Bioprocess Container Market Size

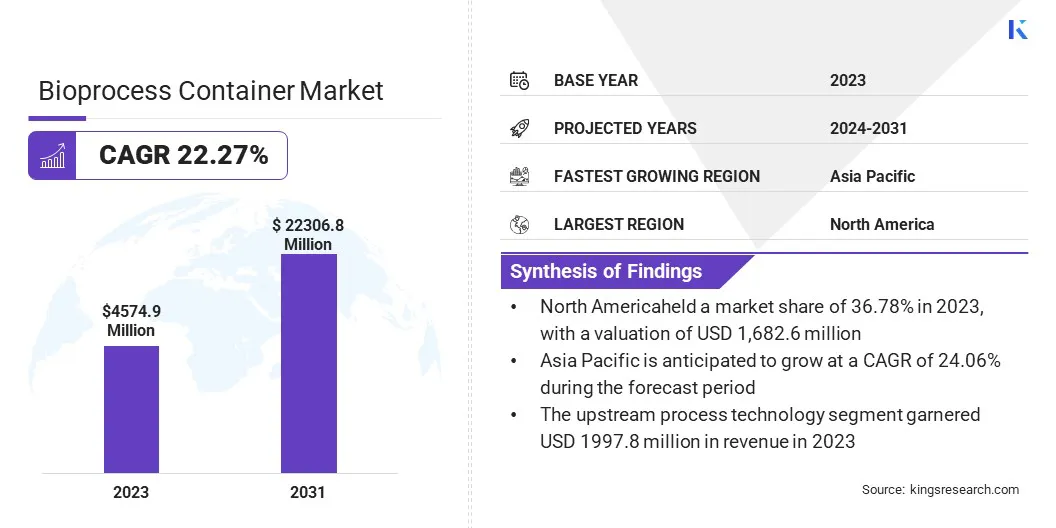

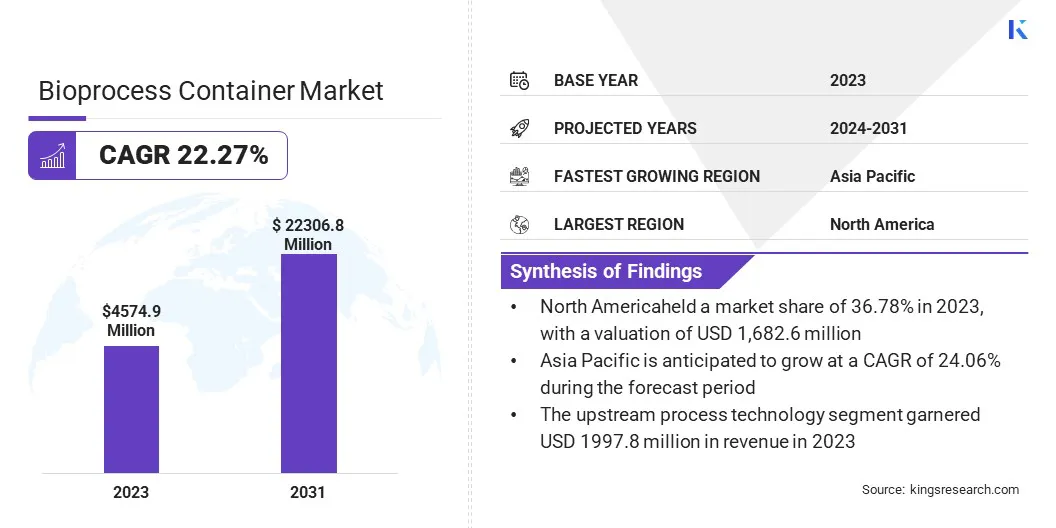

The global Bioprocess Container Market size was valued at USD 4,574.9 million in 2023 and is projected to grow from USD 5,461.1 million in 2024 to USD 22,306.8 million by 2031, exhibiting a CAGR of 22.27% during the forecast period. The market is expanding rapidly due to advancements in biomanufacturing technologies and the growing trend of single-use systems.

These innovations enhance production efficiency and flexibility, catering to diverse biopharmaceutical applications. The growing shift toward automated processes and integrated systems is propelling market growth, as companies actively seek solutions that streamline operations and reduce contamination risks in drug development and production.

In the scope of work, the report includes solutions offered by companies such as Thermo Fisher Scientific Inc., Cytiva, Saint-Gobain S.A, Lonza Group AG, Avantor Inc, Merck KGaA, Sartorius AG, CellBios Healthcare and Lifesciences Pvt Ltd, Cole-Parmer Instrument Co, Biomass Sensor, and others.

The rising global prevalence of cancer and immunological disorders is creating a strong demand for vaccines and biologics, which are essential for the treatment of these conditions.

- According to a report published by the American Cancer Society in April 2022, biologics are widely used in cancer treatment, thereby fueling the need for efficient containment solutions.

Additionally, the increased preference for immunotherapy and chemotherapy is increasing the requirement for versatile and scalable bioprocess containers. These containers are engineered to support the complex needs of biologics production, ensuring safety, efficiency, and adaptability throughout the biomanufacturing process. This growing demand for advanced containment solutions is significantly boosting the bioprocess container market growth.

A bioprocess container is a specialized, flexible, and scalable storage solution used in the biopharmaceutical industry for handling, storing, and transporting biological materials during various stages of the production process. Typically made from high-quality, sterile materials, these containers are designed to maintain the integrity and quality of sensitive biological products such as vaccines, biologics, and cell cultures.

They come in various forms, including single-use bags, tanks, and assemblies, and are essential for ensuring contamination control, process efficiency, and adaptability in biomanufacturing environments. Their design supports both small-scale research and large-scale commercial production, thereby facilitating the advancement of biopharmaceutical development.

Analyst’s Review

Business expansion strategies such as mergers, acquisitions, and collaborations are anticipated to support the growth of the bioprocess container market over the forecast period.

- For instance, in June 2022, AstraZeneca's Rare Disease division, Alexion, announced an investment of approximately USD 68.20 million to enhance its biologics manufacturing capabilities in Ireland over the next 18 months. This investment aims to boost biologics production and research initiatives.

These efforts by key players, including significant investments and strategic expansions, are poised to bolster market growth by increasing biologics production capacity and advancing research initiatives. As companies integrate bioprocess containers into high-performance systems, the market is anticipated to witness robust growth in the coming years.

Bioprocess Container Market Growth Factors

The increasing demand for biopharmaceuticals is propelling the growth of the market, as companies continually seek efficient, flexible, and scalable containment solutions. The expansion of the biopharmaceutical sector is highlighting the pressing need for advanced containers that adapt to various manufacturing processes while ensuring the safety and quality of the products.

As the biopharmaceutical industry continues to evolve, the market is witnessing rising adoption of bioprocess containers, which are enhancing operational efficiency and meeting the industry's stringent requirements. This growing demand for adaptable and reliable containment solutions is boosting market expansion.

A significant challenge impeding the development of the bioprocess container market is the high cost associated with advanced materials and technologies, which is limiting accessibility and affordability, especially for smaller firms and emerging markets. This high expense is restricting market entry and hampering the adoption of new technologies.

To navigate these challenges, key players are investing heavily in research and development to create cost-effective materials and streamline manufacturing processes. Additionally, companies are leveraging economies of scale through large-scale production and forming strategic partnerships to lower costs and improve accessibility. These strategies are making advanced bioprocess containers more affordable and widely adopted, which is likely to stimulate market growth in the forthcoming years.

Bioprocess Container Market Trends

This increasing adoption of single-use bioprocess containers is a prominent trend influencing the market. This trend is further fueled by their convenience, reduced contamination risk, and cost-effectiveness. Companies are continually adopting these containers due to their ability to streamline production processes and minimize the need for cleaning and sterilization.

This trend is propelling the bioprocess container market growth by enhancing safety, lowering operational costs, and facilitating faster, more efficient biomanufacturing through the use of single-use systems. The ongoing shift toward these containers is contributing to significant advancements in biopharmaceutical production and fueling market expansion.

The market is witnessing a growing trend toward the adoption of automated and integrated bioprocess systems, which are significantly enhancing production efficiency and accuracy. Companies are continually integrating advanced bioprocess containers with these automated systems to streamline operations and reduce human error.

This ongoing trend is fostering market growth by boosting the demand for innovative container solutions that enhance automation, increase precision, and improve overall process efficiency. The integration of automated systems and advanced containers is contributing to the expansion of the biopharmaceutical production market.

Segmentation Analysis

The global market is segmented based on application, type, end user, and geography.

By Application

Based on application, the bioprocess container market is categorized into upstream process, downstream process, and process development. The upstream process segment garnered the highest revenue of USD 1,997.8 million in 2023, largely attributed to advancements in cell culture, media preparation, and fermentation technologies.

Innovations in cell culture systems are advancing the development of cell line, leading to increased yields and enhanced efficiencies. Improvements in media preparation are optimizing nutrient formulations, reducing costs, and increasing productivity. Additionally, advancements in fermentation technologies are enabling more scalable and cost-effective production processes. As the demand for biologics and vaccines rises, these technological advancements are boosting the growth of the segment.

By Type

Based on type, the market is categorized into 2D bioprocess containers, 3d bioprocess containers, and others. The 3D bioprocess containers segment captured the largest bioprocess container market share of 45.34% in 2023, mainly due to their major role in streamlining biopharmaceutical production processes, including media preparation, fluid management, and storage. The increasing focus on biologics development is prompting manufacturers to improve and expand their container offerings.

- For instance, in February 2022, ALLpaQ Packaging Group launched its ALLpaQ 500 PLUS Bioprocess Container, reflecting a strategic investment aimed at addressing market demands and fostering innovation in the sector.

The emphasis on advancing container technology and meeting client needs is expected to propel the growth of the 3D bioprocess containers segment in the near future.

By End User

Based on end user, the market is categorized into pharmaceutical & biotechnology, CROs & CMOs, and academic & research institutes. The pharmaceutical & biotechnology segment is expected to garner the highest revenue of USD 11,853.6 million by 2031.

The increasing focus on biologics, such as monoclonal antibodies and gene therapies, necessitates the development of advanced and scalable containment solutions. As pharmaceutical companies and biotech firms invest in the development of new drug and innovative therapies, there is an increasing demand for high-quality bioprocess containers.

Moreover, stringent regulatory requirements for drug production mandate that containers must meet high standards of quality and compliance. This rising demand for advanced, flexible, and regulatory-compliant containers is supporting segmental expansion.

Bioprocess Container Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America bioprocess container market share stood around 36.78% in 2023 in the global market, with a valuation of USD USD 1,682.6 million. The high demand for biopharmaceutical products, attributed to the growing prevalence of chronic diseases and supportive government policies, is anticipated to boost regional market expansion.

Furthermore, the regional market is benefiting from significant investments and government initiatives aimed at addressing the high burden of chronic diseases and boosting the expansion of the biopharmaceutical sector.

- For instance, in April 2022, Catalent announced a USD 350 million investment in its Bloomington, Indiana facility. This expansion aims to bolster its biologics drug substance and product manufacturing capabilities by adding new bioreactors, syringe filling lines, and increased lyophilization capacity. The project is anticipated to feature upgraded quality control laboratories and advanced automated packaging solutions, catering to the industry’s robust biologics pipeline.

Such investments are strengthening the market's infrastructure and supporting the growing demand for biopharmaceutical products in North America, thereby fueling regional market expansion.

Asia-Pacific is anticipated to witness robust growth at a staggering CAGR of 24.06% over the forecast period. This growth is fueled by increased investments in biopharmaceutical development and a rising prevalence of chronic diseases.

- For instance, in August 2022, Innovent Biologics of China and Sanofi from Paris announced a substantial investment of USD 2.42 billion to co-develop cancer treatments in China. This funding is specifically allocated to advancing the development of SAR408701, a drug for treating lung and gastric cancers, as well as SAR444245, which is undergoing phase-II trials for skin cancer and other tumors.

Such large-scale investments in cancer therapeutics highlight the region’s commitment to addressing critical healthcare challenges, thereby propelling the demand for bioprocess containers in Asia-Pacific.

Competitive Landscape

The global bioprocess container market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expanding services, investing in research and development (R&D), establishing new service delivery centers, and optimizing their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Bioprocess Container Market

Key Industry Development

- April 2023 (Product Launch): Merck introduced the Ultimus Single-Use Process Container Film, designed to provide exceptional durability and leak resistance for single-use assemblies used in bioprocessing liquid applications.

The global bioprocess container market is segmented as:

By Application

- Upstream Process

- Downstream Process

- Process Development

By Type

- 2D Bioprocess Containers

- 3D Bioprocess Containers

- Others

By End User

- Pharmaceutical & Biotechnology

- CROs & CMOs

- Academic & Research Institutes

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America