Market Definition

The market includes bioactive protein fragments derived from the enzymatic hydrolysis of collagen, commonly sourced from bovine, porcine, marine, or poultry origins. These peptides are formulated through specific processes involving controlled enzymatic breakdown to enhance bioavailability and absorption.

Used in nutraceuticals, functional foods, sports nutrition, and personal care products, collagen peptides support skin health, joint function, and muscle recovery. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Collagen Peptides Market Overview

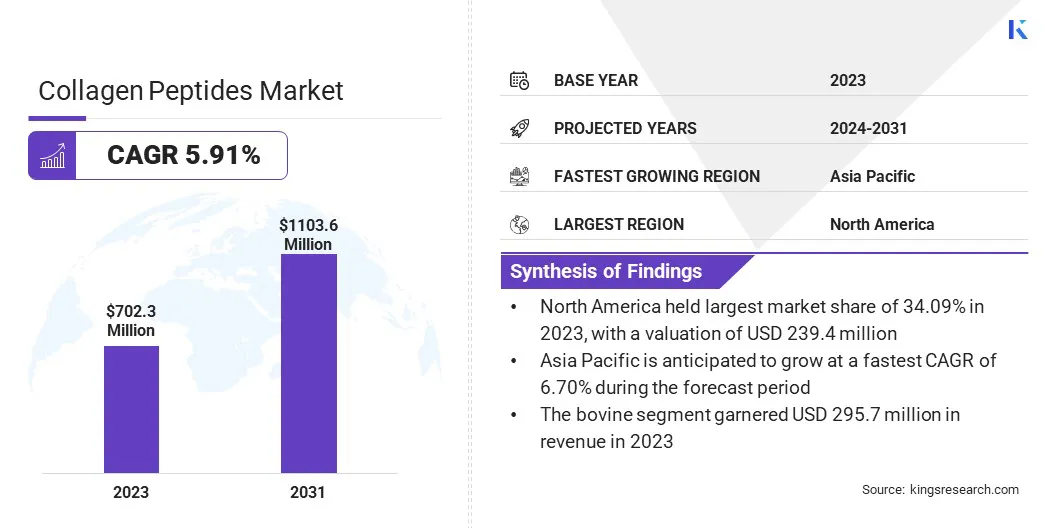

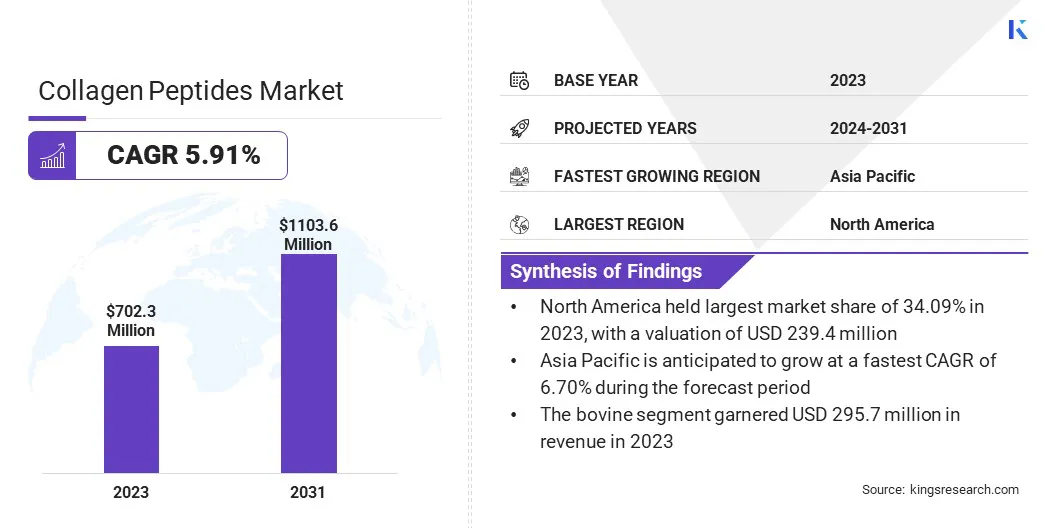

The global collagen peptides market size was valued at USD 702.3 million in 2023 and is projected to grow from USD 738.6 million in 2024 to USD 1,103.6 million by 2031, exhibiting a CAGR of 5.91% during the forecast period.

The growth of the market is driven by the expanding nutraceutical industry worldwide, as consumers seek natural and effective solutions for health and wellness. Additionally, the rise of clean-label and natural ingredient trends is increasing demand for collagen peptides, aligning with consumer preferences for transparency and high-quality, safe ingredients.

Major companies operating in the collagen peptides industry are GELITA AG, Darling Ingredients, Nitta Gelatin Inc., Gelnex, Weishardt Group, Asahi Gelatine, Tessenderlo Group, Holista Colltech Limited, Ewald-Gelatine GmbH, Geistlich Pharma AG, Juncà Gelatines SL, Italgelatine SpA, Advanced BioMatrix Inc., BioCell Technology LLC, Athos Collagen Pvt. Ltd.

The increasing consumer shift toward health-oriented diets is contributing to the growth of the market. Collagen peptides are being widely incorporated into functional food and beverage formulations due to their benefits in skin health, joint support, and muscle recovery.

This demand is further amplified by the growing preference for natural and protein-enriched ingredients, which has positioned collagen peptides as a core component in health supplements and fortified food categories.

- In May 2024, GELITA unveiled OPTIBAR, a collagen peptide solution optimized for bar production. OPTIBAR allows manufacturers to create high-protein bars with a soft texture and acts as a sugar-free binder, enabling 'low sugar' and 'no sugar' claims in cereal bars. This innovation caters to the growing demand for protein-enriched, health-oriented snacks.

Key Highlights

- The collagen peptides market size was valued at USD 702.3 million in 2023.

- The market is projected to grow at a CAGR of 5.91% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 239.4 million.

- The bovine segment garnered USD 295.7 million in revenue in 2023.

- The powder segment is expected to reach USD 838.7 million by 2031.

- The enzymatic hydrolysis segment secured the largest revenue share of 63.02% in 2023.

- The cosmeceuticals segment is poised for a robust CAGR of 8.14% through the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.70% during the forecast period.

Market Driver

ExpandingNutraceutical Industry Worldwide

The expansion of the global nutraceutical industry is significantly supporting the growth of the market. Collagen peptides are increasingly being used in dietary supplements aimed at improving bone strength, skin elasticity, and gut health.

With a rising geriatric population and increasing awareness about preventive healthcare, manufacturers are investing in collagen-based formulations, which has further accelerated the adoption of collagen peptides in capsule, powder, and liquid supplement formats.

- In Februry 2024, Evonik introduced Vecollage Fortify L, a vegan collagen ingredient identical to human skin collagen, developed through fermentation technology. This innovation caters to the rising demand for sustainable and ethical collagen sources in beauty and personal care products. This ingredient offers dual benefits by preventing age-related collagen degradation and stimulating the skin’s own collagen production.

Market Challenge

Sourcing and Sustainability Issues

A significant challenge impacting the growth of the collagen peptides market is sourcing raw materials sustainably. The increasing demand for collagen peptides, particularly from animal-derived sources like bovine, marine, and poultry, puts pressure on supply chains and raises concerns over environmental impact.

Key players are addressing this challenge by investing in sustainable sourcing practices and exploring alternative sources such as plant-based collagen or lab-grown collagen. Additionally, firms are adopting stricter traceability measures and focusing on eco-friendly processing technologies to minimize their environmental footprint and meet consumer demand for ethically sourced, sustainable products.

Market Trend

Growth of Clean-label and Natural Ingredient Trends

The increasing consumer inclination toward clean-label products is positively impacting the market. Collagen peptides, often derived from natural sources such as bovine, marine, and poultry, align with the preferences of health-conscious buyers looking for traceable and minimally processed ingredients.

As clean-label demand rises, manufacturers are actively promoting collagen peptides as natural and ethically sourced, which is helping grow their acceptance in the health and wellness market.

- In August 2024, Vital Proteins debuted a new 80% paperboard canister for its best-selling collagen peptides, reducing plastic use by over 90%. The packaging is made from responsibly sourced materials and is curbside recyclable, reflecting the brand's commitment to sustainability and meeting consumer demand for environmentally friendly products.

Collagen Peptides Market Report Snapshot

|

Segmentation

|

Details

|

|

By Source

|

Bovine, Porcine, Marine, Poultry, Others,

|

|

By Form

|

Powder, Liquid

|

|

By Extraction Process

|

Enzymatic Hydrolysis, Chemical Hydrolysis

|

|

By Application

|

Nutritional Products, Food & Beverage, Pharmaceuticals, Cosmeceuticals, Pet Nutrition

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Source (Bovine, Porcine, Marine, Poultry, Others): The bovine segment earned USD 295.7 million in 2023 due to its high availability, cost-effectiveness, and superior collagen content, making it the preferred choice for manufacturers across various applications.

- By Form (Powder, Liquid): The powder segment held 76.40% of the market in 2023, due to its ease of use, versatility in formulations, and the growing consumer preference for mixable, convenient, and customizable product formats for both dietary supplements and functional foods.

- By Extraction Process (Enzymatic Hydrolysis, Chemical Hydrolysis): The enzymatic hydrolysis segment is projected to reach USD 684.5 million by 2031, owing to its ability to efficiently produce high-quality collagen peptides with improved bioavailability and minimal degradation, making it a preferred extraction process for manufacturers.

- By Application (Nutritional Products, Food & Beverage, Pharmaceuticals, Cosmeceuticals, Pet Nutrition): The cosmeceuticals segment is poised for significant growth at a CAGR of 8.14% through the forecast period, attributed to the growing consumer demand for anti-aging solutions and skin health improvements, driving widespread use in skincare products.

Collagen Peptides Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America collagen peptides market share stood around 34.09% in 2023 in the global market, with a valuation of USD 239.4 million. North America has a mature and highly competitive sports nutrition sector. Collagen peptides are being widely adopted in protein powders, recovery blends, and performance supplements.

Their joint-support and muscle-repair properties make them attractive to athletes and fitness-conscious consumers. Leading U.S.-based supplement companies are innovating with flavored, mixable collagen formats, which is helping to strengthen market penetration across online and retail channels.

- In June 2024, Glanbia Nutritionals, in partnership with Jellice Co., introduced Collameta, a patented high-potency collagen tripeptide. Clinically evidenced to be absorbed four times faster and have greater efficacy in vivo than competing collagen peptide products, Collameta is designed to support joint health and muscle recovery, making it particularly appealing to athletes and fitness enthusiasts. The ingredient is initially offered in the North American market.

Moreover, North American companies are leading in customized collagen formulations, targeting specific consumer groups such as aging adults, athletes, and women. These advanced offerings cater to highly segmented wellness needs, helping drive the growth of the market in the region.

Asia Pacific is poised for significant growth at a robust CAGR of 6.70% over the forecast period. In Asia Pacific, nutricosmetics have become a major trend, with consumers increasingly using supplements to improve skin appearance, elasticity, and hydration. Collagen peptides are widely recognized in the region for their role in promoting youthful skin.

Beauty brands are offering collagen-enriched drinks, powders, and tablets, often marketed as part of daily beauty routines, which is accelerating the growth of the market in the region.

Regulatory Frameworks

- In the U.S., collagen peptides are regulated as dietary supplements under the Dietary Supplement Health and Education Act (DSHEA) of 1994.The Food and Drug Administration (FDA) oversees these products but does not require pre-market approval.Manufacturers are responsible for ensuring product safety and accurate labeling.The FDA monitors compliance and can take action against misbranded or adulterated products.

- The European Food Safety Authority (EFSA) regulates collagen peptides used in food and supplements.Products must comply with Regulation (EC) No 853/2004, which outlines hygiene rules for food of animal origin.Collagen peptides must be derived from approved animal sources and processed under strict conditions to ensure safety.

- The National Medical Products Administration (NMPA) regulates collagen peptides, especially those used in medical and cosmetic applications.In 2018, China implemented the GB 31645-2018 standard, specifying technical requirements for collagen peptides.Recombinant collagen products are subject to additional guidelines to ensure safety and efficacy.

- Japan's Consumer Affairs Agency oversees the labeling of functional foods, including collagen peptides.Manufacturers can submit a Foods with Function Claims (FFC) notification, providing scientific evidence to support health claims.This system allows for the marketing of collagen peptides with specific health benefits, such as skin elasticity improvement.

Competitive Landscape

Market players in the collagen peptides industry are increasingly adopting strategies such as product launches and portfolio expansion to strengthen their market position.

These initiatives are designed to cater to evolving consumer preferences, including demand for clean-label, flavored, and function-specific collagen products. By introducing targeted formulations for beauty, sports recovery, and healthy aging, companies are widening their customer base.

- In May 2024, Rousselot, a Darling Ingredients’ collagen and gelatin brand, launched Nextida, a platform of specific collagen peptide compositions designed to support the body's balance naturally. The first product, Nextida GC, demonstrated a significant reduction in post-meal glucose spikes, offering a natural approach to glucose management.

List of Key Companies in Collagen Peptides Market:

- GELITA AG

- Darling Ingredients.

- Nitta Gelatin Inc.

- Gelnex

- Weishardt Group

- Asahi Gelatine

- Tessenderlo Group

- Holista Colltech Limited

- Ewald-Gelatine GmbH

- Geistlich Pharma AG

- Juncà Gelatines SL

- Italgelatine SpA

- Advanced BioMatrix Inc.

- BioCell Technology LLC

- Athos Collagen Pvt. Ltd.

Recent Developments (Product Launches)

- In November 2024, Nitta Gelatin introduced DI-PEPTIDE, a new collagen peptide product line aimed at enhancing collagen supplementation.This launch reflects the company's commitment to advancing collagen-based health solutions.

- In November 2024, BioCell Technology launched BioCell Collagen ERP (Extra Refined Palatable), designed for non-pill formats like gummies and chewables.This product maintains the benefits of hydrolyzed collagen type II peptides, chondroitin sulfate, and hyaluronic acid in more palatable forms.

- In May 2024, GELITA introduced new Bioactive Collagen Peptides (BCP) solutions, including PeptENDURE for sports nutrition, VERISOL for beauty, and FORTIBONE and FORTIGEL for healthy aging, at Vitafoods Europe 2024.These innovations aim to enhance protein bars and supplements with targeted health benefits.