Market Definition

The market comprises financial operations methodologies designed to optimize cloud spending while maintaining performance and innovation. It integrates finance, engineering, and business teams to establish cost accountability, streamline budgeting, and enhance resource allocation.

Cloud FinOps involves continuous monitoring, forecasting, and real-time analytics to track cloud usage and expenses effectively. Organizations implement FinOps frameworks to formulate cost optimization strategies, such as rightsizing resources, leveraging reserved instances, and automating cost controls.

Its applications extend across industries leveraging cloud services, including SaaS providers, financial institutions, and enterprises managing multi-cloud environments, ensuring cost efficiency and alignment with business objectives.

Cloud FinOps Market Overview

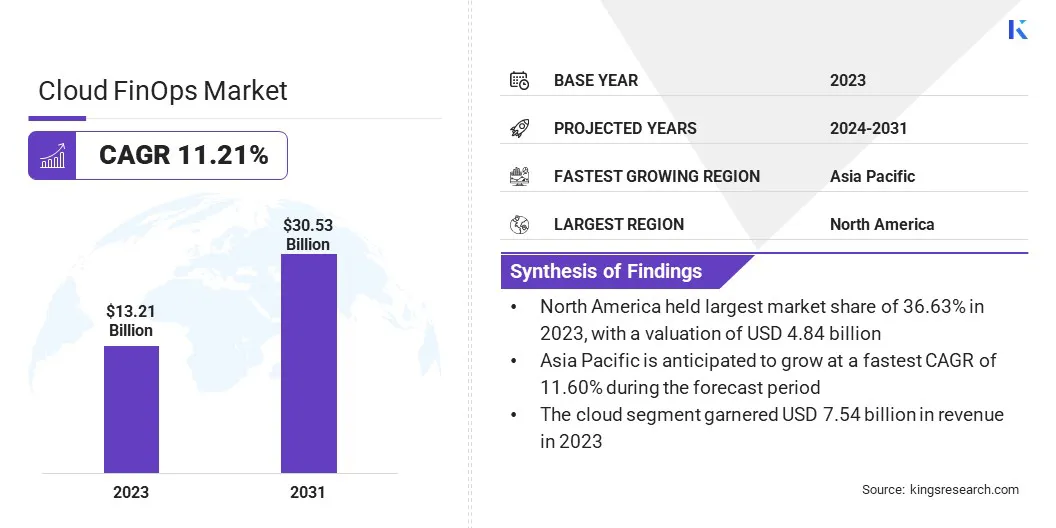

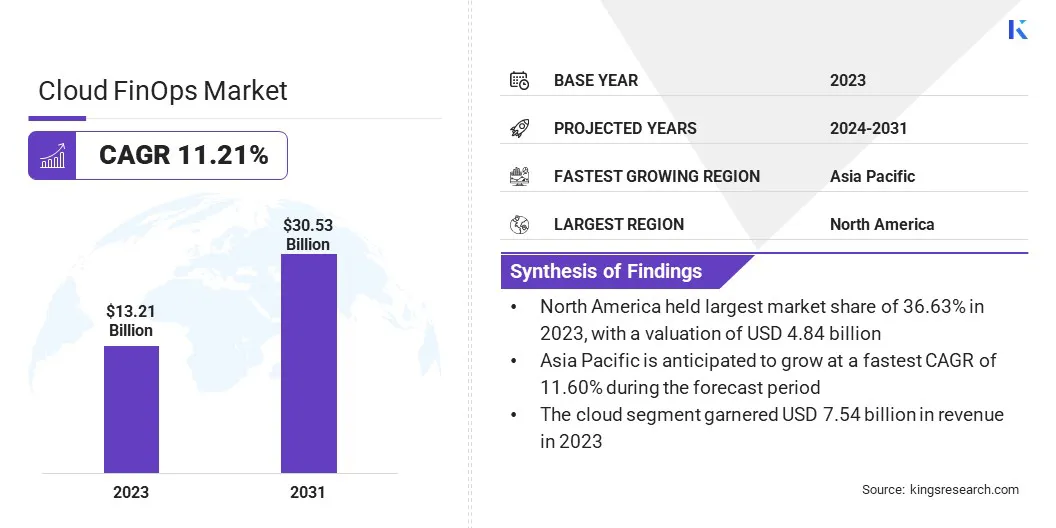

The global cloud FinOps market size was valued at USD 13.21 billion in 2023 and is projected to grow from USD 14.51 billion in 2024 to USD 30.53 billion by 2031, exhibiting a CAGR of 11.21% during the forecast period.

Market growth is fueled by the increasing complexity of multi-cloud environments, highlighting the need for advanced cost optimization and financial governance solutions. Organizations are adopting AI-driven analytics to enhance real-time visibility into cloud spending, improving cost efficiency.

Additionally, rising cloud adoption across industries, coupled with stricter financial accountability requirements, is accelerating the demand for automated FinOps platforms to streamline cloud cost management and operational control.

Major companies operating in the cloud FinOps industry are Finout, nOps, CloudCheckr, Lucidity.cloud, Flexera, IBM, CloudZero Inc., Anodot, Cloudability, Yotascale, Cast.AI, ProsperOps, Usage.AI, Datadog, Kubecost, and others.

Rising adoption of cloud computing has led to increased need for financial accountability and cost efficiency. The market is expanding as organizations seek solutions that provide real-time cost tracking, intelligent budgeting, and automated cost-saving recommendations.

Uncontrolled cloud spending impacts profitability, making structured financial operations essential for maintaining budget discipline. FinOps frameworks enable businesses to rightsize cloud instances, negotiate pricing with providers, and eliminate redundant resources.

Cost transparency across departments allows enterprises to allocate budgets effectively, preventing unexpected cloud expenses. By integrating FinOps practices, companies strenghthen financial governance and maximize cloud investment returns.

Key Highlights:

- The cloud FinOps industry size was recorded at USD 13.21 billion in 2023.

- The market is projected to grow at a CAGR of 11.21% from 2024 to 2031.

- North America held a share of 36.63% in 2023, valuation of USD 4.84 billion.

- The cost management segment garnered USD 5.25 billion in revenue in 2023.

- The cloud segment is expected to reach USD 17.06 billion by 2031.

- The large enterprises segment secured the largest revenue share of 57.33% in 2023.

- The banking, financial services, and insurance (BFSI) segment is set to grow at a robust CAGR of 12.10% through the forecast.

- Asia Pacific is anticipated to grow at a CAGR of 11.60% through the projection period.

Market Driver

Surge in Cloud-Based SaaS and PaaS Adoption

Growing reliance on cloud-based Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) solutions has led to complex cost structures, boosting demand for cloud FinOps solutions. Organizations seek granular cost visibility and automated budget controls.

SaaS providers leverage FinOps frameworks to track per-customer usage, allocate cloud resources efficiently, and manage pricing strategies. Businesses using PaaS services require cost optimization tools to prevent unnecessary spending while maintaining infrastructure scalability.

Real-time financial monitoring enables enterprises to align cloud expenses with revenue streams, supporting sustainable growth. The adoption of FinOps enhances cost predictability, strengthening financial management in cloud-driven business models.

- In November 2024, Anodot partnered with OpenOps, a no-code FinOps automation company. This collaboration allows Anodot’s FinOps platform to seamlessly integrate with over 100 tools and platforms through OpenOps’ no-code automation framework. By integrating no-code automation with Anodot’s FinOps platform, OpenOps enhances its adaptability and flexibility while leveraging Anodot’s granular data insights and cost optimization recommendations. This partnership simplifies and streamlines cloud cost management, providing businesses with more efficient financial operations.

Market Challenge

Complexity in Multi-Cloud Cost Management

Managing cloud costs across multiple providers presents a significant challenge to the development of the cloud FinOps market, as organizations struggle with inconsistent pricing models, dynamic resource allocation, and billing complexities. The lack of standardized cost structures makes it difficult to track, forecast, and optimize cloud spending efficiently.

To overcome this challenge, companies are adopting AI-driven analytics and automation to enhance cost visibility and streamline financial operations. FinOps platforms are integrating machine learning to predict usage patterns and recommend cost-saving measures.

Additionally, businesses are leveraging unified dashboards that consolidate multi-cloud expenses, enabling better decision-making and improved financial accountability in cloud environments.

Market Trend

Increased Adoption of AI-Driven Cost Management Tools

Artificial intelligence and machine learning are transforming financial operations by enabling predictive analytics, anomaly detection, and automated cost optimization. The growth of the cloud FinOps market is propelled by AI-powered solutions that proactively identify inefficiencies and recommend cost-saving measures.

Businesses leverage machine learning algorithms to detect usage patterns, optimize resource allocation, and forecast future cloud expenses. Automated workflows enhance financial decision-making by eliminating manual processes and reducing human errors.

AI-driven FinOps tools provide actionable insights, allowing enterprises to maintain cost efficiency while supporting dynamic cloud workloads. Advanced analytics empowers organizations to align cloud spending with business objectives.

- In August 2024, nOps, a leading AWS cost optimization platform, secured USD30 million Series A funding round, led by Headlight Partners. Unlike point solutions, nOps’ comprehensive platform provides FinOps, DevOps, Engineering, and Finance teams with full transparency into AWS costs. Leveraging artificial intelligence (AI) and machine learning (ML), the platform analyzes computing requirements and automatically optimizes them for efficiency, reliability, and cost-effectiveness.

Cloud FinOps Market Report Snapshot

|

Segmentation

|

Details

|

|

By Offering

|

Cost Management, Resource Optimization, Performance Management, Compliance Management

|

|

By Deployment Model

|

Cloud, On-Premises

|

|

By Organization Size

|

Large Enterprises, Small and Medium-Sized Enterprises (SMEs)

|

|

By End Use Industry

|

Banking, Financial Services, and Insurance (BFSI), IT & Telecom, Healthcare, Retail, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Offering (Cost Management, Resource Optimization, Performance Management, and Compliance Management): The cost management segment earned USD 5.25 billion in 2023, fueled by the rising demand for real-time cloud expense tracking, automated cost allocation, and AI-driven optimization. Organizations are priortizing these solutions to enhance financial accountability, reduce overspending, and improve budget forecasting in complex multi-cloud environments.

- By Deployment Model (Cloud and On-Premises): The cloud segment held a share of 57.11% of the market in 2023, as enterprises increasingly rely on fully managed, scalable, and AI-driven cost optimization solutions that provide real-time visibility, automated governance, and seamless integration across multi-cloud environments, eabling more efficient financial management and resource allocation.

- By Organization Size (Large Enterprises and Small and Medium-Sized Enterprises (SMEs)): The Large Enterprises segment is projected to reach USD 16.64 billion by 2031, owing to the high complexity of managing multi-cloud expenses at scale, requiring advanced AI-driven cost optimization solutions to enhance financial visibility, automate resource allocation, and ensure compliance with stringent governance policies.

- By End Use Industry (Banking, Financial Services, and Insurance (BFSI), IT & Telecom, Healthcare, and Retail): The BFSI segment is set to grow at a CAGR of 12.10% through the forecast period, largely attributed to its reliance on scalable cloud infrastructure, stringent regulatory compliance requirements, and the need for real-time cost optimization to manage complex financial transactions and large-scale data processing efficiently.

Cloud FinOps Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America cloud FinOps market share stood at around 36.63% in 2023, valued at USD 4.84 billion. This dominance is reinforced by the substantial cloud spending, fueled by enterprise-scale digital transformation and the rapid adoption of cloud-native architectures.

Large corporations, tech giants, and digital-first businesses allocate significant budgets to cloud infrastructure, requiring FinOps solutions to manage and optimize costs effectively. The presence of cloud-heavy industries, including software-as-a-service (SaaS), e-commerce, and media streaming, contributes to the region’s leadership in cloud cost optimization.

With increasing cloud expenditures, companies are prioritizing structured FinOps practices to maximize financial efficiency and prevent uncontrolled cloud cost escalations.

Additionally, North America enforces strict financial and regulatory standards that influence cloud cost management, leading to the widespread adoption of FinOps frameworks.

Public companies must comply with financial regulations such as the Sarbanes-Oxley Act (SOX), Financial Accounting Standards Board (FASB) regulations, and Generally Accepted Accounting Principles (GAAP), requiring structured cloud financial governance.

Enterprises implement FinOps strategies to maintain financial transparency, track cloud expenses, and ensure regulatory compliance. The need for accurate financial reporting and governance in cloud spending positions North America at the forefront of Cloud FinOps adoption.

Asia Pacific cloud FinOps industry is set to grow at a robust CAGR of 11.60% over the forecast period. This growth is stimualted by aggressive digital transformation across China, India, Japan, and Southeast Asia. Governments and enterprises are investing heavily in cloud adoption to strengthen digital economies.

Initiatives such as India’s Digital India, China’s New Infrastructure Plan, and Japan’s Society 5.0 are accelerating cloud infrastructure expansion. In response, the demand for structured FinOps frameworks is rising to optimize cloud costs and resource allocation for large-scale digital projects.

Furthermore, there is a widespread adoption of public cloud services in the region, with enterprises and SMEs migrating workloads to platforms such as AWS, Microsoft Azure, Alibaba Cloud, and Google Cloud. As businesses increasingly rely on cloud-native solutions for operational efficiency, rising cloud expenditures necessitate robust FinOps solutions to optimize costs and prevent overspending.

The growth of e-commerce, fintech, and digital banking sectors in countries such as India, Indonesia, and Vietnam further fuels the demand for FinOps platforms to manage complex multi-cloud environments.

Regulatory Frameworks

- The United States enforces regulations impacting the Cloud FinOps market through agencies such as the Federal Financial Institutions Examination Council (FFIEC) and Federal Trade Commission (FTC). Financial institutions must comply with FFIEC outsourcing guidelines, while cloud providers handling sensitive data must meet HIPAA and sector-specific regulations. State-specific data privacy laws further influence cloud cost management strategies.

- The General Data Protection Regulation (GDPR) governs data security and privacy across the EU, affecting cloud cost management solutions. Additionally, the Digital Operational Resilience Act (DORA) mandates ICT risk management for financial institutions, ensuring compliance and operational resilience in cloud-based financial operations.

- China’s Cybersecurity Law and Data Security Law impose stringent data localization mandates, requiring cloud providers to store and process critical data domestically. These laws necessitate local infrastructure for international FinOps providers, shaping cost optimization strategies in China’s cloud market.

- Japan’s Act on the Protection of Personal Information (APPI) establishes strict data handling regulations for cloud-based financial operations. The Cybersecurity Management Guidelines promote risk assessment and compliance frameworks for businesses leveraging cloud cost management solutions. These regulations boost demand for secure and transparent cloud FinOps solutions tailored to Japan’s financial sector.

Competitive Landscape

The cloud FinOps industry is characterized by several market players that are actively adopting strategies such as the development of AI-driven cloud systems and funding initiatives to strengthen their market presence. AI-powered cloud solutions enable real-time cost analysis, improve financial visibility, and optimize cloud spending in real time.

Companies are also securing significant funding to accelerate product innovation, expand their customer base, and enhance platform capabilities. These initiatives address the increasing demand for intelligent cloud cost management solutions, enabling businesses to gain deeper insights, improve financial accountability, and enhance operational efficiency.

- In December 2024, CloudZero introduced CloudZero Intelligence, an AI-driven system powering CloudZero Advisor, a free tool for optimizing cloud infrastructure costs through conversational AI. Utilizing advanced AI technology from Anthropic and AWS, CloudZero Intelligence taps into CloudZero’s vast dataset to deliver actionable insights for addressing complex cloud efficiency challenges.

List of Key Companies in Cloud FinOps Market:

- Finout

- nOps

- CloudCheckr

- cloud

- Flexera

- IBM

- CloudZero Inc.

- Anodot

- Cloudability

- Yotascale

- ProsperOps

- Datadog

- Kubecos

Recent Developments (M&A/Agreements)

- In March 2025, Flexera acquired Spot from NetApp, a leading intelligent data infrastructure company. This acquisition reinforces Flexera’s commitment to delivering comprehensive solutions for managing increasing cloud cost and usage, propelled by increased AI adoption.

- In February 2025, Lucidity secured a USD 21 million Series A investment led by WestBridge Capital, with participation from existing investor Alpha Wave. The funding will support the expansion of Lucidity’s go-to-market team and enhance its platform to address critical storage management challenges for enterprises globally.