Market Definition

Biotechnology contract manufacturing involves outsourcing the production and development of biologic drugs and related products. It includes manufacturing, formulation, fill-finish, packaging, and labeling across clinical and commercial scales.

The process employs diverse expression systems, including mammalian and non-mammalian sources, supporting multiple therapeutic areas such as oncology, autoimmune, cardiovascular, metabolic, infectious diseases, and neurological diseases.

Biotechnology Contract Manufacturing Market Overview

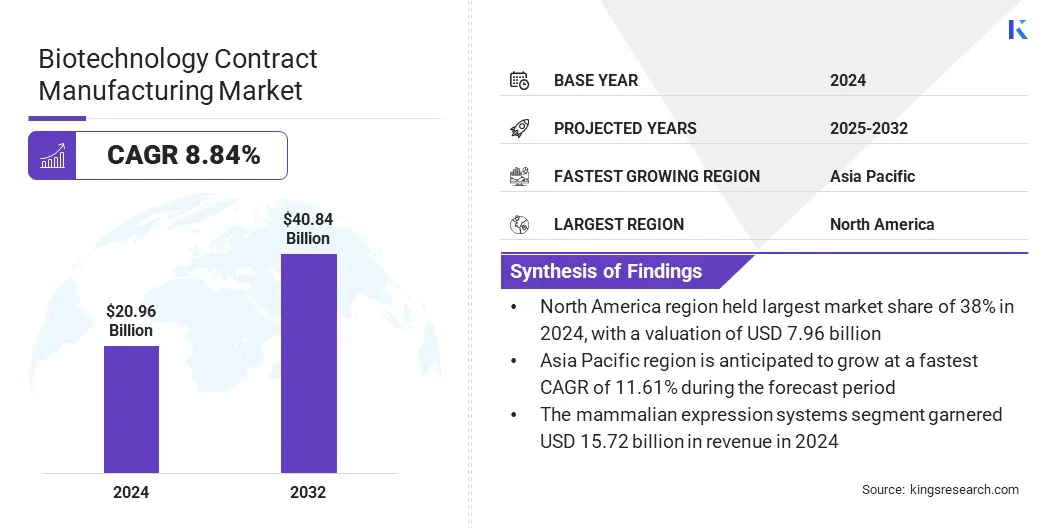

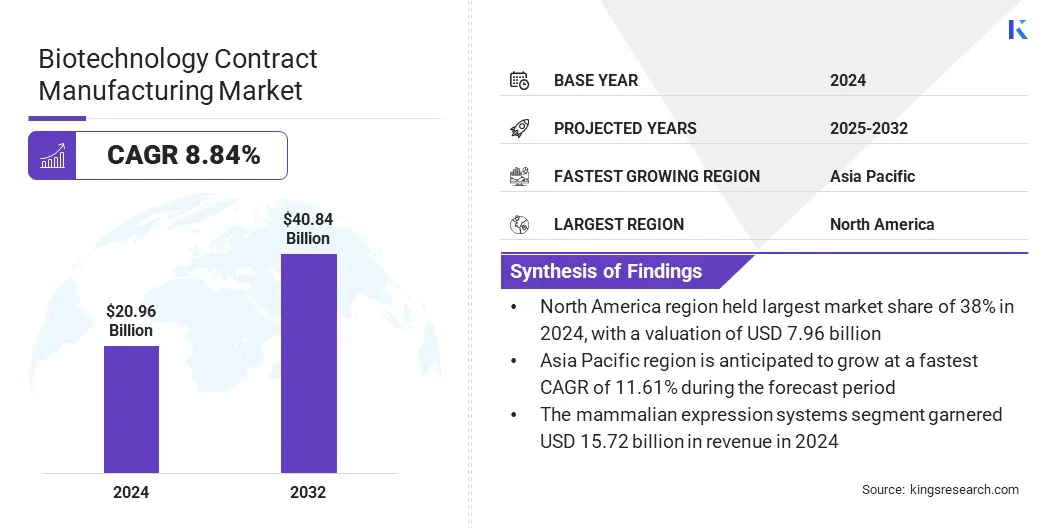

The global biotechnology contract manufacturing market size was valued at USD 20.96 billion in 2024 and is projected to grow from USD 22.57 billion in 2025 to USD 40.84 billion by 2032, exhibiting a CAGR of 8.84% during the forecast period.

This growth is driven by the growing demand for antibody development, which underscores the need for specialized manufacturing services. Additionally, the adoption of high-concentration formulation platforms facilitates the production of high-dose biologics, enhancing drug stability and patient compliance.

Key Highlights:

- The biotechnology contract manufacturing industry size was recorded at USD 20.96 billion in 2024.

- The market is projected to grow at a CAGR of 8.84% from 2025 to 2032.

- North America held a share of 38.00% in 2024, valued at USD 7.96 billion.

- The manufacturing segment garnered USD 9.43 billion in revenue in 2024.

- The biologic drug substance manufacturing segment is expected to reach USD 24.34 billion by 2032.

- The commercial operations segment is projected to generate a revenue of USD 27.79 billion by 2032.

- The mammalian expression systems segment is likely to reach USD 29.93 billion by 2032.

- The monoclonal antibodies segment is estimated to register a value of USD 15.81 billion by 2032.

- The oncology segment garnered USD 7.34 billion in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 11.61% over the forecast period.

Major companies operating in the biotechnology contract manufacturing market are Lonza, Thermo Fisher Scientific Inc., Catalent, Inc, WuXi Biologics, SAMSUNG, FUJIFILM Corporation, Recipharm AB, Rentschler Biopharma SE, AGC Biologics, Boehringer Ingelheim International GmbH, CELLARES, LOTTE, Evotec SE, PORTON, and Grifols.

Market growth is propelled by increasing investments in biologic therapies, boosting demand for specialized contract manufacturing services. Manufacturers are expanding capacities and adopting advanced technologies to meet regulatory requirements and ensure product quality.

These efforts improve operational efficiency and support the timely delivery of complex biologic products. These advancements enable companies to address rising market needs while maintaining compliance with industry standards.

Market Driver

Growing Demand for Antibody Development

The growth of the biotechnology contract manufacturing market is fueled by the increasing demand for antibody development. The rise in chronic and complex diseases has intensified the need for targeted biologic therapies, particularly monoclonal antibodies, which require specialized manufacturing processes.

Pharmaceutical companies increasingly outsource antibody development to contract manufacturers with advanced technical expertise and state-of-the-art facilities. This outsourcing strategy allows for accelerated development timelines, enhanced product quality, and cost efficiencies. This growing reliance on contract manufacturers is aiding market expansion.

- In February 2024, Samsung Biologics partnered with LegoChem Biosciences to provide antibody development and drug substance manufacturing services for LegoChem’s antibody-drug conjugate (ADC) program targeting solid tumors.

Market Challenge

Complex Regulatory Compliance

A significant challenge impeding the expansion of the biotechnology contract manufacturing market is managing regulatory requirements across regions. These complexities increase operational costs and delay product approvals. Companies encounter difficulties in ensuring compliance while adhering to project timelines and client expectations.

To address this issue, manufacturers are enhancing regulatory expertise and adopting standardized quality management frameworks. Additionally, they are engaging proactively with regulatory authorities to facilitate approval processes and ensure consistent compliance.

Market Trend

Adoption of High-Concentration Formulation Platforms

The biotechnology contract manufacturing market is witnessing a notable trend toward the growing adoption of high-concentration formulation platforms. These platforms accelerate the development of high-dose biologic drugs by improving their stability and reducing the required injection volumes.

This approach enhances patient compliance by making administration easier and less painful. Additionally, it enables manufacturers to meet increasing demand for convenient treatments while supporting faster development timelines and improved production efficiency.

- In October 2024, Samsung Biologics launched the S-HiCon high-concentration formulation platform to enhance the development and manufacturing of high-dose biopharmaceuticals. The platform is designed to maximize drug delivery and stability by addressing challenges related to viscosity and formulation stability.

Biotechnology Contract Manufacturing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Service

|

Manufacturing, Formulation and Fill-Finish, Packaging and Labeling, Others

|

|

By Type

|

Biologic Drug Substance Manufacturing, Biologic Drug Product Manufacturing

|

|

By Scale of Operation

|

Commercial Operations, Clinical Operations

|

|

By Source

|

Mammalian Expression Systems, Non-Mammalian Expression Systems

|

|

By Molecule Type

|

Monoclonal Antibodies, Cell Therapy and Gene Therapy, Antibody-Drug Conjugates (ADCs), Vaccines, Therapeutic Peptides and Proteins, Others

|

|

By Therapeutic Area

|

Oncology, Autoimmune Diseases, Cardiovascular Diseases, Metabolic Diseases, Infectious Diseases, Neurology, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Service (Manufacturing, Formulation and Fill-Finish, Packaging and Labeling, and Others): The manufacturing segment earned USD 9.43 billion in 2024, mainly due to increasing demand for large-scale biologic production.

- By Type (Biologic Drug Substance Manufacturing and Biologic Drug Product Manufacturing): The biologic drug substance manufacturing segment held a share of 60.00% in 2024, fueled by the complexity of drug substance development .

- By Scale of Operation (Commercial Operations and Clinical Operations): The commercial operations segment is projected to reach USD 27.79 billion by 2032, owing to rising approvals of biologic therapies.

- By Source (Mammalian Expression Systems and Non-Mammalian Expression Systems): The mammalian expression systems segment is projected to reach USD 29.93 billion by 2032, owing to their efficiency in producing complex proteins.

- By Molecule Type (Monoclonal Antibodies, Cell Therapy and Gene Therapy, Antibody-Drug Conjugates (ADCs), Vaccines, Therapeutic Peptides and Proteins, and Others): The monoclonal antibodies segment held a share of 40.00% in 2024, attributed to their widespread use in targeted therapies.

- By Therapeutic Area (Oncology, Autoimmune Diseases, Cardiovascular Diseases, Metabolic Diseases, Infectious Diseases, Neurology, and Others): The oncology segment earned USD 7.34 billion in 2024, propelled by increasing cancer prevalence and targeted biologic treatments.

Biotechnology Contract Manufacturing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America biotechnology contract manufacturing market share stood at 38.00% in 2024, with a valuation of USD 7.96 billion. This dominance is reinforced by a well-established biopharmaceutical industry, advanced technological infrastructure, and robust regulatory frameworks ensuring high-quality manufacturing standards. The region’s strong focus on innovation and extensive clinical research further strengthen its leading position.

The Asia-Pacific biotechnology contract manufacturing industry is poised to grow at a CAGR of 11.61% over the forecast period. This growth is bolstered by substantial expansion of manufacturing plants and increased investments in biotechnology infrastructure.

Rapid industrialization, favorable government initiatives, and rising demand for biologic drugs in emerging economies are prompting contract manufacturing companies to establish new facilities, further accelerating regional market growth.

- In May 2024, WuXi AppTec opened a new R&D and manufacturing facility in Singapore’s Tuas Biomedical Park. The facility will provide active pharmaceutical ingredient research and manufacturing services for small molecules, oligonucleotides, peptides, and complex synthetic conjugates.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates biotechnology contract manufacturing through guidelines such as Current Good Manufacturing Practices (cGMP) to ensure product quality and safety.

- In Europe, the European Medicines Agency (EMA) oversees contract manufacturing activities under strict compliance with EU GMP (European Good Manufacturing Practice) regulations. The EMA requires manufacturers to maintain strict quality control systems and adhere to validated processes.

- In India, the Central Drugs Standard Control Organization (CDSCO) regulates contract manufacturing by enforcing GMP and other quality standards. CDSCO guidelines include requirements for manufacturing environment, quality assurance, and product testing.

Competitive Landscape

Key players operating in the global biotechnology contract manufacturing industry are prioritizing strategic acquisitions and geographic expansion to reinforce their competitive positioning. They acquire organizations to enhance technological capabilities, diversify service portfolios, and gain access to specialized expertise.

Expansion into emerging and established markets enables access to varied customer segments and the ability to navigate diverse regulatory frameworks effectively. Additionally, forming partnerships and joint ventures with local entities facilitates efficient market entry and operational optimization. These strategies collectively strengthen their global presence and capacity to address evolving client requirements across regions.

- In October 2024, Lonza acquired Roche’s large-scale biologics manufacturing facility in Vacaville, California. The acquisition enhances Lonza’s mammalian manufacturing capacity and strengthens its West Coast commercial presence. With a bioreactor capacity of approximately 330,000 liters, the site supports late-stage clinical, commercial products, and molecules advancing toward commercialization.

Key Companies in Biotechnology Contract Manufacturing Market:

- Lonza

- Thermo Fisher Scientific Inc.

- Catalent, Inc

- WuXi Biologics

- SAMSUNG

- FUJIFILM Corporation

- Recipharm AB

- Rentschler Biopharma SE

- AGC Biologics

- Boehringer Ingelheim International GmbH

- CELLARES

- LOTTE

- Evotec SE

- PORTON

- Grifols

Recent Developments (Partnerships/Expansion)

- In June 2025, WuXi Biologics commenced construction of a new microbial manufacturing site in Chengdu, China. The site will house a 15,000L fermenter with potential expansion to 60,000L, supporting annual production of 80 to 110 drug substance batches. It will include China’s first dual-chamber lyophilization line and a vial filling line with drug product capacity exceeding 10 million vials per year.

- In October 2024, Samsung Biologics entered into a USD 1.24 billion contract manufacturing agreement with an Asia-based pharmaceutical company . The agreement covers production at Samsung Biologics’ Songdo site and runs through December 2037. This deal represents the company's largest single-client contract to date and contributed to Samsung Biologics’ total accumulated contracts exceeding USD 3.3 billion in 2024.