Market Definition

The market refers to the ecosystem of technologies that detect and measure changes in capacitance to sense proximity, position, humidity, fluid level, pressure, or touch.

These sensors operate based on the principle of capacitance change between conductive surfaces and are widely used across consumer electronics, automotive, healthcare, industrial automation, and aerospace sectors.

Capacitive sensors offer advantages such as high sensitivity, low power consumption, and resistance to environmental contaminants like dust and moisture. The report examines key driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the forecast period.

Capacitive Sensor Market Overview

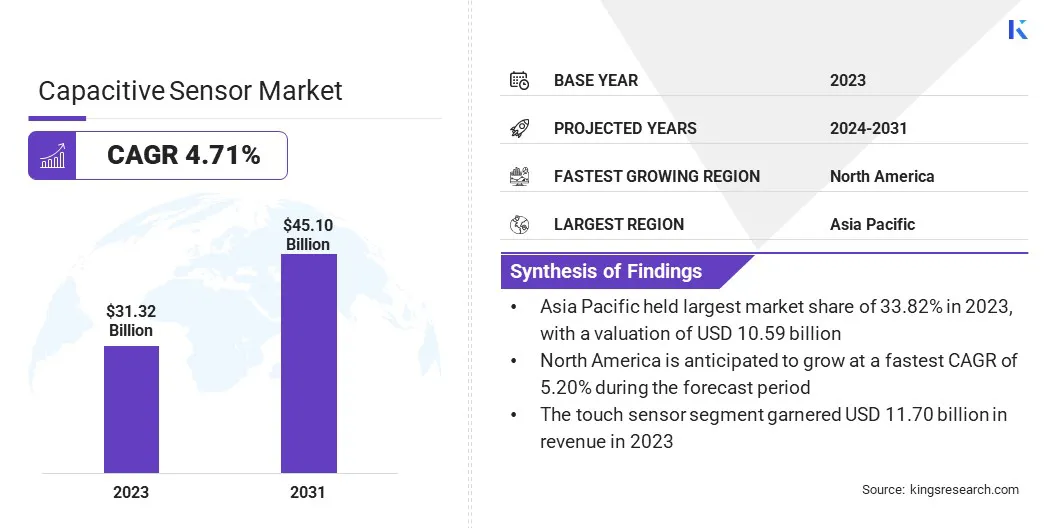

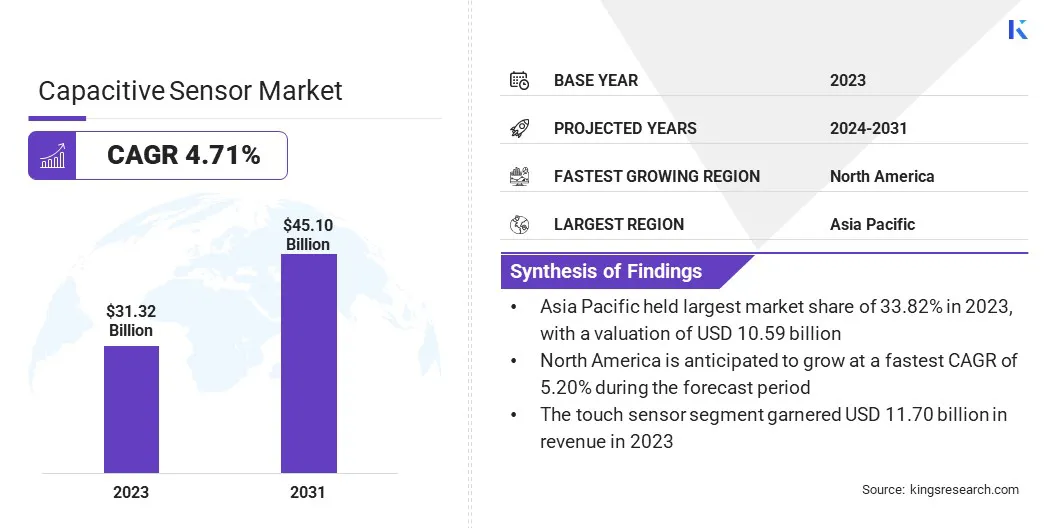

Global capacitive sensor market size was valued at USD 31.32 billion in 2023, which is estimated to be valued at USD 32.67 billion in 2024 and reach USD 45.10 billion by 2031, growing at a CAGR of 4.71% from 2024 to 2031.

The rise of IoT devices and automation is driving the demand for capacitive sensors. Capacitive sensors enable intuitive touchless controls, enhancing the user experience and promoting the widespread adoption of connected devices.

Major companies operating in the capacitive sensor industry are Analog Devices, Inc., Infineon Technologies AG, Microchip Technology Inc., MICRO-EPSILON MESSTECHNIK GmbH & Co. KG, OMRON Corporation, Renesas Electronics Corporation, Schneider Electric, Texas Instruments, Fujitsu, Pepperl+Fuchs (Pty) Ltd, Baumer, Touch Biometrix, Balluff GmbH, S.R.I Electronics, and RECHNER Industrie-Elektronik GmbH.

The market is experiencing strong growth due to the rising demand across industries such as consumer electronics, automotive, aerospace, and industrial automation. These sensors are valued for their high precision, non-contact measurement capabilities, and durability in harsh environments.

The shift toward smart devices and touch interfaces, along with the expansion of IoT and automation technologies, is driving adoption globally. Continued investment in advanced manufacturing, improved signal processing, and integration with AI-driven systems is further propelling market expansion.

- In September 2023, CoreMorrow launched a compact ultra-precision capacitive sensor capable of non-contact measurement with 1.25nm resolution. Designed for aerospace, automotive, and semiconductor applications, it features a Φ10mm×18.5mm probe, 0–500μm range, and a small, integrable control module.

Key Highlights:

- The capacitive sensor industry size was recorded at USD 31.32 billion in 2023.

- The market is projected to grow at a CAGR of 4.71% from 2024 to 2031.

- Asia Pacific held a market share of 33.82% in 2023, with a valuation of USD 59 billion.

- The touch sensor segment garnered USD 11.70 billion in revenue in 2023.

- The consumer electronics segment is expected to reach USD 10.38 billion by 2031.

- North America is anticipated to grow at a CAGR of 5.20% during the forecast period.

Market Driver

"Rise of Smart and IoT Devices"

The surge in IoT devices, and automation is a significant growth driver for the capacitive sensor market. As more devices become interconnected, capacitive sensors are increasingly used to facilitate seamless interaction through touchless or highly responsive interfaces.

In smart homes, they enable functions such as lighting control, security systems, and appliances that respond to proximity or touch. Additionally, capacitive sensors contribute to enhancing the user experience in wearables, robotics, and industrial automation, expanding the scope of connected, intelligent devices.

- In January 2023, Alps Alpine collaborated with StellarLink to develop the Add-on AirInput Panel for touchless operation via a USB connection. The panel uses high-sensitivity capacitive sensors for mid-air input, offering businesses a cost-effective, intuitive solution to enhance touchless functionality in various industries.

Market Challenge

"Constraints and Limitations in Design"

A significant challenge faced by the capacitive sensor market is the difficulty in detecting non-conductive or non-metallic materials, limiting their application in certain industries.

Since capacitive sensors rely on changes in electrical fields, they may struggle to detect materials like plastics, ceramics, or certain composites. To address these challenges, key players in the market are actively investing in R&D to enhance material detection capabilities.

Companies are exploring hybrid sensor architectures that combine capacitive sensing with ultrasonic, optical, or inductive technologies. This multi-modal approach improves accuracy and enables the detection of non-conductive materials in complex environments.

Market Trend

"Advanced Multi-Sensing Solutions"

A key trend in the capacitive sensor market is the integration of multiple sensing technologies, such as inductive, optical, and ultrasonic sensors, into a single system. This advanced multi-sensing approach enhances the capabilities of capacitive sensors, making them more versatile and effective in various applications.

By combining different sensor types, these systems can detect a broader range of inputs, improve accuracy, and adapt to more complex environments. This trend is driving innovation across industries, offering solutions that are more efficient, reliable, and flexible for modern applications.

- In March 2025, Infineon Technologies introduced its PSOC 4 Multi-Sense microcontroller, enhancing capacitive sensing with inductive and liquid sensing capabilities. This innovation supports new applications like touch-on-metal, waterproof designs, and liquid level detection, offering improved performance, low power consumption, and greater design flexibility.

Capacitive Sensor Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Touch Sensor, Motion Sensor, Position Sensor, Others

|

|

By End Use

|

Consumer Electronics, Food & Beverages, Oil & Gas, Healthcare, Automotive, Aerospace & Defense, Manufacturing, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Touch Sensor, Motion Sensor, Position Sensor, Others): The touch sensor segment earned USD 11.70 billion in 2023, driven by increased demand for intuitive, user-friendly interfaces in smartphones, wearables, and other devices.

- By End Use (Consumer Electronics, Food & Beverages, Oil & Gas, Healthcare, Automotive, Aerospace & Defense, Manufacturing, Others): The consumer electronics held 23.13% of the market in 2023, driven by the growing demand for touch-based interfaces in smartphones, tablets, and smart devices.

Capacitive Sensor Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific capacitive sensor market share stood around 33.82% in 2023 in the global market, with a valuation of USD 10.59 billion. Asia Pacific remains the dominant region for the market, driven by rapid industrialization, technological advancements, and growing demand in consumer electronics, automotive, and healthcare sectors.

The region benefits from large-scale manufacturing capabilities and increasing investments in IoT, smart devices, and automation. Countries like India, China, Japan, and South Korea lead the market, supported by strong research and development efforts.

Additionally, the growing adoption of smart home technologies and rising investment in electric vehicle production, is further boosting the need for high-precision, energy-efficient capacitive sensors across residential and mobility applications in this region.

- In March 2023, researchers from IIT Jodhpur and Delhi developed a cost-effective tactile pressure sensor for fruit ripeness detection. The capacitive sensor uses nanoneedle-textured PDMS (polydimethylsiloxane), offering high sensitivity and scalability. This innovation aims to revolutionize fruit sorting during harvesting, improving efficiency and reducing waste.

North America capacitive sensor industry is poised for significant growth at a robust CAGR of 5.20% over the forecast period. North America is the fastest-growing region in the market, driven by significant advancements in technology and increased adoption across various sectors.

The region's strong presence in consumer electronics, automotive, and industrial automation fuels the demand for capacitive sensors. Additionally, innovations in IoT, smart devices, and touchless technologies further boost the market growth in this region.

Regulatory Frameworks

- The Bureau of Indian Standards (BIS) governs product quality and safety standards in India. Capacitive sensors used in critical applications like automotive, medical, or industrial sectors must comply with the BIS standards.

- In the healthcare sector, capacitive sensors used in medical devices must comply with the U.S. Food and Drug Administration (FDA) regulations, ensuring safety and effectiveness.

- Capacitive sensors sold within the European Union must carry the CE mark, indicating compliance with EU regulations regarding safety, health, and environmental protection standards.

Competitive Landscape

Companies in the capacitive sensor industry are increasingly focusing on innovation to meet the growing demand for advanced sensing solutions. They are developing multi-sensing technologies that integrate capacitive with inductive, optical, and ultrasonic capabilities to enhance performance and versatility.

Additionally, businesses are investing in miniaturization, reducing power consumption, and improving sensitivity to cater to industries like consumer electronics, automotive, and healthcare.

Strategic partnerships and acquisitions are also being pursued to expand product portfolios, improve manufacturing capabilities, and accelerate time-to-market for new solutions.

- In November 2023, Touch Biometrix introduced the world’s largest capacitive fingerprint sensor, TCAP60, built with its novel Active Pixel technology. This high-resolution, low-power sensor is scalable, sensitive, and suitable for diverse applications. Developed in collaboration with Sharp Display Technology, it sets a new standard in fingerprint biometrics, with potential for secure devices across mobile and consumer electronics industries.

List of Key Companies in Capacitive Sensor Market:

- Analog Devices, Inc.

- Infineon Technologies AG

- Microchip Technology Inc.

- MICRO-EPSILON MESSTECHNIK GmbH & Co. KG

- OMRON Corporation

- Renesas Electronics Corporation

- Schneider Electric

- Texas Instruments

- Fujitsu

- Pepperl+Fuchs (Pty) Ltd

- Baumer

- Touch Biometrix

- Balluff GmbH

- R.I Electronics

- RECHNER Industrie-Elektronik GmbH

Recent Developments (Product Launch)

- In Dec 2023, Baumer introduced the PL240 capacitive sensor, designed to detect point levels despite films and residues adhering to tank walls. This innovative sensor addresses challenges in fluid monitoring by maintaining accuracy even with microfilms, ensuring reliable performance in industries such as lab automation, cleaning fluids, and food production.