Enquire Now

Cell Culture Media Market Size, Share, Growth & Industry Analysis, By Product (Serum-Free Media, Classical Media, Stem Cell Culture Media, Pluripotent Stem Cells, Others), By Type (Liquid Media, Semi-solid and Solid Media), By Application, By End User, and Regional Analysis, 2025-2032

Pages: 200 | Base Year: 2024 | Release: September 2025 | Author: Versha V.

Key strategic points

Cell culture media are nutrient-rich solutions that support the growth and maintenance of cells under controlled conditions. They contain essential amino acids, vitamins, minerals, and growth factors required for cell survival and proliferation.

They are widely used in research, biopharmaceutical production, tissue engineering, and regenerative medicine, with applications in vaccine development, monoclonal antibody production, drug screening, and immunology studies. Key end users include pharmaceutical companies, diagnostic laboratories, and academic institutes.

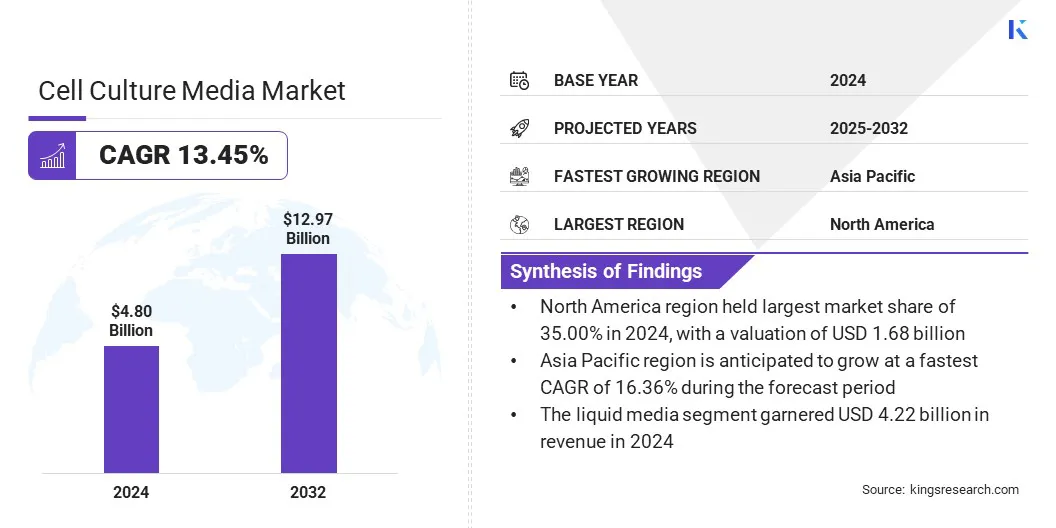

The global cell culture media market size was valued at USD 4.80 billion in 2024 and is projected to grow from USD 5.36 billion in 2025 to USD 12.97 billion by 2032, exhibiting a CAGR of 13.45% during the forecast period.

This growth is driven by the expansion of biologics manufacturing capacity to meet the rising demand for advanced therapies, including antibody-drug conjugates, monoclonal antibodies, and vaccines. AI-powered solutions are enabling the development of animal-free culture media, ensuring ethical, scalable, and consistent formulations tailored for specialized applications.

Major companies operating in the cell culture media market are Thermo Fisher Scientific Inc., Merck KGaA, Danaher Corporation, Lonza Group Ltd., Corning Incorporated, FUJIFILM Corporation, Sartorius AG, BD, Avantor, Inc., STEMCELL Technologies, HiMedia Laboratories, PromoCell, Bio-Rad Laboratories, Inc., Takara Bio Inc., and MP Biomedicals.

Market growth is propelled by the increasing adoption of single-use technology systems designed to automate and streamline the hydration of media, feeds, and buffers. These systems reduce process complexity, minimize contamination risk, and enhance operational efficiency in biopharmaceutical manufacturing.

They enable faster preparation cycles and support flexible production environments required for scaling advanced therapies. Single-use systems also lower cleaning requirements and associated costs, making them a strategic solution for improving productivity and maintaining quality standards in large-scale operations.

Expansion of Biologics Manufacturing Capacity

The growth of the market is fueled by increasing investments in biologics manufacturing to address the rising demand for advanced therapies. Pharmaceutical and biotechnology companies are allocating significant resources to develop infrastructure for next-generation biologics, including potent antibody-drug conjugates (ADCs), therapeutic proteins, and cell-based therapies.

These biologics require precise and high-quality culture media to ensure scalability, consistency, and compliance during production. The expansion of large-scale manufacturing facilities globally is generating strong demand for specialized media formulations tailored for biopharmaceutical production.

High Cost of Specialized Components

A major challenge hindering the expansion of the cell culture media market is the high cost of specialized components such as growth factors, hormones, and recombinant proteins. While essential for cell proliferation and viability, their production and purification significantly increase overall manufacturing expenses.

This cost burden limits affordability for small-scale research labs and emerging biopharmaceutical companies. To address this issue, manufacturers are investing in recombinant technology, process optimization, and scalable production systems to lower component costs and ensure consistent quality. Companies are also focusing on developing cost-effective formulations without compromising performance.

Rising Adoption of AI-Powered Solutions

The market is witnessing a notable trend toward the adoption of artificial intelligence for the development of animal-free culture media. AI-driven platforms are being utilized to design formulations that eliminate the use of fetal bovine serum while maintaining optimal cell growth and functionality.

This approach accelerates the formulation process, reduces development costs, and enables customization for specific cell types. The trend aligns with the growing demand for ethical, consistent, and scalable media solutions, particularly for biopharmaceutical production and cultivated meat applications.

|

Segmentation |

Details |

|

By Product |

Serum-Free Media (CHO Media, BHK Medium, Vero Medium, HEK 293 Media, Insect Cell Media, Others), Classical Media, Stem Cell Culture Media (Mesenchymal Stem Cells (MSCs), Hematopoietic Stem Cells (HSCs), Induced Pluripotent Stem Cells (iPSCs), Others), Pluripotent Stem Cells, Immunology Media (T Cells, B Cells, Natural Killer (NK) Cells, Others), Specialty Media, Chemically Defined Media, Others |

|

By Type |

Liquid Media, Semi-solid and Solid Media |

|

By Application |

Biopharmaceutical Production (Monoclonal Antibodies, Vaccine Production, Others), Diagnostics, Drug Screening and Development, Tissue Engineering and Regenerative Medicine, Research, Others |

|

By End User |

Pharmaceutical & Biotechnology Companies, Hospitals & Diagnostic Laboratories, Research & Academic Institutes, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

|

|

South America: Brazil, Argentina, Rest of South America |

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America cell culture media market share stood at 35.00% in 2024, valued at USD 1.68 billion. This dominance is reinforced by its well-established healthcare infrastructure and advanced research facilities.

Strong capabilities in biopharmaceutical production and the presence of leading research institutes have accelerated the adoption of cell culture media in large-scale manufacturing and clinical applications. Continuous advancements in biologics and cell-based therapies further reinforce the region’s leading position.

Asia Pacific is poised to grow at a significant CAGR of 16.36% over the forecast period. This growth is attributed to substantial investments in biopharmaceutical manufacturing and the launch of new product lines by key industry players.

Countries in the region are witnessing increased funding for advanced research and development activities, which is creating a strong demand for specialized media formulations. Expansion of regional production facilities and strategic partnerships by global companies further contributes to the rapid regional market growth.

Key players in the global cell culture media market are expanding their geographic presence and enhancing production capacity through the establishment of new facilities. Companies are developing large-scale manufacturing plants in strategically selected locations to meet regional demand and minimize reliance on centralized operations.

These facilities incorporate advanced automation and modular designs to improve operational efficiency and maintain consistent product quality. Organizations are also building regional production hubs to ensure localized supply, accelerate distribution, and support the increasing biopharmaceutical and research activities in high-growth markets.

Frequently Asked Questions