Market Definition

Cargo drones are unmanned aerial systems designed to autonomously transport goods through the air, bypassing traditional road networks. These vehicles are typically equipped with advanced navigation, sensing, and payload systems to ensure efficient and reliable aerial delivery.

The market spans industries including retail, healthcare, agriculture, logistics, and defense, serving applications such as last-mile delivery, medical supply transport, warehouse automation, and middle-mile freight. Organizations are deploying cargo drones to enhance delivery speed, reduce operational costs, and overcome geographic limitations.

Cargo Drones Market Overview

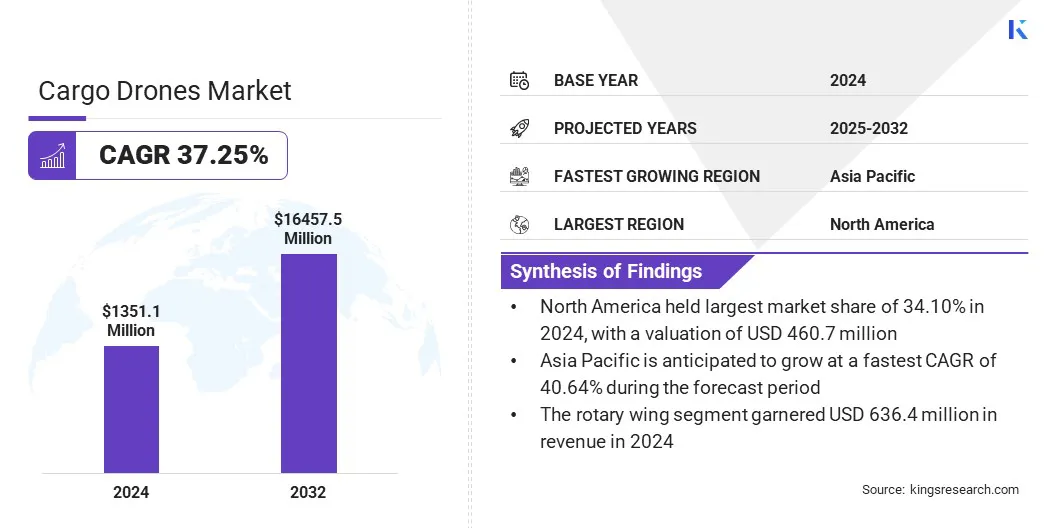

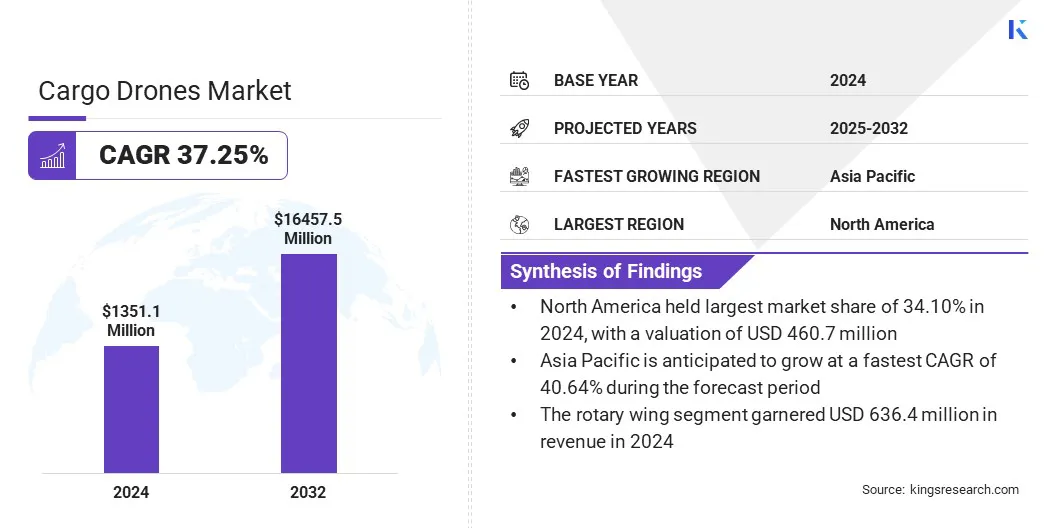

The global cargo drones market size was valued at USD 1,351.1 million in 2024 and is projected to grow from USD 1,794.0 million in 2025 to USD 16,457.5 million by 2032, exhibiting a CAGR of 37.25% over the forecast period.

The growth of the market is driven by rising adoption in defense and humanitarian applications, where drones are used for rapid resupply and delivery to remote or crisis-affected regions. In addition, advancements in autonomous navigation and artificial intelligence integration are enhancing reliability, enabling safer long-range and complex logistics operations.

Key Highlights

- The cargo drones industry size was valued at USD 1,351.1 million in 2024.

- The market is projected to grow at a CAGR of 37.25% from 2025 to 2032.

- North America held a market share of 34.10%in 2024, with a valuation of USD 460.7 million.

- The rotary wing segment garnered USD 636.4 million in revenue in 2024.

- The fully autonomous segment is expected to reach USD 8,246.5 million by 2032.

- The 150 Km to 650 Km segment secured the largest revenue share of 31.64% in 2024.

- The above 50 kg is poised for a robust CAGR of 41.37% through the forecast period.

- The retail and e-commerce segment secured the largest revenue share of 32.32% in 2032.

- Asia Pacific is anticipated to grow at a CAGR of 40.64% over the forecast period.

Major companies operating in the cargo drones market are DJI, AeroVironment, Inc., Elroy Air, Yates Electrospace Corporation, Dronamics Group Limited., Sabrewing Aircraft Company, Dufour Aerospace, PteroDynamics Inc., Zipline International Inc., Wingcopter GmbH, Matternet Inc., Windracers Ltd, Pyka Inc., Amber Wings, and Natilus.

Rising online retail activity is fueling the need for fast and cost-efficient delivery solutions, thereby driving the growth of the market. Increasing consumer expectations for same-day and next-day delivery are encouraging logistics companies to adopt drone-based transportation. Growing congestion in urban areas is further driving the adoption of drones to reduce delivery time and ensure efficiency in last-mile logistics.

Expanding cross-border e-commerce trade is creating demand for scalable aerial solutions that can handle medium to long-range deliveries. Rising investment from retail and logistics players in drone technology is strengthening the commercial adoption of cargo drones. Growing focus on cost optimization and reduced environmental footprint in the logistics sector is further accelerating demand for drone-based cargo delivery solutions.

- In Jun 2025, Walmart expanded drone delivery to 100 more U.S. stores across metro areas such as Atlanta, Charlotte, Houston, Orlando, and Tampa. These drones can carry up to 5 lb and deliver orders in under 19 minutes, with a goal to reduce delivery time further to 15 minutes.

Market Driver

Adoption in Defense & Humanitarian Applications

Military supply chains and emergency relief operations increasingly using drones for secure and timely delivery of critical supplies are driving the growth of the cargo drones market. Rising demand for rapid transport of medical aid, food, and equipment in disaster-hit or remote regions is encouraging the use of drone-based logistics.

- In June 2025, the Indian Army deployed custom-built drones to deliver critical supplies, such as rations and medical provisions, to isolated villagers in Arunachal Pradesh’s Dibang Valley, India, following floods and landslides. The drones enabled rapid delivery to inaccessible areas with an innovative rope-line cable system to facilitate ongoing logistics.

Increasing focus on minimizing risks to human personnel in conflict zones is strengthening the adoption of unmanned aerial cargo solutions. Rising partnerships between defense agencies and drone manufacturers are advancing the development of heavy-lift cargo drones. Increasing emphasis on resilient and flexible logistics networks during crises is further supporting the integration of cargo drones in humanitarian and defense applications.

Market Challenge

Limited Payload Capacity Limits Market Growth

A key challenge in the cargo drones market is the limited payload capacity of current drone models, which restricts their use to lightweight goods. This limitation reduces the scope of adoption in industries that require the transportation of bulk materials or heavy cargo. Additionally, payload constraints affect operational efficiency and limit the ability of drones to compete with conventional logistics modes for larger shipments.

To address this challenge, market players are working on enhancing battery efficiency, integrating hybrid propulsion systems, and advancing structural materials to improve load-bearing capacity. These innovations are expanding the range of applications for cargo drones across logistics, healthcare, and industrial supply chains.

Market Trend

Autonomous Navigation & AI Integration

The cargo drones market is advancing with the adoption of AI-powered autonomous navigation systems that minimize the need for manual control. These systems combine computer vision, machine learning, and real-time sensor data to support precise route planning, obstacle avoidance, and adaptive decision-making during flight.

By enabling drones to operate safely in dynamic environments, such as urban airspaces or remote regions, AI integration is improving reliability and reducing operational risks.

- In August 2025, Elroy Air showcased the Chaparral hybrid-electric vertical take-off and landing (hVTOL) cargo drone through full autonomous transition from vertical takeoff to wingborne forward flight at speeds up to 70 mph. The Chaparral is designed to autonomously transport 300 pounds over distances of 300 miles. The flight demonstrated the aircraft's advanced autonomous flight control systems, including seamless transitions between flight modes.

Cargo Drones Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Fixed Wing, Rotary Wing, Hybrid

|

|

By Automation Level

|

Fully Autonomous, Semi-Autonomous, Remotely Controlled

|

|

By Range

|

Up to 50 Km, 50 Km to 149 Km, 150 Km to 650 Km, More than 650 Km

|

|

By Load Capacity

|

Less than 20 kg, 20 kg to 50 kg, Above 50 kg

|

|

By End User

|

Healthcare, Retail and E-Commerce, Infrastructure, Defence, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Fixed Wing, Rotary Wing, and Hybrid): The Rotary Wing segment earned USD 636.4 million in 2024 due to its ability to perform vertical take-off and landing in confined spaces and provide efficient short-range delivery in urban and remote environments.

- By Automation Level (Fully Autonomous, Semi-Autonomous, and Remotely Controlled): The Fully Autonomous segment held 41.37% of the market in 2024, due to its ability to reduce operational costs and enable long-range, efficient deliveries without constant human intervention.

- By Range (Up to 50 Km, 50 Km to 149 Km, 150 Km to 650 Km, and More than 650 Km): The 150 Km to 650 Km segment is projected to reach USD 5,764.4 million by 2032, owing to its ability to support regional logistics and cross-border deliveries that require greater range and payload efficiency than short-distance operations.

- By Load Capacity (Less than 20 kg, 20 kg to 50 kg, and Above 50 kg): The Above 50 kg segment is poised for significant growth at a CAGR of 41.37% through the forecast period, attributed to its ability to carry heavier payloads over longer distances, meeting the growing demand for industrial, defense, and long-range logistics applications.

Cargo Drones Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America cargo drones market share stood at 34.10% in 2024 in the global market, with a valuation of USD 460.7 million. This dominance is due to significant investments from the defense sector in drone-based resupply operations.

The U.S. Department of Defense is supporting the use of heavy-lift drones for transporting equipment, ammunition, and medical supplies. These projects are pushing forward advancements in drone endurance and payload capacity. The progress is benefiting the commercial cargo drone market through technology transfer.

- In June 2024, the U.S. Department of Defense’s Defense Innovation Unit announced that approximately 50% of its nearly USD 1 billion FY 2024 budget, totaling around USD 491 million, will be allocated to priority programs focused on autonomous air logistics and drone technologies.

The cargo drones industry in Asia Pacific is poised for a CAGR of 40.64% over the forecast period. This growth is due to the strong rise of e-commerce platforms that require efficient delivery systems across dense cities and rural zones. Online retailers are exploring drones to shorten delivery times in congested urban areas and underserved regions. Logistics companies are integrating drones into their distribution networks to cut operational costs.

- In July 2024, India’s logistics provider DTDC launched a drone delivery service in partnership with Skye Air Mobility. The service enables last-mile deliveries throuh drones over a 7.5 km route between Bilaspur and Gurgaon Sector 92, aiming to improve delivery speed and reduce road congestion in rapidly growing e-commerce areas.

Regulatory Frameworks

- In the U.S., the Federal Aviation Administration (FAA) governs cargo drone operations. Current rules allow drone flights under 400 feet, and operators must comply with the Remote Identification (Remote ID) requirement for digital tracking. Access to controlled airspace below this altitude is managed through the Low Altitude Authorization and Notification Capability (LAANC).

- In the UK, the Civil Aviation Authority (CAA) regulates drone operations under a risk-based framework. Operators must obtain a Flyer ID and Operator ID, which must be marked on the drone, and commercial operations require third-party liability insurance. Beyond Visual Line of Sight (BVLOS) operations are permitted under the Specific category with special authorizations, and new frameworks are under consultation.

- China regulates drones under a weight-based system overseen by the Civil Aviation Administration of China (CAAC). Drones under 1.5 kilograms are largely exempt from strict rules, while those up to 150 kilograms fall under civil aviation regulations. Agricultural drones up to 5,700 kilograms are covered by special provisions.

- The Japan Civil Aviation Bureau (JCAB), under the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), regulates drone use. All drones over 100 grams must be registered, display Remote ID, and follow strict flight rules. Flights in populated areas, at night, or beyond visual line of sight require special permission.

- In South Korea, the Ministry of Land, Infrastructure and Transport (MOLIT) enforces drone regulations. Drones must operate below 150 meters, within visual line of sight, and at least 9.3 kilometers away from airports. Commercial operators require a Remote Pilot Certificate (RPC) and additional authorization for carrying goods or operating in restricted areas.

Competitive Landscape

Major players in the cargo drones industry are adopting strategies such as securing regulatory certifications, advancing research and development, and forming strategic partnerships to remain competitive in the market. Companies are focusing on improving payload capacity and extending range to address the needs of cross-border and regional logistics. Firms are also entering collaborations with logistics providers to integrate drones into existing supply chains.

- In March 2024, Dronamics received European Union Aviation Safety Agency (EASA) approval for its Black Swan cargo drone. This fixed-wing drone offers a 350 kg payload and 2,500 km range, enabling inter-country freight across 11 European nations. The certification opens doors for expanded international logistics operations.

Key Companies in Cargo Drones Market:

- DJI

- AeroVironment, Inc.

- Elroy Air

- Yates Electrospace Corporation

- Dronamics Group Limited.

- Sabrewing Aircraft Company

- Dufour Aerospace

- PteroDynamics Inc.

- Zipline International Inc.

- Wingcopter GmbH

- Matternet Inc.

- Windracers Ltd

- Pyka Inc.

- Amber Wings

- Natilus

Recent Developments (Approval/Agreements/Product Launch)

- In August 2025, Grid Aero unveiled its Lifter-Lite cargo drone, named the pickup truck of the skies, capable of hauling thousands of pounds over thousands of miles. The company emerged from stealth with a U.S. Air Force contract and USD 6 million in seed funding.

- In July 2025, Amber Wings received Type Certification from India’s Directorate General of Civil Aviation (DGCA) for its ATVA-1 hybrid cargo drone. This allows Amber Wings to perform frequent last-mile drone deliveries using ATVA-1 across the country.

- In February 2025, Natilus announced that Nolinor Aviation will purchase multiple KONA blended-wing cargo aircraft. The KONA model is designed as a long-range freighter with a payload capacity of 3.8 tons, offering efficiency for regional and international cargo operations.

regional