2025, commercial real estate investments reached USD 2.70 million, a 12% increase from Q1 2024, led by strong living (+91%) and retail (+48%) segments.

Market Challenge

High Cost of Premium Repair Mortars

High cost of premium repair mortars remains a major challenge to the expansion of the global concrete repair market, particularly in large-scale projects requiring advanced formulations. Polymer-modified and epoxy-based mortars offer superior performance, durability, and significantly increase project budgets compared to traditional alternatives.

Small- and medium-scale contractors often face financial constraints, limiting broader adoption. Regional budget variations further restrict uptake, particularly in cost-sensitive economies. Market stakeholders are increasingly exploring affordable and durable formulations to balance performance with cost efficiency, ensuring wider accessibility and long-term adoption.

To address this challenge, manufacturers are developing cost-efficient formulations, leveraging alternative raw materials and advanced admixtures. They are forming partnerships with contractors and suppliers to streamline distribution, while also offering training programs that maximize mortar efficiency and reduce overall project expenses.

Market Trend

Rising Adoption of Sustainable and Low-Carbon Repair Materials

Rising adoption of sustainable and low-carbon repair materials is emerging as a key trend in the concrete repair mortars market. Construction stakeholders are prioritizing eco-friendly formulations that reduce carbon emissions and enhance regulatory compliance through sustainable practices and adherence to green building standards.

Manufacturers are developing mortars with supplementary cementitious materials, recycled aggregates, and bio-based additives to align with green building standards. Growing regulatory emphasis on sustainability, coupled with demand from infrastructure and real estate sectors for long-lasting, environmentally responsible solutions, is further supporting this shift.

- In June 2025, Adani Cement partnered with Confederation of Real Estate Developers’ Associations of India (CREDAI) to promote sustainable, high-quality construction in India. The alliance combines Adani’s cement expertise with CREDAI’s developer network to promote sustainable, high-quality construction, support large-scale infrastructure projects, and enhance collaboration across the construction industry for long-term sector growth.

Concrete Repair Mortars Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Cementitious, Epoxy

|

|

By Application

|

Structural, Non-Structural

|

|

By End Use

|

Residential, Commercial, Industrial, Infrastructure

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Cementitious and Epoxy): The cementitious segment earned USD 1,569.7 million in 2024, mainly due to widespread use in structural repairs, high compatibility with existing concrete, cost-effectiveness, and increasing adoption in infrastructure rehabilitation and industrial maintenance projects.

- By Application (Structural and Non-Structural): The structural segment held a share of 57.70% in 2024, owing to growing investments by companies into bridges, tunnels, and industrial facilities requiring high-strength, durable repair mortars to maintain safety and long-term performance.

- By End Use (Residential, Commercial, Industrial, and Infrastructure): The commercial segment is projected to reach USD 1,366.1 million by 2032, propelled by rising construction and renovation of office buildings, retail complexes, and mixed-use developments demanding advanced, high-performance concrete repair solutions.

Concrete Repair Mortars Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific concrete repair mortars market share stood at 33.49% in 2024, valued at USD 846.5 million. This dominance is reinforced by rapid urbanization, large-scale infrastructure development, and accelerated industrial expansion.

Governments have increased spending on transportation networks, energy facilities, and residential projects, requiring durable repair solutions to maintain structural integrity. Rising demand for polymer-modified mortars, coupled with growing adoption of sustainable and low-carbon formulations, is further boosting regional market expansion.

- For instance, in April 2025, Indian government’s allocation for road transport and highways rose from nearly USD 4 million in 2013–14 to around USD 36 million in 2024–25. Capital expenditure on National Highways increased from USD 6.55 million to USD 36.20 million during the same period.

The North America concrete repair mortars industry is set to grow at a CAGR of 5.46% over the forecast period. This growth is stimulated by rising renovation and rehabilitation activities in commercial and residential construction. Increased infrastructure maintenance, including bridges, highways, and industrial facilities, sustains demand for high-performance repair mortars.

Regulatory focus on structural safety and durability is boosting the use of advanced materials, including epoxy-based and sustainable formulations. Additionally, a strong presence of specialized contractors and suppliers supports regional market expansion.

Regulatory Frameworks

- In the EU, the Construction Products Regulation (CPR 305/2011) regulates product performance and CE marking. It ensures concrete repair mortars meet harmonized safety, durability, and environmental standards across member states.

- In the U.S., ASTM International Standards govern material composition, testing, and application. They provide specifications for polymer-modified mortars, epoxy systems, and cementitious repair products to ensure performance consistency and structural reliability.

- In China, the GB/T Standards oversee cementitious and polymer-based repair materials. These standards outline technical requirements for strength, durability, and safety, aligning with the country’s infrastructure development and quality control initiatives.

- In India, the Bureau of Indian Standards (IS Codes) regulates concrete repair and protection products. They establish guidelines for formulation, application practices, and quality benchmarks to support structural safety and long-term performance.

Competitive Landscape

Key players operating in the concrete repair mortars industry are focusing on advanced product formulations, polymer-modified, and eco-friendly formulations to address evolving industry requirements. They are expanding production capacity through new and upgraded facilities to meet rising demand.

Players are allocating resources to digital tools and application technologies, while increasing R&D spending to improve mortar performance and align with sustainability standards. New plant setup and distribution partnerships are established to enhance supply chain efficiency and strengthen regional reach.

- In August 2025, Sika inaugurated a new production facility in Ust-Kamenogorsk, Kazakhstan, equipped with mortar and concrete admixture lines and a modern laboratory. The plant strengthens supply capacity to meet rising demand from the mining and construction industries.

Key Companies in Concrete Repair Mortars Market:

- Sika AG

- BASF SE

- MAPEI Corporation

- Saint-Gobain Weber

- Fosroc International Limited

- Ardex Group

- Holcim Ltd

- One Pidilite PWA

- TCC Materials

- CEMEX S.A.B de C.V

- RPM International Inc.

- SCHOMBURG GmbH & Co. KG

- Normet Group

- Kryton International Inc.

- Remmers GmbH

Recent Developments (M&A)

- In July 2025, CRH signed an agreement to acquire Eco Material Technologies, a North American supplementary cementitious material (SCM) supplier, for USD 2.1 million. The acquisition aims to strengthen CRH’s integrated cement and SCM capabilities.

- In April 2024, Mapei Group launched its zero line of sustainable mortars to extend structural service life and reduce environmental impact. The products are engineered to lower carbon dioxide emissions, and ensure consistent high performance.