Calcium Ammonium Nitrate Market Size

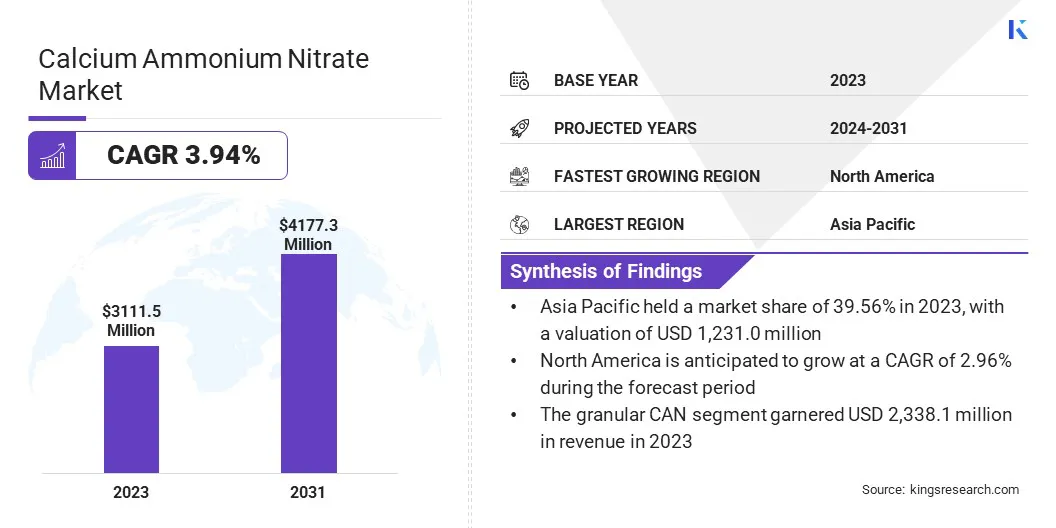

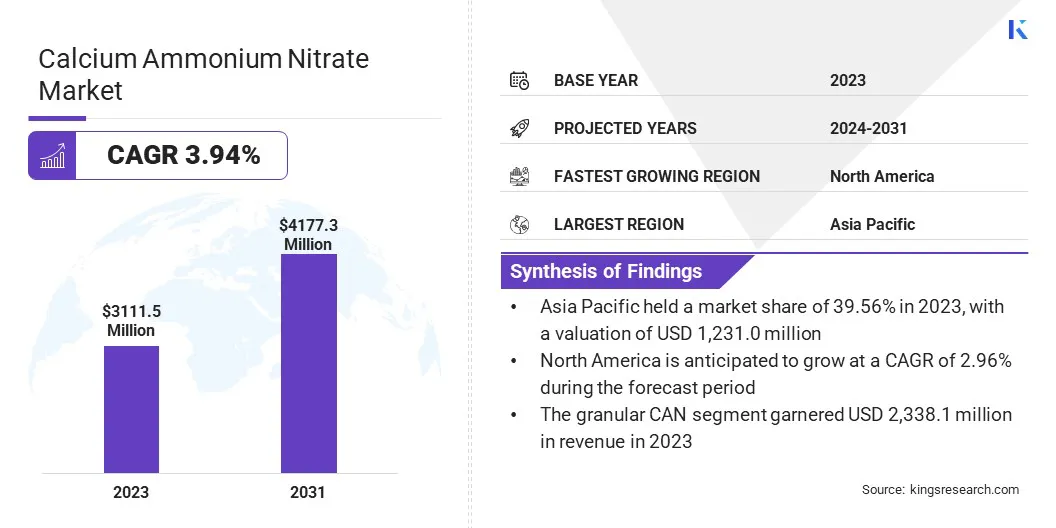

The global Calcium Ammonium Nitrate Market size was valued at USD 3,111.5 million in 2023 and is projected to grow from USD 3,187.4 million in 2024 to USD 4,177.3 million by 2031, exhibiting a CAGR of 3.94% during the forecast period.

The market is expanding due to the rising demand for cost-effective and efficient fertilizer solutions from the agriculture industry. New product formulations and application methods are also enhancing CAN's performance.

The increasing need for crop productivity and soil health and growing investments in fertilizer technology, is driving product demand and market development. In the scope of work, the report includes solutions offered by companies such as Yara, EuroChem Group, HELM AG, Agrico, Ravensdown, Hebei Sanyuanjiuqi Fertilizer Co., Ltd., AB “Achema”, LAT Nitrogen Austria GmbH, Barium & Chemicals, Inc., Incitec Pivot Fertilisers Pty Ltd, and others.

The calcium ammonium nitrate market is experiencing steady growth, driven by the rising demand for high-efficiency fertilizers to increase agricultural productivity. CAN’s nutrient profile, containing both calcium and nitrogen, makes it an essential input for enhancing crop yield and improving soil health.

The growing focus on sustainable farming practices, coupled with advancements in precision agriculture, is further propelling market expansion.

- In March 2022, the U.S. Department of Agriculture announced a USD 250 million investment to boost sustainable and organic fertilizer production across the nation, highlighting a strong commitment to eco-friendly agricultural practices and improved resource management.

Additionally, increasing global food demand and stricter environmental regulations are leading farmers to adopt eco-friendly fertilizers like calcium ammonium nitrate. As technological innovation in fertilizer application improve efficiency, the CAN market is poised to grow continuously in the coming years.

Calcium ammonium nitrate (CAN) is a granular fertilizer containing a mixture of calcium nitrate and ammonium nitrate. It provides essential nutrients to plants, offering a balanced supply of calcium and nitrogen. Calcium strengthens the cell walls and improves soil structure, while nitrogen supports plant growth, photosynthesis, and protein synthesis.

CAN is primarily used to enhance soil fertility, promote healthy crop development, and improve yield. It is particularly valued as it reduces the risk of leaching compared to other nitrogen fertilizers and maintains soil pH balance. CAN is widely used in various agricultural applications due to its effectiveness and efficiency.

Analyst’s Review

Government initiatives fertilizer industry, by encouraging the adoption of sustainable and efficient fertilizer solutions, is expected to drive market growth. Investments and regulatory support, such as subsidies for eco-friendly fertilizers and funding for research and development, are pushing the industry toward more innovative and sustainable practices.

- According to the United States Department of Agriculture (USDA), the government is ramping up U.S. fertilizer production to mitigate rising costs for farmers, a consequence of the Russia-Ukraine conflict. In September 2022, the government announced a USD 500 million grant to boost domestic fertilizer manufacturing. This initiative was part of a broader government effort to enhance competition within the agricultural industry and ensure more stable, affordable fertilizer supplies for farmers.

By aligning with these initiatives, companies can boost competitiveness, meet rising demand, and contribute to market growth while addressing supply chain challenges and cost pressures.

Calcium Ammonium Nitrate Market Growth Factors

The calcium ammonium nitrate market is experiencing robust growth with the increasing global demand for efficient and effective fertilizers. This growth is fueled by the need for higher agricultural productivity to meet the rising food requirements of the growing population.

The market has been expanding as farmers and agricultural business adopt CAN for a balanced nutrient composition, which enhances soil fertility and crop yield.

Additionally, advancements in agricultural and a shift toward sustainable farming practices are contributing to the rising adoption of CAN in various agricultural practices. The focus on precision agriculture and efficient nutrient management further supports the market's expansion.

Calcium Ammonium Nitrate Industry Trends

The shift toward sustainable farming practices is driving the calcium ammonium nitrate market growth for calcium ammonium nitrate (CAN) with increasing focus of farmers on eco-friendly fertilizers.

- In January 2024, Ostchem Holding reported a 20% increase in its mineral fertilizer production in 2023, reaching 2.1 million tons. Notably, the company’s ammonium nitrate production saw a substantial boost of 60% to reach 835,900 tons during the same period.

CAN’s ability to improve soil health, minimize environmental degradation, and optimize nutrient uptake makes it a preferred choice in sustainable agriculture practices. As governments and regulatory bodies enforce stricter policies, the demand for fertilizers like CAN, which reduce the negative impact on soil and water ecosystems, is rising.

Additionally, growing awareness among farmers about the long-term benefits of sustainable practices is contributing to the expansion of the CAN market.

Advancements in precision farming and fertilizer application technologies are driving the market for calcium ammonium nitrate (CAN) by improving its efficiency and appeal among modern farmers. With precision techniques ensuring accurate nutrient delivery, farmers are able to optimize crop yield while minimizing waste and environmental harm.

This efficiency particularly caters to the increasing agricultural demands and allows for better resource management. Additionally, innovations such as controlled-release formulations are enhancing CAN’s performance, which is further fueling product demand.

Segmentation Analysis

The global market has been segmented on the basis of type, end user, and geography.

By Type

Based on type, the calcium ammonium nitrate market has been categorized into granular CAN, liquid CAN, and coated CAN. The granular CAN segment garnered the highest revenue of USD 2,338.1 million in 2023. Increasing preference for granular formulations due to their ease of application and efficient nutrient release to enhance soil fertility and crop productivity is expected to drive the market growth over the forecast period.

This segment's expansion is further supported by rising agricultural demands and a push for high-performance fertilizers. Innovation in product formulations and application technologies are also contributing to the segment’s growth.

As the agricultural segment continues to seek effective, cost-efficient solutions to optimize yields and soil health, the granular CAN segment is positioned for substantial market growth over the forecast period.

By End User

Based on end user, the market has been categorized into agriculture, mining, construction, and chemicals. The agriculture segment captured the largest market share of 68.55% in 2023. With the rise in global food demand, the adoption of CAN is expected to gain pace due to its balanced nutrient profile, which provides essential calcium and nitrogen for robust plant growth.

Advances in fertilizer application and formulations are further fueling the segment’s expansion by improving the efficiency and effectiveness of CAN. The shift toward sustainable and high-performance agricultural practices is positioning CAN as a key player in meeting the evolving needs of the agricultural sector, which is expected to drive the segment growth over the forecast period.

Calcium Ammonium Nitrate Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia Pacific calcium ammonium nitrate market share stood at 39.56% in 2023, accounting for the largest market share with a valuation of USD 1,231.0 million, mainly due to the expanding agricultural sector and increasing food production needs. Countries such as China, India, and Southeast Asian countries are mainly contributing to this growth due to their large agricultural bases and rising demand for high-performance fertilizers.

- According to IBEF, the Indian market is witnessing a surge in demand for organic products, expected to grow at a robust CAGR of 25.25% from 2022 to 2027.

This region benefits from its diverse crop cultivation, which requires versatile and effective nutrient solutions. Additionally, government initiatives promoting sustainable farming practices and investment in agricultural technologies are further boosting the demand for CAN, which is expected to drive the market growth over the forecast period.

North America is also anticipated to witness a significant growth at a CAGR of 2.96% over the forecast period. The calcium ammonium nitrate (CAN) market is expanding due to advanced agricultural practices and substantial investment in agricultural technology.

- According to Agriculture and Agri-Food Canada (AAFC), Canada was the world’s fifth largest agricultural exporter in 2022, generating USD 143.8 billion, approximately 7.0% of its GDP, from agriculture and agri-food sectors.

This highlights the critical role of agriculture in Canada’s economy which drives the demand for effective fertilizers. The region benefits from robust infrastructure for fertilizer distribution and a strong emphasis on sustainable farming practices, which is further supporting the market growth.

Competitive Landscape

The global calcium ammonium nitrate market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Calcium Ammonium Nitrate Market

- Yara

- EuroChem Group

- HELM AG

- Agrico

- Ravensdown

- Hebei Sanyuanjiuqi Fertilizer Co., Ltd.

- AB “Achema”

- LAT Nitrogen Austria GmbH

- Barium & Chemicals, Inc.

- Incitec Pivot Fertilisers Pty Ltd

Key Industry Developments

January 2024 (Partnership): Yara, a global leader in crop nutrition, and ATOME PLC, a key player in green fertilizer projects, signed Heads of Terms for a long-term supply agreement covering all calcium ammonium nitrate from ATOME’s renewable production facility in Villeta, Paraguay. Yara will market and sell this fertilizer under the YaraBela product line. The 145 MW project, set to commence production and export in 2027, will utilize baseload renewable power to produce and supply fertilizers.

The global calcium ammonium nitrate market has been segmented:

By Type

- Granular CAN

- Liquid CAN

- Coated CAN

By End User

- Agriculture

- Mining

- Construction

- Chemicals

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America