Combined Heat and Power Market

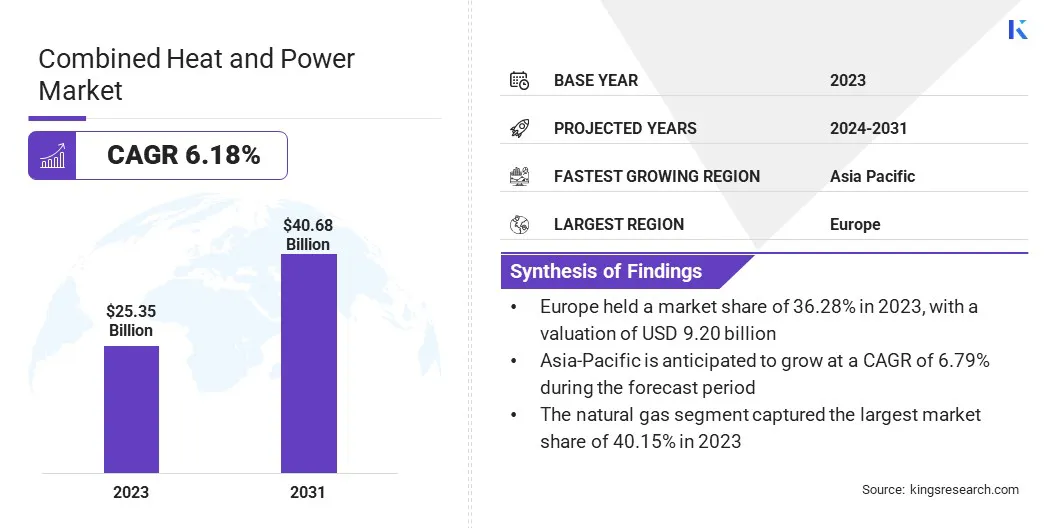

Global Combined Heat and Power Market size was recorded at USD 25.35 billion in 2023, which is estimated to be at USD 26.73 billion in 2024 and projected to reach USD 40.68 billion by 2031, growing at a CAGR of 6.18% from 2024 to 2031. In the scope of work, the report includes services offered by companies such as Kawasaki Heavy Industries, Ltd., General Electric, Viessmann Vietnam Company Limited, Bosch Industriekessel GmbH, Wartsila, Veolia, Siemens AG, 2G Energy, Inc., MAN Energy Solutions SE, MITSUBISHI HEAVY INDUSTRIES, LTD. and others.

Integration with smart grids and the rise of micro-combined heat and power systems are driving the combined heat and power market growth. Integration of combined heat and power systems with smart grids represents a pivotal trend in the energy sector. Smart grids facilitate two-way communication between power suppliers and consumers, enabling more efficient distribution and utilization of electricity. CHP systems, which generate electricity and capture waste heat for heating or cooling purposes simultaneously, align well with the goals of smart grid integration.

By coordinating with smart grid technologies, CHP operators optimize their energy output based on real-time demand and pricing signals. This integration enhances grid stability, reduces transmission losses, and supports renewable energy integration by providing flexible and dispatchable power. Moreover, it enables CHP systems to participate in demand response programs, where they adjust their output to match fluctuating electricity demand, thereby contributing to overall grid reliability and resilience.

Combined heat and power (CHP), also known as cogeneration, refers to the simultaneous generation of electricity and useful thermal energy (such as steam or hot water) from a single fuel source. CHP systems are fueled by a variety of sources including natural gas, biomass, coal, and waste heat from industrial processes. These systems vary widely in scale, ranging from small-scale micro-CHP units used in residential buildings to large industrial-scale installations.

The technology behind CHP systems involves capturing waste heat produced during electricity generation and utilizing it for heating or cooling purposes, thereby significantly increasing overall energy efficiency compared to separate generation of electricity and heat. Applications of CHP are diverse and include industrial processes, district heating and cooling systems, commercial buildings, and residential complexes. The key benefits of CHP include reduced energy costs, lower greenhouse gas emissions, enhanced energy security, and improved energy resilience.

Analyst’s Review

In the combined heat and power market, key players are strategically focused on expanding their technological capabilities and geographic footprint to capitalize on the growing demand for energy-efficient solutions. Companies are increasingly investing in research and development to enhance the efficiency and flexibility of their CHP systems, aiming to meet stringent environmental regulations and customer demands for sustainable energy solutions. Current growth strategies include partnerships with utilities and government agencies to leverage incentives and subsidies promoting CHP adoption.

- For instance, in July 2023, Mitsubishi Power has secured a comprehensive contract from Chiba-Sodegaura Power Co., Ltd., backed by TOKYO GAS CO., LTD, to construct three 650MW class natural gas-fired gas turbine combined cycle (GTCC) power plants in Sodegaura City, Chiba Prefecture.

Moreover, market leaders are prioritizing customer-centric approaches, offering customized solutions tailored to the specific energy needs of industries and communities. Imperatives for key players in the market include navigating complex regulatory landscapes, optimizing operational efficiency, and fostering innovation in CHP technologies to maintain competitive advantage amidst evolving market dynamics.

Combined Heat and Power Market Growth Factors

The rise of micro-CHP systems represents a significant trend in the combined heat and power market, particularly in residential and small commercial sectors. Micro-CHP systems are compact units that generate both electricity and heat, typically using natural gas or propane as fuel. These systems are designed to meet the energy needs of individual buildings or small communities, offering improved energy efficiency compared to traditional separate generation methods. One key driver behind the popularity of micro-CHP systems is their ability to reduce energy costs and enhance energy security for end-users.

By generating electricity onsite, micro-CHP systems offset grid electricity purchases, thereby lowering utility bills and providing a reliable source of power during grid outages. Additionally, advancements in technology have made micro-CHP systems more efficient and affordable, making them a viable option for residential and small commercial applications.

High initial investment costs pose a significant challenge for widespread adoption of combined heat and power systems. These costs typically include equipment purchase, installation, and integration with existing infrastructure. While CHP systems offer long-term cost savings and environmental benefits, the upfront capital expenditure are prohibitive for many potential adopters, especially small businesses and residential users. Mitigating this challenge requires strategic financial planning and leveraging available incentives and financing options.

Businesses are exploring financing solutions such as grants, subsidies, and low-interest loans offered by governments or utility companies to offset initial investment costs. Additionally, partnerships with energy service companies (ESCOs) or equipment suppliers that offer lease or power purchase agreements (PPAs) are serving as alternative funding mechanisms. Moreover, demonstrating the return on investment (ROI) through energy savings and operational efficiencies help justify the upfront costs to stakeholders and decision-makers, which is fueling product uptake.

Combined Heat and Power Market Trends

The growing preference for biomass, biogas, and waste heat utilization in combined heat and power systems, driven by increasing emphasis on sustainability and renewable energy sources. Biomass and biogas are organic materials derived from agricultural waste, forestry residues, or landfill gases, which are converted into fuel for CHP systems.

Waste heat, a byproduct of industrial processes or power generation, is captured and utilized to generate additional energy, enhancing overall efficiency. This trend aligns with global efforts to reduce greenhouse gas emissions and mitigate climate change impacts by utilizing renewable resources for energy production. Furthermore, advancements in technology have improved the efficiency and reliability of biomass and biogas-based CHP systems, making them competitive alternatives to conventional fossil fuel-based generation.

Segmentation Analysis

The global market is segmented based on fuel, capacity, technology, application, and geography.

By Fuel

Based on fuel, the market is categorized into natural gas, coal, biomass, and others. The natural gas segment captured the largest combined heat and power market share of 40.15% in 2023. Natural gas is widely available and considered a relatively clean fossil fuel compared to coal and oil, aligning with global efforts toward cleaner energy solutions.

Advancements in natural gas-based CHP technologies have significantly improved efficiency and reduced emissions, making them attractive for industrial, commercial, and residential applications. Favorable government policies and incentives promoting natural gas utilization for energy generation have spurred investments in natural gas CHP projects. Moreover, the reliability and cost-effectiveness of natural gas supply compared to other fuels have thereby supported segmental expansion.

By Technology

Based on technology, the market is divided into gas turbine, steam turbine, reciprocating engine, and fuel cell. The fuel cell segment is poised to record a staggering CAGR of 7.68% through the forecast period. Fuel cells, which convert chemical energy directly into electricity through electrochemical reactions, offer several advantages such as high efficiency, low emissions, and quiet operation. This makes them particularly suitable for applications where clean and reliable power generation is crucial, including residential, commercial, and automotive sectors.

The growing emphasis on sustainability and decarbonization goals globally has spurred increased research and development investments in fuel cell technologies. Additionally, advancements in fuel cell durability, performance, and cost-effectiveness have bolstered their competitiveness against traditional CHP technologies. Moreover, supportive government policies and incentives promoting the adoption of fuel cells for CHP applications have further accelerated segment growth.

By Application

Based on application, the combined heat and power market is classified into residential, commercial, industrial, and utility. The industrial segment garnered the highest revenue of USD 11.74 billion in 2023. Industries have significant energy demands for manufacturing processes, heating, and cooling, making CHP systems highly beneficial due to their efficiency in utilizing waste heat.

CHP systems help industries reduce energy costs, enhance energy reliability, and improve operational efficiency, which are critical factors driving adoption. Industries often operate on large scales and have continuous energy needs, making CHP systems economically viable solutions compared to conventional energy sources.

Moreover, stringent environmental regulations and corporate sustainability initiatives have compelled industries to adopt cleaner and more efficient energy technologies such as CHP systems. Furthermore, government support through incentives and subsidies for industrial CHP installations has further incentivized adoption.

Combined Heat and Power Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

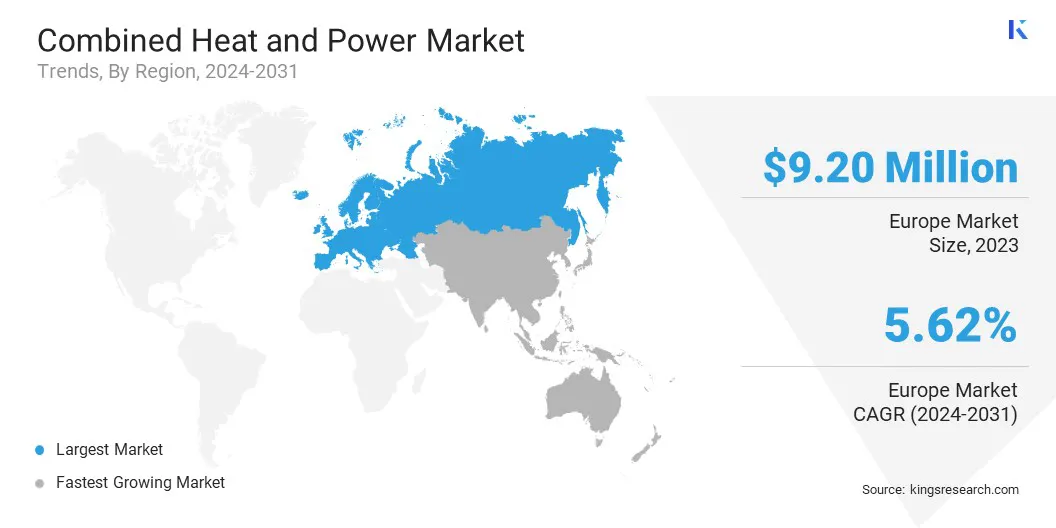

Europe combined heat and power market share was recorded at 36.28% and was valued at USD 9.20 billion in 2023. The region has established ambitious climate goals and stringent environmental regulations, driving the demand for energy-efficient and low-emission technologies, which is impelling the usage of CHP systems.

Europe's mature infrastructure and extensive district heating networks provide a conducive environment for CHP deployment across residential, commercial, and industrial sectors. Supportive policies and incentives from European Union initiatives, such as the Energy Efficiency Directive and the Clean Energy for All Europeans Package, are encouraging investments in CHP projects.

- For instance, in May 2024, the European Commission endorsed a Czech initiative, compliant with EU State aid regulations, to provide a USD 3.46 billion scheme supporting the development of electricity production from newly established and upgraded high-efficiency combined heat and power facilities. This measure aligns with Czechia's National Energy and Climate Plan objectives.

Moreover, the region's commitment to reducing dependency on imported energy sources and enhancing energy security is promoting the adoption of CHP systems.

Asia-Pacific combined heat and power market is poised to grow at the highest CAGR of 6.79% in the forthcoming years. Rapid industrialization and urbanization in countries such as China, India, and Southeast Asian nations have escalated energy demand, prompting a shift toward efficient energy solutions viz., CHP systems.

Increasing awareness of energy efficiency and sustainability goals among governments and industries in the region is fostering investments in CHP infrastructure. Moreover, improving economic conditions and rising investments in infrastructure projects across the Asia-Pacific region are creating opportunities for CHP deployment in residential, commercial, and industrial applications.

Competitive Landscape

The global combined heat and power market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Combined Heat and Power Market

- Kawasaki Heavy Industries, Ltd.

- General Electric

- Viessmann Vietnam Company Limited

- Bosch Industriekessel GmbH

- Wartsila

- Veolia

- Siemens AG

- 2G Energy, Inc.

- MAN Energy Solutions SE

- MITSUBISHI HEAVY INDUSTRIES, LTD.

Key Industry Developments

- June 2024 (Collaboration): Rolls-Royce initiated a collaboration with a consortium of five firms and research institutions to pioneer advanced technologies for a highly efficient hydrogen combustion engine for driving combined heat and power (CHP) systems. Funded by the German Government under the Phoenix project, the consortium aims to achieve equivalent electrical and thermal energy generation capabilities as conventional natural gas CHP units, focusing on the higher power range up to 2.5 MW.

- August 2023 (Agreement): Kawasaki Heavy Industries disclosed that its Thai subsidiary, Kawasaki Heavy Industries (Thailand) Co., Ltd. (KHIT), entered into a Memorandum of Understanding (MoU) with PTT Global Chemical Public Company Ltd. (GC) to explore the potential development, construction, and operation of a hydrogen gas turbine power generation facility. This initiative was purposed to utilize Kawasaki's advanced hydrogen gas turbine technology.

The global combined heat and power market is segmented as:

By Fuel

- Natural Gas

- Coal

- Biomass

- Others

By Capacity

- Up to 10 MW

- 11-150 MW

- 151-300 MW

- Above 300 MW

By Technology

- Gas Turbine

- Steam Turbine

- Reciprocating Engine

- Fuel Cell

By Application

- Residential

- Commercial

- Industrial

- Utility

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America