Market Definition

Capsule endoscopy is a medical procedure used to visually examine the inside of the digestive tract, particularly the small intestine, using a small, swallowable capsule with a camera inside.

The capsule transmits images to an external recorder, allowing doctors to diagnose conditions like Crohn’s disease, gastrointestinal bleeding, and other disorders that may be difficult to detect using traditional endoscopic procedures.

The diiferent types of capsule endoscopy are small bowel capsule endoscopy, esophageal capsule endoscopy, colon capsule endoscopy. The report presents a comprehensive assessment of the primary drivers propelling the market, alongside a detailed examination of regional analysis and the competitive landscape impacting industry dynamics.

Capsule Endoscopy Market Overview

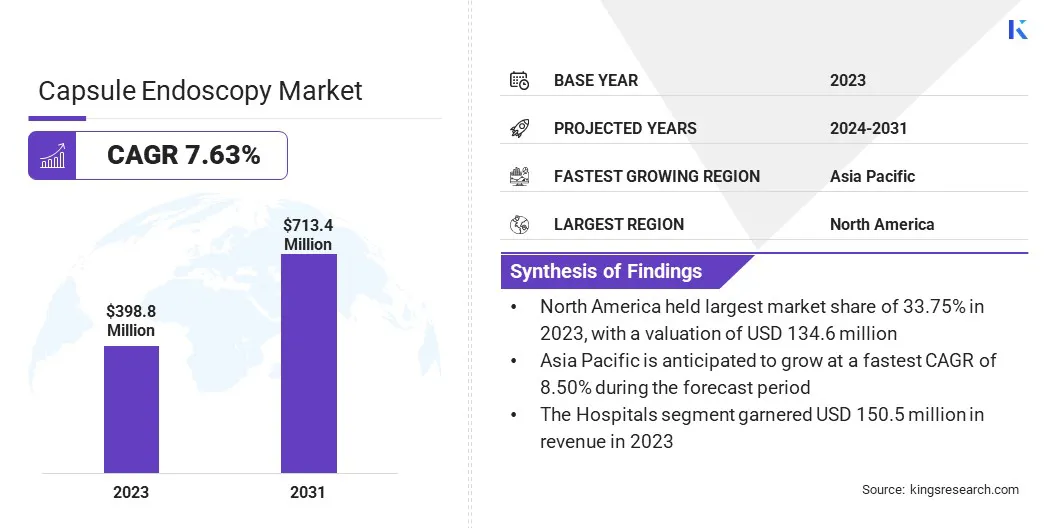

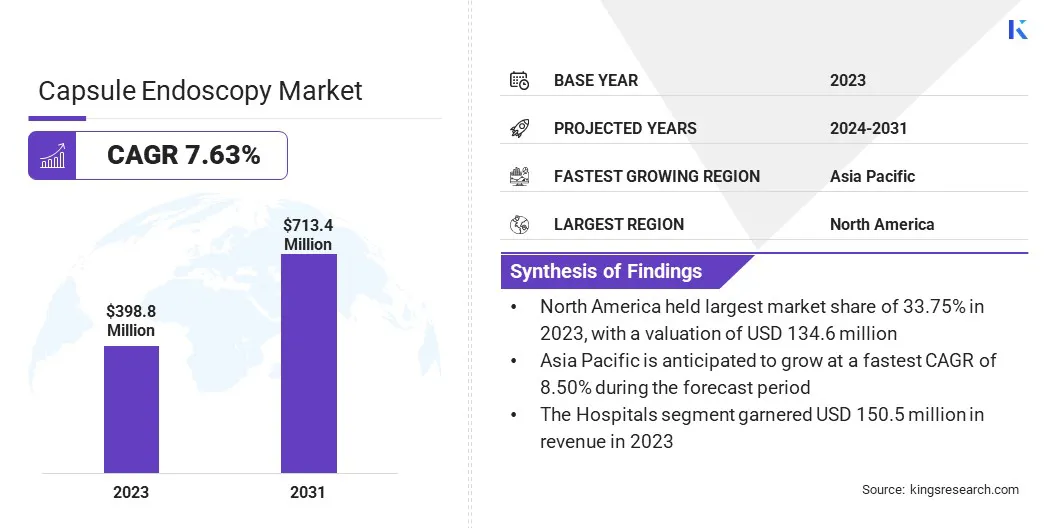

The global capsule endoscopy market size was valued at USD 398.8 million in 2023, which is estimated to be USD 426.4 million in 2024 and reach USD 713.4 million by 2031, growing at a CAGR of 7.63% from 2024 to 2031.

The rising incidence of gastrointestinal disorders, including Crohn’s disease, colorectal cancer, and gastrointestinal bleeding, is a major driver of the market, increasing the demand for advanced, non-invasive diagnostic tools.

Major companies operating in the capsule endoscopy industry are CapsoVision, Inc., Shangxian Minimal Invasive Inc, INTROMEDIC, Medtronic, Olympus America, AnX Robotics, JINSHAN Science & Technology (Group) Co., Ltd, Check-Cap, RF Co., Ltd., BioCam, Motilis Medica SA, and STERIS.

The market is expanding rapidly, due to the growing preference for minimally invasive diagnostic procedures. Capsule endoscopy is gaining traction as patients and healthcare providers prioritize non-invasive, safer, and more comfortable alternatives to traditional diagnostic methods.

This method offers an effective solution for visualizing the gastrointestinal tract without the need for incisions, driving adoption across hospitals, clinics, and diagnostic centers. The shift toward non-invasive technologies is fueling the market.

- In November 2024, Guam Regional Medical City (GRMC) introduced an advanced capsule endoscopy service, offering a minimally invasive solution for digestive health diagnostics. This new service, backed by a USDA Rural Development grant, enhances patient care by enabling convenient, non-invasive gastrointestinal imaging with remote telemedicine integration.

Key Highlights:

- The capsule endoscopy industry size was valued at USD 398.8 million in 2023.

- The market is projected to grow at a CAGR of 7.63% from 2024 to 2031.

- North America held a market share of 33.75% in 2023, with a valuation of USD 134.6 million.

- The small bowel capsule endoscopy segment garnered USD 137.3 million in revenue in 2023.

- The OGIB (Obscure GI Tract Bleeding) segment is expected to reach USD 264.1 million by 2031.

- The diagnostic laboratories segment is anticipated to register the fastest CAGR of 7.75% during the forecast period

- The market in Asia Pacific is anticipated to grow at a CAGR of 8.50% during the forecast period.

Market Driver

Rising Incidence of Gastrointestinal Disorders

The growing prevalence of gastrointestinal diseases, such as Crohn’s disease, colorectal cancer, and gastrointestinal bleeding, is significantly driving the demand for more advanced diagnostic tools like capsule endoscopy.

- According to the National Center for Health Statistics, 8.4 million visits to the emergency department were reported in 2023, with diseases of the digestive system as the primary diagnosis.

These conditions often require early detection and precise imaging for effective treatment. Capsule endoscopy offers a non-invasive, efficient alternative to traditional procedures like colonoscopies, providing detailed images of the digestive tract. Healthcare providers are increasingly adopting capsule endoscopy to improve patient care, diagnosis, and overall treatment outcomes.

- In May 2024, the FDA cleared the next-generation Medtronic PillCam solution suite, a significant advancement in capsule endoscopy technology. This approval enhances diagnostic capabilities for gastrointestinal disorders, offering improved imaging and a more efficient, patient-friendly approach to gastrointestinal (GI) health.

Market Challenge

Risk of Capsule Retention

The rare risk of capsule retention in the gastrointestinal tract can lead to complications for patients and concerns for doctors. This issue is uncommon however, it requires careful monitoring.

Advancements in capsule design, such as the use of dissolvable or more compact capsules, along with real-time tracking technologies, are being integrated to reduce retention risks. Improved patient screening and post-procedure follow-ups can further mitigate this challenge and ensure safer outcomes.

Market Trend

Home-based Diagnostics

A notable trend in the capsule endoscopy market is the rise of home-based diagnostics. Advancements in home-use technologies now enable patients to undergo capsule endoscopy procedures from the comfort of their own homes. This shift enhances accessibility, reduces hospital visits, and improves patient convenience.

Innovations in telemedicine integration and remote monitoring can enable healthcare providers to analyze the results in real time, ensuring accurate diagnostics and personalized care. This trend is transforming GI health management by offering a more patient-centric approach to diagnostics.

- In December 2024, Medtronic announced the successful first ingestion of its next-generation PillCam Genius SB Kit at the University of Miami Health System. This innovative kit enhances flexibility, enabling patients to undergo capsule endoscopy procedures either in clinical settings or remotely during telehealth appointments, improving accessibility and convenience for both patients and healthcare providers.

Capsule Endoscopy Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Small Bowel Capsule Endoscopy, Esophageal Capsule Endoscopy, Colon Capsule Endoscopy, Others

|

|

By Application

|

OGIB (Obscure GI Tract Bleeding), Crohn’s disease, Small Intestine tumor, Others

|

|

By End User

|

Hospitals, Diagnostic Laboratories, Specialty Clinics

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Small Bowel Capsule Endoscopy, Esophageal Capsule Endoscopy, Colon Capsule Endoscopy, Others): The small bowel capsule endoscopy segment earned USD 137.3 million in 2023, due to its effectiveness in diagnosing small intestine disorders.

- By Application [OGIB (Obscure GI Tract Bleeding), Crohn’s disease, Small Intestine tumor, and Others]: The OGIB (Obscure GI Tract Bleeding) segment held 37.37% share of the market in 2023, due to the increasing demand for accurate bleeding detection and diagnosis.

- By End User (Hospitals, Diagnostic Laboratories, Specialty Clinics): The hospitals segment is projected to reach USD 266.4 billion by 2031, owing to growing patient volumes and advanced diagnostic technologies.

Capsule Endoscopy Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a market share of around 33.75% in 2023, with a valuation of USD 134.6 million. North America is the dominating region in the capsule endoscopy market, driven by advanced healthcare infrastructure, high patient awareness, and a strong demand for non-invasive diagnostic solutions.

The U.S., in particular, is a key contributor to this growth, with increasing cases of gastrointestinal disorders and a high adoption rate of innovative technologies. Additionally, extensive research and development activities in the region, backed by leading healthcare companies and academic institutions, continue to drive growth and technological advancements in the market.

- In July 2024, research conducted by the Research Institute at Children’s Health Orange County (CHOC) and collaborators from UCI Medical Center and Chapman University focused on leveraging AI and diagnostic imaging to predict pediatric IBD outcomes, which aligns with advancements in capsule endoscopy technology for non-invasive gastrointestinal diagnostics.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 8.50% over the forecast period. Asia Pacific is the fastest-growing region for the market, fueled by the increasing prevalence of GI diseases and improving healthcare infrastructure.

Rising healthcare awareness, along with a growing demand for advanced diagnostic tools, is propelling the adoption of capsule endoscopy across countries like China, India, and Japan. Additionally, rapid advancements in technology, cost-effective solutions, and expanding access to healthcare services are contributing to the rapid growth of the market in Asia Pacific.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) ensures the safety, efficacy, and security of medical devices, including capsule endoscopy, which must receive FDA clearance or approval before being marketed.

- In the EU, capsule endoscopy devices must obtain a CE mark, signifying compliance with high safety, health, and environmental protection requirements, ensuring the product meets European standards for market approval.

Competitive Landscape:

Companies in the capsule endoscopy industry are focusing on enhancing patient convenience and diagnostic accuracy by developing innovative, user-friendly systems.

They are integrating advanced technologies like remote ingestion capabilities, improving image quality, and streamlining workflows to reduce patient discomfort. Additionally, companies are exploring ways to expand accessibility through telehealth solutions and reduce the need for in-person visits.

- In January 2025, CapsoVision's CapsoCam Plus capsule endoscopy system earned FDA clearance for remote ingestion, enhancing patient accessibility & comfort by enabling home-based procedures and eliminating the need for in-person clinic visits while ensuring high-quality diagnostic care.

List of Key Companies in Capsule Endoscopy Market:

- CapsoVision, Inc.

- Shangxian Minimal Invasive Inc

- INTROMEDIC

- Medtronic

- Olympus America

- AnX Robotics

- JINSHAN Science & Technology (Group) Co., Ltd

- Check-Cap

- RF Co., Ltd.

- BioCam

- Motilis Medica SA

- STERIS

Recent Developments (FDA Approval)

- In January 2025, CapsoVision received FDA clearance for its capsule endoscopy system for pediatric use. This approval allows young patients to undergo non-invasive, comfortable diagnostic procedures, improving accessibility, reducing stress, and eliminating the need for traditional equipment, making the process more child-friendly.

- In January 2024, AnX Robotica received FDA clearance for expanded indications of its NaviCam Small Bowel Video Capsule Endoscopy, now available for adults and children aged 2 years and above, enhancing diagnostic capabilities and introducing innovative visualization tools for improved patient care.