Braze Alloys Market Size

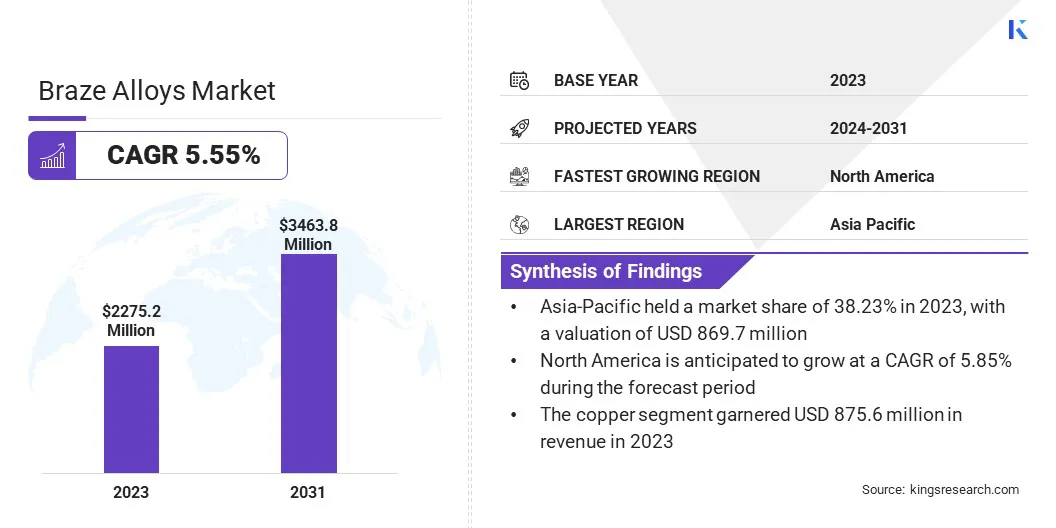

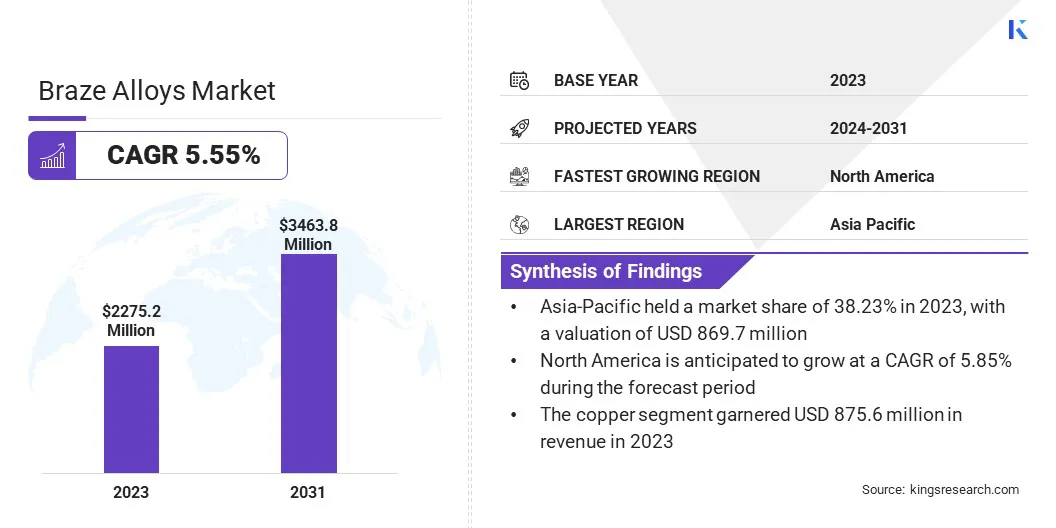

The global Braze Alloys Market size was valued at USD 2,275.2 million in 2023 and is projected to grow from USD 2,373.7 million in 2024 to USD 3,463.8 million by 2031, exhibiting a CAGR of 5.55% during the forecast period. The market is experiencing significant growth as HVAC, electronics, and construction sectors are increasingly adopting brazing for precision joining to ensure enhanced durability.

The industry is also seeing a shift toward eco-friendly, lead-free braze alloys in response to the increasing stringency of environmental regulations. Additionally, rising infrastructure development and the growing demand for energy-efficient systems are driving the need for reliable brazing solutions, further propelling the market growth.

In the scope of work, the report includes solutions offered by companies such as Aimtek Inc., Cupro Alloys Corporation, Indian Solder and Braze Alloys Pvt. Ltd., Johnson Matthey, Lucas-Milhaupt, Inc., Morgan Advanced Materials plc, OC Oerlikon Management AG, Saru Silver Alloy Private Limited, Sulzer Ltd., VBC Group, and others.

The braze alloys market is experiencing robust growth driven by their increasing demand mainly across aerospace and automotiv industries. Advanced manufacturing techniques like additive manufacturing (3D printing) are creating new opportunities for braze alloys, as they enable the production of complex and lightweight components.

The automotive industry's shift toward lightweight materials to enhance fuel efficiency and meet emission standards is boosting the demand for high-performance braze alloys.

- According to the Organization Internationale des Constructeurs d'Automobiles (OICA), the total number of new automobile sales or registrations in OICA member countries was close to 69 million units in 2022.

Additionally, the need for reliable, high-stress component fabrication in the aerospace industry is further fueling market expansion.

Braze alloys are specialized filler metals used in the brazing process, which involves joining two or more metals by melting the braze alloy without melting the base metals.

These alloys typically consist of a combination of metals like silver, copper, zinc, nickel, or aluminum, chosen for their ability to create strong, durable joints. Braze alloys are engineered to flow into narrow gaps through capillary action, forming a metallurgical bond as they solidify.

Used across industries such as aerospace, automotive, HVAC, and electronics, braze alloys are ectensively used to join dissimilar metals while maintaining the integrity and strength of the components.

Analyst’s Review

The rise in the construction sector is expected to drive the market for braze alloys as the industry increasingly demands durable and reliable joining solutions for complex infrastructure projects.

- As reported by the National Bureau of Statistics of China, the construction output in China amounted to about USD 40 billion in the fourth quarter of 2022. This figure representsed a substantial 50% rise from the third quarter, which recorded a value of USD 27.6 billion.

Key players are leveraging this growth by investing in advanced braze alloys to meet the growing demand from the construction industry. By focusing on innovation and expanding their product offerings to meet the specific needs of modern infrastructure projects, these players are enhancing their market presence and driving further expansion of the braze alloys market.

Braze Alloys Market Growth Factors

Increasing dependency of the aerospace industry on brazing for fabricating high-stress components, such as turbine blades and heat exchangers, is significantly driving the market for braze alloys. As global air travel and defense budgets continue to escalate, the demand for advanced braze alloys that deliver superior performance under extreme conditions is intensifying.

This demand is further intensified by the industry’s push for more fuel-efficient and environmentally compliant aircraft. In addition, the market is experiencing robust growth, as aerospace manufacturers are seeking regulatory compliant materials for modern aviation and defense applications.

A major challenge in the braze alloys market is the volatility in the prices of raw materials, such as silver and copper. This price instability may lead to increased production costs and affect profit margins, hindering market growth by making it difficult for manufacturers to maintain stable pricing and profitability.

Key players are addressing this challenge by developing alternative braze alloys that use less volatile or more cost-effective materials. They are also implementing strategic sourcing practices and establishing long-term contracts with suppliers to stabilize raw material costs.

Additionally, companies are focusing on improving their production efficiency and technology to reduce overall costs. By diversifying their material sources and optimizing operations, key players are focusing on mitigating the impact of flauctuating raw material prices and sustaining market growth.

Braze Alloys Market Trends

The automotive industry's shift toward lightweight materials to improve fuel efficiency and meet emission standards is propelling the growth of the market. As manufacturers increasingly rely on brazing to join aluminum and specialized steel alloys, the demand for advanced braze alloys that ensure strong, reliable joints is rising.

This growing emphasis on efficient vehicle design is also driving the market, as automakers seek high-performance brazing solutions to meet the demands of modern automotive manufacturing and regulatory compliance. Consequently, the braze alloys market is experiencing robust growth driven by the industry's increasing focus on innovation and sustainability.

There is a growing trend favoring the adoption of advanced manufacturing techniques, particularly additive manufacturing (3D printing), in conjunction with brazing. This combination is revolutionizing how complex and lightweight components are designed and produced, especially in high-performance industries like aerospace and automotive.

Additive manufacturing allows the creation of intricate geometries where specialized braze alloys enable the joining of complex parts without compromising the structural integrity or performance of the final product.

As industries increasingly embrace these innovative manufacturing processes, the demand for cutting-edge braze alloys tailored to these applications is rising, driving significant advancements and growth in the market.

Segmentation Analysis

The global market has been segmented on the basis of metal type, end-use, and geography.

By Metal Type

Based on metal type, the braze alloys market has been categorized into copper, gold, aluminum, silver, nickel, and others. The copper segment held the highest revenue of USD 875.6 million in 2023, due to its widespread application in HVAC, plumbing, and electrical engineering.

Copper-based braze alloys are favored for their excellent thermal and electrical conductivity, corrosion resistance, and cost-effectiveness, making them ideal for joining copper and copper alloys.

The increasing demand for efficient heating and cooling systems, along with the expansion of renewable energy projects, is driving the use of copper brazing in these applications.

As infrastructure development and electrification projects continue to rise globally, the copper segment is expected to witness considerable growth, contributing significantly to the overall market expansion.

By End Use

Based on end use, the market has been categorized into automotive, electronics and electrical, industrial, and others. The automotive segment captured the largest braze alloys market share of 39.31% in 2023, mainly driven by the industry's increasing focus on lightweight materials and advanced manufacturing techniques.

As automakers aim for greater fuel efficiency and reduced emissions, the use of materials like aluminum and specialized steel alloys is rising. Brazing is becoming the preferred method for joining these materials, ensuring strong, reliable joints without compromising the base metals integrity.

This shift is significantly boosting the demand for advanced braze alloys in automotive applications. Additionally, the rise in global passenger car production is further driving market growth.

- The European Automobile Manufacturers' Association (ACEA) reported that more than 68 million passenger cars were made worldwide in 2022, reflecting a 7.9% increase compared to the previous year.

In addition, the ongoing trend toward electric vehicles (EVs) and sustainable transportation solutions is also propelling the segment growth.

Braze Alloys Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

Asia-Pacific braze alloys market share stood around 38.23% in 2023 in the global market, with a valuation of USD 869.7 million, due to rapid industrialization, infrastructure development, and a well-developed automotive industry. China, India, and Japan are major contributors to this region's growth.

China's dominance in manufacturing, India’s expanding infrastructure and automotive production, and Japan’s technological advancements are further expected to drive the product demand.

- The Society of Indian Automobile Manufacturers reported that the total number of cars made in India in FY 2022 was close to 23 million. Two-wheelers, which constituted about 74% of the total production, holding the majority of market share.

Southeast Asian countries are also emerging as key markets with growth in the manufacturing and automotive industries. Additionally, the region's focus on energy efficiency and sustainability is boosting the use of advanced braze alloys in HVAC systems and renewable energy projects.

North America is anticipated to witness significant growth at a CAGR of 5.85% over the forecast period. The region’s focus on enhancing vehicle safety and performance is leading to the adoption of braze alloys in automotive manufacturing.

Additionally, ongoing infrastructure projects and the expansion of smart building technologies are boosting the demand for brazing solutions that ensure strong, durable joints in construction materials. The rise of energy-efficient and sustainable building practices is also contributing to the market’s growth.

As North America continues to innovate and invest in these sectors, the demand for advanced braze alloys is expected to increase, which is driving the market growth in the region.

Competitive Landscape

The global braze alloys market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategies, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Braze Alloys Market

- Aimtek Inc.

- Cupro Alloys Corporation

- Indian Solder and Braze Alloys Pvt. Ltd.

- Johnson Matthey

- Lucas-Milhaupt, Inc.

- Morgan Advanced Materials

- OC Oerlikon Management AG

- Saru Silver Alloy Private Limited

- Sulzer Ltd.

- VBC Group

The global braze alloys market has been segmented as:

By Metal Type

- Copper

- Gold

- Aluminum

- Silver

- Nickel

- Others

By End Use

- Automotive

- Electronics and Electrical

- Industrial

- Others

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America