Market Definition

The ceramic fibers market involves the production and distribution of high-temperature-resistant, lightweight fibers derived from ceramic materials. These fibers are primarily composed of alumina, silica, or other ceramic compounds and are characterized by their exceptional thermal resistance, low thermal conductivity, and durability in extreme environments.

Ceramic Fibers Market Overview

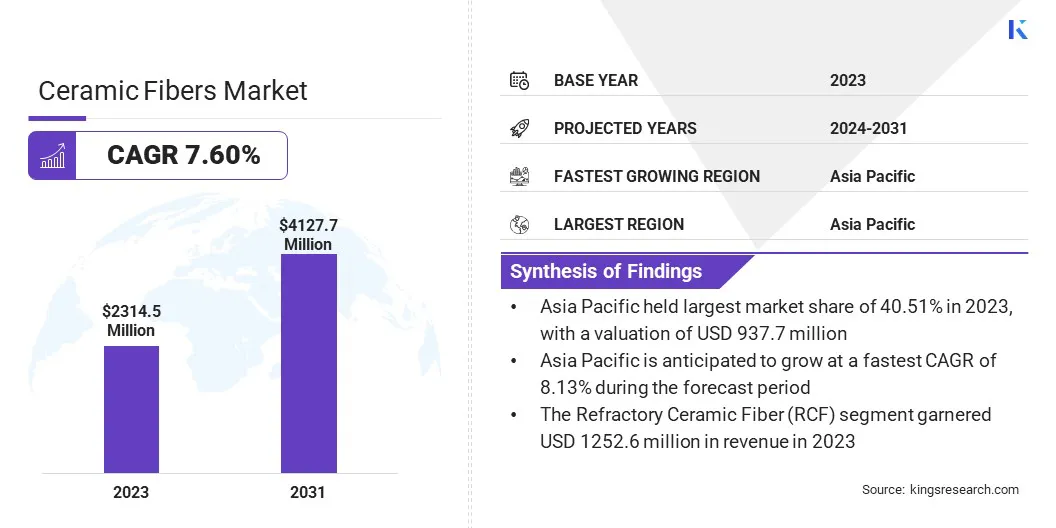

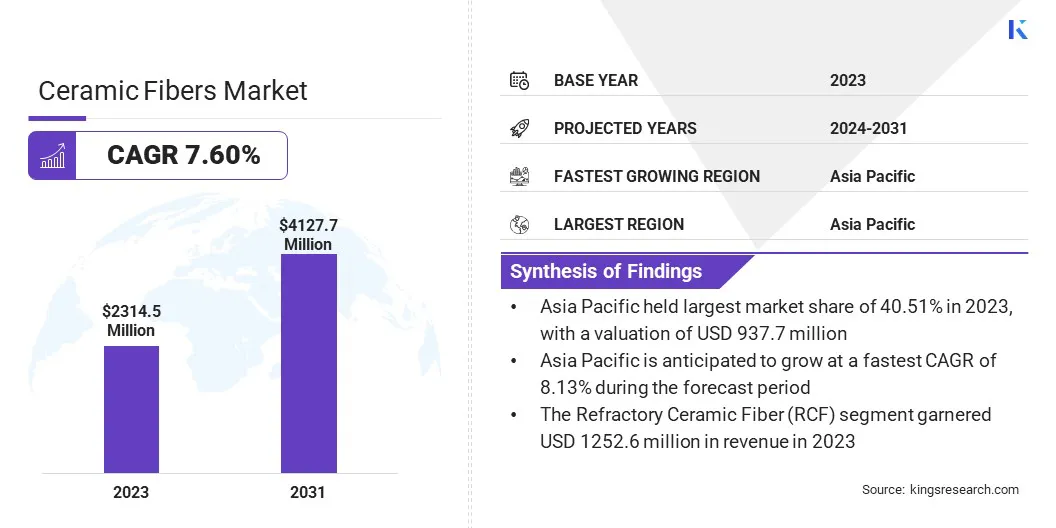

The global ceramic fibers market size was valued at USD 2314.5 million in 2023 and is projected to grow from USD 2471.2 million in 2024 to USD 4127.7 million by 2031, exhibiting a CAGR of 7.60% during the forecast period.

The growth of the market can be attributed to the increasing demand for high-performance insulation materials across various industries, including automotive, aerospace, manufacturing, and energy.

Ceramic fibers are recognized for their superior thermal resistance, low thermal conductivity, and high tensile strength, making them ideal for high-temperature applications such as furnaces, kilns, and boilers.

Major companies operating in the global ceramic fibers industry are Morgan Advanced Materials, IBIDEN, NUTEC Incorporated, Alkegen, HWI, Isolite Insulating Products Co., Ltd., YESO INSULATING PRODUCTS COMPANY LIMITED, Rath-Group, ZIRCAR Ceramics, THERMOST THERMTECH CO., LTD., General Insulation Company., Luyang Energy-saving Materials Co., FibreCast Inc., Pyrotek., and CeramSource.

The rising emphasis on energy efficiency and environmental sustainability is driving the adoption of ceramic fiber products, as they contribute to reducing energy consumption and minimizing carbon emissions.

The market is also benefiting from ongoing advancements in ceramic fiber manufacturing technologies, which are enhancing product performance and driving cost reductions.

- In June 2023, HarbisonWalker International (HWI) unveiled a new brand identity following its integration with Calderys, a leading global refractories company. The rebranding reflects HWI’s position as a key member of the Calderys Group in the Americas. The new visual identity of HWI, as a member of Calderys, represents a significant step in their journey to form a unified business that blends the strengths of both brands, aiming to create a global high-growth leader.

Key Highlights:

- The global ceramic fibers market size was valued at USD 2314.5 million in 2023.

- The market is projected to grow at a CAGR of 7.60% from 2024 to 2031.

- Asia Pacific held a market share of 40.51% in 2023, with a valuation of USD 937.7 million.

- The refractory ceramic fiber (RCF) segment garnered USD 1252.6 million in revenue in 2023.

- The blankets segment is expected to reach USD 1687.4 million by 2031.

- The aerospace & defense segment is anticipated to register the fastest CAGR of 8.97% during the forecast period.

- The market in North America is anticipated to grow at a CAGR of 7.47% during the forecast period.

Market Driver

"Increasing Demand for High-performance Insulation Materials"

The growing demand for high-performance insulation materials is a key driver of the ceramic fibers market, as various industries require materials capable of withstanding extreme temperatures and challenging operational conditions.

Ceramic fibers are highly regarded for their exceptional thermal resistance, low thermal conductivity, and high tensile strength, making them ideal for applications in high-temperature environments.

For instance, the aerospace industry relies on lightweight, heat-resistant materials for components such as engine nacelles, thermal protection systems, and exhaust systems. Ceramic fibers play a critical role in these applications, providing efficient thermal insulation while minimizing weight.

Market Challenge

"Health and Safety Risks"

Ceramic fibers, especially in their raw form, can pose health risks if not handled properly. Prolonged inhalation of ceramic fiber dust can irritate the respiratory system and lead to chronic lung conditions, such as pulmonary fibrosis.

Regulatory bodies in some regions, such as the European Union (EU) and the U.S., have imposed stricter health and safety guidelines for handling and using ceramic fibers.

Manufacturers have developed safer, bio-soluble versions of ceramic fibers; however, concerns related to worker safety, cost of compliance with health regulations, and the need for specialized protective equipment remain major challenges in the market.

The use of bio-soluble ceramic fibers significantly reduces the risk of respiratory issues by ensuring safer decomposition in the human body. Improving manufacturing processes to minimize dust release, such as employing wetting techniques and closed systems, helps reduce airborne exposure.

Proper ventilation systems, along with comprehensive safety training and the use of Personal Protective Equipment (PPE) like respirators, further enhance worker safety. These measures are essential for ensuring compliance with health and safety regulations while promoting the safe handling of ceramic fibers.

Market Trend

"Development of Bio-soluble and Safer Materials"

The development of bio-soluble and safer ceramic fibers is a key trend in the market, driven by health concerns and stricter regulatory standards. Traditional ceramic fibers, while effective in high-temperature applications, can pose respiratory risks if inhaled over time.

Bio-soluble fibers are designed to dissolve more easily in the body, reducing the risk of long-term health issues. These fibers are typically made from materials like alumino-silicate or silica blends, offering similar thermal performance but with reduced toxicity.

The adoption of bio-soluble fibers is expanding their use across industries like aerospace, where high-temperature insulation is critical, without compromising safety. This shift toward safer materials is driving the market, enabling broader industry adoption and compliance with health and environmental standards.

Ceramic Fibers Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Refractory Ceramic Fiber (RCF), Alkaline Earth Silicate (AES) Wool, Polycrystalline Ceramic Fiber

|

|

By Product Form

|

Blankets, Boards, Papers, Modules, Other

|

|

By End-use Industry

|

Aerospace & Defense, Petrochemical & Chemical Processing, Power Generation, Iron & Steel, Aluminum & Glass, Other

|

|

By Application

|

High-temperature Insulation, Thermal Barrier Coatings, Fireproofing, Refractory Linings, Catalytic Converters

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Refractory Ceramic Fiber (RCF), Alkaline Earth Silicate (AES) Wool, Polycrystalline Ceramic Fiber): The refractory ceramic fiber (RCF) segment earned USD 1252.6 million in 2023, due to its widespread use in high-temperature industrial applications, including furnaces, kilns, and power generation, where its superior thermal resistance and insulating properties are critical.

- By Product Form (Blankets, Boards, Papers, Modules, Other): The blankets segment held 40.65% share of the market in 2023, due to their versatility, ease of installation, and superior thermal insulation properties, making them widely used in applications such as furnaces, kilns, and industrial ovens.

- By End-use Industry (Aerospace & Defense, Petrochemical & Chemical Processing, Power Generation, Iron & Steel, Aluminum & Glass, Other): The petrochemical & chemical processing segment is projected to reach USD 995.6 million by 2031, owing to the growing demand for high-temperature insulation in reactors, furnaces, and pipelines, where ceramic fibers offer excellent thermal stability and resistance to aggressive chemicals.

- By Application (High-temperature Insulation, Thermal Barrier Coatings, Fireproofing, Refractory Linings, Catalytic Converters): The thermal barrier coatings segment is anticipated to register the fastest CAGR of 9.08% during the forecast period, driven by the growing demand for heat-resistant coatings in aerospace, automotive, and power generation industries.

Ceramic Fibers Market Regional Analysis

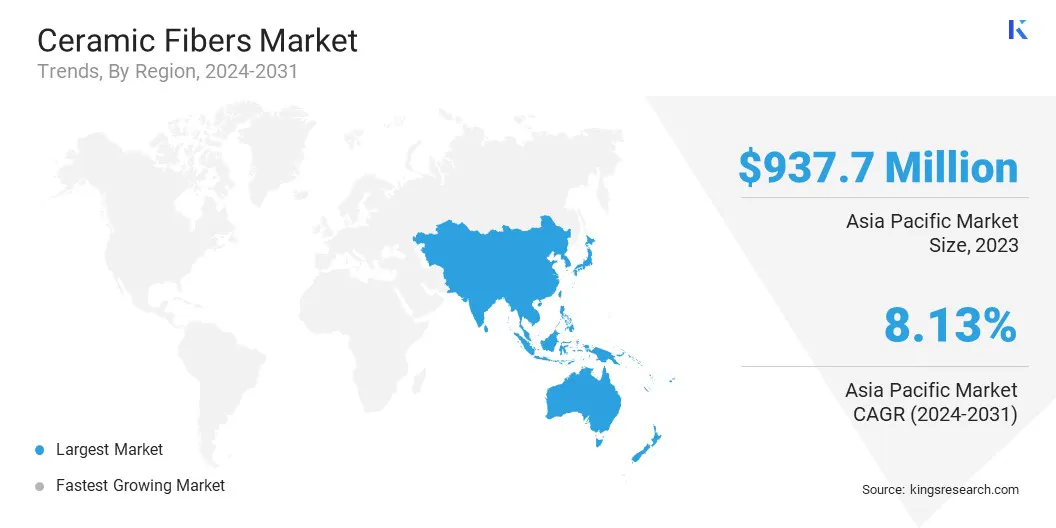

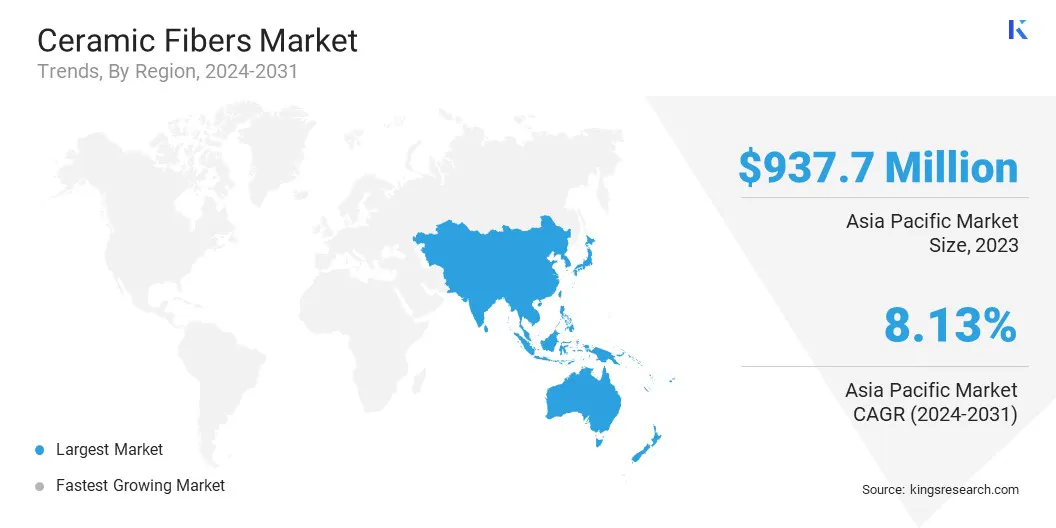

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a ceramic fibers market share of around 40.51% in 2023, with a valuation of USD 937.7 million. The market dominance of the region is expected to continue, due to rapid industrialization, especially in countries like China, India, and Japan. Increasing demand for high-performance insulation materials in industries such as automotive, power generation, and manufacturing is driving the market in the region.

The rising adoption of energy-efficient solutions and the growing focus on infrastructure development contribute to the demand for ceramic fibers. The presence of key manufacturing hubs and significant investments in industrial sectors further support the expansion of the market in this region, positioning Asia Pacific as a key region in the global market.

- In July 2023, Morgan Advanced Materials announced the commercial start-up of the expansion of its Yixing plant to increase its production capacity by more than 50%. The plant specializes in manufacturing TJM Insulating Firebricks (IFBs), which are essential for industries such as petrochemicals, iron & steel, aluminium, and cathode materials.

The ceramic fibers industry in North America is poised for significant growth at a robust CAGR of 7.47% over the forecast period, driven by the region's strong industrial base, particularly in the automotive, aerospace, and energy sectors.

Increasing demand for energy-efficient and fire-resistant materials, along with stringent regulations promoting environmental sustainability, is boosting the adoption of ceramic fibers.

Furthermore, the expansion of the renewable energy sector and the need for advanced insulation in high-temperature applications such as gas turbines and industrial furnaces are expected to accelerate the market growth. The presence of established manufacturers and ongoing technological advancements in fiber production also contribute to the positive market outlook for North America.

Regulatory Frameworks

- The Occupational Safety and Health Administration (OSHA) Permissible Exposure Limits (PELs) set maximum allowable concentrations for airborne substances, including ceramic fibers, to protect workers' health. These limits require employers to implement safety measures such as respiratory protection, ventilation, and monitoring to minimize exposure to hazardous materials.

- The REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) requires manufacturers and importers to register chemical substances used in products, including ceramic fibers, with the European Chemicals Agency (ECHA).

- The Clean Air Act (CAA) regulates air emissions from stationary and mobile sources to protect public health and the environment. It sets limits on the release of pollutants, including particulates from industrial processes like ceramic fiber production.

- The (International Organization for Standardization) ISO 18729:2017 specifies the requirements for Refractory Ceramic Fibers (RCF) used in industrial applications, including their classification, physical properties, and safety precautions.

Competitive Landscape

The global ceramic fibers market is characterized by several participants, including established corporations and rising organizations. Key industry participants are investing in research and development to innovate and produce advanced, bio-soluble, and environmentally sustainable ceramic fiber solutions, in response to increasingly stringent health and safety regulations.

Companies are also expanding their geographic reach into emerging markets, where industrial growth is driving the demand for high-performance insulation materials.

Furthermore, the competitive environment is shaped by strategic mergers, acquisitions, and partnerships aimed at enhancing manufacturing capabilities, broadening product offerings, and strengthening market presence across sectors such as aerospace, automotive, and energy.

- In December 2023, the Cerame-Unie President officially launched the Ceramic Manifesto 2024-2029 during the public conference and in the presence of the European Commission, trade unions, research and industry representatives. Ceramics are essential in many value chains to deliver on the European Green Deal.

List of Key Companies in Ceramic Fibers Market:

- Morgan Advanced Materials

- IBIDEN

- NUTEC Incorporated

- Alkegen

- HWI

- Isolite Insulating Products Co., Ltd.

- YESO INSULATING PRODUCTS COMPANY LIMITED

- Rath-Group

- ZIRCAR Ceramics

- THERMOST THERMTECH CO., LTD.

- General Insulation Company.

- Luyang Energy-saving Materials Co.

- FibreCast Inc.

- pyrotek

- CeramSource

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In November 2024, NUTEC Inc. made a substantial investment in the expansion of its U.S. headquarters in Huntersville, North Carolina. The expansion includes the opening of a new production facility, which will increase manufacturing capacity and improve logistical capabilities for the North American market.

- In October 2024, IWC Schaffhausen and the German Aerospace Center (DLR) partnered to explore the use of fiber-reinforced ceramics for watch cases and new applications in space. This collaboration aims to leverage advanced materials developed by DLR for use in the high-performance, precision-engineered components of IWC's timepieces.

- In July 2024, Goodman Technologies announced its partnership with ECM Engineered Materials GmbH for advanced ceramic materials. Their combined expertise in engineering, design, and manufacturing with advanced materials enables them to meet the most extreme requirements, whether on the ground, in the air, or in space.

- In February 2024, the Mitsubishi Chemical Group announced that it developed a high heat-resistant Ceramic Matrix Composite (CMC) using pitch-based carbon fibers. Providing heat resistance as high as 1,500 °C, the CMC is expected to be used mainly for space industry applications.