Market Definition

The market comprises the global production, distribution, and sale of fibers derived from natural sources such as wood, cotton, and other plant materials. These biodegradable and renewable fibers are primarily used in textiles, non-woven fabrics, and industrial applications, offering an eco-friendly alternative to synthetic fibers in various sectors including apparel, hygiene products, and home furnishings.

The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Cellulose Fiber Market Overview

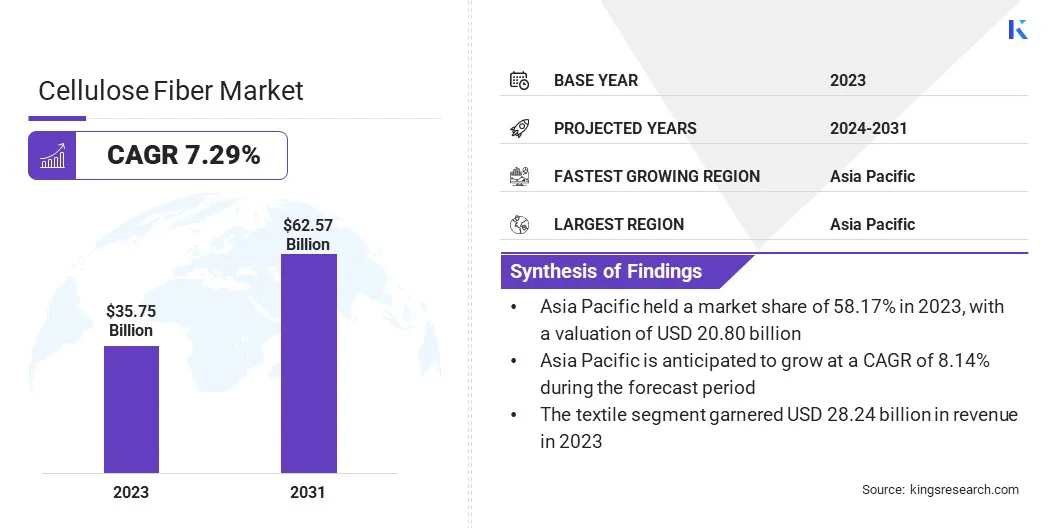

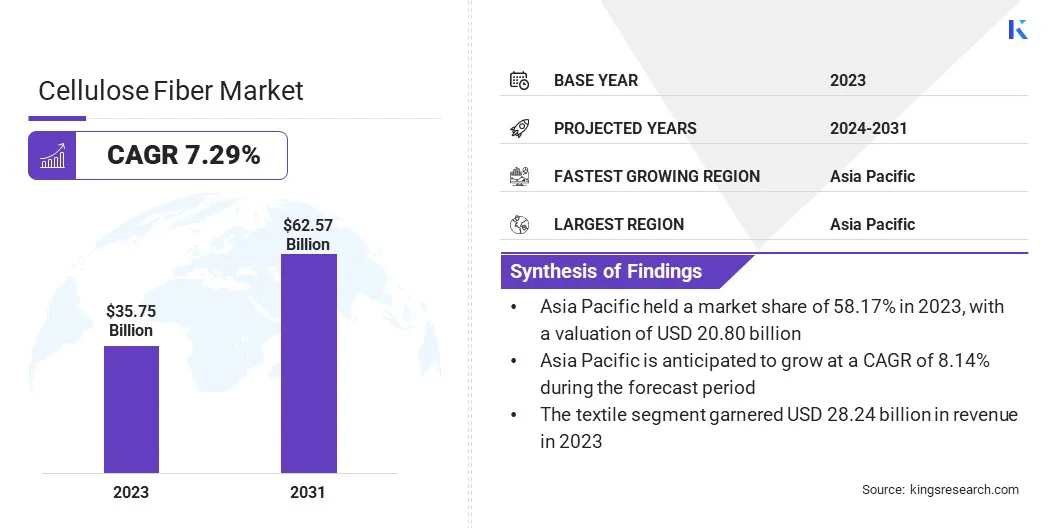

The global cellulose fiber market size was valued at USD 35.75 billion in 2023 and is projected to grow from USD 38.17 billion in 2024 to USD 62.57 billion by 2031, exhibiting a CAGR of 7.29% during the forecast period.

The market is growing rapidly, driven by the rising demand for sustainable textiles, expanding non-textile applications, and technological advancements that enhance fiber performance.

Major companies operating in the cellulose fiber industry are LENZING AG, Aditya Birla Management Corporation Pvt. Ltd., sateri, Södra, Kelheim Fibres GmbH, Eastman Chemical Company, HI-TECH HEAVY INDUSTRY CO., LTD., Tangshan Sanyou Xingda Chemical Fiber CO.Ltd, CFF GmbH & Co. KG, Daicel Corporation., Fulida Group Holding Co., Ltd, Sappi, Nabco Microtech, Oji Holdings Corporation, and Wuxi Lvjian Technology Co., Ltd.

The market is experiencing significant growth due to the increasing demand for sustainable and eco-friendly textiles. As consumers and industries prioritize environmental responsibility, there is a marked shift toward biodegradable and renewable materials. This demand is further supported by stricter regulations and a heightened focus on sustainability across the global supply chain.

In response to the surging demand for sustainable and eco-friendly textiles, businesses are strategically aligning their operations and product development with cellulose fiber innovations to enhance brand value, comply with environmental regulations, and gain a competitive edge in an increasingly sustainability-driven global market.

- In October 2024, Lenzing Group acquired a minority stake in TreeToTextile AB, alongside shareholders LSCS Invest, H&M Group, Stora Enso, and Inter IKEA Group. The partnership aims to speed up the development of TreeToTextile’s renewable cellulose fiber.

Key Highlights:

Key Highlights:

- The cellulose fiber industry size was recorded at USD 35.75 billion in 2023.

- The market is projected to grow at a CAGR of 7.29% from 2024 to 2031.

- Asia-Pacific held a market share of 58.17% in 2023, with a valuation of USD 20.80 billion.

- The natural cellulose fibers segment garnered USD 22.07 billion in revenue in 2023.

- The textile segment is expected to reach USD 46.21 billion by 2031.

- The healthcare & personal care segment is anticipated to witness the fastest CAGR of 9.29% during the forecast period

- Middle East & Africa is anticipated to grow at a CAGR of 7.50% during the forecast period.

Market Driver

"Expanding applications of cellulose fibers in non-textile industries"

The cellulose fiber market is experiencing significant growth due to the expanding applications of cellulose fibers in non-textile industries. These fibers are increasingly utilized in sectors like automotive, packaging, and medical products, driven by their biodegradable and sustainable properties.

As industries move toward eco-friendly alternatives to synthetic materials, cellulose fibers are gaining popularity for their versatility and performance. Their integration into nonwoven fabrics, composites, and coatings offers manufacturers opportunities to diversify product portfolios, meet sustainability goals, and access emerging markets seeking green materials.

- In November 2024, Lenzing expanded its LENZING Lyocell Dry fiber portfolio with two innovative cellulosic fiber types, fine and coarse. They offer enhanced strength, softness, and fluid management. These biodegradable, wood-based fibers enable applications in hygiene products such as diapers and sanitary pads.

Market Challenge

"Fluctuating raw material prices"

Fluctuating raw material prices, particularly for wood pulp and cotton, present a significant challenge in the cellulose fiber market. These price variations disrupt cost structures, reduce profitability for manufacturers.

To overcome this challenge, companies are diversifying their supplier base, investing in long-term contracts to stabilize costs, and exploring alternative sustainable raw materials.

Additionally, integrating digital supply chain solutions is enhancing forecasting and procurement strategies, enabling businesses to manage risks more effectively and maintain operational resilience.

Market Trend

"Technological Advancements in Fiber Production"

Technological advancements in fiber production are significantly enhancing the quality, performance, and application range of cellulose fibers. Innovations such as improved spinning techniques, molecular-level customization, and advanced tracing technologies are enabling the development of fibers with superior strength, softness, and environmental benefits.

These developments are expanding their use beyond textiles into sectors like automotive, hygiene, and home furnishings.

- In June 2024, LENZING AG entered into a global partnership with Diane von Furstenberg (DVF) to incorporate LENZING’s sustainable ECOVERO and TENCEL fibers into DVF’s fashion collections and accessories. These environmentally friendly fibers are sourced from responsibly managed wood. They will be integrated across DVF’s product range and made available through the brand’s global online and retail outlets.

Cellulose Fiber Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Natural Cellulose Fibers (Cotton, Jute, Flax, Hemp, Others), Regenerated Cellulose Fibers (Viscose, Modal, Lyocell, Others)

|

|

By Application

|

Textile (Apparel, Home Textiles, Industrial Textiles), Non-Textile (Hygiene & Personal Care, Medical, Automotive, Paper and Pulp, Packaging, Filtration, Others)

|

|

By End-Use Industry

|

Textile & Apparel, Healthcare & Personal Care, Paper & Packaging, Automotive, Construction, Food & Beverage ,Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Natural Cellulose Fibers, Regenerated Cellulose Fibers): The natural cellulose fibers segment earned USD 22.07 billion in 2023 due to increasing consumer demand for sustainable, biodegradable materials in various industries, particularly textiles and packaging.

- By Application (Textile, Non-Textile): The textile held 79.00% of the market in 2023, due to the growing demand for sustainable and eco-friendly fabrics, particularly in fashion and home textiles.

- By End-Use Industry (Textile & Apparel, Healthcare & Personal Care, Paper & Packaging, and Automotive, Construction, Food & Beverage, Others): The textile & Apparel segment is projected to reach USD 40.91 billion by 2031, owing to the increasing consumer preference for sustainable and eco-friendly fibers driven by growing environmental awareness and demand for responsible fashion.

Cellulose Fiber Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific cellulose fiber market share stood around 58.17% in 2023 in the global market, with a valuation of USD 20.18 billion. Asia Pacific dominates the market due to several key factors, including a robust raw material supply, cost-effective manufacturing capabilities, and a well-established textile industry.

Asia Pacific cellulose fiber market share stood around 58.17% in 2023 in the global market, with a valuation of USD 20.18 billion. Asia Pacific dominates the market due to several key factors, including a robust raw material supply, cost-effective manufacturing capabilities, and a well-established textile industry.

The region benefits from strong government support, rising domestic demand for sustainable products, and a large consumer base. Additionally, rapid industrialization, increasing environmental awareness, and growing investments in sustainable fiber technologies further strengthen its market position.

- In June 2023, Birla Cellulose launched Birla SaFR at ITMA 2023 in Milan. This phosphate-based, inherently flame-retardant sustainable cellulosic fiber is designed for the technical textile industry, offering high-performance flame resistance and eco-friendly attributes, aligning with the company’s strategy to expand into advanced textile applications.

The cellulose fiber industry in the Middle East & Africa is poised for significant growth at a robust CAGR of 7.50% over the forecast period. The market in the Middle East and Africa is driven by increasing demand for sustainable and eco-friendly materials across various industries, including textiles, packaging, and automotive.

As environmental regulations tighten and consumer awareness of sustainability rises, manufacturers in the region are seeking greener alternatives to traditional synthetic fibers.

Additionally, the expanding textile and packaging sectors, along with strategic investments in eco-friendly technologies, are boosting market growth. The availability of raw materials and growing industrial infrastructure further support the adoption of cellulose fibers in the region.

Regulatory Framework

- In the U.S., the market is governed by federal and state agencies, with the Environmental Protection Agency (EPA) setting standards for pulp and paper production and waste management. The Food and Drug Administration (FDA) also regulates cellulose in food products.

- In India, the Ministry of Textiles oversees policy formulation, promotion, and regulation of the textile sector including cellulose fibers, while the Bureau of Indian Standards (BIS) establishes quality and safety standards for textile products made from cellulose-based materials.

- In China, the Ministry of Commerce (MOFCOM) plays a crucial role in regulating the market, overseeing industry standards, and trade policies, and ensuring compliance with both domestic and international regulations.

Competitive Landscape

The cellulose fiber industry is characterized by a large number of participants, including both established corporations and rising organizations. Key players are leveraging initiatives such as mergers and acquisitions, alongside new product launches, to stay competitive in the market.

They are also focusing on launching new cellulose fiber products and increasing production capacities to solidify their standing in the global arena. These actions are part of a broader effort to remain competitive and responsive to the rapidly evolving trends within the textile and materials sector.

These strategies are essential in positioning companies to capitalize on emerging opportunities and strengthen their competitive advantage in the market.

- In October 2024, Birla Cellulose, a unit of Grasim Industries Limited, formed a strategic partnership with U.S.-based Circ to advance fiber recycling in the textile sector. As part of the agreement, Birla Cellulose will annually procure up to 5,000 tons of pulp from Circ’s first commercial facility for five years, converting it into lyocell staple fiber to increase recycled material usage.

List of Key Companies in Cellulose Fiber Market:

- LENZING AG

- Aditya Birla Management Corporation Pvt. Ltd.

- sateri

- Södra

- Kelheim Fibres GmbH

- Eastman Chemical Company

- HI-TECH HEAVY INDUSTRY CO., LTD.

- Tangshan Sanyou Xingda Chemical Fiber CO., Ltd

- CFF GmbH & Co. KG

- Daicel Corporation.

- Fulida Group Holding Co., Ltd

- Sappi

- Nabco Microtech

- Oji Holdings Corporation

- Wuxi Lvjian Technology Co., Ltd

Recent Developments

- In December 2024, ANDRITZ opened a modern technical center in Montbonnot, France, focused on advancing Dry Molded Fiber (DMF) technology for sustainable packaging. Developed in partnership with PulPac, the facility includes a pilot line for R&D, product trials, and customized designs. This initiative enhances ANDRITZ’s role in eco-friendly packaging.

- In June 2024, Eastman launched Naia Renew at the Denim Première Vision exhibition. Made from 40% certified recycled content and 60% sustainably sourced wood pulp, this hypoallergenic cellulosic acetate fiber offers enhanced softness, moisture control, and odor management.

Key Highlights:

Key Highlights: Asia Pacific cellulose fiber market share stood around 58.17% in 2023 in the global market, with a valuation of USD 20.18 billion. Asia Pacific dominates the market due to several key factors, including a robust raw material supply, cost-effective manufacturing capabilities, and a well-established textile industry.

Asia Pacific cellulose fiber market share stood around 58.17% in 2023 in the global market, with a valuation of USD 20.18 billion. Asia Pacific dominates the market due to several key factors, including a robust raw material supply, cost-effective manufacturing capabilities, and a well-established textile industry.