Market Definition

Ceramic tiles are made from natural clay, minerals, and other inorganic materials. They encompass floor tiles, wall tiles, porcelain tiles, glazed tiles, mosaic tiles, and decorative tiles, designed for specific aesthetic and functional purposes.

Their applications include residential and commercial flooring, wall cladding, kitchen and bathroom surfaces, exterior facades, swimming pools, and decorative installations. Ceramic tiles provide durability, easy maintenance, and design versatility across interior and exterior environments.

Ceramic Tiles Market Overview

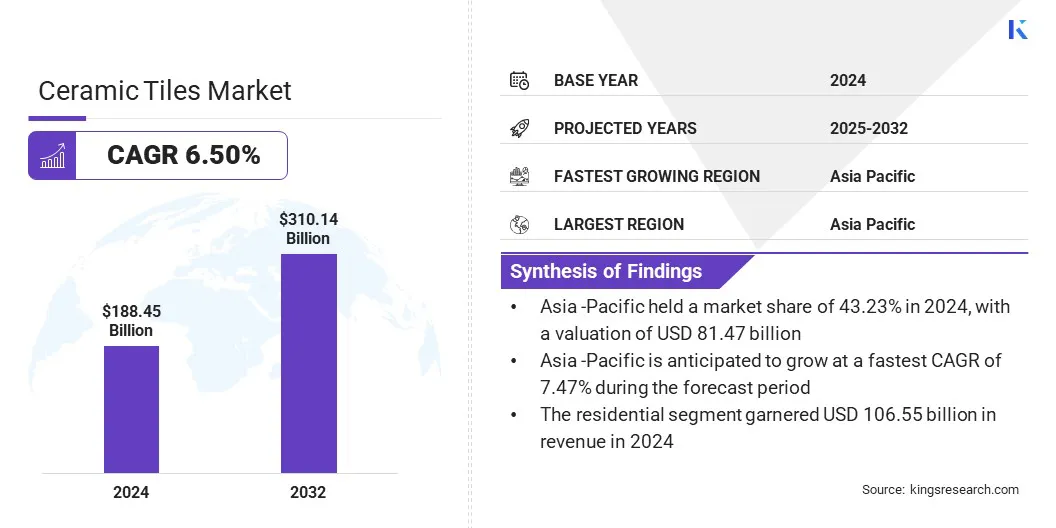

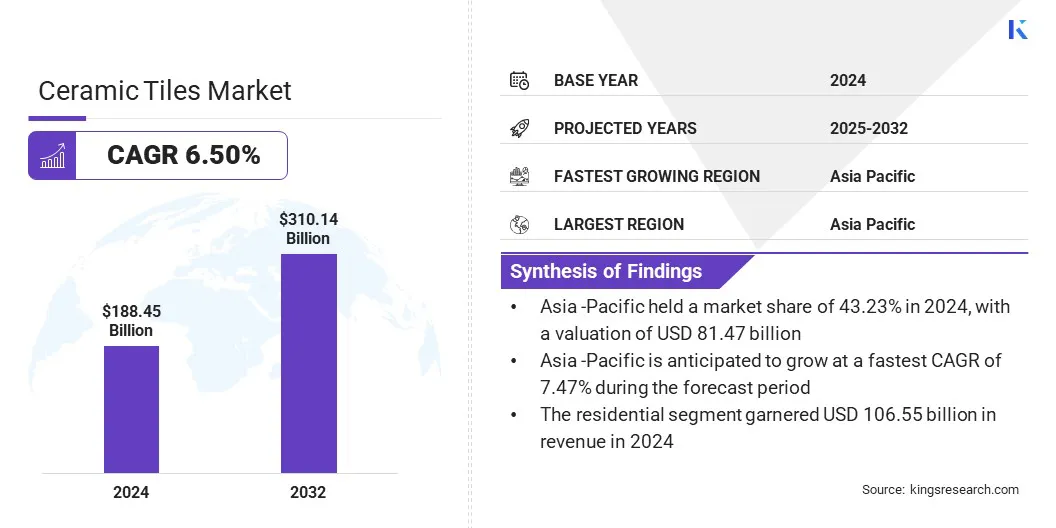

The global ceramic tiles market was valued at USD 188.45 billion in 2024 and is projected to grow from USD 199.54 billion in 2025 to USD 310.14 billion by 2032, exhibiting a CAGR of 6.50% over the forecast period.

The market is driven by the increasing demand for premium and aesthetic tiles in residential and commercial spaces, as consumers and designers seek unique patterns, textures, and finishes to elevate interior and exterior designs. Advancements in production techniques and materials are further driving the adoption of premium ceramic tiles by enabling customization, durability, and high-quality finishes to meet client preferences.

Key Highlights:

- The ceramic tiles industry was recorded at USD 188.45 billion in 2024.

- The market is projected to grow at a CAGR of 6.50% from 2025 to 2032.

- Asia Pacific held a market of 43.23% in 2024, with a valuation of USD 81.47 billion.

- The glazed ceramic segment garnered USD 98.22 billion in revenue in 2024.

- The floor tiles segment is expected to reach USD 163.21 billion by 2032.

- The commercial segment is anticipated to witness the fastest CAGR of 7.21% over the forecast period.

- North America is anticipated to grow at a CAGR of 6.55% over the forecast period.

Major companies operating in the ceramic tiles market are Mohawk Industries, Inc, SCG Ceramics, Kajaria Ceramics Limited, Rak Ceramics, Pamesa Cerámica, Florim Ceramiche S.P.A., Somany Ceramics, H & R Johnson, OrientBell, NITCO Tiles, Asian Granito India Ltd., CERA, Marazzi Group S.r.l, Saudi Ceramic Company, and ABK GROUP INDUSTRIE CERAMICHE S.p.A.

The surge in home renovation and remodeling activities is driving the market by increasing demand for durable and aesthetically appealing flooring and wall solutions. Upgrades in kitchens, bathrooms, and living spaces are creating opportunities for manufacturers and distributors. This increased remodeling activity is also driving product innovation, further supporting market growth.

- The U.S. National Association of Home Builders (NAHB) forecasted a 5% gain in residential remodeling activity in the U.S. in 2025, boosting demand for flooring and wall materials, including ceramic tiles.

Market Driver

Rising Government Investment in Infrastructure

A major driver in the ceramic tiles market is the rising government investment in infrastructure projects aimed at developing and modernizing roads, bridges, public buildings, and urban spaces.

Large-scale construction and renovation activities increase the demand for durable and aesthetically appealing building materials, including ceramic tiles. This demand is encouraging manufacturers to expand production, improve supply chains, and offer a wider range of high-quality tiles. It is enabling construction projects to meet functional and design requirements efficiently and supporting market growth across residential, commercial, and public sectors.

- In October 2024, the U.S. Department of Transportation’s FHWA allocated USD 62 billion under the Bipartisan Infrastructure Law, boosting construction activity and driving demand for building materials, including ceramic tiles.

Market Challenge

Volatility in Raw Material Prices

A key challenge in the ceramic tiles market is the volatility of raw material prices, including clay, feldspar, and silica. These fluctuations increase production costs and can reduce profit margins for manufacturers.

Additionally, sudden price changes force companies to adjust product pricing, affecting competitiveness and demand. This combination of cost uncertainty and operational complexity hinders market stability, slows expansion, and creates challenges in maintaining consistent quality and affordability for customers.

To address this challenge, market players are securing long-term supply contracts and building strong relationships with suppliers to stabilize input costs. Companies are also investing in alternative materials and efficient production technologies to reduce dependency on expensive or scarce raw materials. Additionally, they are optimizing inventory management and adopting flexible pricing strategies to absorb cost fluctuations.

Market Trend

Rising Demand for High End Design Driven Tiles

A key trend in the ceramic tiles market is the growing preference for premium, design-oriented tiles. Manufacturers are offering premium tiles with unique patterns, textures, and finishes to elevate the aesthetics of residential and commercial spaces.

These tiles combine advanced materials and production techniques with customization options to meet client preferences. This trend is prompting innovation in luxury tiles and boosting the adoption of exclusive, high-quality ceramic tiles.

- In October 2024, ABK Group partnered with MOOOI to launch a high-end series of ceramic floor and wall tiles. Through this partnership, ABK Group aims to strengthen its presence in the premium residential and architectural sector.

Ceramic Tiles Market Report Snapshot

|

Segmentation

|

Details

|

|

By Product Type

|

Glazed Ceramic, Porcelain, Scratch-Free, Others

|

|

By Application

|

Floor Tiles, Wall Tiles, Roof Tiles, Others

|

|

By End-Use Industry

|

Residential, Commercial, Industrial

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Product Type (Glazed Ceramic, Porcelain, Scratch-Free, and Others): The glazed ceramic segment earned USD 98.22 billion in 2024 due to its durability, aesthetic appeal, and widespread use in residential and commercial projects.

- By Application (Floor Tiles, Wall Tiles, Roof Tiles, and Others): The floor tiles segment held 53.43% of the market in 2024, due to high demand for residential and commercial flooring solutions.

- By End-Use Industry (Residential, Commercial, and Industrial): The residential segment is projected to reach USD 173.84 billion by 2032, owing to increasing urbanization, rising disposable incomes, and growing home renovation activities.

Ceramic Tiles Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific ceramic tiles market share stood at 43.23% in 2024 in the global market, with a valuation of USD 81.47 billion. This dominance is attributed to rapid urbanization and growing construction activities across countries like China, India, and Southeast Asia. Rising disposable incomes and the expanding middle-class population are driving the adoption of premium and designer ceramic tiles in residential projects.

Moreover, government initiatives promoting smart cities and infrastructure development are encouraging the use of high-quality ceramic tiles in large-scale construction projects. Additionally, strategic acquisitions by regional market players to expand manufacturing capacity and brand presence are further fueling market expansion in the region.

- In July 2025, Infra.Market acquired a majority stake in Metro Group, aiming to expand its presence in India’s market and strengthen its manufacturing capacity and brand portfolio.

North America is set to grow at a CAGR of 6.55% over the forecast period. This growth is attributed to the rising demand for durable and aesthetically appealing flooring solutions in residential and commercial construction projects across this region. Increasing renovation and remodeling activities are encouraging the adoption of premium ceramic tiles.

Growing awareness of sustainable and low-maintenance building materials is also boosting the market growth. Additionally, the adoption of innovative installation technologies that enhance convenience and design flexibility is further fueling market growth in the region.

- In April 2024, i4F partnered with Akgün Group-Duratiles to launch a “clickable” floating floor installation system for real ceramic tiles, introducing modular installation technology while maintaining durability and aesthetic appeal.

Regulatory Frameworks

- In the U.S., the Department of Commerce (USDOC) regulates the market by enforcing trade laws and ensuring fair competition. It investigates anti-dumping and countervailing duties to prevent foreign ceramic tile imports from being sold at unfairly low prices or benefiting from government subsidies.

- In China, the General Administration of Quality Supervision, Inspection and Quarantine (AQSIQ) oversees quality and safety standards for ceramic tiles. It enforces national standards covering physical properties, chemical composition, and safety requirements. It monitors production processes to ensure compliance and protect consumer health.

- In India, the Bureau of Indian Standards (BIS) formulates and enforces specifications for glazed and unglazed ceramic tiles. It conducts testing and certification to ensure tiles meet safety, performance, and quality standards, promoting industry credibility and consumer protection.

Competitive Landscape

Major players in the ceramic tiles industry are expanding internationally through strategic acquisitions of regional retail outlets. They are strengthening distribution networks to improve access to ceramic and vitrified tiles across residential and commercial sectors. Additionally, players are enhancing product availability to meet diverse customer preferences and regional demand.

- In August 2024, Kajaria Ceramics acquired seven UK stores from CTD Tiles to expand its international presence and strengthen its distribution network for ceramic and vitrified tiles in the residential and commercial sectors.

Key Companies in Ceramic Tiles Market:

- Mohawk Industries, Inc

- SCG Ceramics

- Kajaria Ceramics Limited

- Rak Ceramics

- Pamesa Cerámica

- Florim Ceramiche S.P.A.

- Somany Ceramics

- H & R Johnson

- OrientBell

- NITCO Tiles

- Asian Granito India Ltd.

- CERA

- Marazzi Group S.r.l

- Saudi Ceramic Company

- ABK GROUP INDUSTRIE CERAMICHE S.p.A.

Recent Developments (M&A/Product Launch)

- In November 2024, Eurocer, through its Italian subsidiary Ferro Italy Specialities, acquired the ceramic business and assets of Vibrantz Italia to strengthen its presence in Italy and Europe.

- In August 2024, KPG Roofings launched domestic manufacturing of ceramic roof tiles in Gujarat, India, aiming to ensure a steady supply and reduce dependence on imports.

Companies are retaining skilled workforce and integrating existing staff to ensure operational continuity