Market Definition

The market encompasses digital solutions used by chemical manufacturers and researchers to optimize processes, ensure regulatory compliance, manage data, and support innovation across product development and production cycles.

It includes platforms for simulation, modeling, process design, lab data management, and enterprise resource planning, serving industries such as specialty chemicals, petrochemicals, agrochemicals, and pharmaceuticals. The report offers a thorough assessment of the main factors driving the market, along with detailed regional analysis and the competitive landscape influencing market dynamics.

Chemical Software Market Overview

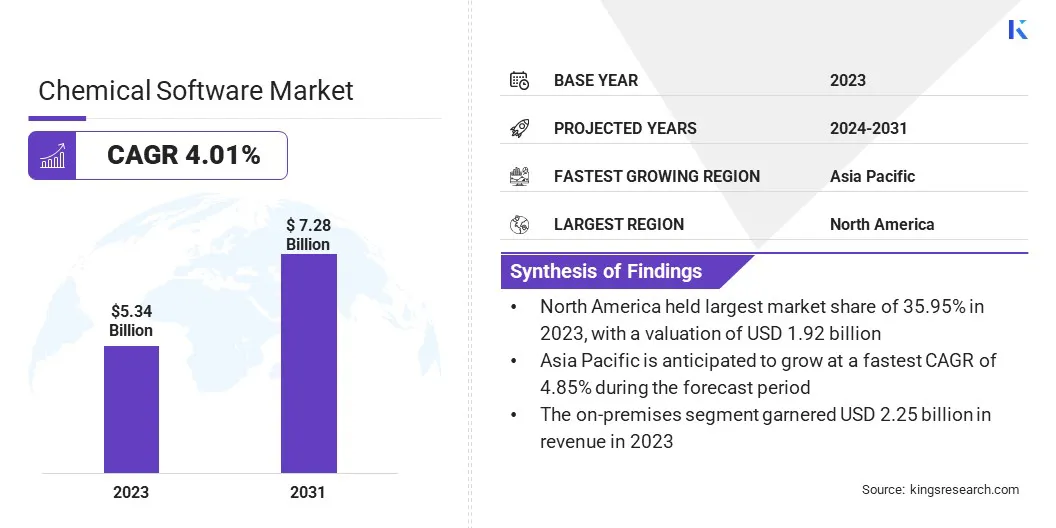

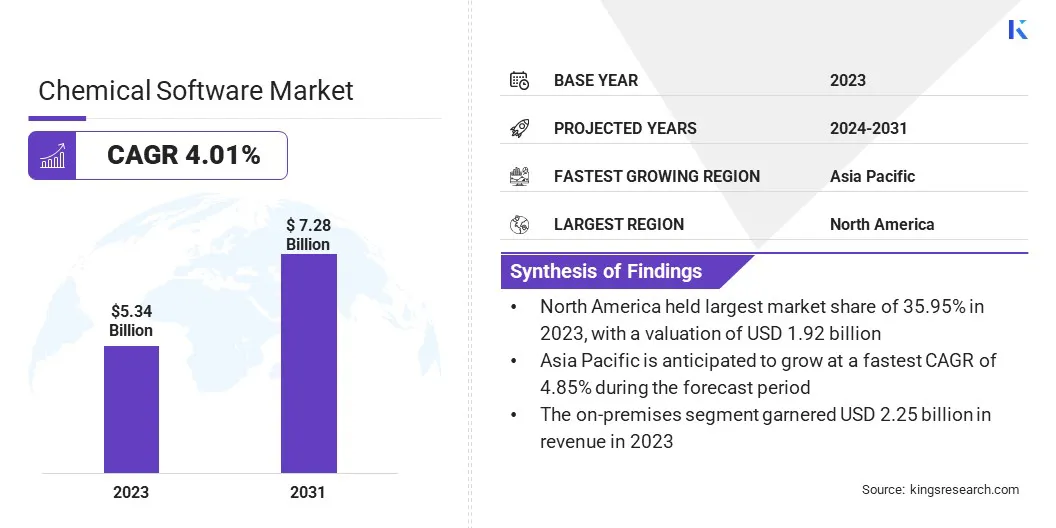

The global chemical software market size was valued at USD 5.34 billion in 2023 and is projected to grow from USD 5.53 billion in 2024 to USD 7.28 billion by 2031, exhibiting a CAGR of 4.01% during the forecast period.

The market is registering steady growth driven by the increasing need for digital transformation across the chemical industry. Key factors driving growth include the need for better automation and data analysis to increase efficiency. Furthermore, the demand for software that helps companies meet regulations and manage product development more effectively is growing.

Major companies operating in the chemical software industry are Kohezion, Absolute ERP, SAP SE, Oracle, Epicor Software Corporation, Infor, BatchMaster Software, Focus Softnet Pvt Ltd, CLOUD SDS MANAGEMENT, LabWare, FindMolecule, SafetyCulture, UL LLC, Capterra Inc., and Collaborative Drug Discovery, Inc.

The shift toward sustainable production, along with the use of cloud-based solutions, is helping companies innovate faster, which is boosting the market. Additionally, software that supports modeling and simulation is becoming more popular for speeding up product development.

- In December 2023, Enamine and BioSolveIT formed an exclusive partnership to create the world's most comprehensive chemical space exploration platform. The alliance aims to revolutionize drug discovery by combining Enamine's expertise in chemical synthesis and BioSolveIT’s advanced software solutions for ligand and structure-based exploration, enabling faster and more cost-effective discovery of novel chemical entities.

Key Highlights

- The chemical software market size was valued at USD 5.34 billion in 2023.

- The market is projected to grow at a CAGR of 4.01% from 2024 to 2031.

- North America held a market share of 35.95% in 2023, with a valuation of USD 1.92 billion.

- The simulation software segment garnered USD 1.90 billion in revenue in 2023.

- The on-premises segment is expected to reach USD 3.04 billion by 2031.

- The pharmaceutical companies segment is expected to reach USD 2.59 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 4.85% during the forecast period.

Market Driver

Growing Demand for Green Chemistry and Sustainable Manufacturing

The market is expanding, due to the rising demand for green chemistry and sustainable manufacturing practices. Industries are facing the pressure to reduce their environmental impact, compelling them to adopt chemical processes that are safer, more resource-efficient, and eco-friendly.

Green chemistry focuses on minimizing waste, avoiding harmful chemicals, and optimizing energy and resource use. This shift toward sustainability is driving the demand for software that supports these goals, enabling chemical manufacturers to optimize their processes in ways that are both environmentally responsible and cost-effective.

Leveraging these solutions can help companies make significant strides in reducing their ecological footprint while improving their overall business performance.

- In October 2024, Together for Sustainability (TfS) launched its Product Carbon Footprint (PCF) Exchange solution, powered by Siemens’ SiGREEN technology. The solution focused on enhancing transparency, collaboration, and efficiency in tracking and exchanging emissions data across global chemical supply chains to support decarbonisation efforts.

Market Challenge

High Costs of Software Implementation and Maintenance

A major challenge in the chemical software market is the high cost of adopting and maintaining new software. The upfront investment required to purchase and implement advanced software can be prohibitive for many chemical companies, particularly smaller ones. In addition to the initial costs, these systems require ongoing updates, customization, and staff training, which contribute to continuous expenses.

This financial burden can make it difficult for companies to stay updated with evolving technologies, potentially hindering their ability to improve processes and maintain competitiveness. A viable solution is the introduction of more affordable pricing models, such as subscription-based services, which allow companies to pay overtime rather than make a large upfront investment.

Cloud-based software presents another cost-effective option, as it removes the need for expensive on-premise hardware and allows companies to scale their software needs as their operations grow.

Market Trend

Use of Advanced Process Control (APC) and Machine Learning (ML)

The market is registering growth, due to the increasing use of APC and ML technologies in chemical manufacturing. APC allows companies to better control and optimize their production processes in real time, leading to smoother and more efficient operations.

When combined with ML, these technologies can analyze vast amounts of data to predict potential issues, identify areas for improvement, and support better decision-making.

This integration helps companies reduce costs, enhance resource management, and make their operations more sustainable. APC and ML are proving essential in streamlining operations and reducing environmental impacts as the industry continues to prioritize efficiency and sustainability.

- In March 2025, Valmet Oyj introduced the Valmet High Yield Pulping Optimizer, the world’s first advanced process control for optimizing high-yield pulping. The solution focused on enhancing cooking and refining processes to maximize pulp yield, reduce wood consumption, and improve sustainability in chemical brown pulp production.

Chemical Software Market Report Snapshot

|

Segmentation

|

Details

|

|

By Solution

|

Simulation Software, Data Management Software, Process Design Software, Molecular Modeling Software

|

|

By Deployment

|

On-premises, Cloud-based

|

|

By End User

|

Chemical Manufacturers, Pharmaceutical Companies, Academic Institutions, Research Organizations

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Solution (Simulation Software, Data Management Software, Process Design Software, Molecular Modeling Software): The simulation software segment earned USD 1.90 billion in 2023, due to its widespread use in improving process efficiency and reducing operational costs in chemical production.

- By Deployment (On-premises, Cloud-based): The on-premises segment held 42.17% share of the market in 2023, due to the preference of certain industries for secure, locally controlled systems over cloud-based solutions.

- By End User (Chemical Manufacturers, Pharmaceutical Companies, Academic Institutions, Research Organizations): The pharmaceutical companies segment is projected to reach USD 2.59 billion by 2031, owing to the increasing demand for software solutions that support drug development and regulatory compliance.

Chemical Software Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 35.95% share of the chemical software market in 2023, with a valuation of USD 1.92 billion. This dominance is primarily driven by the presence of a well-established chemical manufacturing sector, particularly in the U.S., which heavily invests in digital transformation to improve R&D productivity and process optimization.

Major software providers are also headquartered in this region, enabling easier access to advanced technologies and fostering strong industry collaborations. The region’s focus on high-value specialty chemicals and its adoption of advanced simulation and modeling tools have further contributed to its leading position.

The chemical software industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 4.85% over the forecast period. This growth is fueled by rapid industrialization in countries such as China, India, and South Korea, where chemical and pharmaceutical industries are expanding production capacities and increasing investments in modernizing operations.

Additionally, the rising number of research institutions and partnerships between academia and industry is creating the demand for molecular modeling and data management software. The region’s growing emphasis on digital infrastructure and skilled technical workforce is further accelerating software adoption across diverse end-use sectors.

Regulatory Frameworks

- In the U.S., chemical regulatory compliance is managed by multiple federal agencies, most notably the Environmental Protection Agency (EPA). The Occupational Safety and Health Administration (OSHA) also plays a crucial role, along with the Food and Drug Administration (FDA) and the Consumer Product Safety Commission (CPSC). These agencies oversee various aspects of chemical safety, including production, distribution, use, and disposal.

- In Europe, the European Chemicals Agency (ECHA) is the primary regulatory authority for chemical substances, particularly concerning the REACH regulation. The ECHA manages the technical and administrative aspects of REACH, which ensures the safe use of chemicals.

Competitive Landscape

The chemical software market is characterized by continuous innovation, strategic collaborations, and a strong emphasis on product differentiation. Key players in the market are actively investing in Research and Development (R&D) to enhance the capabilities of their platforms, particularly in areas such as process simulation, molecular modeling, and predictive analytics.

Many companies are expanding their portfolios through the integration of AI and ML features to provide deeper insights and improved user experiences. Companies are increasingly focusing on cloud-based and modular solutions to provide greater scalability and flexibility, enabling them to effectively serve both large enterprises and smaller organizations.

Furthermore, strategic partnerships with chemical manufacturers, research institutions, and technology providers are commonly employed to tailor solutions to specific industry needs and accelerate adoption. Mergers and acquisitions are also used to gain access to niche technologies and broaden global reach.

- In April 2025, Enamine and ChemPass formed a strategic collaboration to accelerate hit discovery using AI-assisted and computational software tools. The partnership leverages ChemPass’s Universal Fragment Library Design Platform to generate target-specific fragment libraries, while Enamine supports screening, hit expansion, and Structure-Activity Relationship (SAR) development using its REAL Space and medicinal chemistry expertise.

List of Key Companies in Chemical Software Market:

- Kohezion

- Absolute ERP

- SAP SE

- Oracle

- Epicor Software Corporation

- Infor

- BatchMaster Software

- Focus Softnet Pvt Ltd

- CLOUD SDS MANAGEMENT

- LabWare

- FindMolecule

- SafetyCulture

- UL LLC

- Capterra Inc.

- Collaborative Drug Discovery, Inc.

Recent Developments (Acquisitions/Collaborations/ Software Launches)

- In April 2025, Recursion and Enamine formed a collaboration to generate AI-enabled targeted compound libraries. The partnership combines Recursion's AI/ML-driven drug discovery platform, Recursion OS, with Enamine's REAL Space chemical library to curate 10 enriched screening libraries designed to accelerate drug discovery against difficult biological targets. The collaboration aims to enhance the drug discovery toolset by predicting small molecule compatibility with protein targets.

- In January 2025, VelocityEHS launched enhancements to its Accelerate Platform, a unified EHS solution designed to streamline safety, chemical management, industrial ergonomics, and operational risk processes. The platform combines best-in-class EHS solutions, leveraging ML and AI to deliver actionable insights and improve workplace safety and risk management.

- In October 2024, Certara, Inc. completed the acquisition of Chemaxon. The acquisition combines Certara’s advanced modeling and biosimulation solutions with Chemaxon’s scientific informatics software, providing life sciences companies with enhanced tools for in-silico research, drug discovery, and development. The integration aims to improve prediction accuracy, streamline scientific decision-making, and accelerate innovation, particularly in precision medicine.

- In March 2024, Revvity Signals Software introduced its new Signals ChemDraw offering, a cloud-native chemistry communication platform designed to enhance research productivity and collaboration across the chemical, pharmaceutical, biotechnology, and academic sectors. Integrated within the Revvity Signals Research platform, the suite enables advanced chemical drawing, data management, and interdisciplinary cooperation, supporting the development of novel therapeutics, specialty chemicals, and sustainable materials.

For many chemical companies, particularly smaller ones,