Market Definition

A coffee roaster is a machine used to heat and transform green coffee beans into roasted coffee through controlled thermal processes. The market encompasses a wide range of equipment, including small-scale artisan models and large industrial roasters, across electric, gas, and hybrid technologies.

Additionally, it includes roasting systems, automation controls, and related accessories used in commercial roasting facilities, cafés, and specialty coffee operations, with applications spanning retail, foodservice, and industrial production worldwide.

Coffee Roaster Market Overview

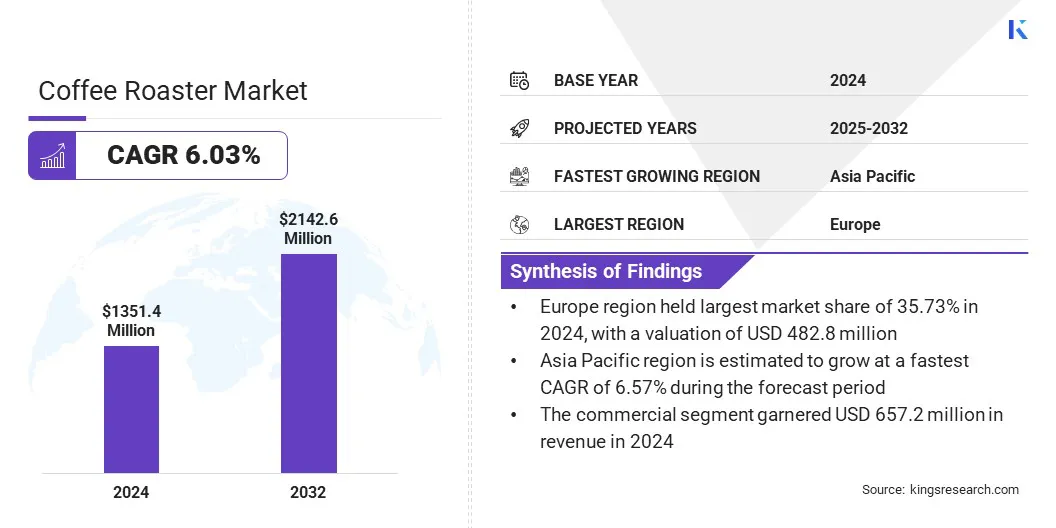

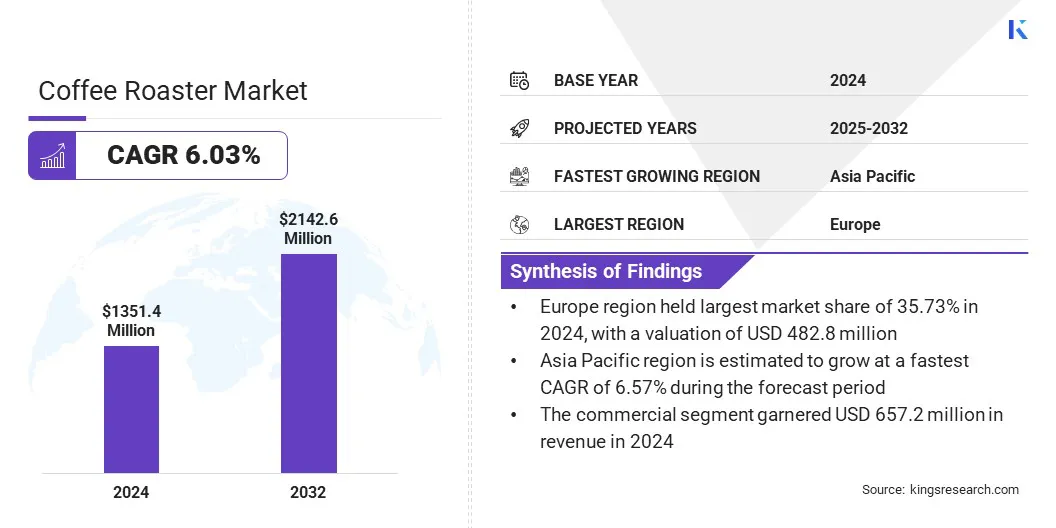

The global coffee roaster market size was valued at USD 1,351.4 million in 2024 and is projected to grow from USD 1,421.9 million in 2025 to USD 2,142.6 million by 2032, exhibiting a CAGR of 6.03% during the forecast period.

Market growth is driven by rising coffee consumption and the widespread adoption of electric roasters, as manufacturers shift toward cleaner energy sources and improved operational efficiency.

Key Market Highlights:

- The coffee roaster industry size was recorded at USD 1,351.4 million in 2024.

- The market is projected to grow at a CAGR of 6.03% from 2025 to 2032.

- Europe held a share of 35.73% in 2024, valued at USD 482.8 million.

- The drum roasters segment garnered USD 520.9 million in revenue in 2024.

- The industrial (more than 50 kg) segment is expected to reach USD 829.3 million by 2032.

- The commercial segment is anticipated to witness the fastest CAGR of 6.91% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.57% through the projection period.

Major companies operating in the coffee roaster market are PROBAT SE, Bühler AG, Loring Smart Roast, Inc., Giesen, IMF s.r.l., NEUHAUS NEOTEC Maschinen- und Anlagenbau GmbH, BESCA ROASTERS, Joper Roasters, oper, Garanti Roasters, US Roaster Corp, Behmo, Inc., Hottop Americas LLC, Fuji Kouki Co., Ltd., Stronghold Robotics Inc., and others.

Expansion of coffee shop chains is fueling market growth by increasing demand for high-capacity, consistent roasting solutions across global retail networks. Major brands such as Starbucks and Costa Coffee are scaling rapidly, requiring roasting systems that ensure flavor consistency and operational efficiency.

Equipment providers are aligning technologies with chain-specific requirements and scalable automation. This sustained growth in branded outlets continues to boost demand for advanced roasting systems, supporting broader market expansion.

Market Driver

Rising Coffee Consumption

Rising global coffee consumption is propelling the expansion of the market by increasing demand for roasted coffee products, particularly in emerging economies with increasing per capita intake. This highlights the increased need for high-capacity, efficient roasting systems that deliver consistent quality.

The growing preference for fresh, locally roasted products, fueled by changing consumption habits, urbanization, and demand for premium varieties, is further boosting market expansion.

- In April 2024, the National Coffee Association (NCA) reported that 67% of American adults consumed coffee daily, reflecting a 37% rise since 2004 and the highest consumption rate in over 20 years.

Market Challenge

High Capital Requirements

The coffee roaster market faces significant barriers due to high initial investment and operational costs, particularly affecting small and mid-sized enterprises. Advanced roasting systems require significant capital for procurement, installation, and maintenance, which restricts market entry and slows adoption in cost-sensitive regions.

To mitigate this challenge, manufacturers are introducing modular systems, flexible financing options, and scalable solutions tailored to varying production capacities. These strategic measures are aimed at lowering entry barriers, improving accessibility, and supporting broader market participation.

Market Trend

Rising Adoption of Electric Roasters

A prominent trend influencing the market is the increasing adoption of electric-powered roasters, supported by rising environmental concerns and stringent emission regulations. This transition is prominent in urban areas and sustainability-focused segments, where reducing carbon emissions is a priority.

The shift toward electric models is enabling manufacturers to comply with regulatory standards while improving energy efficiency. This development is strengthening market competitiveness and supporting long-term sustainability goals.

- In April 2024, Diedrich Roasters launched the DR3‑E, its first 3-kilogram electric coffee roaster, at the Specialty Coffee Expo held in Chicago. This launch marks a strategic shift from its conventional gas-powered DR3 line.

Coffee Roaster Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Drum Roasters, Hot-Air / Fluid-Bed Roasters, Direct Fire Roasters

|

|

By Batch Size

|

Small (100 grams to 1 kg), Medium (1 kg to 15 kg), Large (above 15 kg), Industrial (More than 50 kg)

|

|

By Application

|

Industrial, Commercial, Residential

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Drum Roasters, Hot-Air / Fluid-Bed Roasters, and Direct Fire Roasters): The drum roasters segment earned USD 520.9 million in 2024, mainly due to its widespread commercial adoption, consistent roasting performance, and capacity to handle large batch volumes with uniform heat distribution.

- By Batch Size (Small (100 grams to 1 kg), Medium (1 kg to 15 kg), Large (above 15 kg), and Industrial (More than 50 kg)): The industrial (more than 50 kg) segment held a share of 38.28% in 2024, propelled by its high suitability for large-scale commercial operations, enabling efficient processing and cost-effective bulk roasting.

- By Application (Industrial, Commercial, and Residential): The commercial segment is projected to reach USD 1,110.5 million by 2032, owing to the growing number of cafés, roasteries, and specialty coffee shops requiring high-capacity equipment to meet increasing consumer demand and enhance operational efficiency.

Coffee Roaster Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Europe coffee roaster market share stood at 35.73% in 2024, valued at USD 482.8 million. This dominance is attributed to the region's well-established coffee culture, particularly in countries such as Italy, France, and Germany, where consistent demand for high-quality roasted coffee persists.

Consumer preference for premium blends and fresh preparation promotes continuous investment in advanced technologies and artisanal methods by roasters, specialty brands, and equipment manufacturers. These factors contribute to stable market conditions and reinforce Europe’s leading market position.

The Asia-Pacific coffee roaster industry is estimated to grow at a CAGR of 6.57% over the forecast period. This growth is fostered by the rising coffee consumption among millennials in urban centers in China, India, and Vietnam, where changing lifestyles are boosting demand for fresh and specialty coffee.

This has led to increased preference for premium blends and in-store roasting experiences. Moreover, the growth of cafe culture is bolstering demand for commercial roasting equipment aligned with evolving consumer preferences.

These developments are positioning Asia Pacific as the fastest-growing market for coffee roasters, supported by rising disposable income and urban retail expansion.

Regulatory Frameworks

- In Europe, the European Food Safety Authority (EFSA) sets food safety standards and offers scientific guidance on contaminants, acrylamide levels in roasted coffee, and hygiene during roasting and packaging.

- In India, the Food Safety and Standards Authority of India (FSSAI) regulates hygiene standards, labelling requirements, and permissible levels of contaminants to ensure the safety and quality of roasted coffee products.

Competitive Landscape

Key players in the coffee roaster market are focusing on acquisitions and product innovation to enhance capabilities and meet evolving customer demands. Companies are integrating advanced technologies like precision control, automation, and data analytics to improve efficiency and roast quality.

Sustainability is also a key focus, with energy-efficient systems and eco-friendly designs gaining traction. These strategies are helping firms strengthen their market position, support artisanal and commercial roasting needs, and drive innovation across the global coffee industry.

Key Companies in Coffee Roaster Market:

- PROBAT SE

- Bühler AG

- Loring Smart Roast, Inc.

- Giesen

- IMF s.r.l.

- NEUHAUS NEOTEC Maschinen- und Anlagenbau GmbH

- BESCA ROASTERS

- Joper Roasters

- Toper

- Garanti Roasters

- US Roaster Corp

- Behmor, Inc.

- Hottop Americas LLC

- Fuji Kouki Co., Ltd.

- Stronghold Robotics Inc.

Recent Developments (Product Launches)

- In February 2024, Neuhaus Neotec commissioned the industrial-scale electric coffee roaster at Café William’s facility in Canada, marking a major advancement in sustainable roasting technology and large-scale clean energy adoption.