Bioanalytical Testing Services Market Size

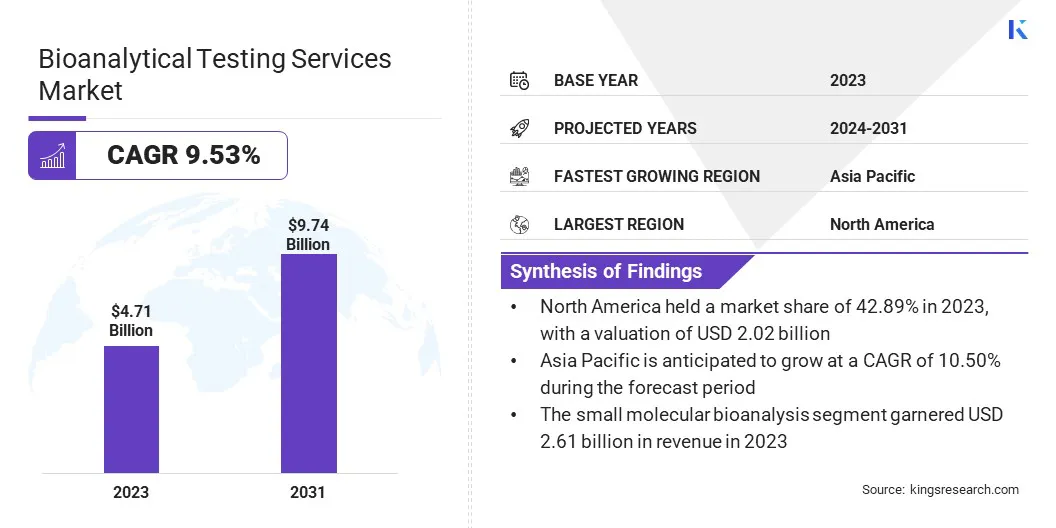

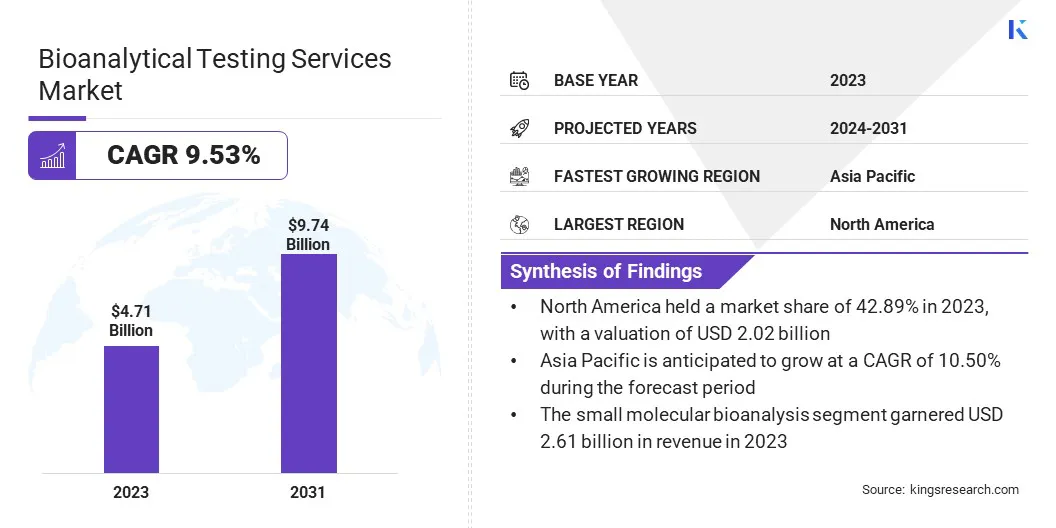

The global Bioanalytical Testing Services Market size was valued at USD 4.71 billion in 2023 and is projected to reach USD 9.74 billion by 2031, growing at a CAGR of 9.53% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as Charles River Laboratories International, Inc., Eurofins Scientific SE, Laboratory Corporation of America Holdings (LabCorp), ICON plc, SGS SA, WuXi AppTec, BioAgilytix Labs, Intertek Group plc, PRA Health Sciences, Inc. and Others.

The market is poised to experience steady growth in the coming years, driven by increasing pharmaceutical R&D activities, stringent regulatory requirements, and advancements in analytical technologies. Emerging markets, technological innovations, and collaborations are expected to fuel market expansion and foster competitive strategies among service providers.

Growing trends such as multi-omics integration and digital transformation are further augmenting growth prospects. These advancements enable comprehensive molecular profiling, real-time diagnostics, and improved data management, thereby driving demand for accurate and efficient bioanalytical testing solutions in the pharmaceutical and biotechnology sectors.

Additionally, the market benefits from increased outsourcing by pharmaceutical and biotechnology companies seeking specialized expertise and cost-effective solutions. Growing awareness of the importance of early disease detection and precise drug monitoring further boosts demand for bioanalytical testing services. Moreover, collaborations with research institutions and academic organizations offer potential opportunities for innovation and expansion into emerging markets, thereby indicating the positive trajectory of the market.

Bioanalytical testing encompasses analytical techniques used to quantify drugs, biomarkers, and metabolites in biological samples. These tests play a crucial in pharmaceutical research by ensuring drug safety, efficacy, and pharmacokinetics in preclinical and clinical studies. Bioanalytical methods include chromatography, mass spectrometry, and immunoassays, providing precise measurements of drug concentrations and metabolite profiles. The applications of bioanalytical testing range from pharmacokinetic studies to drug metabolism investigations, therapeutic drug monitoring, and biomarker analysis for disease diagnosis and monitoring. Bioanalytical testing plays a vital role in drug development, personalized medicine, and healthcare advancements.

Analyst’s Review

Key players in the bioanalytical testing services market prioritize strategies to thrive in evolving regulatory landscapes. A crucial strategy implemented by these companies involves maintaining compliance with regulatory standards such as Good Laboratory Practice (GLP) and Good Manufacturing Practice (GMP) to ensure data integrity and ethical conduct. Regulatory bodies such as the U.S. FDA and the European Medicines Agency set guidelines for bioanalytical method validation, sample handling, and reporting. Companies are increasingly investing in quality management systems, staff training, and technology infrastructure to meet these standards.

Collaborations with regulatory consultants and participation in industry forums help adapt to regulatory changes swiftly. Key players are further focusing on innovation in analytical technologies, automation, and data management to enhance efficiency, reduce costs, and meet the growing demand for advanced bioanalytical testing services.

Bioanalytical Testing Services Market Growth Factors

Increasing drug development activities across the globe are significantly driving the growth of the bioanalytical testing services market. Pharmaceutical and biotechnology companies are intensifying their research and development efforts to introduce new drugs to the market. The demand for bioanalytical testing services is rising proportionally, thus ensuring the safety, efficacy, and quality of pharmaceutical products throughout their development lifecycle. These services quantify drug concentrations, assess pharmacokinetics, monitor metabolites, and identify potential adverse reactions, thereby facilitating informed decision-making during drug development stages.

Additionally, stringent regulatory requirements are supporting the growth of the bioanalytical testing services market, as pharmaceutical and biotechnology companies face growing pressure to comply with standards such as GLP and GMP. These standards ensure the quality, safety, and efficacy of drugs, necessitating rigorous bioanalytical testing throughout the development and manufacturing processes. This increased demand for bioanalytical testing services is driven by the need to meet regulatory requirements and obtain necessary approvals from agencies such as the FDA and EMA.

Companies offering these services must stay updated on regulatory changes, invest in advanced testing technologies, and maintain robust quality management systems to gain a competitive edge in the market.

However, data security and confidentiality are major challenges impeding market growth, thereby requiring robust measures to protect sensitive patient and drug-related data. Compliance with global regulations such as GDPR and HIPAA is complex, requiring advanced encryption, secure data storage, access controls, and regular security audits. Ongoing investment in cybersecurity infrastructure, staff training, and adherence to best practices is crucial to maintaining trust with clients and regulatory authorities.

- The National Institute of Standards and Technology defines information security as preserving data confidentiality, integrity, and availability, with federal legislation mandating compliance. Data privacy challenges include regulations such as CCPA and GDPR, necessitating robust strategies to protect against cyber threats and insider risks.

Bioanalytical Testing Services Market Trends

Integrating genomics, proteomics, metabolomics, and other -omics technologies in bioanalytical testing enables a holistic view of biological systems. This comprehensive molecular profiling aids in understanding disease mechanisms, identifying biomarkers for early disease detection, and developing targeted therapies in precision medicine and drug development.

Additionally, portable and rapid bioanalytical testing devices for point-of-care applications offer immediate diagnostic results, facilitating timely interventions, personalized treatments, and remote patient monitoring. POCT devices empower healthcare providers to deliver efficient and accurate care outside traditional clinical settings, especially in resource-limited or remote areas.

Moreover, adopting digital technologies such as big data analytics, cloud computing, and IoT in bioanalytical testing enhances data management, collaboration, and decision-making processes. This digital transformation streamlines workflows improves data accuracy, and enables real-time insights, leading to more efficient and precise bioanalytical testing services in pharmaceutical research and healthcare delivery.

Segmentation Analysis

The global market is segmented based on service, test type, application, and geography.

By Service

Based on service, the bioanalytical testing services market is bifurcated into small molecular bioanalysis and large molecular bioanalysis. The small molecular bioanalysis segment garnered the highest revenue of USD 2.61 billion in 2023. There is a growing demand for small molecule drugs in various therapeutic areas such as oncology, cardiovascular diseases, and infectious diseases, thereby driving the need for precise bioanalytical testing services.

Additionally, advancements in analytical technologies such as mass spectrometry and chromatography have improved the sensitivity and accuracy of small molecule analysis, attracting pharmaceutical and biotechnology companies to invest in these services. Moreover, regulatory requirements for small molecule drug development necessitate comprehensive bioanalytical testing, thereby boosting the growth of the segment.

By Test Type

Based on test type, the bioanalytical testing services market is segmented into bioavailability, bioequivalence, pharmacokinetics, pharmacodynamics, and others. The bioavailability segment is anticipated to lead the market by 2031, capturing a revenue share of 34.50%. Bioavailability studies are essential in drug development to assess the rate and extent of drug absorption, which is crucial for determining dosing regimens and therapeutic efficacy. With the rise in personalized medicine and novel drug delivery systems, there is an increased focus on optimizing drug bioavailability for better patient outcomes.

By Application

Based on application, the market is classified into oncology, neurology, infectious diseases, gastroenterology, cardiology, and other applications. The neurology segment is poised to witness significant growth at a staggering CAGR of 10.26% between 2024 and 2031. There is an increasing prevalence of neurological disorders such as Alzheimer's disease, Parkinson's disease, and multiple sclerosis globally, thereby driving demand for bioanalytical testing services in this therapeutic area. Moreover, ongoing advancements in neuroscience research and drug development efforts targeting neurological conditions necessitate comprehensive pharmacokinetic and pharmacodynamic studies, thus boosting the need for bioanalytical testing.

Bioanalytical Testing Services Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The North America Bioanalytical Testing Services Market share stood around 42.89% in 2023 in the global market, with a valuation of USD 2.02 billion. Several factors contributing to this significant growth include a well-established pharmaceutical and biotechnology industry, stringent regulatory frameworks necessitating extensive bioanalytical testing, and a growing focus on research and development activities.

Asia-Pacific is likely to witness significant growth at a CAGR of 10.50% over the forecast period. This growth can be attributed to several factors such as increasing investments in healthcare infrastructure, rising pharmaceutical outsourcing to countries such as India and China, expanding biotechnology sector, and growing awareness of personalized medicine. Additionally, the presence of a large patient population and efforts to improve healthcare access and quality contribute to the region's promising outlook in the market.

Competitive Landscape

The bioanalytical testing services market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, are foreseen to create new opportunities for market growth.

List of Key Companies in the Bioanalytical Testing Services Market

Key Industry Developments

- March 2024 (Partnership): Allumiqs, a leading provider of artificial intelligence-driven drug discovery solutions, announced a strategic partnership with Prolytix, a pioneer in next-generation high-content proteomics technology. The collaboration aimed to leverage Prolytix's innovative proteomics platform with Allumiqs' AI capabilities to accelerate drug discovery and development processes, enhancing efficiency and effectiveness in bringing new therapeutics to market.

- December 2023 (Partnership): SGS, a global leader in testing, inspection, and certification services, announced a strategic partnership with Agilex Biolabs, a leading bioanalytical contract research organization (CRO). This collaboration aimed to enhance SGS's capabilities in bioanalytical testing and accelerate drug development processes for pharmaceutical and biotechnology companies, ensuring efficient and reliable services for their clients.

The global Bioanalytical Testing Services Market is segmented as:

By Service

- Small Molecular Bioanalysis

- Large Molecular Bioanalysis

By Test Type

- Bioavailability

- Bioequivalence

- Pharmacokinetics

- Pharmacodynamics

- Others

By Application

- Oncology

- Neurology

- Infectious Diseases

- Gastroenterology

- Cardiology

- Other Applications

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America