Market Definition

The market encompasses the production, distribution, and sale of chainsaws used in forestry, landscaping, construction, and residential applications. It includes gas-powered, electric, and battery-operated chainsaws for professional and consumer use.

This report highlights the primary market drivers, along with significant trends, regulatory frameworks, and the competitive landscape, shaping the market in the coming years.

Chainsaw Market Overview

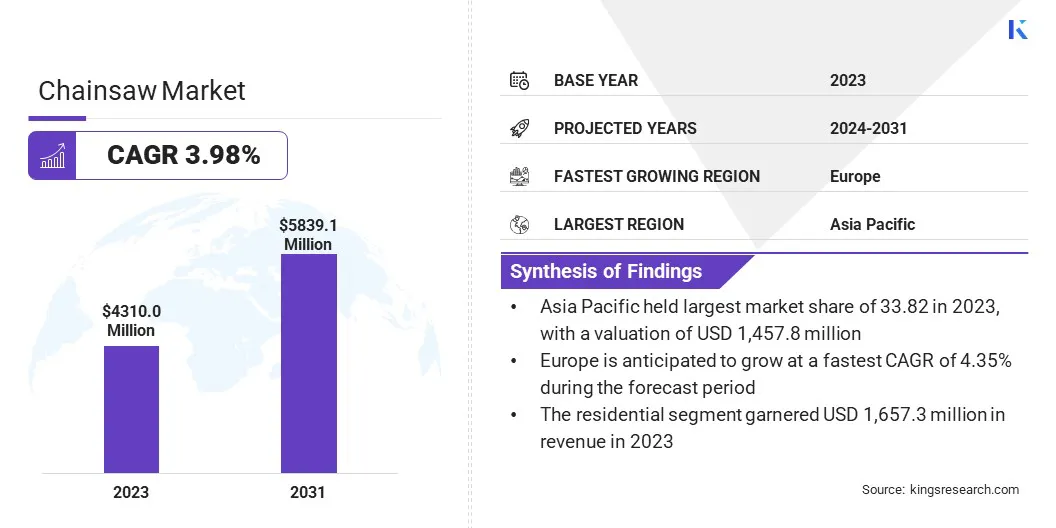

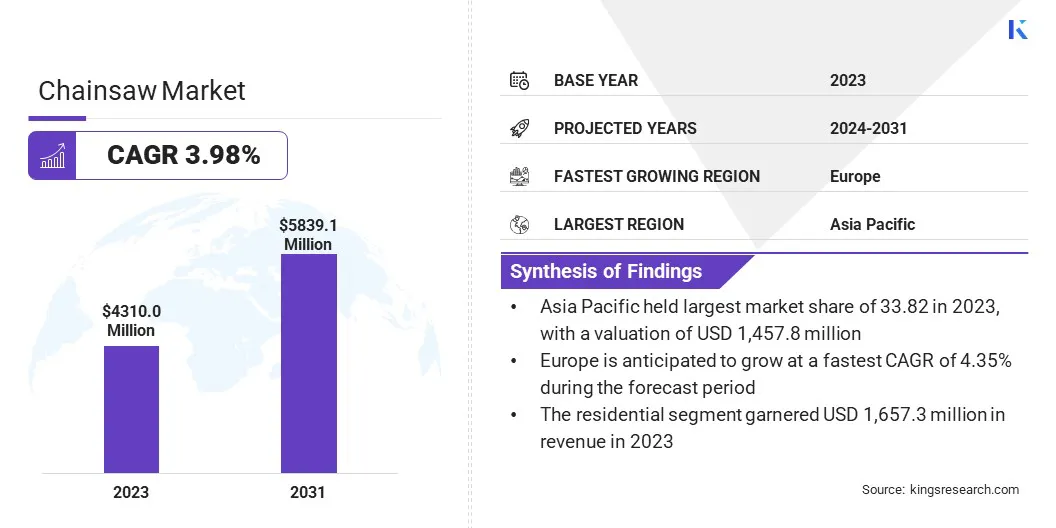

The global chainsaw market size was valued at USD 4,310.0 million in 2023 and is projected to grow from USD 4,443.6 million in 2024 to USD 5,839.1 million by 2031, exhibiting a CAGR of 3.98% during the forecast period.

The market is experiencing steady growth, driven by rising demand for chainsaws in forestry, agriculture, landscaping, and construction. The increasing popularity of urban green spaces and backyard maintenance is boosting the demand for battery-powered and electric chainsaws due to their convenience.

Additionally, technological advancements such as improved battery life, low-emission engines, and enhanced safety features are further increasing the adoption of chainsaws.

Major companies operating in the chainsaw industry are ANDREAS STIHL AG & Co. KG, Husqvarna AB, YAMABIKO Corporation, Makita, Oregon Tool, Inc., Robert Bosch Stiftung GmbH, BLACK+DECKER, DEWALT, Greenworks North America LLC, Milwaukee Tool, RYOBI, STIGA S.p.A., AL-KO Gardentech, Einhell Germany AG, and Emak S.p.A.

The expansion of infrastructure projects and the need for efficient tree-cutting solutions in disaster management is also contributing to market growth. The increasing adoption of mechanized logging and land-clearing equipments further drives demand for high-performance chainsaws. Moreover, the rise of e-commerce platforms is increasing the adoption chainsaws, in turn driving the growth of the market.

- In September 2024, GARDENA introduced GARDENA Battery Chainsaw PowerSaw 250/18V P4A, a compact and powerful cordless chainsaw designed for effortless wood cutting and pruning. This new chainsaw features a brushless motor, Oregon guide bar, and automatic chain lubrication.

Key Highlights

- The chainsaw industry size was valued at USD 4,310.0 million in 2023.

- The market is projected to grow at a CAGR of 3.98% from 2024 to 2031.

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 1,457.8 million.

- The battery-powered segment garnered USD 1,538.0 million in revenue in 2023.

- The residential segment is expected to reach USD 2,248.0 million by 2031.

- The market in Europe is anticipated to grow at a CAGR of 4.35% during the forecast period.

Market Driver

"Rising Demand from Forestry and Landscaping Industries"

The chainsaw market is expanding due to the increasing demand from the forestry, landscaping, and urban maintenance sectors. Chainsaws play a crucial role in wood production, and deforestation, enabling efficient tree felling, log processing, and land clearing.

Additionally, urban landscaping and tree maintenance projects require chainsaws for trimming, pruning, and maintaining green spaces in residential and commercial areas. As reforestation and land development projects are growing worldwide, the need for high-performance cutting tools is steadily rising.

The market is experiencing a significant shift toward battery-powered models, driven by the rise in demand for eco-friendly and low-maintenance solutions. Battery-operated chainsaws offer reduced maintenance, smoother operation, compared to traditional gas-powered chainsaws, which require frequent engine maintenance.

As a result, professionals and homeowners are opting for sustainable, fuel-independent chainsaws that are convenient and effective in supporting environmentally responsible practices.

- In April 2023, Milwaukee Tool launched the M18 FUEL Top Handle Chainsaw, expanding its battery-powered chainsaw lineup for professional users. M18 FUEL Top Handle Chainsaw is designed for arborists, power utility linemen, and landscape maintenance professionals. The chainsaw delivers faster cutting speed than gas chainsaws while reducing emissions and maintenance issues. It features a POWERSTATE Brushless Motor, REDLITHIUM Battery Pack, and REDLINK PLUS Intelligence for increased power, runtime, and durability.

Market Challenge

"Limited Battery Runtime for Heavy-Duty Applications"

One of the major challenges in the chainsaw market is the limited battery runtime of cordless models, especially for heavy-duty applications in forestry and commercial landscaping. Battery-powered chainsaws are unable to match the extended operation time of gas-powered models.

This limitation poses a challenge for professionals who require uninterrupted performance for tasks like tree felling, log cutting, and large-scale land clearing, where downtime for recharging or swapping batteries can reduce productivity. For users working in remote areas with limited access to charging facilities, reliance on battery-powered chainsaws can be difficult.

Unlike gas chainsaws that can be quickly refueled, battery-powered models require multiple spare batteries, which makes them less practical for long work shifts. Additionally, as battery life reduces, users may experience a gradual decline in performance, requiring expensive battery replacements.

To address this challenge, manufacturers are focusing on increasing battery efficiency and runtime by developing high-capacity lithium-ion batteries. Key players are developing newer battery models with higher amp-hour (Ah) ratings, for longer operational time per charge. Furthermore, fast-charging technology is being incorporated into power tool ecosystems, reducing downtime by allowing batteries to recharge significantly faster.

Market Trend

"Advancements in Chainsaw Technology and Rising Demand for Lightweight Models"

The chainsaw market is undergoing a transformation driven by technological advancements and changing consumer expectations. Manufacturers are enhancing battery efficiency, enabling longer runtimes, faster charging, and increased cutting power, making battery-operated chainsaws more suitable for professional applications.

The development of low-noise motors addresses issues about noise pollution, making these tools more practical for urban and residential use. Safety remains a priority, with features like anti-kickback systems, electronic chain brakes, and improved grip designs reducing operational risks and enhancing user control.

At the same time, there is a growing demand for lightweight chainsaws, especially among homeowners, hobbyists, and users who prioritize agility. Manufacturers are focusing on ergonomic designs with optimized weight distribution, ensuring that smaller chainsaws remain powerful without compromising on performance.

This trend is making chainsaws easy to access for casual users while maintaining high standards required by professionals working.

- In April 2023, Bosch launched the AdvancedChain 36V-35-40, a cordless chainsaw designed for demanding wood-cutting tasks. The model features OptiCut technology for continuous sawing, a brushless motor, and a lightweight design for enhanced efficiency and ease of use. The chainsaw operates on a 36V lithium-ion battery, compatible with other Bosch garden tools, offering users cost-effectiveness and sustainability.

Chainsaw Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Gas-powered, Electric-powered, Battery-powered, Others

|

|

By Application

|

Residential, Commercial, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Gas-powered, Electric-powered, Battery-powered, Others): The battery-powered segment earned USD 1,538.0 million in 2023 due to increasing consumer preferences for sustainable, low-maintenance, and easy-to-use chainsaws.

- By Application (Residential, Commercial, and Industrial): The residential segment held 38.45% of the market in 2023, due to the growing trend of DIY home improvement, backyard maintenance, and the rising popularity of battery-powered chainsaws among homeowners.

Chainsaw Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific chainsaw market share stood around 33.82% in 2023, with a valuation of USD 1,457.8 million. The region’s dominance is primarily driven by high demand from countries such as China, India, and Japan, where rapid urbanization and infrastructure development are significantly increasing the need for chainsaws in construction, land clearing, and disaster management.

In addition, the strong presence of the forestry and agricultural industries in Southeast Asia, particularly in Indonesia, Malaysia, and Vietnam, has led to the increased adoption of chainsaws for logging, plantation management, and rubber tree harvesting.

The rising popularity of battery-powered chainsaws among small-scale farmers and homeowners in countries like India, is further fueling market growth. The expansion of e-commerce platforms in the region has also played a crucial role in improving chainsaw accessibility, particularly in rural and semi-urban areas.

The chainsaw industry in Europe is expected to register the fastest growth in the market, with a projected CAGR of 4.35% over the forecast period. This growth is fueled by the region’s forestry sector, particularly in countries such as Sweden, Finland, and Norway, where sustainable logging and timber harvesting are key economic activities.

The demand for high-performance and eco-friendly chainsaws is also rising due to European Union regulations on emissions and noise levels, driving a shift toward battery-powered and low-emission models.

Furthermore, the increasing trend of DIY gardening and landscaping in urban centers, specifically in the UK, France and Italy, is driving sales among residential users. The presence of leading chainsaw manufacturers and strong retail and distribution networks are expected to further accelerate market growth in this region.

Regulatory Frameworks

- In the United States, chainsaws are regulated by the Occupational Safety and Health Administration (OSHA) which sets safety requirements for logging operations. The Environmental Protection Agency (EPA) enforces emission standards under the Clean Air Act, while the Consumer Product Safety Commission (CPSC) oversees product safety regulations.

- In the European Union, chainsaws must comply with the Machinery Directive and the EN ISO 11681 safety standards. The European Chemicals Agency (ECHA) regulates emissions under the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation.

- In China, chainsaws are regulated by the State Administration for Market Regulation (SAMR) under GB Standards, ensuring product safety and environmental compliance. The Ministry of Ecology and Environment (MEE) enforces emissions regulations.

- In Japan, chainsaws fall under the Ministry of Economy, Trade, and Industry (METI) regulations, following the Industrial Safety and Health Act and the Japan Industrial Standards (JIS) for product safety.

- In India, the Bureau of Indian Standards (BIS) provides safety and quality standards for chainsaws, while the Ministry of Environment, Forest and Climate Change (MoEFCC) regulates their use in forestry and environmental conservation.

Competitive Landscape

The chainsaw industry is characterized by key players, that focus on innovation, product differentiation, and strategic partnerships to strengthen their market position. Companies are investing heavily in research and development to introduce advanced chainsaw models with enhanced safety features, improved battery life, and reduced emissions.

The shift towards battery-powered and eco-friendly chainsaws has led to increased efforts in developing high-efficiency motors and lightweight designs to cater to professional and residential users.

To expand market reach, leading manufacturers are strengthening their distribution networks through collaborations with retailers, online marketplaces, and specialized equipment dealers. Many players are also using digital marketing strategies and direct-to-consumer sales channels to enhance customer engagement.

In addition to this, companies are investing in after-sales services, including maintenance packages and extended warranties, to build brand loyalty. Strategic acquisitions are another key approach, allowing companies to expand their geographic presence and product portfolios.

Some players are focusing on localized manufacturing and supply chain optimization to reduce production costs and mitigate disruptions. Overall, competition in the market remains strong, with continuous advancements in technology and strategic business expansions shaping the industry’s landscape.

- In February 2025, Husqvarna and Flex announced a strategic manufacturing partnership to enhance supply chain flexibility, efficiency, and time to market in North America. As part of the agreement, Flex will provide supply chain and manufacturing services, expanding its portfolio into outdoor and power equipment, while Husqvarna will strengthen its competitive position by leveraging Flex’s vertically integrated manufacturing and distribution capabilities.

List of Key Companies in Chainsaw Market:

- ANDREAS STIHL AG & Co. KG

- Husqvarna AB

- YAMABIKO Corporation

- Makita

- Oregon Tool, Inc.

- Robert Bosch Stiftung GmbH

- BLACK+DECKER

- DEWALT

- Greenworks North America LLC

- Milwaukee Tool

- RYOBI

- STIGA S.p.A.

- AL-KO Gardentech

- Einhell Germany AG

- Emak S.p.A.

Recent Developments (New Product Launch)

- In June 2024, Milwaukee Tool launched the M18 FUEL 20 Dual Battery Chainsaw designed for professional use in felling, bucking, limbing, and stump cutting. The chainsaw delivers 70cc gas-equivalent power with faster cutting speeds and reduced stalls. It features POWERSTATE brushless motor technology and is optimized for use with M18 REDLITHIUM FORGE XC8.0 Batteries for high efficiency and productivity.

- In March 2024,onda introduced its first-ever cordless chainsaw, the HHC36BXB, expanding its 36V cordless power tool lineup. Equipped with a 1.6kW brushless motor and Honda's Thermo Smart battery technology, the chainsaw delivers high performance suitable for tasks like firewood preparation, DIY projects, and small tree felling. Its automatic speed control system adjusts torque and RPM based on wood hardness, optimizing cutting efficiency and preventing overheating.