Chemical Distribution Market Size

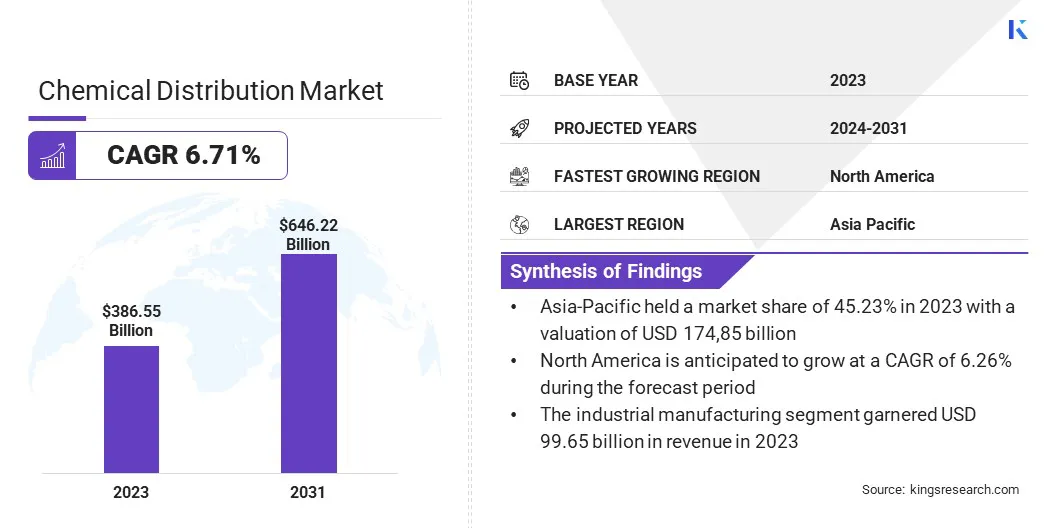

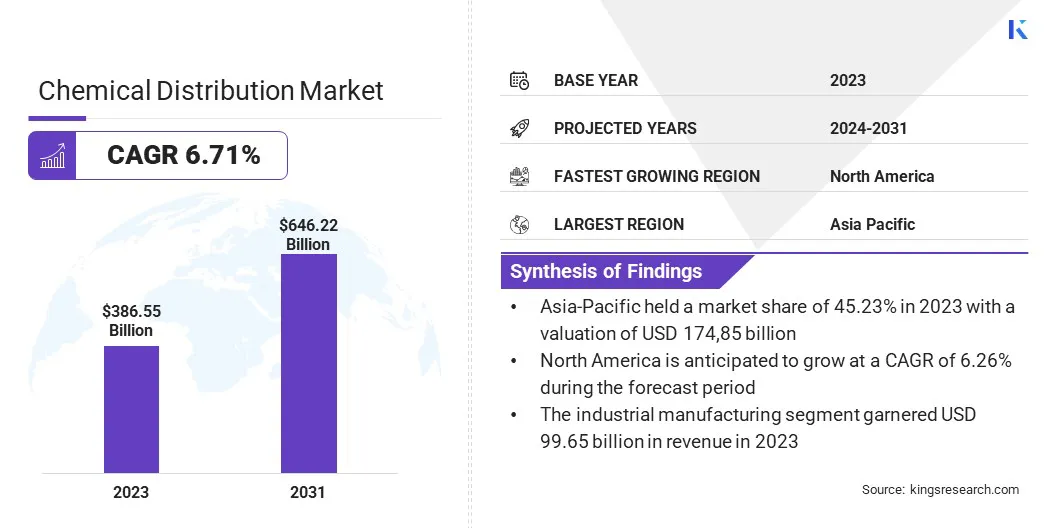

The global Chemical Distribution Market size was valued at USD 386.55 billion in 2023 and is projected to grow from USD 410.13 billion in 2024 to USD 646.22 billion by 2031, exhibiting a CAGR of 6.71% during the forecast period. The market is witnessing robust growth, driven by the increasing demand for advanced chemical solutions across various sectors.

Innovations in chemical formulations and the rise of specialized applications are reshaping the market landscape. Additionally, the market is undergoing transformations due to regulatory changes and the inclination toward environmentally friendly products, compelling distributors to adapt and offer solutions that meet evolving industry standards and consumer preferences.

In the scope of work, the report includes solutions offered by companies such as Helm AG, Univar Inc., Omya AG, Jebsen& Jessen Offshore Pte. Ltd., TER Group, Azelis Holding S.A., Solvadis, Ashland, Inc., Brenntag AG, ICC Chemical Corporation, and others.

The chemical distribution market is evolving rapidly, propelled by increasing demand for specialty chemicals across various sectors, including pharmaceuticals, agriculture, and automotive. As industries increasingly seek tailored and high-performance chemical solutions, the market is evolving to meet these needs.

Key trends include the growing adoption of digital tools and automation technologies, which significantly enhance supply chain efficiency and streamline operational processes. These advancements are enabling distributors to manage inventories more effectively, reduce costs, and improve customer service. Additionally, the focus on sustainability and eco-friendly products is shaping market dynamics, as companies strive to align with regulatory requirements and evolving consumer preferences.

- For instance, in November 2023, Insecticides (India) Limited, unveiled four new products: Nakshatra, Supremo SP, Opaque, and Million. These products were developed to provide robust protection against weeds, pests, and specifically the Phalaris minor weed impacting wheat crops. The launch was intended to support farmers and promote sustainability within the agricultural industry.

Chemical distribution refers to the process of sourcing, handling, and delivering chemicals and related products from manufacturers to end-users across various industries. This includes a range of activities such as storage, transportation, and logistics, as well as providing value-added services including packaging, blending, and technical support.

Chemical distributors act as intermediaries, ensuring that chemicals are delivered efficiently and safely while meeting regulatory requirements and industry standards. They play a crucial role in connecting producers with businesses that require chemicals for manufacturing, processing, or other applications.

Analyst’s Review

Rising innovation and strategic acquisitions by key players are propelling the growth of the market.

- For instance, in October 2023, Perstorp introduced Rashinban, a new grade of 2-Ethylhexanol (2-EH) with a 100% renewable, traceable mass-balanced carbon content. This innovative product, designed to protect chili crops during the flowering stage, represents a global milestone in both sustainability and functionality.

- Additionally, in June 2023, IMCD acquired 100% of the shares of Brylchem Pte Ltd, a specialty distributor, to bolster its presence in Southeast Asia. This acquisition aims to enhance IMCD's regional capabilities and market reach.

The introduction of innovative products such as Perstorp's Rashinban and strategic acquisitions such as IMCD's purchase of Brylchem Pte Ltd are expected to boost market growth. These advancements enhance product offerings and expand regional reach, thereby stimulating increased demand and creating new opportunities in the chemical distribution market.

Chemical Distribution Market Growth Factors

The development of the chemical distribution market is bolstered by the increasing demand for specialty chemicals across diverse industries, including pharmaceuticals, agriculture, and automotive. In the pharmaceutical sector, specialty chemicals are crucial for developing advanced drug formulations and ensuring high-quality manufacturing processes. The agriculture industry relies heavily on specialty chemicals to provide innovative solutions for crop protection and yield enhancement.

In automotive manufacturing, these chemicals are essential for producing high-performance materials and coatings. As these industries evolve and require more sophisticated chemical solutions, the demand for specialized products and distribution services grows, aiding the expansion of the market.

The market faces challenges such as the need for regulatory compliance and the rising costs of raw materials. Stringent regulations necessitate extensive documentation and strict adherence, which increases operational complexity and costs.

Additionally, fluctuating raw material prices impact profit margins and disrupt supply chains. To address these issues, key players are investing heavily in regulatory expertise and adopting advanced technologies to streamline compliance processes. They are further focusing on strategic sourcing and long-term supplier relationships to stabilize raw material costs and ensure a reliable supply chain.

Chemical Distribution Market Trends

The market is witnessing a notable trend toward increasing interest in specialty chemicals, supported by their critical applications across various sectors. Industries such as pharmaceuticals, agriculture, and automotive are increasingly relying on specialty chemicals to achieve higher performance standards and address specific needs. In pharmaceuticals, these chemicals are vital for the development of advanced drugs and formulations.

In agriculture, they play a crucial role in enhancing crop protection and productivity. The automotive industry uses specialty chemicals for the development of high-performance materials and coatings. This rising demand reflects a broader trend towards innovation and customization in chemical applications, thereby fueling the growth of the market.

The increased adoption of digital tools and automation technologies is augmenting the progress of the chemical distribution market by enhancing operational efficiency and improving service quality. Digital platforms are enabling more precise inventory management and demand forecasting, thereby reducing stockouts and overstock situations and optimizing supply chain operations.

Automation technologies are streamlining processes such as warehousing and logistics, thus minimizing manual errors and operational costs. These advancements are facilitating real-time tracking and communication, leading to faster and more accurate order fulfillment, thereby aiding market growth.

Segmentation Analysis

The global market is segmented based on application, type, and geography.

By Application

Based on application, the chemical distribution market is categorized into automotive & transport, construction, agriculture, consumer goods, textiles, pharmaceuticals, industrial manufacturing, and others. The industrial manufacturing segment garnered the highest revenue of USD 99.65 billion in 2023, owing to its extensive reliance on chemicals for various applications, including production processes, material handling, and product formulation.

The sector's continuous evolution and the increasing demand for advanced manufacturing solutions necessitate the use of specialized chemicals and the development of efficient distribution channels. Innovations in industrial manufacturing, such as automation and sustainable practices, have increased the demand for high-performance and environmentally friendly chemical products.

As manufacturers seek to enhance operational efficiency and product quality, the need for chemical distribution is growing. This expansion reflects broader industry trends and underscores the critical role of chemical distributors in supporting industrial advancements.

By Type

Based on type, the market is categorized into specialty chemicals and commodity chemicals. The commodity chemicals segment captured the largest chemical distribution market share of 58.77% in 2023. The high demand for essential chemicals like ethylene, propylene, and chlorine necessitates extensive production and distribution activities.

Innovations in production technologies enhance both efficiency and sustainability, while global supply chains facilitate widespread distribution. Regulatory pressures and growing consumer preferences for eco-friendly solutions are shaping market dynamics. As economies expand and industries evolve, the demand for commodity chemicals. This trend highlights its crucial role in supporting diverse industrial applications.

Chemical Distribution Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

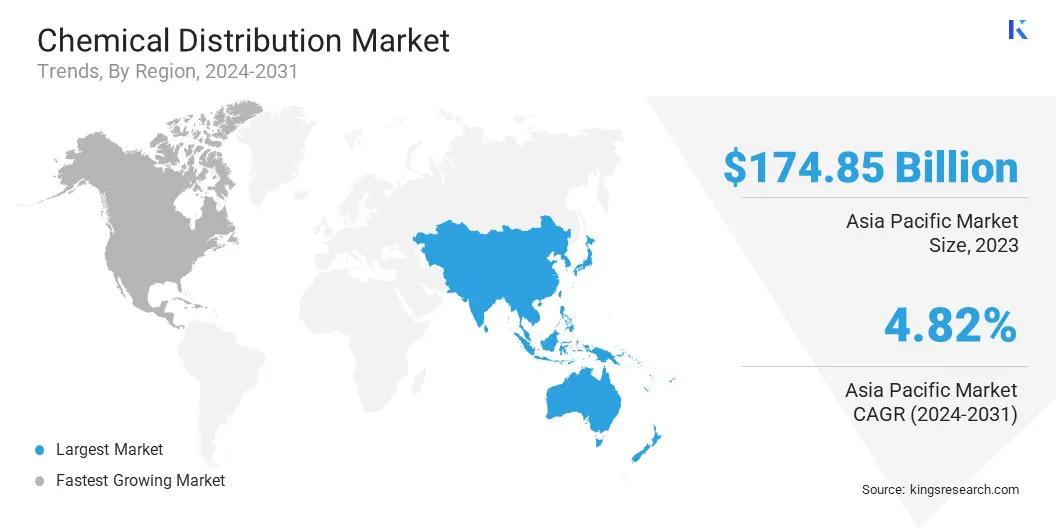

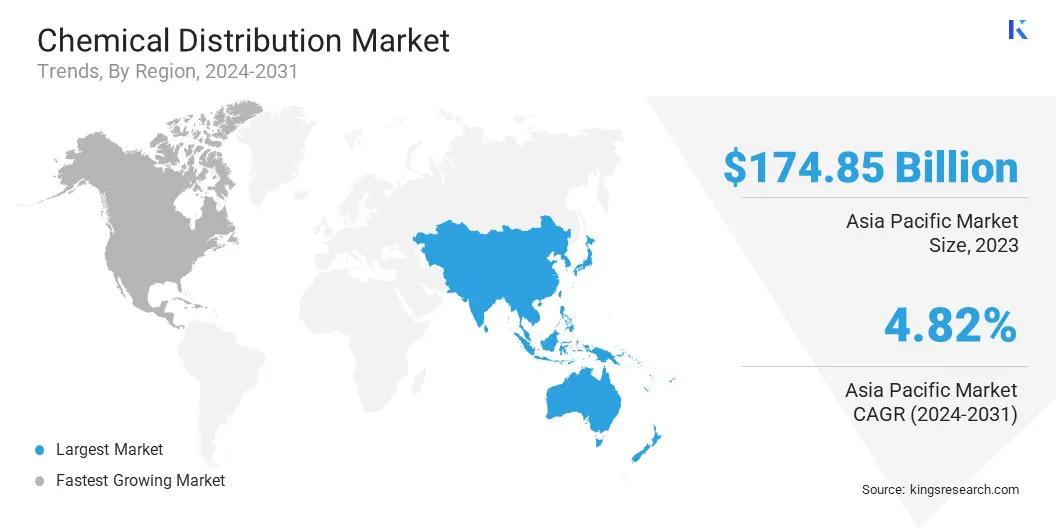

Asia-Pacific chemical distribution market share stood around 45.23% in 2023 in the global market, with a valuation of USD 174.85 billion. This notable expansion is attributed to the increasing demand from diverse industries, including automotive, pharmaceuticals, mining, cosmetics, and plastic additives. The region's rapid industrialization is creating lucrative opportunities for market participants.

- Notably, in November 2023, Godrej Agrovet Limited launched Rashinban in India, an advanced pest control product specifically designed to protect chili crops during the flowering stage.

- Additionally, in June 2023, Brenntag completed the acquisition of Shanghai Saifu Chemical Development Co., Ltd. in China, significantly expanding its presence in the specialty chemicals sector within the Asia-Pacific region.

These developments reflect the region's growing prominence in the global chemical distribution landscape.

North America is anticipated to witness significant growth at a CAGR of 6.26% over the forecast period. The increasing demand for innovative and sustainable chemical solutions across diverse industries such as healthcare, technology, and energy is contributing to regional market growth.

The region’s strong emphasis on sustainability and adherence to regulatory standards boosts the demand for eco-friendly and compliant products. Significant investments in infrastructure and technological advancements are enhancing distribution efficiency and logistics. Additionally, a robust industrial base and a rising focus on research and development foster domestic market growth.

Competitive Landscape

The global chemical distribution market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Chemical Distribution Market

- Helm AG

- Univar Inc.

- Omya AG

- Jebsen& Jessen Offshore Pte. Ltd.

- TER Group

- Azelis Holding S.A.

- Solvadis

- Ashland, Inc.

- Brenntag AG

- ICC Chemical Corporation

Key Industry Development

- November 2023 (Acquisition): Azelis strengthened its global footprint in the flavors and fragrances sector by acquiring BLH SAS (BLH), a distributor specializing in fine perfumery in France. This acquisition follows Azelis' recent acquisitions of Quimdis in France, Vigon in America, and Ashapura in India over the past two years.

The global chemical distribution market is segmented as:

By Application

- Automotive & Transport

- Construction

- Agriculture

- Consumer Goods

- Textiles

- Pharmaceuticals

- Industrial Manufacturing

- Others

By Type

- Specialty Chemicals

- Commodity Chemicals

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America