Market Definition

A charcoal briquette is a compressed block of charcoal dust, coal, or other carbon-rich materials bound together with a natural or synthetic binder, designed to provide a uniform, efficient, and long-lasting fuel source.

It is primarily used for grilling, cooking, and heating applications due to its steady burn and ease of handling. It includes raw materials such as wood charcoal, agricultural waste, and binders, which form a solid and easy-to-handle fuel that burns with minimal smoke.

Charcoal Briquette Market Overview

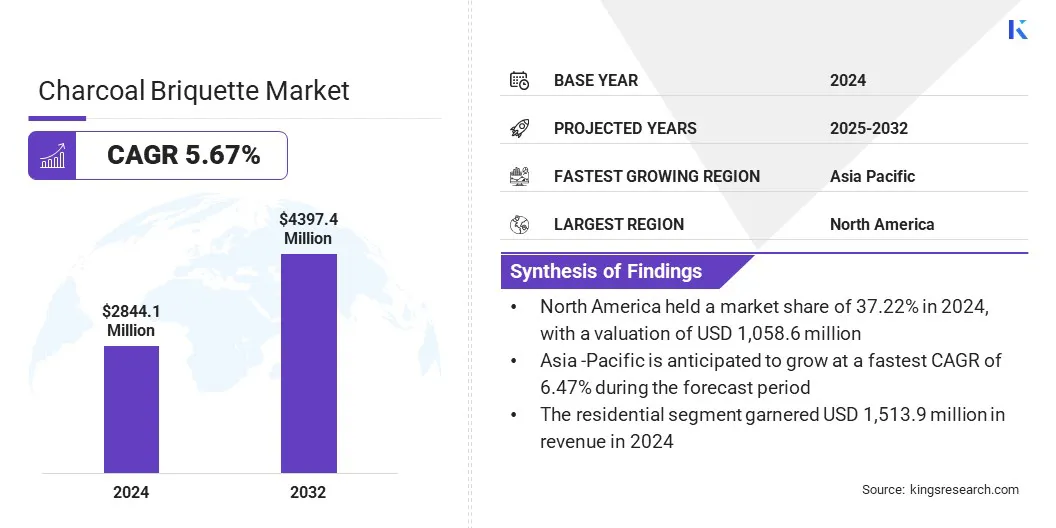

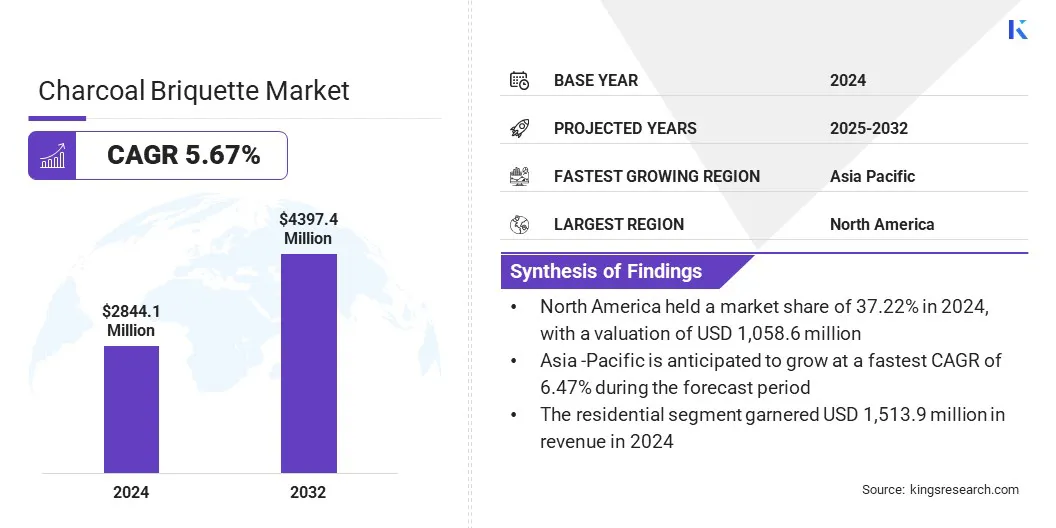

The global charcoal briquette market size was valued at USD 2,844.1 million in 2024 and is projected to grow from USD 2,988.0 million in 2025 to USD 4,397.4 million by 2032, exhibiting a CAGR of 5.67% over the forecast period.

It is driven by increasing consumer demand for sustainable and low-emission charcoal briquettes that offer cleaner cooking and grilling options. The market is further expanding due to the rising popularity of outdoor cooking and barbecuing in urban and suburban households.

Key Market Highlights:

- The charcoal briquette industry size was recorded at USD 2,844.1 million in 2024.

- The market is projected to grow at a CAGR of 5.67% from 2025 to 2032.

- North America held a market of 37.22% in 2024, with a valuation of USD 1,058.6 million.

- The wood-based segment garnered USD 1,302.6 million in revenue in 2024.

- The pillow-shaped segment is expected to reach USD 1,604.7 million by 2032.

- The residential segment is anticipated to witness the fastest CAGR of 6.16% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.47% over the forecast period.

Major companies operating in the charcoal briquette market are Royal Oak Enterprises, LLC, Weber Group, Kingsford Products Company, Duraflame, Inc, Fogo Charcoal, Rancher Charcoal, Subur Tiasa Holdings Berhad, Sun Briquettes, NIKOSI EXPORTS, GPCHARCOAL, The Oxford Charcoal Company, VESP Energy, Sagar Charcoal and Firewood Depot, Milazzo Industries, Inc PT Coco Nusantara.

The lack of access to clean cooking fuels is creating a strong demand for affordable and cleaner alternatives. Charcoal briquettes provide a cost-effective and efficient fuel option that improves health and reduces environmental impact.

- In February 2025, the United Nations Development Programme (UNDP) reported that 2.1 billion people worldwide lack access to clean cooking fuels and technologies, driving the demand for affordable and cleaner alternatives like charcoal briquettes.

Market Driver

Rising International Tourism

A major factor driving the market is the rising international tourism. This growth leads to increased outdoor recreational activities such as camping, barbecuing, and picnicking worldwide.

Moreover, the travel and hospitality industries are increasingly incorporating outdoor cooking and barbecue facilities to enhance guest experiences. This is prompting market players to develop convenient, portable, and efficient fuel solutions such as charcoal briquettes, catering to the growing needs of travelers and hospitality providers.

- In January 2025, the United Nations World Tourism Organization reported that international tourism recovered 99% of pre-pandemic levels in 2024, with 1.4 billion overnight visitors recorded globally, and an 11% increase over 2023. This significant rise in global travel is driving higher demand for charcoal briquettes.

Market Challenge

Competition from Alternative Fuels

A key challenge hindering the progress of the charcoal briquette market is competition from alternative fuels. Increasing use of propane, natural gas, electric grills, and renewable biofuels provides consumers with more convenient and cleaner options.

These fuels offer faster ignition, lower emissions, and reduced smoke compared to charcoal briquettes. Growing environmental awareness and government support for sustainable energy encourage consumers to adopt these alternatives.

To address this challenge, market players are developing cleaner, low-smoke charcoal briquettes using natural binders and additives that enhance burning efficiency.

They are investing in eco-friendly production processes and obtaining sustainability certifications which appeal to environmentally conscious consumers. Additionally, market players are expanding their product portfolios with premium, flavored, or slow-burning briquettes to differentiate their offerings.

Market Trend

Shift Towards Sustainable and Eco-Friendly Briquettes

A key trend influencing the market is the shift towards sustainable and eco-friendly briquettes. Manufacturers are increasingly using renewable raw materials such as agricultural residues and biomass waste to reduce dependence on traditional wood. Companies are replacing synthetic binders with natural alternatives to lower emissions.

This shift prompts the adoption of greener production methods and sustainable sourcing certifications, and the market is moving towards cleaner fuel options that meet consumer demand and regulatory requirements for environmental responsibility.

Charcoal Briquette Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Wood-Based, Coconut Shell, Bamboo, Others

|

|

By Shape

|

Pillow-Shaped, Hexagonal, Round or Cylindrical, Custom/Composite

|

|

By End Use

|

Residential, Commercial, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Product Type (Wood-Based, Coconut Shell, Bamboo, and Others): The wood-based segment earned USD 1,302.6 million in 2024, due to its wide availability and strong consumer preference for traditional fuel sources.

- By Shape (Pillow-Shaped, Hexagonal, Round or Cylindrical, and Custom/Composite): The pillow-shaped segment held 36.56% of the market in 2024, due to its ease of handling and efficient combustion properties.

- By End Use (Residential, Commercial, and Industrial): The residential segment is projected to reach USD 2,427.9 million by 2032, owing to the increasing demand for convenient and eco-friendly cooking fuels in households.

Charcoal Briquette Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America charcoal briquette market share stood at 37.22% in 2024, with a valuation of USD 1,058.6 million. This dominance is attributed to the region’s focus on developing and distributing sustainable charcoal briquettes.

The market continues to expand through the launch of certified and chemical-free hardwood briquettes designed to meet consumer demand for cleaner grilling fuels. Retail partnerships are increasing product availability across the region and driving greater adoption across residential and commercial settings.

- In March 2024, The Good Charcoal Company launched its Super Briquettes, the first FSC-certified charcoal sold in the U.S., in partnership with Lowe’s to make the product available nationwide. The chemical-free hardwood lump charcoal briquettes offer a cleaner and sustainable grilling option, supporting the company’s mission to promote eco-friendly fuel and social impact initiatives.

Asia Pacific is set to grow at a CAGR of 6.47% over the forecast period. This growth is primarily driven by the rising demand for affordable and sustainable cooking fuels across rapidly urbanizing and densely populated countries. Increasing awareness about the environmental impact of traditional firewood and charcoal is encouraging the adoption of cleaner alternatives like charcoal briquettes.

Increasing consumer preference for sustainable and certified wood-based briquettes is driving innovation in low-ash and long-burning variants. Expanding outdoor cooking and barbecue culture further fuels this demand. Moreover, the presence of a large consumer base, wide availability of natural resources, and supportive policies is contributing significantly to the market growth.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) regulates charcoal briquette production and use under the Clean Air Act, overseeing emissions standards for particulate matter and volatile organic compounds (VOCs). It enforces labeling requirements to ensure consumer safety and promotes sustainable sourcing to minimize deforestation and air pollution linked to charcoal manufacturing and combustion.

- In the UK, the Environment Agency (EA) oversees charcoal briquette production through regulations on emissions and waste management, under the Environmental Permitting Regulations. It ensures that manufacturers comply with air quality standards, restricts the use of harmful additives, and promotes sustainable raw material sourcing.

- In India, the Central Pollution Control Board (CPCB) regulates charcoal briquettes by monitoring emissions from manufacturing units under the Air (Prevention and Control of Pollution) Act. It enforces standards to control particulate and gaseous pollutants and promotes environmentally sustainable production practices.

Competitive Landscape

Major players operating in the charcoal briquette market are focusing on product innovation by developing eco-friendly, low-smoke, and longer-burning briquettes to meet growing consumer demand for cleaner fuels. They are investing in automated and scalable production technologies to improve efficiency and reduce costs.

Moreover, market players are pursuing certifications and compliance with environmental regulations to appeal to eco-conscious customers. Additionally, they are launching flavored briquettes and premium packaging to attract customers and differentiate their product offerings.

Top Companies in Charcoal Briquette Market:

- Royal Oak Enterprises, LLC

- Weber Group

- Kingsford Products Company

- Duraflame, Inc

- Fogo Charcoal

- Rancher Charcoal

- Subur Tiasa Holdings Berhad

- Sun Briquettes

- NIKOSI EXPORTS

- GPCHARCOAL

- The Oxford Charcoal Company

- VESP Energy

- Sagar Charcoal and Firewood Depot

- Milazzo Industries, Inc

- PT Coco Nusantara

Recent Developments (Product Launch)

- In May 2025, Kingsford partnered with Miller Lite to launch their limited-edition Beercoal charcoal briquettes infused with real beer. The collaboration aims to enhance the grilling experience by adding a smoky beer flavor to charcoal briquettes.