Market Definition

The bioceramics market involves the production, development, and application of ceramic materials used in medical and dental applications. Bioceramics, including alumina, and calcium, are engineered for biocompatibility, durability, and functionality in orthopedic implants, dental prosthetics, and tissue engineering.

These materials play a crucial role in bone grafts, joint replacements, and drug delivery systems, due to their bio-inert, bioactive, or resorbable properties.

Bioceramics Market Overview

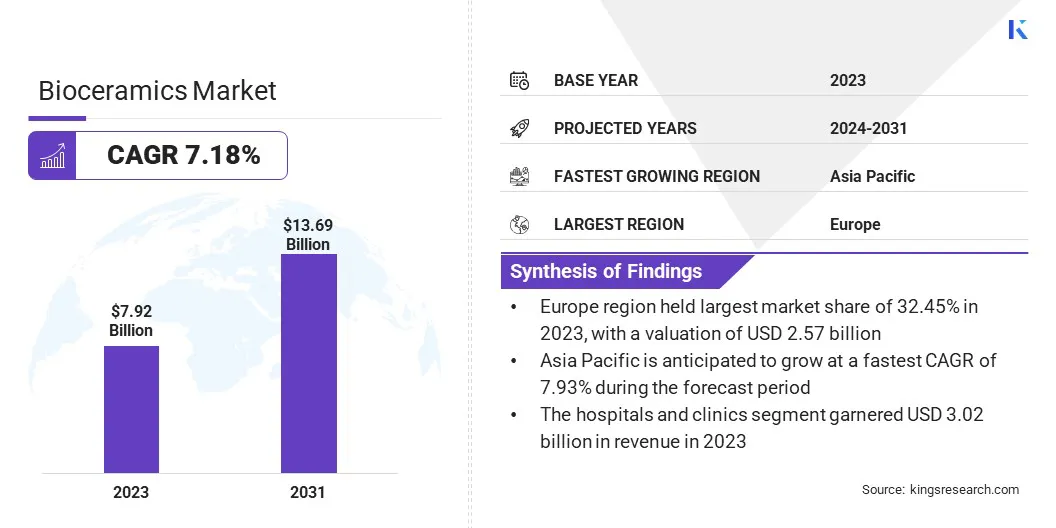

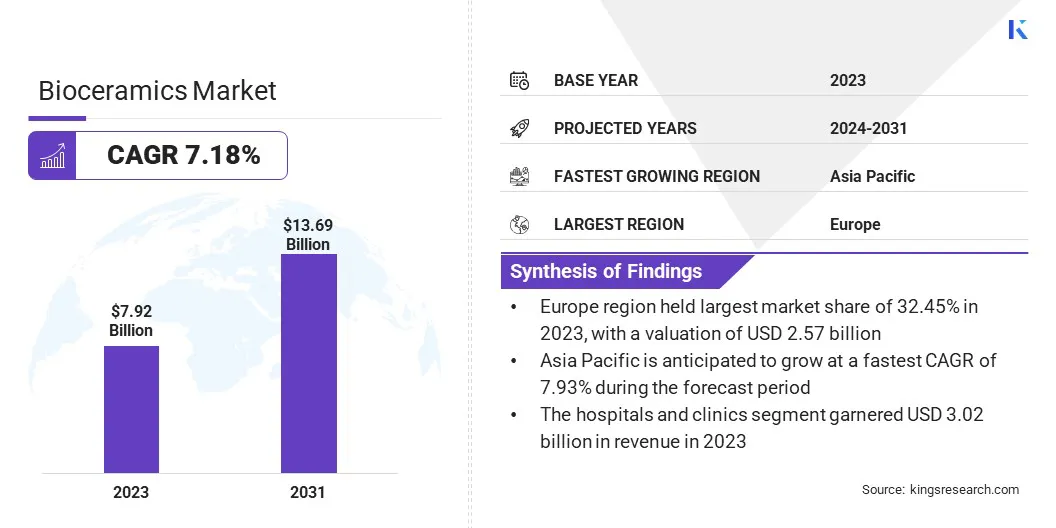

The global bioceramics market size was valued at USD 7.92 billion in 2023 and is projected to grow from USD 8.43 billion in 2024 to USD 13.69 billion by 2031, exhibiting a CAGR of 7.18% during the forecast period.

This is attributed to the rising demand for advanced healthcare solutions, an aging population, and increased prevalence of orthopedic & dental disorders. Innovations in nanotechnology, 3D printing, and regenerative medicine further enhance material performance, creating significant growth opportunities.

Major companies operating in the global bioceramics Industry are Tosoh Europe B.V., Institut Straumann AG, Dentsply Sirona, CeramTec GmbH, 3M, CoorsTek Inc., CAM Bioceramics, KYOCERA Corporation, CGbio, Stryker, dsm-firmenich, Morgan Advanced Materials plc, Zimmer Biomet, Nobel Biocare Services AG,and Bioceramed, S.A.

The expansion of minimally invasive surgeries and government investments in healthcare infrastructure further propel the market. Additionally, the growing adoption of customized implants and advanced drug delivery systems is driving the market.

Key Highlights:

- The global bioceramics market size was valued at USD 7.92 billion in 2023.

- The market is projected to grow at a CAGR of 7.18% from 2024 to 2031.

- Europe held a market share of 32.45% in 2023, with a valuation of USD 2.57 billion.

- The calcium segment garnered USD 2.73 billion in revenue in 2023.

- The bio-active segment is expected to reach USD 5.07 billion by 2031.

- The dental implants segment is expected to reach USD 5.04 billion by 2031.

- The hospitals and clinics segment is expected to reach USD 5.32 billion by 2031.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.93% during the forecast period.

Market Driver

"Rising Demand for Orthopedic and Dental Implants"

Increasing demand for orthopedic and dental implants, driven by an aging population and the growing prevalence of bone-related disorders, is a key driver of the market. Conditions such as osteoporosis, arthritis, and fractures are becoming more common, fueling the need for joint replacements, bone grafts, and spinal implants.

Additionally, rising dental issues, including tooth loss and periodontal diseases, are accelerating the adoption of ceramic-based dental implants and prosthetics.

Advancements in bioceramic materials, such as zirconia and hydroxyapatite, have enhanced their biocompatibility, durability, and mechanical strength, making them a preferred choice in medical applications. These materials offer superior wear resistance and corrosion resistance properties, improving patient outcomes and extending the lifespan of implants.

Market Challenge

"High Manufacturing Costs"

High manufacturing costs are a significant challenge in the bioceramics market, primarily due to the complex production processes required to create advanced ceramic materials such as high-purity alumina, zirconia, and bioactive glass.

The production of these materials involves sophisticated processing techniques, including high-temperature sintering and precision machining, which require specialized equipment, skilled labor, and strict quality control measures.

These factors drive up raw material costs and energy consumption, making the production of bioceramics more expensive compared to traditional materials like metals and polymers.

Companies are increasingly investing in automated manufacturing technologies, advanced material innovations, and process optimization techniques, including 3D printing and nanotechnology, to reduce material waste, improve production efficiency, and enhance cost-effectiveness.

Market Trend

"Adoption of 3D Printing"

A major trend in the bioceramics market is the increasing use of 3D printing (additive manufacturing) to produce customized medical implants and prosthetics. Traditional manufacturing methods involve extensive machining, which leads to material loss and high costs.

However, 3D printing allows for precise, patient-specific implant designs with minimal waste, improving cost efficiency and performance. The use of bioceramic powders and bio inks in 3D printing is transforming the production of bone grafts, dental implants, and scaffolds for tissue engineering.

Materials such as hydroxyapatite-based bio inks closely mimic natural bone, promoting osseointegration and faster healing. The ability to create complex, porous structures using 3D printing also enhances implant mechanical strength and bioactivity.

Bioceramics Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Alumina, Zirconia, Calcium, Others

|

|

By Type

|

Bio-inert, Bio-active, Bio-resorbable

|

|

By Product

|

Orthopedic Implants, Dental Implants, Surgical Instruments

|

|

By End User

|

Hospitals and Clinics, Research Laboratories, Specialty Clinics

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Material (Alumina, Zirconia, Calcium, Others): The calcium segment earned USD 2.73 billion in 2023, due to its increasing application in bone grafts and regenerative medicine.

- By Type (Bio-inert, Bio-active, Bio-resorbable): The bio-active segment held 37.73% share of the market in 2023, due to the increasing use of bioactive ceramics in applications like bone repair and dental implants.

- By Product (Orthopedic Implants, Dental Implants, Surgical Instruments): The dental implants segment is projected to reach USD 5.04 billion by 2031, owing to the rising demand for cosmetic dental procedures and advances in implant technology.

- By End User (Hospitals and Clinics, Research Laboratories, Specialty Clinics): The hospitals and clinics segment is projected to reach USD 5.32 billion by 2031, owing to the growing number of surgical procedures and the increasing global healthcare investments.

Bioceramics Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Europe accounted for a bioceramics market share of around 32.45% in 2023, with a valuation of USD 2.57 billion. This growth is attributed to the high demand for bioceramics materials in orthopedic and dental implant applications, particularly in countries like Germany, France, and the UK.

Europe has a well-established healthcare infrastructure, which contributes to the high adoption of advanced bioceramics implants and medical devices. Moreover, aging populations in European countries are driving the need for joint replacements, spinal surgeries, and dental implants, further fueling the market.

- For instance, in January 2024, according to the European Union (EU), the estimated population of the EU stood at 449.3 million, with over 21.6% of the population aged 65 years and older. This signifies a growing demand for healthcare solutions tailored to an aging population, particularly in the areas of orthopedic and dental implants.

The bioceramics Industry in Asia Pacific is poised to grow at a CAGR of 7.93% over the forecast period. This robust growth is driven by several factors, including the rising demand for orthopedic and dental implants, increasing healthcare investments, and a growing aging population.

Countries such as China, India, and Japan are registering rapid urbanization, leading to enhanced access to advanced medical treatments and bioceramics-based implants.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates the bioceramics market, ensuring the safety, efficacy, and quality of medical devices and materials used in healthcare applications, such as bioceramics implants.

- In Europe, the European Commission (EC) oversees the market, ensuring that bioceramics products meet the required standards for medical applications. The market is also influenced by the work of Notified Bodies, which assess the conformity of bioceramics medical devices.

Competitive Landscape:

The global bioceramics market is characterized by a large number of participants, including established corporations and emerging organizations, which intensify competition within the market.

Leading players in the market include global medical device manufacturers, as well as specialized bioceramics producers who focus on advanced materials for specific applications, such as orthopedic implants, dental implants, and regenerative medicine.

These companies are leveraging Research and Development (R&D) to innovate and improve the biocompatibility, durability, and mechanical properties of their products. Strategic collaborations, acquisitions, and partnerships are common as companies look to expand their product portfolios and enhance their market presence.

- In May 2024, Himed and Lithoz launched a Bioceramics Research Center at Himed's New York headquarters, aiming to accelerate the development of advanced bioceramics materials for orthopedic implants and dental applications. This collaboration highlights the growing emphasis on research and innovation to meet the evolving demands of the market.

List of Key Companies in Bioceramics Market:

- Tosoh Europe B.V.

- Institut Straumann AG

- Dentsply Sirona

- CeramTec GmbH

- 3M

- CoorsTek Inc.

- CAM Bioceramics

- KYOCERA Corporation

- CGbio

- Stryker

- dsm-firmenich

- Morgan Advanced Materials plc

- Zimmer Biomet

- Nobel Biocare Services AG

- Bioceramed, S.A.

Recent Developments (New Product Launch)

- In November 2023, Kerr Dental launched ZenSeal, a bioceramic endodontic sealer, designed for enhanced flowability and radiopacity during root canal procedures. The calcium silicate-based formula adheres effectively to dentin and gutta percha, reducing waste by over 60% compared to leading alternatives, making it an economical and efficient choice for clinicians.