Market Definition

Bioplastics and biopolymers are materials derived from renewable biological resources such as corn starch, sugarcane, cellulose, and vegetable oils, or produced through microbial processes. They serve as alternatives to petroleum-based plastics, with benefits such as biodegradability or recyclability. Key types include polylactic acid (PLA), polyhydroxyalkanoates (PHA), starch blends, bio-PET, and bio-based polyethylene.

These materials are increasingly used across packaging, agriculture, automotive, electronics, and consumer goods industries, supported by sustainability initiatives, regulatory support, and growing demand for eco-friendly solutions.

Bioplastics Biopolymers Market Overview

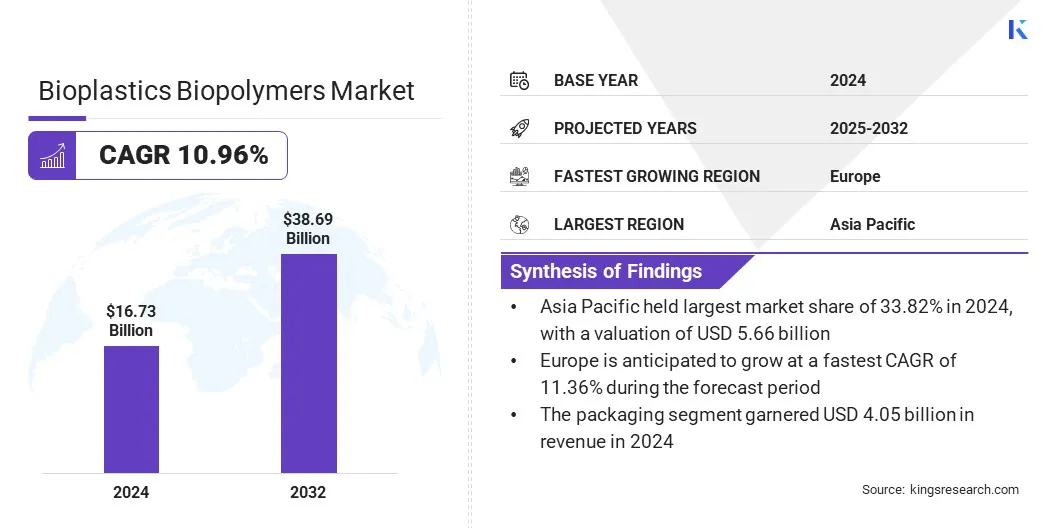

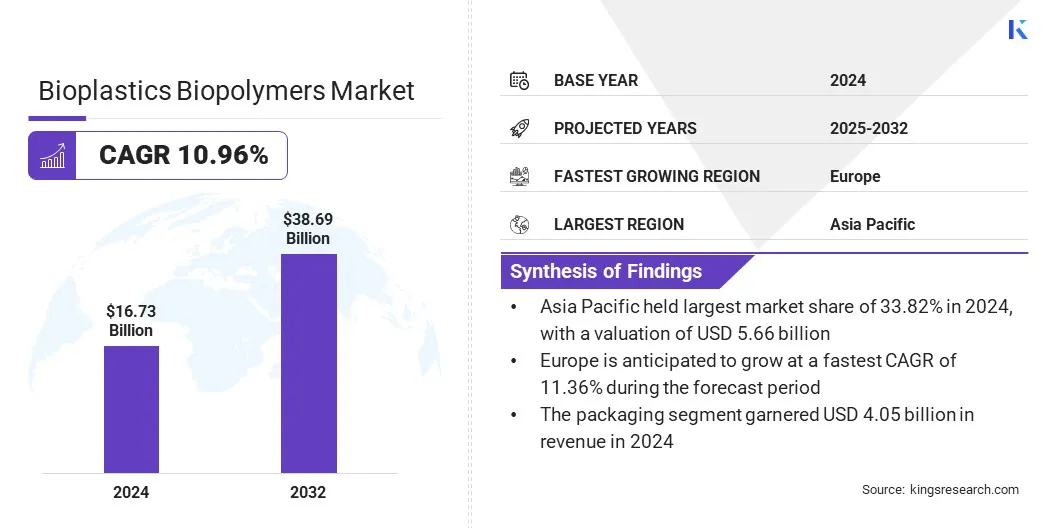

The global bioplastics biopolymers market size was valued at USD 16.73 billion in 2024 and is projected to grow from USD 18.50 billion in 2025 to USD 38.69 billion by 2032, exhibiting a CAGR of 10.96% during the forecast period. This growth is fueled by the rising demand for compostable packaging and expanding retail distribution networks. Sustainability commitments by major food and beverage brands are further boosting the large-scale integration of bioplastics.

Rising corporate commitments to carbon neutrality and circular economy models are propelling market expansion. Industries such as packaging, consumer goods, automotive, and electronics are aligning sustainability objectives with material innovation to reduce carbon footprints and enhance resource efficiency.

Key Highlights:

- The bioplastics biopolymers industry size was recorded at USD 16.73 billion in 2024.

- The market is projected to grow at a CAGR of 10.96% from 2025 to 2032.

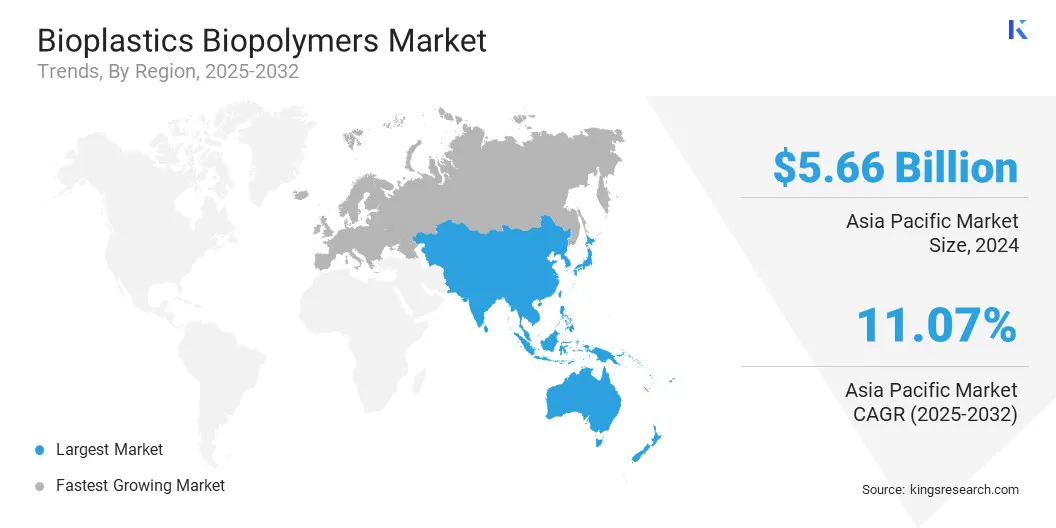

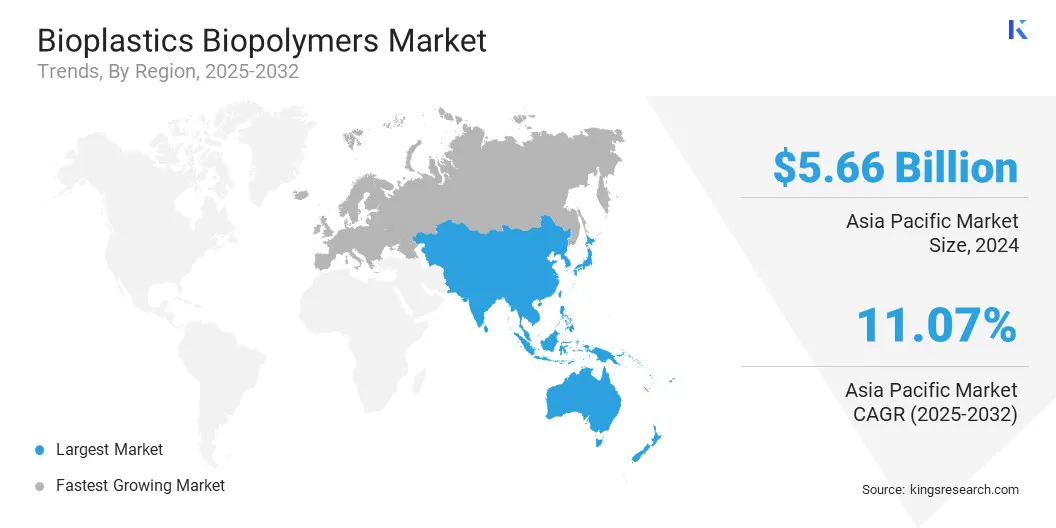

- Asia Pacific held a share of 33.82% in 2024, valued at USD 5.66 billion.

- The non-biodegradable segment garnered USD 10.03 billion in revenue in 2024.

- The packaging segment is expected to reach USD 9.40 billion by 2032.

- Europe is anticipated to grow at a CAGR of 11.36% through the projection period.

Major companies operating in the bioplastics biopolymers market are NatureWorks LLC, BASF SE, TotalEnergies Corbion, Novamont S.p.A., Braskem, Mitsubishi Chemical Group Corporation, Toray Industries, Inc., Eastman Chemical Company, DuPont, Arkema S.A., Dow Inc., Borealis AG, LyondellBasell Industries N.V., Evonik Industries AG, and Solvay SA.

Bioplastics are increasingly prioritized in corporate sustainability strategies for reducing reliance on fossil-based feedstocks while promoting recyclability and biodegradability. Strategic collaborations, procurement of bio-based materials, and investment in closed-loop systems are further integrating biopolymers into mainstream industrial applications.

Bioplastics are increasingly prioritized in corporate sustainability strategies for reducing reliance on fossil-based feedstocks while promoting recyclability and biodegradability. Strategic collaborations, procurement of bio-based materials, and investment in closed-loop systems are further integrating biopolymers into mainstream industrial applications.

- In September 2025, Versalis and Veritas signed an agreement to promote circular economy initiatives focused on valorising post-consumer and post-industrial plastics. The collaboration aims to assess waste streams and secondary raw materials from Veritas’s facilities for Versalis’s recycling processes.

Market Driver

Increasing Bioplastics Production Capacity

The growth of the bioplastics biopolymers market is propelled by the expansion of bioplastics production capacity to meet rising global demand for sustainable materials in packaging, textiles, agriculture, and automotive applications. Investments in large-scale plants, advanced polymerization technologies, and expanded feedstock utilization are enhancing output efficiency and reducing costs.

Emerging markets are witnessing new capacity additions, supported by favorable government policies and corporate sustainability agendas. This expansion ensures a steady supply of biopolymers, promotes wider adoption, and strengthens the competitiveness of bio-based materials against conventional alternatives.

- In 2024, European Bioplastics reported that bioplastics represented about 0.5% of the 414 million tonnes of global plastic production. The Association forecasts production capacity to grow from 2.47 million tonnes in 2024 to 5.73 million tonnes by 2029.

Market Challenge

Limited Industrial Composting Infrastructure and Inconsistent End-Of-Life Disposal Systems

Limited industrial composting infrastructure and inconsistent end-of-life disposal systems remain major challenges restricting large-scale adoption of bioplastics, which is limiting the expansion of the bioplastics biopolymers market.

Many regions lack standardized waste management frameworks to differentiate biopolymers from traditional plastics, leading to contamination in recycling streams. The absence of sufficient composting facilities delays biodegradation benefits and restricts value recovery through circular systems. These gaps undermine consumer confidence and reduce the effectiveness of sustainability initiatives, thereby slowing demand growth in certain markets.

To address this challenge, governments, industry coalitions, and waste management providers are strengthening composting infrastructure, setting certification standards, and advancing sorting technologies to ensure bioplastics deliver their intended environmental performance, foster consumer trust, and support long-term market scalability.

Market Trend

Rising Adoption in the Automotive and Electronics Industries

A notable trend influencing the bioplastics biopolymers market is the rising adoption in the automotive and electronics industries. Automakers are integrating bio-based polymers in interior parts, panels, and structural elements to reduce vehicle weight and meet emission regulations. Electronics manufacturers are adopting biodegradable casings, circuit boards, and housings to enhance sustainability while addressing e-waste concerns.

This trend is supported by continuous R&D efforts improving thermal stability, mechanical strength, and processing capabilities of biopolymers. Expanding industrial applications demonstrate the shift toward sustainability, positioning bioplastics as viable substitutes across advanced manufacturing components.

- In June 2024, under the EU-funded ECOPLAST project, researchers developed new biomass-based thermoplastic composites and enhanced processing technologies for the automobile sector. The research integrated natural fibers, nanofillers, and protein-based polymers with polylactic acid (PLA) and polyhydroxybutyrate (PHB) to reduce environmental impact and support sustainable material adoption.

Bioplastics Biopolymers Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Biodegradable, Non-Biodegradable

|

|

By End Use

|

Packaging, Consumer Goods, Textile, Automotive & Transportation, Construction, Agriculture, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Type (Biodegradable and Non-Biodegradable): The non-biodegradable segment captured the largest share of 59.94% in 2024, primarily due to strong demand for durable, lightweight bioplastics in automotive, construction, and electronics industries, cost-efficiency, established supply chains, and superior mechanical properties compared to biodegradable alternatives.

- By End Use (Packaging, Consumer Goods, Textile, Automotive & Transportation, Construction, Agriculture, and Others): The textile segment is poised to record a CAGR of 11.11% through the forecast period, owing to rising adoption of biopolymer-based fibers in sustainable fashion, growing demand for eco-friendly fabrics, and increasing investments from manufacturers in bio-based textile innovations.

Bioplastics Biopolymers Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific bioplastics biopolymers market share stood at 33.82% in 2024, valued at USD 5.66 billion. This leading position is reinforced by strong manufacturing capabilities, robust downstream demand for sustainable packaging, and favorable policy frameworks promoting bio-based materials adoption. Ample feedstock availability, cost-competitive production infrastructure, and the growth of urbanization and e-commerce further foster regional market expansion.

- In October 2024, Praj Industries launched India’sfirst polylactic acid (PLA) demonstration facility in Pune. This initaitive strengthens domestic biopolymer capabilities, promotes sustainable alternatives, and accelerates the adoption of eco-friendly materials in packaging, textiles, and industrial applications.

Europe is set to grow at a CAGR of 11.36% over the forecast period. This growth is attributed to the regulatory support, including extended producer responsibility schemes and mandatory recycled-content targets, which create structural demand for bio-based alternatives.

Mature waste-management systems and advanced recycling technologies enable integration of biopolymers into circular value chains, enhancing commercial viability for higher-value applications such as specialty packaging and automotive components. Strong consumer preference for certified sustainability claims enables premium pricing, thereby fostering regional market growth.

- In June 2025, TotalEnergies Corbion released updated Luminy PLA life cycle assessment (LCA) results, showing up to 85% lower carbon footprint than conventional plastics. Luminy PLA achieves carbon neutrality with 30% recycled content and a negative footprint with 100% recycled PLA, accounting for biogenic carbon.

Regulatory Frameworks

- In the EU, the Single-Use Plastics Directive regulates the use of certain plastic products. It aims to reduce plastic waste and promote alternatives, supporting the adoption of bioplastics and biopolymers in packaging and consumer goods.

- In the U.S., the EPA Resource Conservation and Recovery Act (RCRA) oversees waste management practices. It encourages sustainable disposal and recycling of plastics, indirectly promoting biopolymer adoption for environmentally compliant products.

- In China, the Measures for the Administration of Plastic Pollution Control govern plastic production and usage. It supports the shift toward biodegradable and bio-based plastics, boosting bioplastics adoption in packaging and industrial applications.

- In India, the Plastic Waste Management Rules regulate the handling and recycling of plastics. It emphasizes eco-friendly alternatives, promoting the use of bioplastics and biopolymers across manufacturing and packaging sectors.

- In Japan, the Act on Promotion of Resource Circulation for Plastics monitors plastic lifecycle management. It promotes recycling and substitution with bio-based materials, boosting biopolymer adoption in industrial and consumer applications.

- In Canada, the Canadian Environmental Protection Act (CEPA) regulates chemical substances and plastic products. It supports sustainable alternatives, promoting bioplastics development and usage to reduce environmental impact.

- In Australia, the National Waste Policy and Product Stewardship Act supervises plastic use and recycling. It fosters the adoption of biodegradable and bio-based plastics.

Competitive Landscape

Key players operating in the bioplastics biopolymers industry are focusing on capacity expansion, vertical integration of feedstock sourcing, and R&D to enhance mechanical and barrier properties. Partnerships, joint ventures, licensing, and off-take agreements enhance market access while mitigating investment risk.

Firms are emphasizing certification, lifecycle transparency, and third-party validation, along with Cost reduction through process optimization and waste-derived feedstocks. Sustained growth depends on scaling pilot technologies, expanding regional presence, enhancing circularity initiatives, and aligning products with regulations and brand sustainability goals.

- In October 2023, Braskem S.A. and FKuR Kunststoff GmbH expanded their distribution agreement to include additional products from the I'm green bio-based portfolio. The partnership now covers I'm green bio-based EVA, leveraging FKuR’s expertise and network to support European clients' sustainability initiatives.

Key Companies in Bioplastics Biopolymers Market:

- NatureWorks LLC

- BASF SE

- TotalEnergies Corbion

- Novamont S.p.A.

- Braskem

- Mitsubishi Chemical Group Corporation

- Toray Industries, Inc.

- Eastman Chemical Company

- DuPont

- Arkema S.A.

- Dow Inc.

- Borealis AG

- LyondellBasell Industries N.V.

- Evonik Industries AG

- Solvay SA

Recent Developments (New Product Launch)

- In June 2024, BASF expanded its certified compostable biopolymer portfolio with biomass-balanced (BMB) Ecoflex, a polybutylene adipate terephthalate (PBAT). Ecoflex BMB allows packaging manufacturers to increase renewable feedstock use, reduce fossil resource consumption, and maintain product performance and quality.

Bioplastics are increasingly prioritized in corporate sustainability strategies for reducing reliance on fossil-based feedstocks while promoting recyclability and biodegradability. Strategic collaborations, procurement of bio-based materials, and investment in closed-loop systems are further integrating biopolymers into mainstream industrial applications.

Bioplastics are increasingly prioritized in corporate sustainability strategies for reducing reliance on fossil-based feedstocks while promoting recyclability and biodegradability. Strategic collaborations, procurement of bio-based materials, and investment in closed-loop systems are further integrating biopolymers into mainstream industrial applications.