Market Definition

The market focuses on systems that automate and control machine tools through programmed instructions. These controllers guide operations such as cutting, shaping, and drilling with high precision. The market covers both hardware and integrated software platforms used in industrial machining.

CNC controllers are essential in sectors such as automotive, aerospace, electronics, and metal fabrication. They support complex part production, improve repeatability, and reduce manual errors.

The market plays a key role in modern manufacturing by enabling flexible and efficient production processes. The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

CNC Controller Market Overview

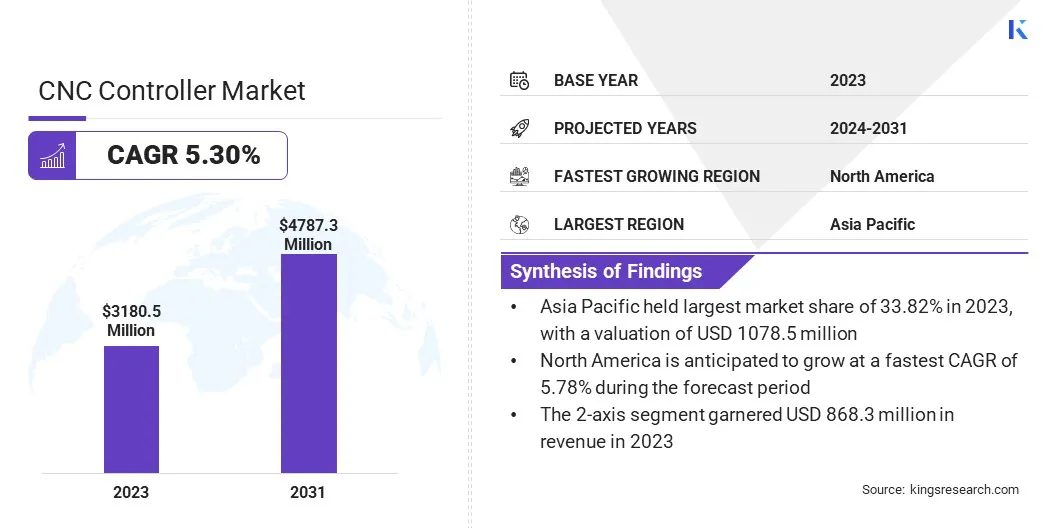

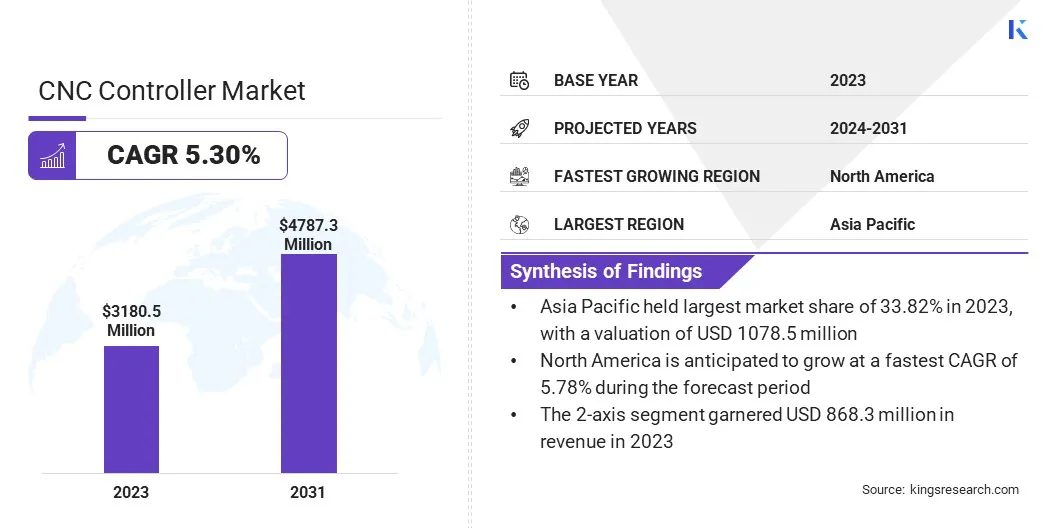

The global CNC controller market size was valued at USD 3180.5 million in 2023 and is projected to grow from USD 3335.1 million in 2024 to USD 4787.3 million by 2031, exhibiting a CAGR of 5.30% during the forecast period.

Market growth is driven by the expansion of the automotive industry, which demands high-precision, high-volume manufacturing systems. Additionally, the development of multi-axis CNC machines is supporting this growth by enabling complex part production with greater speed and accuracy, meeting the evolving needs of advanced manufacturing.

Major companies operating in the CNC controller industry are FANUC America Corporation, Siemens, Mitsubishi Electric Corporation, Bosch, Heidenhain GmbH, Fagor Automation, Delta Electronics, Inc., Okuma Corporation, GSK CNC Equipment Co., Ltd., Yaskawa Electric Corporation, SYNTEC Technology Co., Ltd., Beckhoff Automation GmbH & Co. KG, Kollmorgen Corporation, Parker Hannifin, and Centroid CNC.

The incorporation of Industrial IoT into factory operations is propelling the growth of the market. Modern CNC controllers now support data connectivity, allowing manufacturers to track performance, predict failures, and optimize machining processes remotely.

Real-time monitoring helps reduce downtime and improve machine utilization. IIoT integration transforms CNC systems into smart, connected assets, making them a key component in smart factory initiatives globally.

Key Highlights:

- The CNC controller industry size was valued at USD 3180.5 million in 2023.

- The market is projected to grow at a CAGR of 5.30% from 2024 to 2031.

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 1075.8 million.

- The software segment garnered USD 1765.2 million in revenue in 2023.

- The 2-Axis segment is expected to reach USD 1308.6 million by 2031.

- The aerospace & defense segment secured the largest revenue share of 26.78% in 2023.

- North America is anticipated to grow at a CAGR of 5.78% over the forecast period.

Market Driver

"Expansion of the Automotive Industry"

The expansion of the CNC controller market is propelled by advancements in the automotive sector. Automakers rely on CNC systems for tasks such as engine component production, transmission assembly, and custom fabrication.

With the rise of electric vehicle manufacturing , there is an increasing need for precision machining of battery housing, drive systems, and complex chassis parts. This trend is accelerating the adoption of CNC controllers in both OEM and Tier 1 automotive production environments.

- According to the International Energy Agency’s 2024 report, nearly 14 million new electric cars were registered globally in 2023, bringing the total number of electric vehicles on the road to 40 million. This represents a year-over-year increase of 3.5 million units compared to 2022, representing 35% growth. Electric cars accounted for about 18% of all vehicles sold in 2023, up from 14% in the previous year.

Market Challenge

"High Cost of Advanced CNC Controllers"

A major challenge limiting the growth of the CNC controller market is the high cost of advanced systems, particularly multi-axis and high-speed controllers. These systems require significant investment in both hardware and integration, which can be a barrier for small and mid-sized manufacturers.

To address this challenge, key players are developing scalable controller platforms and offering modular upgrade options. Some are also introducing cost-efficient versions with essential features for entry-level applications.

Additionally, financing options and service-based models are allowing customers adopt advanced CNC technology without the full upfront cost, making it more accessible to businesses of various sizes.

Market Trend

"Development of Multi-Axis CNC Machines"

The emergence of advanced multi-axis CNC machines is reshaping production methods in high-value industries. These machines rely on sophisticated controllers capable of managing complex movements and toolpaths.

The rising demand for 5-axis and 7-axis systems is boosting the expansion of the CNC controller market. These controllers enable manufacturers to achieve faster cycle times and produce geometrically complex parts in a single setup, increasing overall efficiency.

- In January 2023, Hwacheon launched seven CNC machines, the Gantry System GR-5, and an optional “Harmony” CNC interface. The M1-5AX features high-speed spindles (20,000 / 32,000 rpm), a stable rotary table, and robot compatibility. The D3-5AX offers spindle options up to 24,000 rpm, uses an oil-jet lubrication system, and supports “Harmony” for streamlined control. Both models are designed for efficient machining in high-mix, low-volume production environments.

CNC Controller Market Report Snapshot

|

Segmentation

|

Details

|

|

By Component

|

Hardware, Software

|

|

By Axis Type

|

2-Axis, 3-Axis, 4-Axis, 5-axis, Multi-Axis

|

|

By End User

|

Automotive, Industrial, Power & Energy, Aerospace & Defense, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Component (Hardware and Software): The software segment earned USD 1765.2 million in 2023 due to its critical role in enabling complex programming, customization, and seamless integration with advanced manufacturing systems.

- By Axis Type (2-Axis, 3-Axis, 4-Axis, 5-axis, and Multi-Axis): The 2-axis segment held a share of 27.30% in 2023, fueled by its widespread use in basic machining operations, offering cost-effective and efficient solutions for high-volume production in industries such as automotive and metal fabrication.

- By End User (Automotive, Industrial, Power & Energy, Aerospace & Defense, and Others): The aerospace & defense segment is projected to reach USD 1283.0 million by 2031, propelled by its high demand for precision machining and complex multi-axis operations required in the production of critical, high-tolerance components.

CNC Controller Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific CNC controller market share stood at around 33.82% in 2023, valued at USD 1075.8 million. Asia Pacific is home to some of the world's most active manufacturing economies, where sectors such as automotive, electronics, and heavy machinery are expanding production capacity.

This surge is highlighting the need for reliable and high-speed CNC controller systems that can manage complex processes efficiently, fostering regional market growth.

- The International Energy Agency reported that in 2023, China accounted for nearly 60% of all new electric car registrations in China, with 8.1 million new electric cars registered, reflecting a 35% increase from 2022. Additionally, China became the world's largest auto exporter in 2023, exporting over 4 million cars, including 1.2 million electric vehicles (EVs). This represented a 65% overall increase in car exports, , with EV exports increasing by 80% compared to the previous year.

Moreover, Governments across Asia Pacific are funding initiatives to modernize factories with advanced technologies, including CNC automation. Programs promoting digital manufacturing, smart industrial zones, and Industry 4.0 adoption have led to higher investment in CNC controllers.

These systems are seen as a foundational technology for automating machining processes, making them a central component in state-supported modernization efforts.

North America CNC controller industry is set to grow at a CAGR of 5.78% over the forecast period. North America is heavily investing in automation and Industry 4.0 technologies to modernize manufacturing processes.

This shift toward smart factories is generating the demand for advanced CNC controllers that enable high-precision, automated machining. As industries strive to enhance efficiency, reduce errors, and lower production costs, CNC controllers have become essential in maintaining competitiveness.

Furthermore, North America is home to several precision engineering firms such as Parker Hannifin, Harris Machine Tool and Aerotech, Inc., that specialize in high-value, complex components. The growth of these firms, particularly in industries such as medical, defense, and high-tech electronics, is fueling regional market growth.

Regulatory Frameworks

- In the U.S., CNC controllers are regulated by OSHA standards, which ensure workplace safety during machinery operations. Additionally, the National Electrical Code (NEC) governs electrical components, while the EPA sets environmental guidelines for waste disposal and material handling in manufacturing. These regulations ensure safe and efficient operations in CNC machining.

- The EU regulates CNC controllers under the Machine Directive 2006/42/EC, focusing on machine safety, and the Electromagnetic Compatibility Directive (2014/30/EU), addressing electromagnetic interference. Additionally, RoHS (2011/65/EU) limits hazardous substances, and REACH (EC) No 1907/2006 governs chemical safety. These laws ensure the safe and environmentally responsible operation of CNC systems.

- China’s regulations on CNC controllers include the GB/T 15835-2002 Safety of Machinery standard, ensuring machine safety. The China RoHS regulation limits the use of hazardous substances, similar to EU standards. Environmental protection laws govern waste disposal and the safe handling of materials used in CNC machining, ensuring compliance with sustainability goals.

- Japan's JIS (Japanese Industrial Standards) dictate CNC machine quality and safety, ensuring precision and operational reliability. The Industrial Safety and Health Law ensures machine safety, while energy efficiency regulations reduce power consumption. These regulations focus on protecting workers and promoting sustainable, high-quality production methods in the CNC industry.

Competitive Landscape

Players in the CNC controller industry are increasingly adopting strategies such as the development of new products and technological advancements. By enhancing their offerings with advanced capabilities, such as improved motion control and integration with industrial equipment, companies are meeting the rising demand for more efficient, versatile, and precise manufacturing solutions.

These innovations enable manufacturers to optimize production processes, increase productivity, and stay competitive in the market.

- In March 2024, FANUC America Corporation introduced its new combined PLC/CNC motion controller, the Power Motion i-MODEL A Plus (PMi-A Plus), at MODEX 2024 in Atlanta. The PMi-A Plus is capable of controlling multiple industrial machines and running several programs independently and simultaneously. It supports up to 32 control axes, grouped into 10 independent control paths, with each path handling up to 24 axes and four axes of simultaneous motion. Its advanced features allow for flexible motion control using position, speed, torque, and pressure feedback.

List of Key Companies in CNC Controller Market:

- FANUC America Corporation

- Siemens

- Mitsubishi Electric Corporation

- Bosch

- Heidenhain GmbH

- Fagor Automation

- Delta Electronics, Inc.

- Okuma Corporation

- GSK CNC Equipment Co., Ltd.

- Yaskawa Electric Corporation

- SYNTEC Technology Co., Ltd.

- Beckhoff Automation GmbH & Co. KG

- Kollmorgen Corporation

- Parker Hannifin

- Centroid CNC

Recent Developments (Launch)

- In August 2024, FANUC introduced its latest range of robots, cobots, factory automation solutions, and machining offerings at the International Manufacturing Technology Show (IMTS) 2024. The company unveiled the all-new R-50iA Controller, designed to enhance performance and user experience while providing improved cybersecurity. Additionally, FANUC America showcased the FANUC Series 500i-A CNC to North American audiences, a new control series that boosts machining performance with integrated 5-axis technology and faster processing speeds.