Market Definition

The market encompasses the production, development, and application of specialized fasteners designed for structural assemblies. These bolts are made using materials such as steel, aluminum, and titanium to ensure durability and resistance to extreme conditions.

The manufacturing of blind bolts involves precision machining, heat treatment, and coating processes to enhance performance in aerospace, automotive, construction, and railway applications. Blind bolts provide secure fastening in load-bearing structures, particularly in aircraft fuselage assembly, bridge construction, and heavy machinery. Their ability to create strong, vibration-resistant joints without requiring access to both sides makes them necessary for critical engineering applications.

Blind Bolts Market Overview

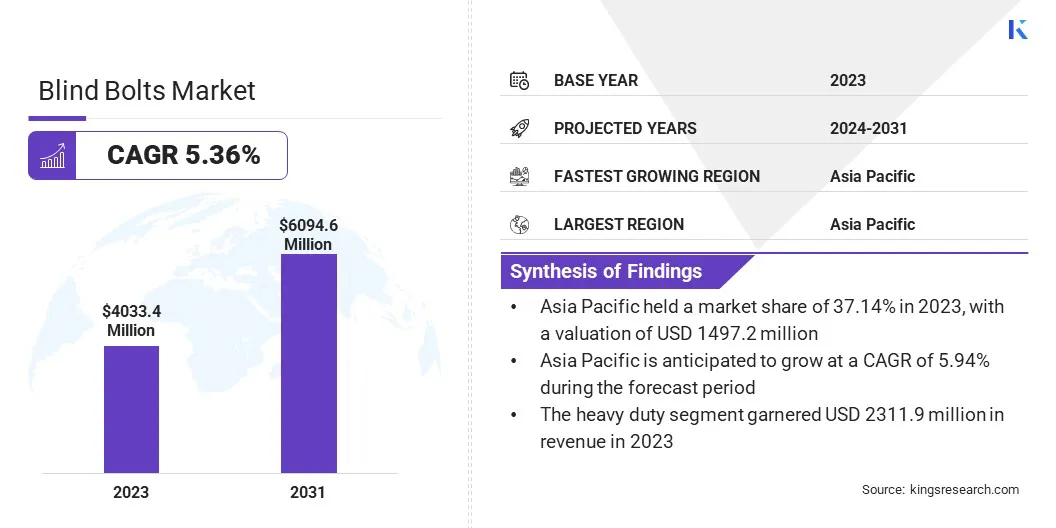

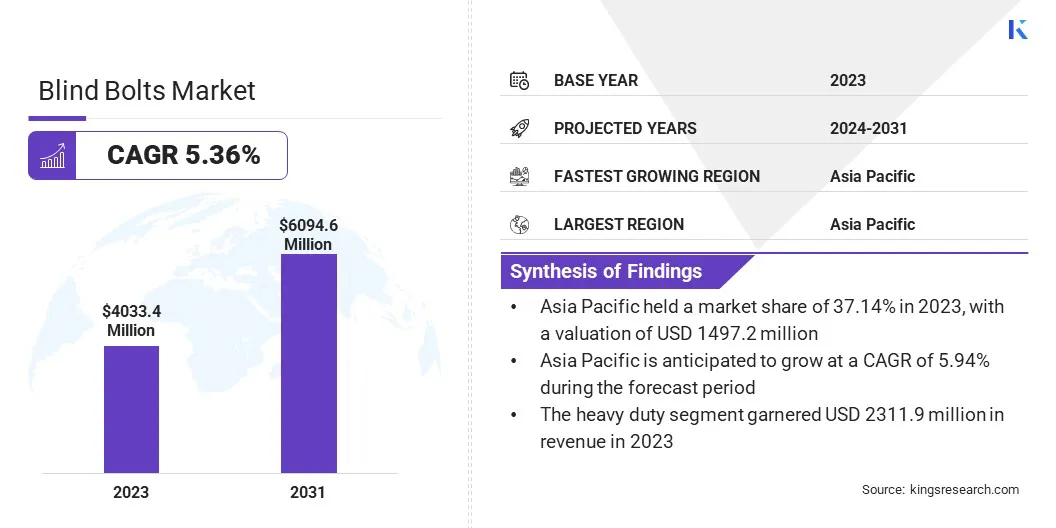

The global blind bolts market size was valued at USD 4,033.4 million in 2023 and is projected to grow from USD 4,227.7 million in 2024 to USD 6,094.6 million by 2031, exhibiting a CAGR of 5.36% during the forecast period.

The aerospace and automotive sectors are witnessing a surge in demand for lightweight automotive components, driving the growth of the market. Technological advancements in fastening systems have led to improved strength, durability, and ease of installation, making blind bolts a preferred choice for high-performance structural applications.

Major companies operating in the blind bolts industry are Howmet Aerospace, ELITE Fasteners, Henry Venables Products Ltd., Kwikbolt Limited, Blind Bolt, PCC Fasteners, Stanley Black & Decker Inc., TriMas, Delta Fitt Inc., Northern Precision Ltd., Trifast plc, Hilti Corporation, ITW Shakeproof Industrial, SFS Group Germany GmbH, and LISI AEROSPACE.

The aerospace sector is witnessing a surge in demand for lightweight and high-strength fastening solutions, directly influencing the growth of the market. Aircraft manufacturers prioritize structural integrity, corrosion resistance, and weight reduction, increasing the adoption of blind bolts in fuselage assembly, wing structures, and critical components.

The rise in global air travel and fleet modernization initiatives has led to increased aircraft production, increasing the demand for advanced fastening technologies that enhance performance and durability.

- The 2024 report by the International Air Transport Association (IATA) highlights a 36.9% increase in total air traffic in 2023 compared to the previous year. On a global scale, overall traffic for 2023 reached 94.1% of pre-pandemic levels recorded in 2019. In December 2023, total air traffic saw a 25.3% rise from December 2022, reaching 97.5% of the level observed in December 2019.

Key Highlights

- The blind bolts industry size was valued at USD 4,033.4 million in 2023.

- The market is projected to grow at a CAGR of 5.36% from 2024 to 2031.

- Asia Pacific held a market share of 37.12% in 2023, with a valuation of USD 1,497.2 million.

- The heavy duty segment garnered USD 2,311.9 million in revenue in 2023.

- The M12 segment is expected to reach USD 2,474.7 million by 2031.

- The automotive segment secured the largest revenue share of 34.38% in 2023.

- Europe is anticipated to grow at a CAGR of 5.94% during the forecast period.

Market Driver

Rising Demand for Lightweight Automotive Components

Automakers are focusing on reducing vehicle weight to improve fuel efficiency and meet emission standards, contributing to the growth of the market. The U.S. Department of Energy emphasizes the significant impact of lightweight materials on enhancing vehicle efficiency. Reduction of a vehicle's weight by 10% can improve fuel economy by 6% to 8%.

The integration of lightweight components and high-efficiency engines is made possible through advanced materials in a quarter of the U.S. vehicle fleet, the industry could save over 5 billion gallons of fuel each year by 2030,

Blind bolts provide secure and durable fastening solutions in areas with limited access, making them essential for lightweight vehicle structures. The adoption of electric vehicles (EVs) has further increased demand, as manufacturers integrate advanced fastening systems to enhance structural stability while maintaining overall vehicle efficiency.

Market Challenge

High Production Costs and Material Limitations

The growth of the blind bolts market faces a significant challenge due to high production costs and material limitations. Manufacturing blind bolts with advanced materials that offer high strength, corrosion resistance, and durability requires sophisticated processes, increasing overall production expenses. Additionally, fluctuations in the prices of raw materials can impact cost efficiency for manufacturers.

To address this challenge, companies are investing in automation and advanced manufacturing technologies to streamline production and reduce operational costs. The adoption of innovative materials, such as high-performance alloys and composite-based fasteners, is also helping improve cost efficiency while maintaining structural integrity, ensuring long-term market growth.

Market Trend

Technological Advancements in Fastening Systems

Innovation in fastening technologies has strengthened the market by improving installation efficiency and reliability. The introduction of self-locking mechanisms, automated installation tools, and corrosion-resistant coatings has enhanced the performance of blind bolts in critical applications.

These advancements have reduced assembly time, minimized maintenance requirements, and improved load-bearing capacity, making them a preferred choice for industries that require precise fastening solutions in complex and high-stress environments.

- In January 2025, Harmon Inc. partnered with Raise Robotics and Universal Robots A/S to transform the installation of glass façade panels on high-rise buildings. This collaboration integrates advanced robotic technology to enhance worker safety while improving installation precision and efficiency. The robots are specifically designed to perform the repetitive and high-risk task of installing blind bolts and fasteners for glass façade panels, streamlining the process in high-rise construction projects.

Blind Bolts Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Heavy Duty, Thin Wall

|

|

By Diameter

|

M8, M10, M12, Others

|

|

By Application

|

Automotive, Aerospace, Machinery and Equipment, Construction, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Heavy Duty, Thin Wall): The heavy duty segment earned USD 2,311.9 million in 2023 due to its superior load-bearing capacity, high shear and tensile strength, and widespread adoption in critical structural applications across aerospace, automotive, and construction industries.

- By Diameter (M8, M10, M12, and Others): The M12 segment held 37.77% of the market in 2023, due to its optimal balance of strength, versatility, and load-bearing capacity, making it a preferred choice for structural applications in aerospace, automotive, and construction industries.

- By Application (Automotive, Aerospace, Machinery and Equipment, Construction, Others): The automotive segment is projected to reach USD 2,000.4 million by 2031, owing to the rising demand for lightweight, high-strength fastening solutions that enhance vehicle efficiency, structural integrity, and manufacturing efficiency.

Blind Bolts Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific blind bolts market share stood around 37.12% in 2023, with a valuation of USD 1,497.2 million. Asia Pacific is witnessing large-scale investments in high-speed rail infrastructure, particularly in China, Japan, and India. Governments are prioritizing the expansion of railways to enhance regional connectivity, increasing demand for secure and vibration-resistant fastening solutions.

- In February 2025, the Vietnamese government approved a railway project exceeding USD 8 billion to enhance connectivity between its northern port city and the Chinese border. The primary route will span 391 kilometers (242 miles), accompanied by 28 kilometers (17 miles) of branch lines.

Blind bolts play a critical role in assembling rail tracks, bridges, and train components where access is limited. With projects like India’s Mumbai-Ahmedabad bullet train and China’s extensive high-speed rail network, the market for blind bolts continues to expand across the transportation sector.

Asia Pacific is at the forefront of electric vehicle (EV) manufacturing, with China, Japan, and South Korea leading the industry. The rapid expansion of EV production, supported by government incentives and investments, is driving significant demand for advanced fastening solutions across the region.

Europe is poised for significant growth at a robust CAGR of 5.55% over the forecast period. Europe is leading the global offshore wind energy sector, with the UK, Germany, and the Netherlands investing heavily in large-scale wind farms. The growth of the blind bolts industry is driven by the increasing demand for high-strength fastening solutions in wind turbine towers, substructures, and maintenance platforms.

Blind bolts are essential due to their durability and resistance to harsh marine conditions. Furthermore, several European countries, including the UK, France, and Germany, are increasing defense budgets and investing in advanced military vehicles, naval ships, and aircraft.

The market is expanding as these industries require high-performance fastening solutions for armored vehicles, warships, and fighter jets. Blind bolts are widely used in assembling aircraft fuselages, naval hulls, and military infrastructure, offering superior strength and resistance to extreme conditions.

Regulatory Frameworks

- In the U.S., the American Institute of Steel Construction (AISC) specifies requirements for structural steel connections, including blind bolts, in its Specification for Structural Steel Buildings (ANSI/AISC 360-16). Additionally, the American Society for Testing and Materials (ASTM) provides standards like ASTM F3125/F3125M, which cover high-strength structural bolts that are applicable only to certain blind bolt types.

- European regulations mandate that construction fasteners, such as blind bolts, bear the CE Mark, indicating compliance with safety and performance standards. Specifically, preload bolting assemblies must comply with EN 14399, while non-preload assemblies should conform to EN 15048. Furthermore, design methods outlined in Eurocode 3 and DIN 18800 ensure the structural integrity of steel structures with the use of blind bolts.

- China's fastener industry follows Guobiao (GB) standards, which are national specifications ensuring product quality and safety. Standards like GB/T 24425.2-2009 detail requirements for wire thread inserts used in blind holes, relevant to certain blind bolt applications.

Competitive Landscape

The blind bolts market is characterized by market players that actively engage in mergers and acquisitions to strengthen their competitive position and expand their product offerings, driving growth in the market. By acquiring companies with specialized expertise and advanced manufacturing capabilities, businesses are enhancing their production efficiency and broadening their reach across key industries such as aerospace, defense, and infrastructure.

These strategic moves enable companies to integrate high-performance solutions, streamline supply chains, and meet evolving industry demands, ultimately contributing to market expansion and reinforcing their presence in both regional and global markets.

- In February 2023, TriMas entered into an agreement to acquire the operating net assets of Weldmac Manufacturing Company, a prominent designer and manufacturer of advanced metal fabricated components and assemblies for the aerospace, defense, and space launch sectors. This acquisition enhances TriMas Aerospace by adding specialized, high-performance products and advanced manufacturing capabilities, strengthening its market position and expanding its offerings across these industries.

List of Key Companies in Blind Bolts Market:

- Howmet Aerospace

- ELITE Fasteners

- Henry Venables Products Ltd.

- Kwikbolt Limited

- Blind Bolt

- PCC Fasteners

- Stanley Black & Decker Inc.

- TriMas

- Delta Fitt Inc.

- Northern Precision Ltd.

- Trifast plc

- Hilti Corporation

- ITW Shakeproof Industrial

- SFS Group Germany GmbH

- LISI AEROSPACE

Recent Developments (M&A)

- In February 2025, TriMas acquired the aerospace division of GMT Gummi-Metall-Technik GmbH, a Germany-based manufacturer specializing in tie-rods and rubber-metal anti-vibration systems for commercial and military aerospace applications. This acquisition strengthens TriMas' portfolio with advanced engineering and manufacturing capabilities, further enhancing its position in the aerospace and defense sector. The integration of highly specialized fastening and structural components aligns with the growing demand for reliable solutions like blind bolts, which play a crucial role in ensuring secure and efficient assembly in aerospace structures.