Market Definition

Coal to liquid (CTL) is a technology process that converts coal into liquid hydrocarbons, such as synthetic crude oil, diesel, gasoline, and jet fuel, through methods like direct liquefaction or indirect liquefaction. The market encompasses coal gasification, syngas production, catalytic synthesis, and refining processes.

Its applications include transportation fuels such as diesel, gasoline, jet fuel, chemical feedstocks, and alternative energy sources for reducing dependency on conventional crude oil.

Coal to Liquid Market Overview

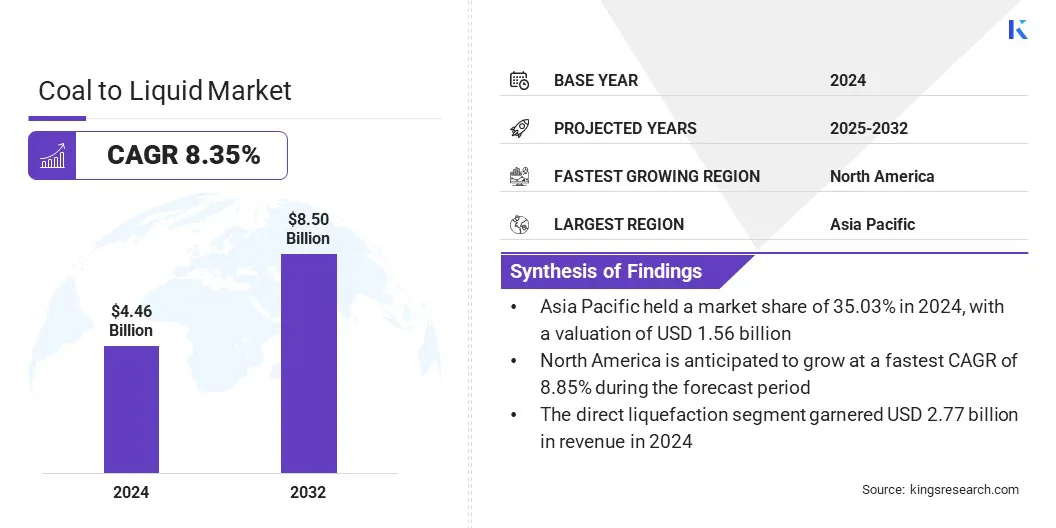

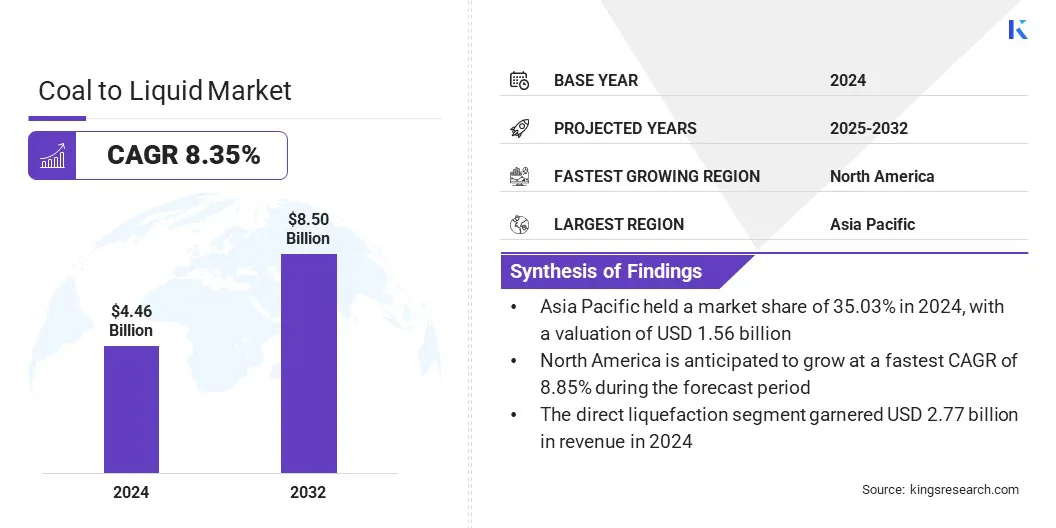

The global coal to liquid market was valued at USD 4.46 billion in 2024 and is projected to grow from USD 4.82 billion in 2025 to USD 8.50 billion by 2032, exhibiting a CAGR of 8.35% over the forecast period.

The market is driven by increasing investments by government and key players in advanced coal to liquid technologies that enhance production efficiency and support the transition to cleaner synthetic fuels. The market is further growing due to the rising demand for transportation and industrial fuels, which is encouraging the expansion of CTL plants and infrastructure across coal-rich regions.

Key Highlights:

- The coal to liquid industry was recorded at USD 4.46 billion in 2024.

- The market is projected to grow at a CAGR of 8.35% from 2025 to 2032.

- Asia Pacific held a market of 35.03% in 2024, with a valuation of USD 1.56 billion.

- The direct liquefaction segment garnered USD 2.77 billion in revenue in 2024.

- The diesel segment is expected to reach USD3.55 billion by 2032.

- The cooking fuel segment is anticipated to witness the fastest CAGR of 8.47% over the forecast period.

- North America is anticipated to grow at a CAGR of 8.85% over the forecast period.

Major companies operating in the coal to liquid market are CHINA SHENHUA, QatarEnergy LNG, Yankuang Energy Group Company Limited, TransGas Development Systems, Regius Synfuels Ltd, Pall Corporation, Air Products and Chemicals, Inc, Envidity Energy Inc, Siemens, Sasol Limited, Linc Energy Systems, and Hunton Andrews Kurth LLP.

Additionally, the adoption of underground coal gasification technology to convert in-situ coal into syngas for fuels and chemical feedstocks is enhancing domestic feedstock availability. This approach is supports CTL development and strengthening energy security by providing an alternative and efficient route to liquid fuel production.

- In June 2024, India’s Ministry of Coal initiated the first underground coal gasification pilot at Jharkhand’s Kasta block, led by Eastern Coalfields Limited, to produce syngas for fuels and chemicals, advancing CTL development and energy security.

Market Driver

Rising Coal to Liquid Investment

A major driver in the coal to liquid market is the rising investment in large-scale CTL projects to strengthen domestic fuel supply and reduce reliance on crude oil imports. Companies are deploying advanced liquefaction technologies integrated with green hydrogen to boost production capacity. This increasing large scale projects is enhancing energy security, stimulating regional economies, and accelerating the adoption of innovative synthetic fuel solutions.

- In October 2024, China Energy Investment (CHN Energy) launched a USD 24.1 billion coal-to-liquid project in Hami, Xinjiang, China. It is designed to apply second-generation liquefaction technology and green hydrogen integration, targeting 4 million tons of annual output to enhance domestic fuel supply.

Market Challenge

High Capital Investment

A major challenge in the coal to liquid market is the high capital investment required to establish and operate CTL plants. The technology involves complex processes such as coal gasification, liquefaction, and refining, which demand advanced infrastructure and significant financial resources.

These high upfront and operational costs limit participation to large corporations and state-backed enterprises, restricting broader industry adoption. This slows down project approvals and makes CTL less competitive against alternatives like natural gas, renewables, and biofuels.

To address this challenge, market players are pursuing strategic collaborations, joint ventures, and government partnerships to share financial risks and secure funding support. Key players are adopting modular plant designs and phased project development to reduce upfront costs and improve the scalability of CTL projects.

Additionally, they are integrating carbon capture and green hydrogen technologies to enhance sustainability, attract policy incentives, and improve the financial viability of these projects.

Market Trend

Rising Focus on Producing Cleaner Synthetic Fuels

A key trend in the coal to liquid market is the rising focus on producing cleaner synthetic fuels to meet environmental and energy security goals. Companies are adopting advanced coal to liquid technologies and coal gasification processes to minimize emissions and improve fuel quality.

Operators are integrating coal beneficiation, flue gas treatment, and carbon capture solutions to ensure sustainable production. This growing focus on cleaner fuels is driving investments in research and development, modernizing CTL plants, and supporting the transition toward low-emission liquid fuels for power, transportation, and industrial applications.

Coal to Liquid Market Report Snapshot

|

Segmentation

|

Details

|

|

By Technology

|

Direct Liquefaction, Indirect Liquefaction

|

|

By Product

|

Diesel, Gasoline, Others

|

|

By Application

|

Transportation Fuel, Cooking Fuel, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Technology (Direct Liquefaction and Indirect Liquefaction): The direct liquefaction segment earned USD 2.77 billion in 2024 due to its higher conversion efficiency and ability to produce cleaner synthetic fuels.

- By Product (Diesel, Gasoline, and Others): The diesel segment held 42.17% of the market in 2024, due to strong demand in transportation and industrial applications.

- By Application (Transportation Fuel, Cooking Fuel, and Others): The transportation fuel segment is projected to reach USD 3.41 billion by 2032, owing to the increasing adoption of synthetic fuels in road and rail transport.

Coal to Liquid Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific coal to liquid market share stood at 35.03% in 2024 in the global market, with a valuation of USD 1.56 billion. This dominance is primarily driven by abundant coal supply and active investments in coal handling, processing, and CTL plant facilities that are sustaining the region’s CTL operations.

Moreover, energy producers are expanding coal gasification and CTL projects to meet growing domestic power demand and reduce reliance on imported crude oil and liquid fuels. The region is enhancing energy stability by diversifying into cleaner coal technologies and advancing liquid fuel production.

Moreover, operators in the region are optimizing coal utilization and scaling coal to liquids (CTL) projects to support national energy requirements. Investments by key players in underground mining enhancements, coal processing facilities, and CTL plant expansions are enabling higher efficiency in CTL processes and supporting the steady expansion of the market in the region.

- In August 2025, Coal India Limited (CIL) announced a coal supply target of 900 million tonnes for FY26, focusing on meeting rising power sector demand and reducing imports. The company is investing in infrastructure, cleaner technologies, and diversification into coal gasification and coal-to-liquid (CTL) projects to enhance energy security and promote sustainable coal utilization.

North America coal to liquid industry is set to grow at a robust CAGR of 8.85% over the forecast period. This growth is attributed to increasing government investments in CTL R&D and the adoption of advanced liquefaction technologies across the region.

Expansion of pilot projects and commercial-scale plants is producing cleaner synthetic fuels that meet stringent environmental regulations. Rising demand for transportation and industrial fuels is encouraging the development and expansion of domestic CTL plants, reducing reliance on imported crude oil.

Additionally, the region is focusing on reducing dependence on imported crude oil and improving energy security through domestic CTL production. Regional market players are leveraging abundant coal reserves and advanced infrastructure to scale operations, optimize coal utilization, and ensure a steady supply of synthetic liquid fuels to support industrial and transportation sectors. These factors are driving the market growth in the region.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency regulates CTL projects under the Clean Air Act and Clean Water Act, overseeing air emissions, wastewater discharges, and carbon management. The EPA enforces fuel quality standards, greenhouse gas reporting, and mandates compliance with environmental impact assessments, ensuring CTL development aligns with national sustainability and climate goals.

- In China, the National Energy Administration supervises CTL projects, focusing on strategic energy security, coal resource utilization, and clean fuel development. The NEA sets capacity approval standards, monitors emissions, and ensures compliance with national energy efficiency targets. It emphasizes scaling CTL under coal-to-chemicals initiatives while enforcing environmental safeguards and integrating carbon reduction measures.

- In India, the Ministry of Coal regulates CTL activities by framing policies for coal resource allocation, project approvals, and technology adoption. It oversees integration with India’s energy security strategy and ensures compliance with environmental clearances under the Ministry of Environment. The ministry promotes pilot CTL plants, supports public-private investments, and monitors sustainable coal utilization.

Competitive Landscape

Major players in the coal to liquid industry are actively expanding production capacities and modernizing existing facilities to enhance operational efficiency of CTL plants.

Key players are investing in advanced coal gasification and direct liquefaction technologies to produce cleaner synthetic fuels while reducing environmental impact. Additionally, market players are focusing on modular plant designs and phased project execution to manage capital expenditure and improve the scalability of CTL operations.

Key Companies in Coal to Liquid Market:

- CHINA SHENHUA

- QatarEnergy LNG

- Yankuang Energy Group Company Limited

- TransGas Development Systems

- Regius Synfuels Ltd

- Pall Corporation

- Air Products and Chemicals, Inc

- Envidity Energy Inc

- Siemens

- Sasol Limited

- Linc Energy Systems

- Hunton Andrews Kurth LLP.

Recent Developments (Expansion)

- In June 2025, Coal India Limited invested over USD 124 million in Talcher Fertilizers to advance India’s first coal gasification-based urea plant. The project targets 1.3 million tonnes of annual urea output.