Market Definition

The market focuses on combining various subsystems, such as sensors, weaponry, communication tools, and command platforms, into cohesive systems for naval, airborne, and land-based defense platforms.

This involves system architecture design, software development, and testing protocols to ensure seamless interoperability and mission readiness. Applications include frigates, destroyers, submarines, aircraft, and armored vehicles for both offensive and defensive missions.

The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Combat System Integration Market Overview

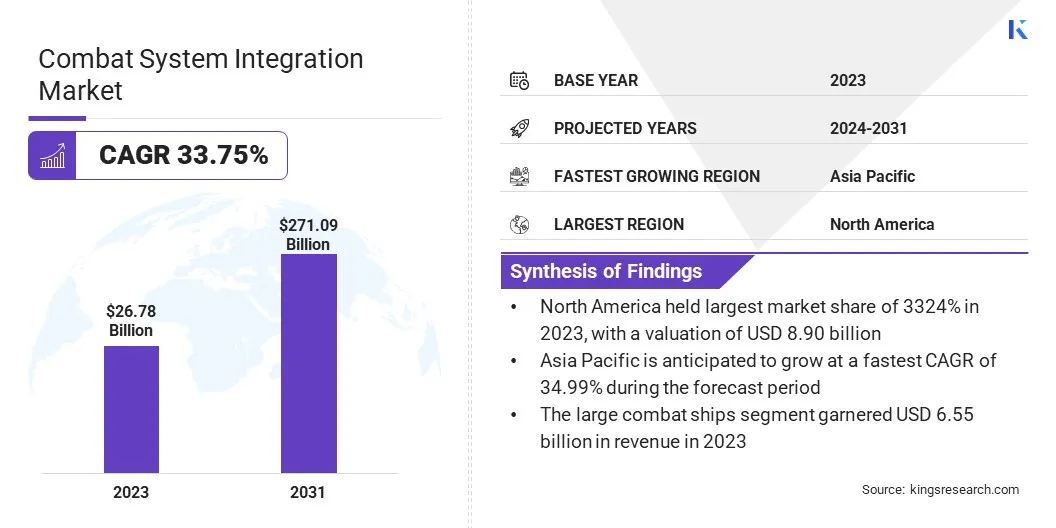

The global combat system integration market size was valued at USD 26.78 billion in 2023 and is projected to grow from USD 35.41 billion in 2024 to USD 271.09 billion by 2031, exhibiting a CAGR of 33.75% during the forecast period.

This growth is propelled by the expansion of naval capabilities and the increasing focus on offshore security missions, creating a strong demand for advanced and unified combat systems. Additionally, the rising integration of cybersecurity measures into defense platforms is enhancing system resilience, supporting expansion across modern military operations.

Major companies operating in the combat system integration industry are Lockheed Martin Corporation, BAE Systems, Thales, RTX Corporation, Leonardo DRS, Saab, Elbit Systems Ltd., General Dynamics, Rheinmetall AG, L3Harris Technologies, Inc., HENSOLDT AG, Kongsberg Gruppen ASA, Hanwha Systems Co., Ltd., ST Engineering Ltd., and Israel Aerospace Industries Ltd.

Increasing defense budgets in both developed and emerging economies are accelerating the deployment of integrated combat solutions. Governments are increasingly directing military spending toward advanced command, control, communications, computers, intelligence, surveillance, and reconnaissance systems, thereby fueling the growth of the market.

- In November 2024, BAE Systems secured a five-year contract worth USD 251 million from the U.S. Navy to support the AEGIS Technical Representative (AEGIS TECHREP) organization. The agreement involves delivering advanced large-scale systems engineering and on-site technical expertise for complex combat system configurations used by the U.S. Navy, the Missile Defense Agency, and the Foreign Military Sales program. As part of the contract, BAE Systems will offer comprehensive services across systems engineering, testing and evaluation, logistics, system acquisition, and cybersecurity.

Key Highlights:

- The combat system integration industry size was valued at USD 26.78 billion in 2023.

- The market is projected to grow at a CAGR of 33.75% from 2024 to 2031.

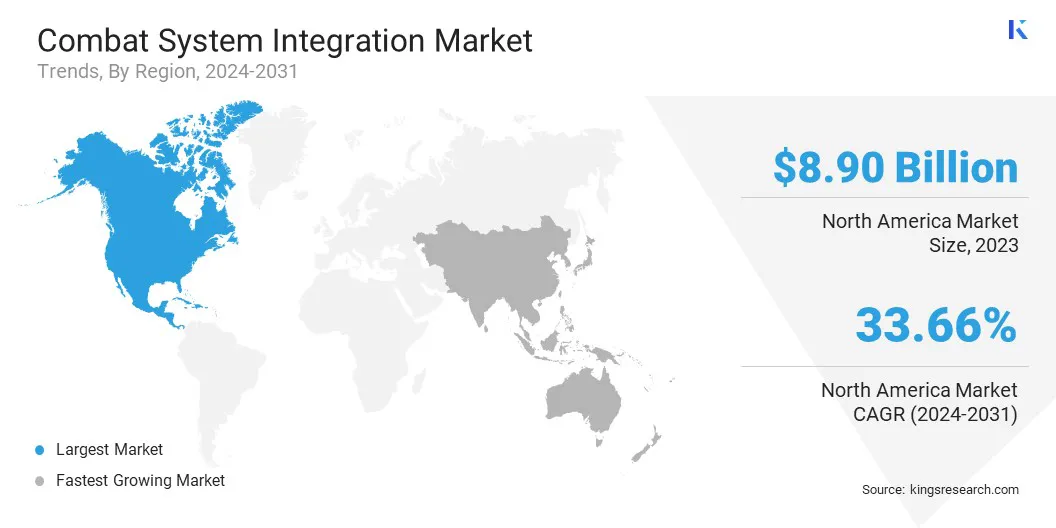

- North America held a market share of 33.24% in 2023, valued at USD 8.90 billion.

- The large combat ships segment garnered USD 6.55 billion in revenue in 2023.

- The land-based segment is expected to reach USD 117.99 billion by 2031.

- The defense segment secured the largest revenue share of 65.77% in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 34.99% over the forecast period.

Market Driver

"Expansion of Naval Capabilities and Offshore Security Missions"

The growing focus on maritime security, offshore territorial protection, and naval dominance is driving investments in advanced naval combat systems, propelling the growth of the combat system integration market.

Frigates, destroyers, and submarines require integrated systems that connect radar, sonar, missile guidance, and electronic warfare components. Combat system integration allows naval vessels to function as intelligent and responsive units. The ongoing development of next-generation warships and underwater platforms is contributing to market growth.

- In January 2025, BAE Systems was awarded a USD 365 million contract by the UK Ministry of Defence to enhance the Royal Navy’s combat management systems (CMS), warship networks, and shared infrastructure under the RECODE programme. This initiative supports fleet readiness amid evolving military demands, with CMS deployment planned for Queen Elizabeth-class aircraft carriers, Type 45 destroyers, and Type 26 frigates.

Market Challenge

"Complex Integration Across Multiple Platforms"

A major challenge limiting the progress of the combat system integration market is the complexity of integrating advanced technologies across various platforms such as naval vessels, land systems, and aircraft. This involves aligning different hardware, software, and communication standards, which can lead to delays and increased costs.

To address this challenge, companies are investing in open architecture frameworks and modular systems that allow for easier upgrades and smoother integration. Additionally, partnerships with technology firms and defense agencies are driving protocol standardization and improving interoperability, accelerating the deployment of integrated solutions across multi-domain operations.

Market Trend

"Integration of Cybersecurity Protocols into Defense Systems"

Integrated combat systems operate using complex digital architectures, making them potential targets for cyber threats. Governments are investing in cyber-resilient defense infrastructure to protect sensitive communication and command systems. Integration of cybersecurity protocols into combat systems has become a strategic priority.

This growing emphasis on securing integrated platforms against digital threats is influencing the combat system integration market by promoting the adoption of secure, layered architectures.

- In February 2025, Leonardo DRS secured a USD 7 million contract to equip the Royal Thai Army's newly acquired Stryker combat vehicles with advanced C4I (command, control, communications, computers, and intelligence) systems. The project includes battle management system (BMS) software integration, cybersecurity implementation, network integration, and training and sustainment support.

Combat System Integration Market Report Snapshot

|

Segmentation

|

Details

|

|

By Platform

|

Large Combat Ships, Medium Combat Ships, Small Combat Ships, Submarines, Fighter Aircraft, Combat Helicopters, Armored Vehicles/ Artillery

|

|

By Application

|

Naval, Airborne, Land-based

|

|

By End User

|

Defense, Government

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Platform (Large Combat Ships, Medium Combat Ships, Small Combat Ships, Submarines, Fighter Aircraft, Combat Helicopters, and Armored Vehicles/ Artillery): The large combat ships segment earned USD 6.55 billion in 2023 due to their extensive use in multi-mission operations, requiring advanced integrated systems for command, control, surveillance, and threat engagement across vast maritime zones.

- By Application (Naval, Airborne, and Land-based): The land-based segment held a share of 43.42% in 2023, fueled by the high demand for integrated command, control, and communication systems in armored vehicles and ground-based defense operations.

- By End User (Defense and Government): The defense segment is projected to reach USD 179.00 billion by 2031, propelled by the continuous modernization of military platforms and the growing demand for integrated command and control systems to enhance operational effectiveness across naval, air, and land forces.

Combat System Integration Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America combat system integration market share stood at around 33.24% in 2023, valued at USD 8.90 billion. The increasing adoption of multi-domain operations (MDO) by the U.S. Department of Defense is boosting the demand for integrated combat systems.

These operations require real-time coordination between land, air, sea, space, and cyber domains, which can only be achieved through highly integrated combat platforms.

Additionally, regional market benefits from a mature defense industrial base, supported by established players such as Lockheed Martin, Raytheon Technologies, Northrop Grumman, and BAE Systems. These companies are continuously involved in upgrading combat systems across land and maritime platforms.

Their strong engineering capabilities, combined with long-standing ties with the Department of Defense facilitate large-scale system integration, contributing significantly to regional market expansion.

- In October 2024, BAE Systems collaborated with Kongsberg Defence and Aerospace to launch the Integrated Combat Solution (ICS), a situational awareness system for combat vehicles. ICS enhances battelfield capabilities by enabling seamlessly sharing of video feeds, targeting data, metadata, slew-to-cue commands, and other mission-critical information, supporting faster and more coordinated decision-making for U.S. forces.

The Asia Pacific combat system integration industry is estimated to grow at a staggering CAGR of 34.99% over the forecast period. The region has seen an increase in multilateral defense cooperation and joint military exercises aimed at improving interoperability among partner forces.

These initiatives require common standards and integrated combat systems that support joint operations across air, land, and sea domains. This trend is promoting the adoption of integration solutions that offer seamless connectivity and cross-platform functionality, fueling regional market growth.

Furthermore, the rise of local defense technology startups and government-funded R&D centers in Asia Pacific is contributing to the development of region-specific integration solutions. These entities are working on advanced sensors, autonomous systems, and AI-enabled platforms, which must be integrated into larger combat systems.

Regulatory Frameworks

- In the U.S., combat system integration is regulated under the International Traffic in Arms Regulations (ITAR) and the Arms Export Control Act (AECA). These laws control the export of defense articles and services, requiring companies to obtain licenses for exporting military technologies. Additionally, the Federal Acquisition Regulation (FAR) and the Defense Federal Acquisition Regulation Supplement (DFARS) govern defense procurement to ensure compliance with national security objectives.

- In the UK, the Export Control Act 2002 and the associated Export Control Order 2008 regulate the export of military and dual-use items through a licensing system. The Ministry of Defence (MOD) oversees procurement and integration standards through the Defence Equipment and Support (DE&S), ensuring compliance with operational standards and defense policies.

- China's National Defense Law emphasizes the integration of military and civilian sectors in defense technology development. The law promotes innovation-driven and independent development of defense industries, ensuring that combat system integration aligns with national defense objectives.

- Japan's Defense Industrial Security Manual (DISM), issued by the Acquisition, Technology & Logistics Agency (ATLA), outlines security protocols for defense contractors involved in combat system integration. The manual ensures the protection of classified information and compliance with international standards, facilitating Japan's participation in joint development programs and the integration of advanced combat systems.

Competitive Landscape

Companies operating in the combat system integration industry are collaborating with key industry players and securing financial backing, enabling them to enhance their capabilities, expand product offerings, and enter new markets. They are further focusing on technological advancements and improving product quality, leading to the development of innovative solutions.

- In October 2024, Leonardo DRS secured a contract with NAVSEA to produce ship-based AN/SPQ-9B radars for air and surface target detection.The contract includes manufacturing, inspection, and testing of the radars and their spare kits. The AN/SPQ-9B is an X-band, pulse Doppler, frequency-agile radar designed for littoral environments, featuring alow false track rates even in high-clutter conditions.

List of Key Companies in Combat System Integration Market:

- Lockheed Martin Corporation

- BAE Systems

- Thales

- RTX Corporation

- Leonardo DRS

- Saab

- Elbit Systems Ltd.

- General Dynamics

- Rheinmetall AG

- L3Harris Technologies, Inc.

- HENSOLDT AG

- Kongsberg Gruppen ASA

- Hanwha Systems Co., Ltd.

- ST Engineering Ltd.

- Israel Aerospace Industries Ltd.

Recent Developments (Joint Venture/Partnerships/Agreements)

- In April 2025, BAE Systems Australia signed a 10-year Head Agreement with Boeing Defence Australia to supply its Vehicle Management System (VMS) for the MQ-28 Ghost Bat uncrewed aircraft program. Boeing expects the flight test phase to conclude by the end of the end of 2025, with the MQ-28 operating alongside RAAF crewed platforms, including the E-7 Wedgetail and F-35 Joint Strike Fighter, for operational missions.

- In April 2025, Thales entered into a joint venture with Singapore’s Defence Science and Technology Agency (DSTA) to establish a joint laboratory focused on developing AI-powered technologies to strengthen the combat systems used by the Singapore Armed Forces (SAF). The collaboration initially concentrates on counter-unmanned aircraft system (C-UAS) solutions and advanced sensing capabilities, along with the co-development of AI algorithms aimed at addressing threats posed by UAS.

- In November 2024, Naval Group signed a Memorandum of Understanding (MoU) with Thales and KNDS to integrate their respective technologies into the Multipurpose and Modular Launching System (MPLS).