Market Definition

The market encompasses the production, distribution, and application machines used in construction and road maintenance to remove asphalt, concrete, or other surfaces without excessive heat.

Cold milling machines are essential for tasks such as road rehabilitation, resurfacing, and removal of damaged layers, allowing for precise and efficient material removal while minimizing dust and vibrations. The market includes various machine sizes, related equipment, and services, driven by the increasing road infrastructure, urbanization, and advancements in construction technology.

Cold Milling Machine Market Overview

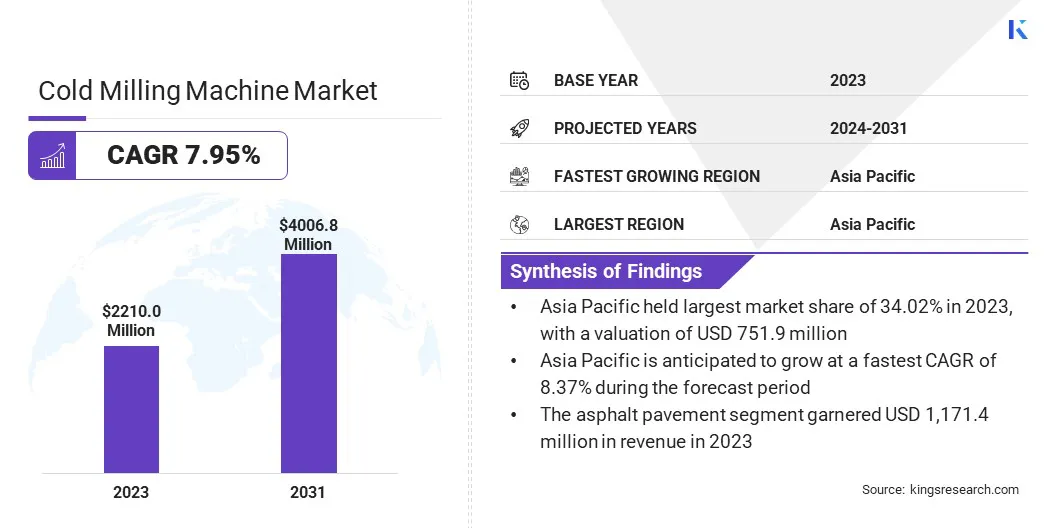

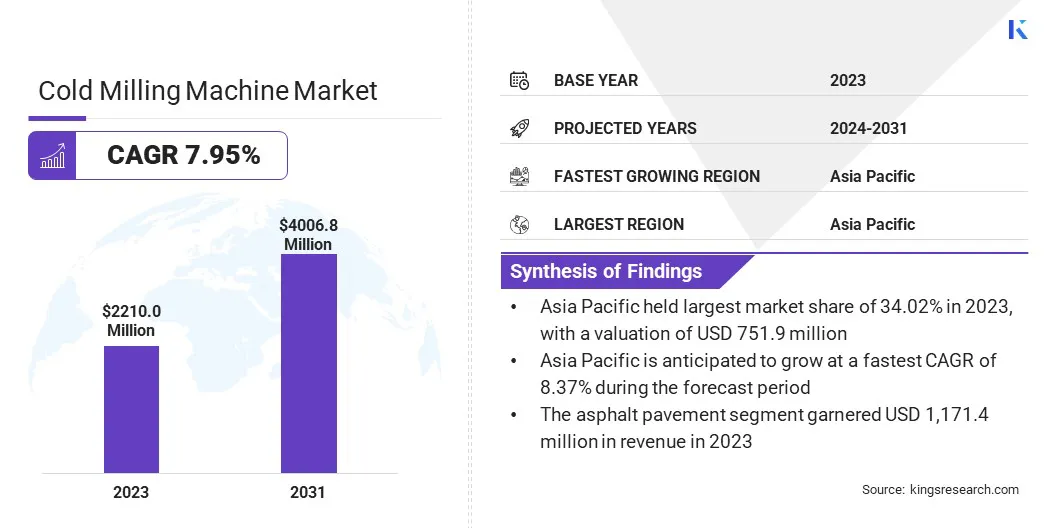

The global cold milling machine market size was valued at USD 2210.0 million in 2023 and is projected to grow from USD 2345.7 million in 2024 to USD 4006.8 million by 2031, exhibiting a CAGR of 7.95% during the forecast period.

This growth is fueled by the increasing global demand for road construction, maintenance, and rehabilitation projects. Cold milling machines, which are used to remove layers of asphalt and concrete from road surfaces, are critical for resurfacing and recycling materials, ensuring cost-effective and sustainable construction.

Infrastructure expansion, particularly in emerging economies, is boosting demand, along with the rising focus on road safety and quality. Additionally, government regulations on construction standards and environmental impact further propel market growth.

Major companies operating in the cold milling machine industry are Caterpillar, AB Volvo, John Deere, XCMG Group, FAYAT Group, Liugong Machinery Co., Ltd., SANY HEAVY INDUSTRY CO., Ltd., J C Bamford Excavators Ltd., Shantui Construction Machinery co.,Ltd, Astec Industries, Inc., CMI Roadbuilding Inc., SAKAI HEAVY INDUSTRIES,LTD., ETW International, Simex S.r.l., and Kubota Corporation.

Moreover, technological advancements in cold milling machines, including enhanced precision, fuel efficiency, and automation, are fostering investments and increasing the adoption in large-scale road construction and repair projects. Additionally, the rising demand for eco-friendly and energy-efficient solutions in construction machinery has contributed to market expansion.

The increasing need for faster, cost-effective, and environmentally responsible solutions in road rehabilitation and maintenance further support this growth.

- In March 2025, Wirtgen announced that it will unveil five world premieres at Bauma 2025 in Munich, showcasing innovations in the cold milling, and recycling, slipform pavers and surface miners. Key highlighlights include the W 250 XF arge milling machine, the next generation WR series, and the debut of the battery-electric W 50 Re and W 250 XF, focusing on sustainable road construction and resource extraction.

Key Highlights:

- The cold milling machine industry size was valued at USD 2210.0 million in 2023.

- The market is projected to grow at a CAGR of 7.95% from 2024 to 2031.

- Asia Pacific held a share of 34.02% in 2023, valued at USD 751.9 million.

- The crawler segment garnered USD 814.9 million in revenue in 2023.

- The below 300 kW segment is expected to reach USD 1542.6 million by 2031.

- The asphalt pavement segment is projected to generate a revenue of USD 2,107.2 million by 2031.

- North America is anticipated to grow at a CAGR of 7.95% through the forecast period.

Market Driver

Increasing Infrastructure Investments and Ongoing Technological Advancements

The cold milling machine market is experiencing significant growth driven by increasing infrastructure investments and ongoing technological advancements.

As governments and private sectors focus on expanding and upgrading infrastructure, the demand for efficient road rehabilitation and resurfacing solutions has intensified. Cold milling machines are essential for removing deteriorating pavement and preparing surfaces for new layers, particularly in urban and developing regions.

Additionally, rapid technological innovations are enhancing the performance and efficiency of cold milling machines. Modern model features GPS and automation, improving precision, material handling, and fuel efficiency.

The ability to track machine performance and emissions in real-time further optimizes workflows and minimizes downtime, making cold milling machines an increasingly attractive solution for contractors aiming to enhance productivity and reduce operational costs.

- In March 2024, Topcon Positioning Systems launched the MC-Max Asphalt Paving and MC-Max Milling solutions. The systems are designed to enhance productivity in asphalt paving and cold milling applications through modular configurations, advanced sensors, and automated features, offering customizable options for contractors to improve road smoothness and reduce costs.

Market Challenge

High Initial Cost of Equipment

A major challenge impeding the expansion of the cold milling machine market is the high initial investment. These machines integrate cutting-edge technologies such as GPS-based control systems, automation for precision milling, and eco-friendly engines to meet emission standards, enhancing efficiency but increasing costs.

For small to medium-sized contractors, this high initial cost can be a significant financial barrier, particularly amid budget constraints and competing priorities.

In addition to machine costs, expenses such as maintenance, operator training, and spare parts further increase overall investment. Consequently, smaller companies may delay or avoid investing in modern equipment, limiting their competitiveness in an industry relying on high-performance machines for efficiency and sustainability.

To address this challenge, manufacturers are offering financing options such as leasing, rentals, and tailored payment plans, enabling smaller contractors to adopt modern equipment with reduced upfront costs.

Market Trend

Integration of Automation and Focus on Sustainability

The market is witnessing significant growth, mainly propelled by the integration of automation and digital technologies. Manufacturers are incorporating advanced machine control systems, GPS, and telematics to enhance precision through real-time performance monitoring and project tracking.

These features reduce manual intervention, improve operational efficiency, and enable predictive maintenance, remote diagnostics, and real-time data sharing. As a result, contractors benefit from optimized productivity, reduced downtime, lower operational costs, and more accurate milling processes, leading to faster project completion and reduced waste.

- In March 2024, Caterpillar launched VisionLink Productivity for its PM600 and PM800 Series Cold Planers. This platform delivers near real-time machine and jobsite data, improving productivity, reducing fuel consumption, and optimizing profitability through enhanced efficiency and lower operating costs.

Increasing emphasis on sustainability in road construction and infrastructure projects is a key trend influencing the market. The construction industry's focus on sustainability is boosting the evolution of cold milling machines toward eco-friendly solutions.

Manufacturers are developing battery-electric and hybrid models to reduce emissions and fuel consumption, aligning with global pollution reduction efforts. These advancements help contractors comply with stringent environmental regulations while ensuring long-term cost savings. The growing demand for sustainable and energy-efficient milling solutions continues to foster innovation in the market.

Cold Milling Machine Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product

|

Drum, Crawler, Wheel

|

|

By Power

|

Below 300 kW, 300 kW - 500 kW, Above 500 kW

|

|

By Application

|

Concrete rehabilitation, Asphalt pavement

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product (Drum, Crawler, and Wheel): The crawler segment earned USD 814.9 million in 2023 due to its superior stability and ability to operate in challenging terrains, making it ideal for large-scale road construction and maintenance projects.

- By Power (Below 300 kW, 300 kW - 500 kW, and Above 500 kW): The below 300 kW segment held a share of 38.45% of the market in 2023, mainly fueled by its cost-effectiveness and suitability for small to medium-sized road repair and resurfacing projects.

- By Application (Concrete rehabilitation and Asphalt pavement): The asphalt pavement segment is projected to reach USD 2,107.2 million by 2031, primarily bolstered by the increasing demand for road resurfacing, high-traffic road maintenance, and the growing adoption of asphalt recycling.

Cold Milling Machine Market Regional Analysis

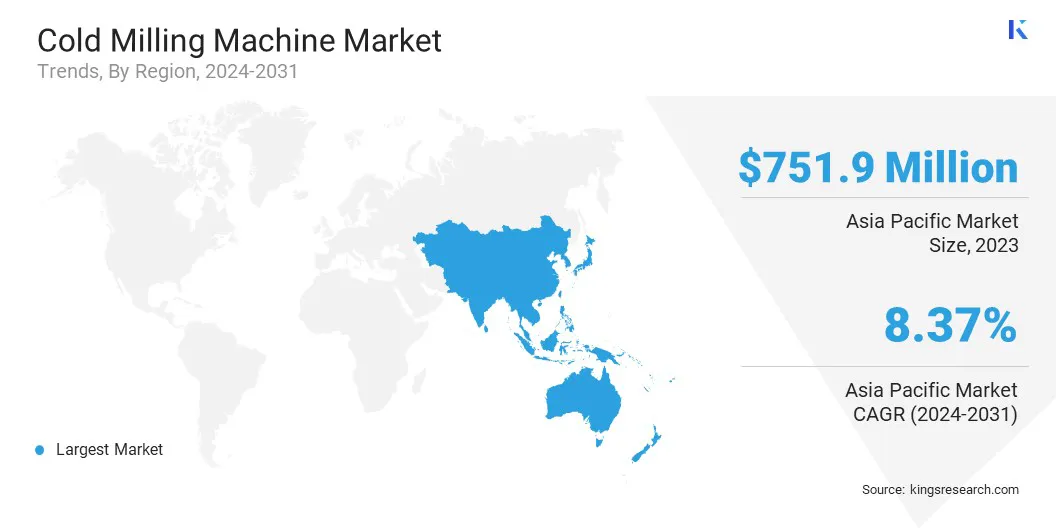

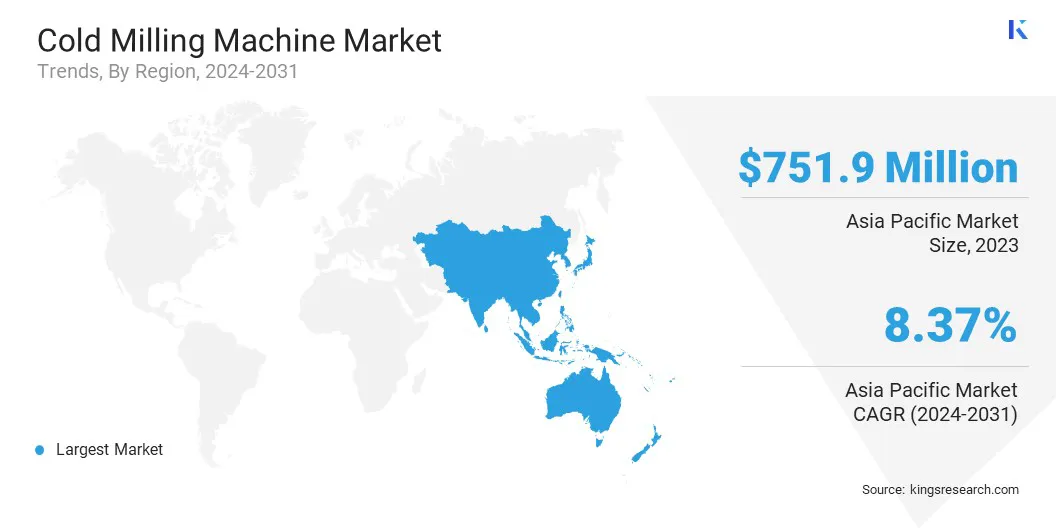

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific cold milling machine market accounted for a substantial share of 34.02% in 2023, valued at USD 751.9 million. This dominant position can be attributed to the region's rapid economic growth, urbanization, and extensive infrastructure development. Countries such as China and India, with large populations and growing transportation needs, fuel regional market expansion.

Significant investments in road construction and modernization have boosted cold milling machine adoption. Additionally, the emphasis on sustainable road maintenance, including recycled materials, supports their use for efficient resurfacing. As governments prioritize road quality and capacity, demand for advanced cold milling technologies continues to rise.

North America cold milling machine industry is expected to register the fastest CAGR of 7.95% over the forecast period. This rapid growth is primarily stimulated by the ongoing need for infrastructure revitalization, particularly in the U.S., where aging road networks require rehabilitation.

Significant investments in road repair and maintenance projects, along with government initiatives to improve road safety, have increased the demand for cold milling machines. Additionally, the adoption of advanced technologies, including automation and fuel-efficient systems, is propelling this growth.

The integration of these machines in both public and private sector projects reinforces North America's position as a key market for cold milling machines.

Regulatory Frameworks

- In the U.S., cold milling machines are regulated by the Occupational Safety and Health Administration (OSHA) under the Occupational Safety and Health Act of 1970. OSHA provides guidelines on operator safety and machine operation standards. Additionally, the Environmental Protection Agency (EPA) regulates emissions and noise levels from construction equipment, including cold milling machines, under the Clean Air Act and the Noise Control Act of 1972.

- In Europe, compliance with the EU Machinery Directive is mandatory, outlining safety requirements for the design and construction of machinery. Additionally, manufacturers must adhere to the EU Noise Directive to limit noise pollution from construction equipment.

- In China, the Ministry of Industry and Information Technology (MIIT) mandates compliance with National Safety Standards for Construction Machinery, while the Ministry of Ecology and Environment (MEE) enforces emissions regulations under the China Stage IV Emissions Standard.

- In Japan, cold milling machines are governed by the Ministry of Land, Infrastructure, Transport, and Tourism (MLIT). The Construction Machinery Safety Regulation ensures the safe operation of construction machines. Furthermore, the Air Pollution Control Act and Noise Regulation Law regulate emissions and noise levels.

- In India, the Ministry of Heavy Industries and Public Enterprises oversees regulations, with safety standards enforced under the Factories Act of 1948. Emission regulations for construction machinery are regulated by the Central Pollution Control Board (CPCB) under the Air (Prevention and Control of Pollution) Act.

Competitive Landscape

The cold milling machine industry is fragmented, with numerous players vying for market share through the development of high-performance machines that offer improved fuel efficiency, enhanced precision, and automation capabilities.

Manufacturers are developing machines equipped to handle various road types and terrains, emphasizing greater milling depths, adaptable configurations, and eco-friendly technologies.

Key players are investing heavily in R&D to develop differentiated products, including machines with advanced sensors and intelligent control systems for improved efficiency. Companies are also forming partnerships with construction firms, government agencies, and contractors to strenghthen market presence and expand offerings.

Additionally, regional players are enhancing service networks to cater to the rising demand for after-sales support, including maintenance, repair, and spare parts, ensuring long-term customer satisfaction.

- In March 2024, Caterpillar updated the Cat PM300 Cold Planer series with design enhancements to improve performance, operator comfort, and milling power. The new models fetaure an integrated engine for increased gross power and torque while meeting emission standards. Key upgrades include improved conveyor sealing, redesigned transition flashing, and enhanced material containment. Additional features such as adjustable on-screen guidance, enhanced safety lighting, and optional dust abatement systems further improve efficiency and safety.

List of Key Companies in Cold Milling Machine Market:

- Caterpillar

- AB Volvo

- John Deere

- XCMG Group

- FAYAT Group

- Liugong Machinery Co., Ltd.

- SANY HEAVY INDUSTRY CO., Ltd.

- J C Bamford Excavators Ltd.

- Shantui Construction Machinery co.,Ltd

- Astec Industries, Inc.

- CMI Roadbuilding Inc.

- SAKAI HEAVY INDUSTRIES,LTD.

- ETW International

- Simex S.r.l.,

- Kubota Corporation

Recent Developments (New Product Launch)

- In March 2025, Wirtgen Group unveiled the W 210 XF cold milling machine at World of Asphalt 2025. Designed for high performance, compact dimensions, it offers milling widths of 2.0-2.5 m and a maximum depth of 330 mm. Ideal for highway and airport pavement rehabilitation, it features WPT Milling for automated documentation and real-time CO₂ emissions tracking.