Market Definition

The biocompatible coatings market encompasses the development and application of specialized coatings for medical devices, implants, and surgical instruments to enhance their compatibility with biological systems.

These coatings help reduce immune responses, prevent infections, improve tissue integration, and offer functionalities like antibacterial protection and controlled drug release.

The market is driven by the increasing demand for advanced healthcare solutions, particularly in orthopedics, cardiology, and drug delivery systems. Key applications include medical implants such as pacemakers, stents, orthopedic prosthetics, and dental implants, as well as surgical tools and diagnostic devices.

Biocompatible coating Market Overview

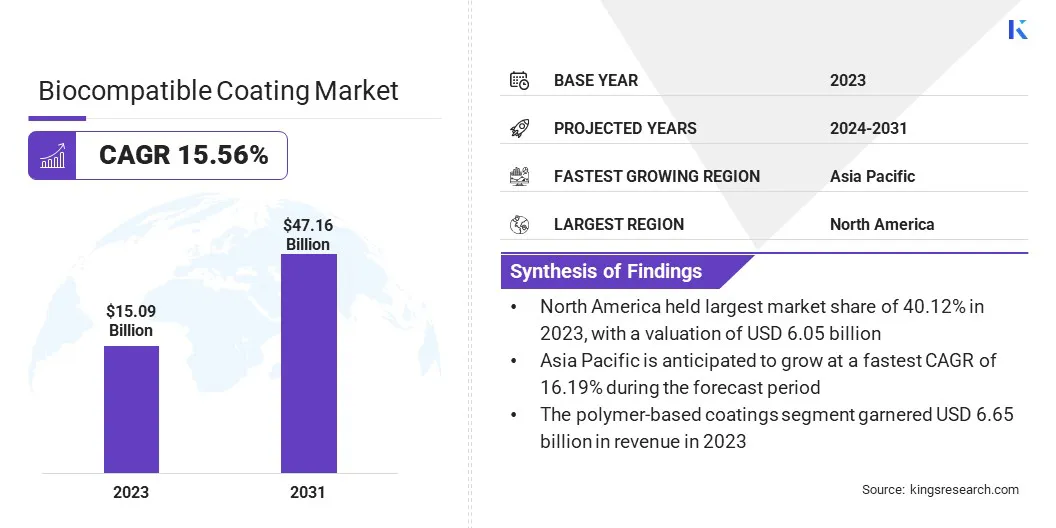

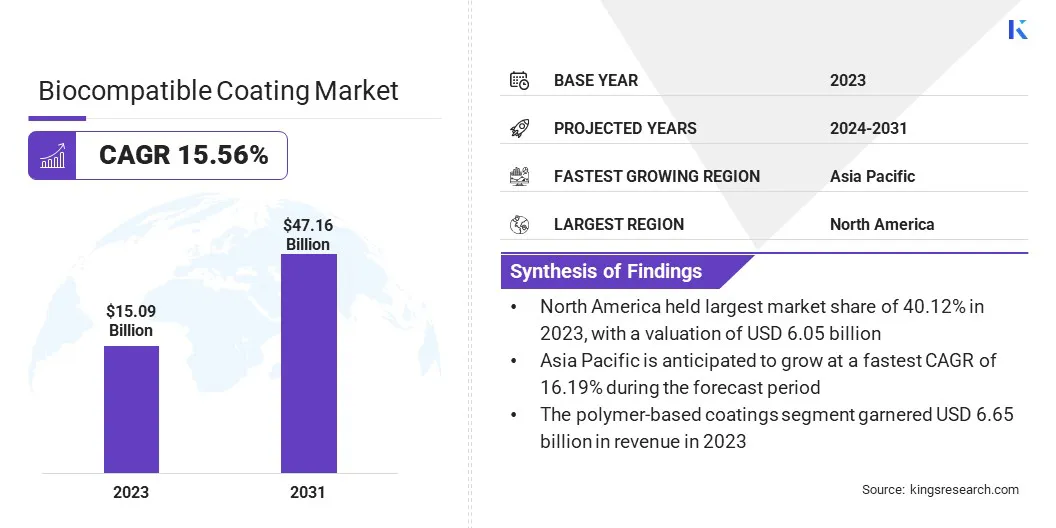

The global biocompatible coating market size was valued at USD 15.09 billion in 2023 and is projected to grow from USD 17.14 billion in 2024 to USD 47.16 billion by 2031, exhibiting a CAGR of 15.56% during the forecast period.

The market is registering significant growth, driven by the rising demand for medical implants, advancements in biomaterial technology, and increasing healthcare expenditures globally.

The growing prevalence of chronic diseases, such as cardiovascular disorders and orthopedic conditions, has fueled the adoption of coated medical devices that enhance biocompatibility and reduce complications.

Major companies operating in the global biocompatible coating industry are Surmodics, Inc., dsm-firmenich, Hydromer, Biocoat Incorporated, RAG-Stiftung, Advanced Deposition & Coating Technologies, Inc., Formacoat, Freudenberg SE, Harland Medical Systems, Inc., Para-Coat Technologies, Inc., Aculon, BioInteractions, Surface Solutions Group, LLC, AST Products, Inc., and APPLIED MEDICAL COATINGS.

Technological innovations, including nanotechnology and antimicrobial coatings, are further boosting the market by improving the performance and longevity of implants and surgical instruments.

Additionally, the expanding use of biocompatible coatings in drug delivery systems and tissue engineering applications is creating opportunities, while supportive government regulations and investments in healthcare infrastructure continue to accelerate the market growth.

- In November 2024, SLTL Medical showcased its specialized coating capabilities at MEDICA 2024, highlighting hydrophilic coatings for balloon catheters and drug coatings for implantable devices. These coatings enhance biocompatibility and performance, improving the safety and functionality of medical devices used in minimally invasive procedures.

Key Highlights:

- The global biocompatible coating market size was valued at USD 15.09 billion in 2023.

- The market is projected to grow at a CAGR of 15.56% from 2024 to 2031.

- North America held a market share of 40.12% in 2023, with a valuation of USD 6.05 billion.

- The hydrophilic coatings segment garnered USD 5.75 billion in revenue in 2023.

- The polymer-based coatings segment is expected to reach USD 20.54 billion by 2031.

- The medical implants segment is expected to reach USD 18.32 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 16.19% during the forecast period.

How is growing demand for medical implants driving this market?

The biocompatible coating market is registering significant growth, due to the increasing prevalence of chronic diseases, such as cardiovascular disorders and orthopedic conditions, which has fueled the need for high-performance coatings that enhance implant longevity and biocompatibility while minimizing complications.

Biocompatible coatings play a crucial role in reducing immune responses, preventing infections, and improving the overall functionality of these devices as the demand for medical implants like pacemakers, stents, and orthopedic prosthetics continues to rise.

Additionally, continuous innovations in biomaterial science, including nanocoatings and drug-eluting coatings, are transforming the industry by improving antimicrobial resistance, reducing friction, and enabling controlled drug release.

Nanotechnology-based coatings enhance surface properties at the molecular level, providing better adhesion and improved interaction with biological tissues. Drug-eluting coatings allow for the controlled release of therapeutic agents, reducing post-surgical complications and the need for additional treatments.

- In June 2024, Hydromer, Inc. announced the launch of HydroThrombX, a next-generation thromboresistant medical device coating designed to reduce platelet adhesion and blood clot formation, thereby improving patient safety and device longevity.

What are the major obstacles for this market?

The biocompatible coating market faces several challenges, including material compatibility issues and high production costs, which can hinder market growth. One of the primary concerns is ensuring that coatings adhere effectively to different medical device surfaces while maintaining durability and functionality.

Variations in material properties, such as polymers, ceramics, or metals, may impact the coating’s performance, leading to potential failures like delamination, reduced biocompatibility, or compromised mechanical strength. In medical applications, where coatings must withstand bodily fluids, mechanical stress, and temperature variations, even minor adhesion issues can lead to device failure or reduced effectiveness.

Companies are investing in advanced surface modification techniques, improved adhesion technologies, and rigorous testing to enhance coating stability and performance across various medical applications.

Another significant challenge is the high production cost associated with advanced biocompatible coatings, particularly those utilizing nanotechnology or specialized drug-eluting materials. The complexity of manufacturing processes and the need for high-quality raw materials contribute to increased expenses, making it difficult for smaller manufacturers to compete.

A key solution to this issue is the adoption of cost-effective production techniques, such as scalable nanomanufacturing and automation, which can reduce overall expenses while maintaining product quality.

What are the major trends in this market?

Emerging trends in the biocompatible coating market are driven by a strong focus on infection prevention. Antimicrobial coatings are becoming increasingly popular in medical devices, helping to reduce hospital-acquired infections and improve treatment outcomes.

These coatings incorporate antimicrobial agents such as silver ions, antibiotics, or specialized polymers that prevent bacterial growth on the surface of implants, catheters, and surgical instruments. The demand for antimicrobial coatings continues to rise as healthcare facilities seek to lower infection rates and improve post-surgical recovery.

Additionally, the shift to sustainable, biodegradable, and biocompatible coatings is driven by stricter environmental regulations and a rising preference for eco-friendly medical solutions.

Manufacturers are exploring naturally derived polymers, bioabsorbable materials, and non-toxic alternatives that break down safely within the body or the environment. These coatings not only reduce long-term environmental impact but also improve biocompatibility, making them suitable for applications in tissue engineering, regenerative medicine, and bioresorbable implants.

- In October 2024, UPM Biomedicals introduced FibGel, the world’s first injectable nanocellulose hydrogel for medical devices. Made from birch wood cellulose and water, it offers a biocompatible, sustainable, and animal-free alternative for soft tissue repair, orthopedics, and regenerative medicine.

Biocompatible coating Market Report Snapshot

|

Segmentation

|

Details

|

|

By Coating Type

|

Hydrophilic Coatings, Hydrophobic Coatings, Antimicrobial Coatings, Drug-eluting Coatings, Non-thrombogenic Coatings

|

|

By Material Type

|

Polymer-based Coatings (Polyethylene Glycol (PEG), Polyurethane (PU), Polytetrafluoroethylene (PTFE)), Ceramic-based Coatings (Hydroxyapatite (HA), Zirconia (ZrO₂), Alumina (Al₂O₃)), Metal-based Coatings (Titanium (Ti) Coatings, Silver (Ag) Coatings, Gold (Au) Coatings), Natural Coatings (Collagen, Chitosan, Hyaluronic Acid)

|

|

By Application

|

Medical Implants (Orthopedic Implants, Cardiovascular Implants, Dental Implants), Surgical Instruments, Catheters & Guidewires, Wearable Medical Devices, Tissue Engineering & Regenerative Medicine, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Coating Type (Hydrophilic Coatings, Hydrophobic Coatings, Antimicrobial Coatings, Drug-eluting Coatings, Non-thrombogenic Coatings): The hydrophilic coatings segment earned USD 5.75 billion in 2023, due to its superior lubricity, reducing friction and enhancing the performance of medical devices.

- By Material Type (Polymer-based Coatings, Ceramic-based Coatings, Metal-based Coatings, Natural Coatings): The polymer-based coatings segment held 44.09% share of the market in 2023, due to their versatility, biocompatibility, and widespread use in medical devices and implants.

- By Application (Medical Implants, Surgical Instruments, Catheters & Guidewires, Wearable Medical Devices, Tissue Engineering & Regenerative Medicine, Others): The medical implants segment is projected to reach USD 18.32 billion by 2031, owing to the increasing demand for long-lasting, biocompatible implants in orthopedic and cardiovascular treatments.

What is the market scenario in North America and Asia-Pacific region?

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America accounted for a substantial biocompatible coating market share of 40.12% in 2023, with a valuation of USD 6.05 billion. This dominance is attributed to the well-established healthcare infrastructure, high adoption of advanced medical technologies, and the presence of key industry players driving continuous innovation.

Additionally, the increasing demand for medical implants, catheters, and drug-eluting coatings, coupled with favorable regulatory policies, has strengthened the region’s market position. Moreover, strong government support for research and development, along with significant investments in cutting-edge biomaterial technologies, has contributed to market growth.

The presence of a highly skilled workforce, well-established supply chains, and collaborations between research institutions and medical device manufacturers continue to drive innovation and expand the applications of biocompatible coatings across various healthcare sectors.

The biocompatible coating industry in Asia Pacific is expected to register the fastest growth, with a projected CAGR of 16.19% over the forecast period. This rapid expansion is fueled by rising healthcare investments, a growing geriatric population, and increasing incidences of chronic diseases, driving the demand for biocompatible coatings in medical devices.

Countries such as China, India, and Japan are registering significant growth, due to expanding medical device manufacturing, government initiatives to enhance healthcare access, and increasing R&D activities. Moreover, the presence of low-cost production facilities and a growing preference for minimally invasive surgeries are propelling the market in the region.

The increasing adoption of advanced medical technologies, coupled with rising disposable incomes and improved healthcare infrastructure, is enhancing market penetration. Additionally, strategic collaborations between global medical device manufacturers and regional players are fostering innovation and accelerating the commercialization of biocompatible coatings.

The expanding medical tourism industry in countries like Thailand, India, and South Korea is also boosting the demand for high-quality medical devices, further supporting the market growth.

- In May 2024, Abbott launched the XIENCE Sierra Everolimus-Eluting Coronary Stent System in India, featuring a biocompatible drug-eluting coating that enhances safety, reduces restenosis risk, and improves deliverability for treating complex arterial blockages.

Regulatory Frameworks Also Play a Significant Role in Shaping the Market

- In the U.S., the Food and Drug Administration (FDA) is the regulatory authority that regulates biocompatible coatings for medical devices. The FDA assesses the biocompatibility of the entire device, including any sterilization processes.

- In Europe, the European Medicines Agency (EMA) oversees the use of biocompatible coatings in medical devices and pharmaceuticals, ensuring compliance with the Medical Device Regulation, which outlines detailed requirements for testing and approval of medical devices.

- In China, the regulatory authority overseeing the approval of biocompatible coatings on medical devices is the National Medical Products Administration (NMPA).

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) regulates the medical applications of biocompatible coatings through the Pharmaceutical and Medical Device Act (PMDA).

- In India, the regulatory authority responsible for overseeing the approval of biocompatible coatings on medical devices is the Central Drugs Standard Control Organization (CDSCO), which falls under the Ministry of Health and Family Welfare.

Competitive Landscape:

The global biocompatible coating market is characterized by a large number of participants, including established corporations and rising organizations. Companies are actively focusing on product innovation, research and development, and strategic collaborations to strengthen their market position.

Continuous advancements in biomaterial science, nanotechnology, and surface engineering have enabled market players to develop coatings with enhanced properties such as antimicrobial resistance, improved adhesion, and controlled drug release.

Manufacturers are investing in expanding their production capacities and enhancing their supply chain networks to meet the growing demand for biocompatible coatings across various healthcare applications.

Mergers and acquisitions, along with partnerships with research institutions and medical device manufacturers, are becoming key strategies for companies looking to expand their product portfolios and gain a competitive edge.

The market is also registering an increasing emphasis on sustainability, with companies exploring eco-friendly and biodegradable coating solutions to align with environmental regulations and consumer preferences.

Emerging players are leveraging technological advancements and cost-effective manufacturing processes to compete with well-established firms, particularly in fast-growing regions.

- In February 2025, Integer Holdings Corporation acquired Precision Coating. The acquisition expands Integer’s service offerings with proprietary surface coating technologies, enhancing its capabilities in cardiovascular, neuromodulation, and other medical device solutions.

Top Companies in Biocompatible Coating Market:

- Surmodics, Inc.

- dsm-firmenich

- Hydromer

- Biocoat Incorporated

- RAG-Stiftung

- Advanced Deposition & Coating Technologies, Inc.

- Formacoat

- Freudenberg SE

- Harland Medical Systems, Inc.

- Para-Coat Technologies, Inc.

- Aculon

- BioInteractions

- Surface Solutions Group, LLC

- AST Products, Inc.

- APPLIED MEDICAL COATINGS

Recent Developments (Partnerships/New Product Launch)

- In February 2025, Silq Technologies Corp. and NuSil Technology LLC partnered to enhance the biocompatibility of silicone-based medical implants using Silq’s zwitterionic surface treatment, aiming to reduce infections, fibrosis, and thrombosis.

- In November 2024, Avient Corporation launched Colorant Chromatics Transcend Biocompatible PEEK Pre-Colored Compounds at MEDICA 2024. These compounds offer high durability, heat resistance, and biocompatibility, making them ideal for medical devices like dental scalers and surgical robots.

- In November 2024, Medeologix partnered with Biocoat to expand hydrophilic coating services, enhancing catheter performance with biocompatible, low-friction coatings. This collaboration strengthens Medeologix’s position as a leading provider of catheter solutions in the Bay Area.

- In February 2023, BioInteractions launched its expanded Product Pathway Partnership service at MD&M West, offering bespoke coatings, optimized application processes, regulatory support, and commercial production assistance to help medical device manufacturers navigate the complex regulatory landscape efficiently.