Market Definition

Carbon offset refers to the reduction or removal of greenhouse gas (GHG) emissions, measured in metric tons of carbon dioxide equivalent (CO₂e), used to compensate for emissions produced by a specific activity. These offsets help balance emissions by funding or implementing projects that avoid or absorb GHG emissions, such as renewable energy, afforestation, and methane capture.

Carbon Offset Market Overview

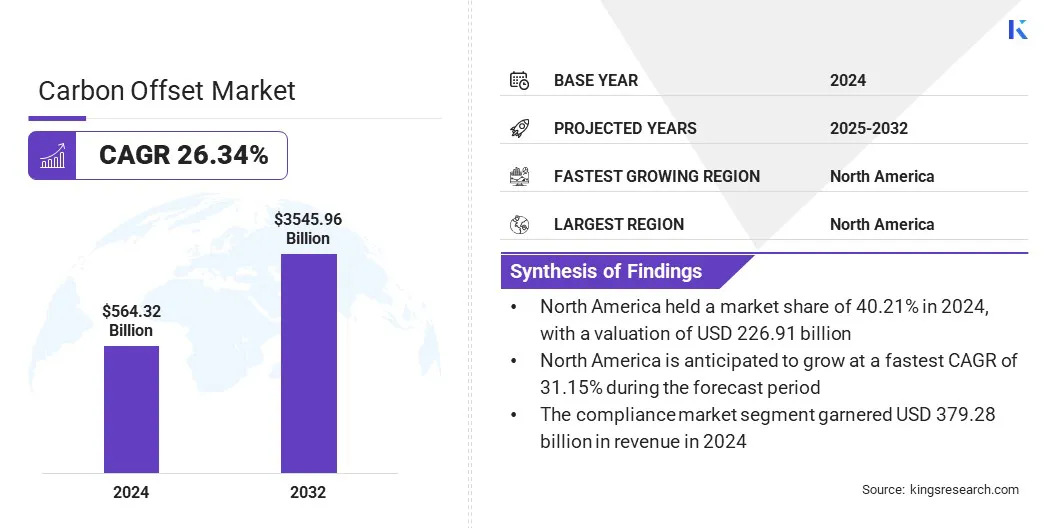

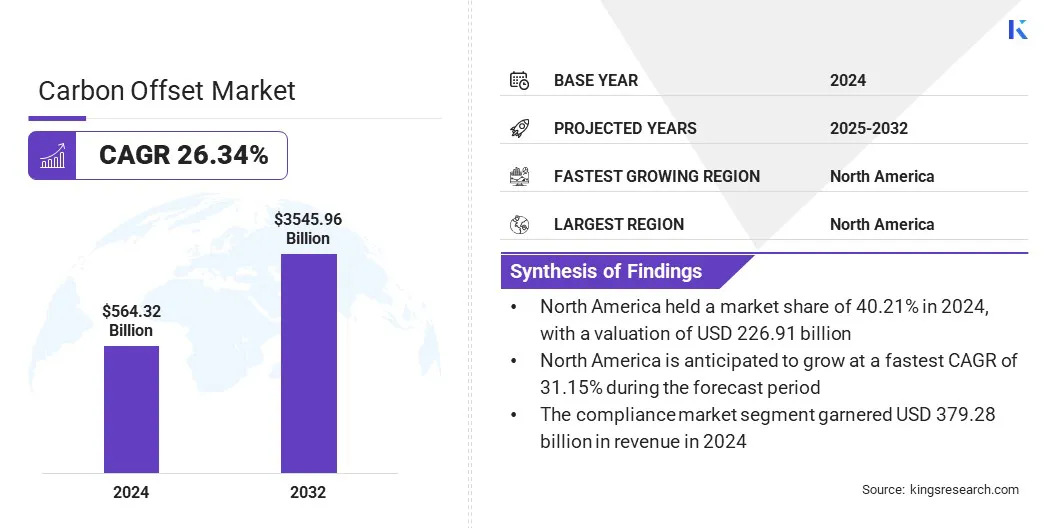

According to Kings Research, the global carbon offset market size was valued at USD 564.32 billion in 2024 and is projected to grow from USD 689.99 billion in 2025 to USD 3,545.96 billion by 2032, exhibiting a CAGR of 26.34% over the forecast period.

The market is driven by climate regulations and carbon pricing mechanisms that mandate emission reduction and encourage participation in offset programs. The market is further expanding due to the growing adoption of corporate net-zero commitments, which accelerate the demand for verified carbon credits.

Key Market Highlights:

- The carbon offset industry size was valued at USD 564.32 billion in 2024.

- The market is projected to grow at a CAGR of 26.34% from 2025 to 2032.

- North America held a market share of 40.21% in 2024, with a valuation of USD 226.91 billion.

- The compliance market segment garnered USD 379.28 billion in revenue in 2024.

- The avoidance/reduction projects segment is expected to reach USD 1,945.81 billion by 2032.

- The power & energy segment is anticipated to witness the fastest CAGR of 37.67% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 24.93% over the forecast period.

Major companies operating in the carbon offset market are EcoAct, Carbon Trust, ClimatePartner GmbH, Terrapass, atmosfair gGmbH, Carbon Footprint Ltd, KARBON-X, South Pole, Green Mountain Energy Company, EKI Energy Services Ltd, Climetrek, ClimeCo LLC, Finite Carbon Corporation, natureOffice, and CarbonBetter.

Government-backed frameworks are driving the market by creating structured platforms that encourage the industrial adoption of emission-neutral practices. These mechanisms promote investment in cleaner operations, support regulatory compliance, and increase access to carbon credit systems, thereby strengthening demand and accelerating the adoption of carbon offsets.

- In October 2024, the Bureau of Energy Efficiency (BEE) introduced a carbon offset mechanism to support emission reductions in India. This mechanism enables companies to invest in projects that generate carbon credits, helping them compensate for their greenhouse gas emissions and meet regulatory compliance targets.

Market Driver

Government Climate Regulations & Carbon Pricing

A major factor propelling the growth of the market is the growing implementation of government climate regulations and carbon pricing mechanisms. Policies such as emission caps, carbon taxes, and compliance frameworks are encouraging organizations to adopt cleaner practices and offset residual emissions.

These regulatory pressures are prompting industries to invest in carbon offset projects as a cost-effective strategy to meet legal obligations. This growing focus on transparent and measurable climate action is encouraging investment in certified offset projects, accelerating market growth.

- In 2024, the European Union (EU), through its Emissions Trading System (ETS), set the carbon allowance price at USD 70.07 per tonne. This pricing significantly increased the financial pressure on high-emitting industries, encouraging them to adopt cleaner technologies and invest in carbon offset projects to meet their emission reduction obligations.

Market Challenge

Lack of Standardization and Quality Control

A key challenge in the carbon offset market is the lack of standardization and quality control across offset verification frameworks. Certification organizations and registries use different methods to measure, report, and validate emission reductions. This inconsistency leads to variations in project assessment and carbon credit issuance, questioning the reliability and environmental impact of certain offsets.

To address this challenge, market players are improving transparency, adopting common standards, and strengthening verification practices. Project developers are aligning their offset reporting processes with globally recognized frameworks such as Verra’s VCS and the Gold Standard to ensure consistency and credibility.

Market players are increasing investment in monitoring and reporting technologies and engaging with independent third-party auditors to enhance accountability and ensure the environmental integrity of carbon offset projects.

Market Trend

Increased Role of Voluntary Carbon Markets (VCM)

A key trend in the market is the increasing role of voluntary carbon markets (VCM) in supporting corporate climate strategies. Companies are turning to VCM to access flexible and credible offset options that align with their emissions reduction efforts.

This trend prompts the development of high-quality carbon projects and boosts greater transparency and accountability in offset transactions. The expansion of VCM is enabling businesses to meet their sustainability goals more effectively and adopting broader participation across various sectors.

- In August 2024, TotalEnergies partnered with Anew Climate and Aurora Sustainable Lands to invest USD 100 million in Improved Forest Management (IFM) projects across 300,000 hectares in 10 U.S. states. The initiative focuses on preserving carbon sinks, supporting biodiversity, and generating carbon credits aligned with the U.S. Voluntary Carbon Market (VCM) Principles.

Carbon Offset Market Report Snapshot

|

Segmentation

|

Details

|

|

By Market Type

|

Compliance Market, Voluntary Market

|

|

By Project Type

|

Avoidance/Reduction Projects, Removal Projects

|

|

By End-Use Industry

|

Power & Energy, Industrial, Aviation & Transportation, Buildings, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Market Type (Compliance Market and Voluntary Market): The compliance market segment earned USD 379.28 billion in 2024, due to stringent emission regulations and mandatory participation in carbon trading schemes.

- By Project Type (Avoidance/Reduction Projects and Removal Projects): The avoidance/reduction projects segment held 66.45% of the market in 2024, due to lower costs and quicker implementation compared to removal solutions.

- By End-Use Industry (Power & Energy, Industrial, Aviation & Transportation, and Buildings): The industrial segment is projected to reach USD 1,280.79 billion by 2032, owing to rising emission liabilities and growing investment in decarbonization initiatives.

Carbon Offset Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America carbon offset market share stood at 40.21% in 2024, with a valuation of USD 226.91 billion. This dominance is attributed to large-scale investments and high-capacity project execution in the region.

Developers in North America are securing expansive land areas to implement afforestation projects that support sustained carbon sequestration. These projects align with the rising demand for removal-based credits and are enabling corporations to meet their emission reduction targets.

Additionally, the market is advancing in this region through proprietary in-house technologies, including patented data models and carbon modeling tools, which improve forest inventory collection and enhance the accuracy of sequestration estimates.

Companies in the region are also expanding specialized teams in regulation, land management, and project execution to meet the growing requirements for verified carbon credits, contributing to regional market expansion.

- In February 2025, Chestnut Carbon raised USD 160 million in a Series B funding round to expand afforestation projects across the U.S. and scale carbon removal efforts. The company aims to sequester 100 million tons of carbon through its Sustainable Restoration Project, generating Gold Standard verified carbon credits. The funding supports land acquisition, technology development, and talent expansion, enabling the company to meet growing demands from corporations committed to high-integrity carbon offsetting and net-zero goals.

Asia Pacific is set to grow at a robust CAGR of 24.93% over the forecast period. This growth is attributed to the increasing integration of carbon offsetting practices into logistics operations across the region.

Players are adopting full emission offset strategies for ocean freight transport. Logistics providers are embedding carbon offset mechanisms into core services, which encourages broader participation from clients seeking emissions-neutral shipping.

- In January 2024, NIPPON EXPRESS HOLDINGS launched a global carbon offset service for all ocean freight LCL (less-than-container-load) transport. The company plans to procure third-party-certified carbon credits, such as those under the Verified Carbon Standard (VCS), to offset all greenhouse gas emissions generated from LCL shipments without additional costs for customers. This initiative supports the firm’s climate action goals and demonstrates its approach to incorporating carbon offsetting within its logistics services.

Regulatory Frameworks

- In the U.S., the California Air Resources Board (CARB) oversees the market under the California Cap-and-Trade Program. It regulates offset protocols, project eligibility, emission reductions, and credit issuance. CARB ensures that offsets are additional, permanent, and verifiable, and enforces stringent standards to prevent fraud and double-counting in trading systems.

- In the UK, the Emissions Trading Scheme Authority (UK ETS Authority) oversees offset use in accordance with national policies. It monitors trading rules, offset limits, and ensures compliance with environmental integrity standards. The Authority evaluates offset mechanisms and restricts low-quality credits.

- In China, the Ministry of Ecology and Environment (MEE) regulates the national carbon sector, including offset mechanisms under the Chinese Certified Emission Reduction (CCER) program. MEE approves methodologies, registers projects, and supervises emission reductions to ensure integrity and alignment with national climate goals.

Competitive Landscape

Major players in the carbon offset market are expanding their presence through strategic partnerships. They are enhancing service portfolios to include greenhouse gas accounting and ESG reporting with tailored solutions for high-emission sectors such as aviation.

These efforts facilitate client access to sustainability services and streamline carbon credit trading processes. Additionally, firms are forming strategic collaborationsto expand client access, build regional presence, and offer targeted carbon offset services through established local partners.

- In 2024, EKI Energy Services Ltd. signed a representative agreement with U.S.-based Aviation Resource Group International (ARGI) to expand carbon credit trading and sustainability services in North America. The agreement supports carbon offset transactions, with a focus on the aviation sector.

Top Companies in Carbon Offset Market:

- EcoAct

- Carbon Trust

- ClimatePartner GmbH

- Terrapass

- atmosfair gGmbH

- Carbon Footprint Ltd

- KARBON-X

- South Pole

- Green Mountain Energy Company

- EKI Energy Services ltd

- Climetrek

- ClimeCo LLC

- Finite Carbon Corporation

- natureOffice

- CarbonBetter

Recent Developments (Product Launch/Expansion)

- In March 2025, Amazon launched a carbon credit service through its Sustainability Exchange to help net-zero committed companies access high-quality and science-based carbon credits. The service supports nature-based and technological decarbonization projects and requires participating firms to commit to rigorous emissions reporting and science-based reduction targets.

- In April 2024, South Pole and GenZero launched the Asia Centre of Carbon Excellence (ACCE) in Singapore to advance innovative carbon project development, policy, and market capacity-building across Asia. Supported by the Singapore Economic Development Board, the centre aims to accelerate regional decarbonization efforts and scale high-integrity carbon credit trading under Article 6 of the Paris Agreement.