Market Definition

The market involves the production of barium petroleum sulfonate (BPS), a chemical compound derived from petroleum. BPS is synthesized by sulfonating petroleum-based products and neutralizing the resulting sulfonic acid with barium hydroxide. Typically a dark brown to black oil-soluble substance, BPS is used in various industrial applications.

The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Barium Petroleum Sulfonate Market Overview

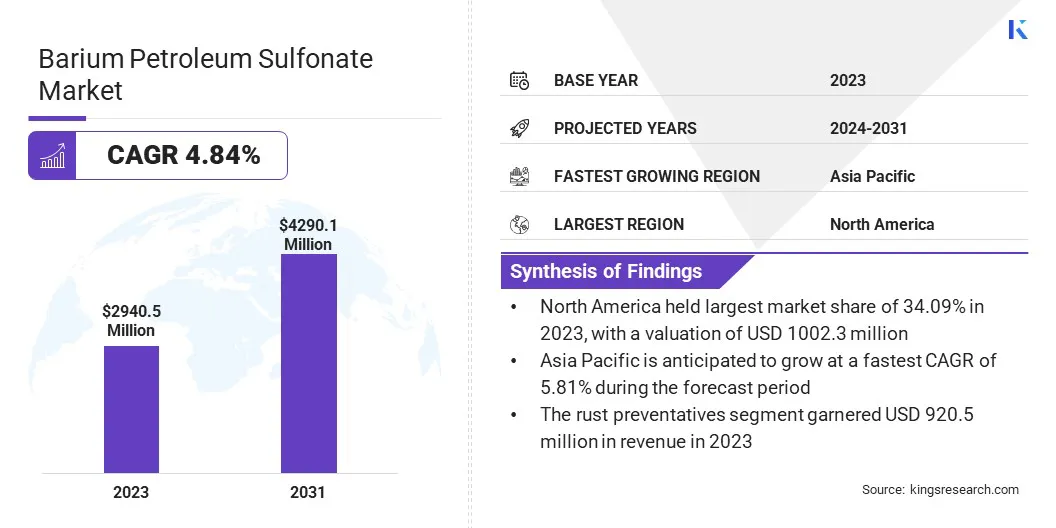

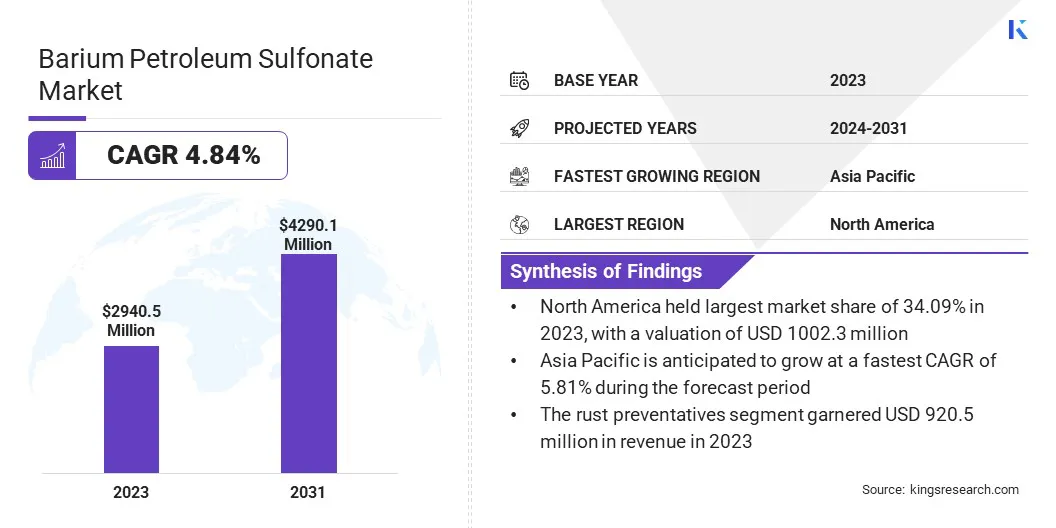

Global barium petroleum sulfonate market size was USD 2940.5 million in 2023, which is estimated to be valued at USD 3081.6 million in 2024 and reach USD 4290.1 million by 2031, growing at a CAGR of 4.84% from 2024 to 2031.

Growth in oilfield infrastructure, driven by advancements in exploration technologies, is fueling demand for barium petroleum sulfonate (BPS). BPS supports well completion, improves fluid performance, and protects pipelines from corrosion and damage.

Major companies operating in the barium petroleum sulfonate industry are Eastern Petroleum Pvt. Ltd., Ganesh Benzoplast Limited, Ataman Chemicals, GBL CHEMICAL LIMITED, Royal Castor Products Limited, TRANSASIA PETROCHEM PVT. LTD., Desire Chemical Pvt. Ltd., Goodway Chemicals Private Limited. , Xinji Jinshi Shengrong Chemical Co., Ltd., Balaji Orgochem, and others.

The market is experiencing steady growth due to its critical role in corrosion inhibition, lubricant enhancement, and oilfield chemical formulations. Increasing global demand for energy, expansion in oil and gas exploration activities, and the need for advanced drilling fluids are further propelling market expansion.

- In August 2024, India’s ONGC announced five new oil and gas discoveries across onshore and offshore sites, including wells such as PURN-1 and West Matar-2.These findings open new exploration zones and confirm commercial viability, boosting demand for oilfield chemicals such as barium petroleum sulfonate used in drilling and corrosion prevention.

Additionally, the rise in automotive and industrial applications that require high-performance lubricants further supports market growth. Technological advancements and investments in infrastructure propel demand for barium petroleum sulfonate.

Key Highlights:

- The barium petroleum sulfonate market size was recorded at USD 2940.5 million in 2023.

- The market is projected to grow at a CAGR of 4.84% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 1002.3 million.

- The corrosion inhibitors segment garnered USD 1549.9 million in revenue in 2023.

- Asia Pacific is anticipated to grow at a CAGR of 5.81% over the forecast period.

Market Driver

Oilfield Infrastructure Growth

The growth of oilfield infrastructure, fueled by advancements in exploration technology, is fostering the growth of the market. BPS plays a critical role in well completion by acting as a corrosion inhibitor and rust preventative, safeguarding metal components from damage in harsh well conditions.

It also enhances fluid performance and ensures pipeline integrity, making it a crucial chemical for maintaining the efficiency, safety, and longevity of modern oilfield operations.

- In April 2024, Ramco secured a long-term contract with Equinor, focusing on oil and gas pipe preparation for offshore operations. This growth in offshore oil activities boosts demand for barium petroleum sulfonate, as it is used in drilling fluids and corrosion prevention in these operations.

Market Challenge

High Production Costs

High production costs present a significant challenge to the progress of the barium petroleum sulfonate market. The synthesis process involves complex chemical procedures and the use of specialized raw materials. This increases the overall cost of production, making BPS less competitive compared to alternative chemicals.

To address this, manufacturers can focus on optimizing production processes, investing in more efficient technologies, and exploring cost-effective sourcing of raw materials. These solutions can help reduce costs while maintaining the quality and performance of BPS in the oilfield industry.

Market Trend

Rising Emphasis on Sustainability

Stricter environmental regulations are emerging as a significant trend in the market, prompting companies to adopt more sustainable and compliant production methods. These regulations push manufacturers to minimize environmental impacts by reducing harmful emissions and waste during production.

Companies are investing in cleaner technologies and sustainable practices to meet legal standards while enhancing their market reputation. This shift toward regulatory compliance is fostering innovation and ensuring long-term industry growth.

- In March 2025, according to the Press Information Bureau (PIB), the Ministry of Petroleum & Natural Gas passed the Oilfield (Regulatory and Development) Amendment Bill in the Lok Sabha. The bill aims to simplify the regulatory framework, enhance the ease of doing business, and attract investment in India's oil and gas exploration. It includes provisions for a single permit system, a streamlined legal framework, and improved dispute resolution, aiming to boost the sector’s efficiency and long-term viability.

Barium Petroleum Sulfonate Market Report Snapshot

|

Segmentation

|

Details

|

|

By Application

|

Corrosion Inhibitors, Coatings & Greases, Rust Preventatives, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Application (Corrosion Inhibitors, Coatings & Greases, Rust Preventatives, and Others): The corrosion inhibitors segment earned USD 1065.1 million in 2023, mainly due to increasing demand for barium petroleum sulfonate in oilfield applications, enhanced oil recovery, and industrial lubricants.

Barium Petroleum Sulfonate Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America barium petroleum sulfonate market share stood at around 34.09% in 2023, valued at USD 1002.3 million. This dominance is reifnorced by its well-established oil and gas industry. The region's advanced infrastructure, robust production capabilities, and increasing demand for enhanced oil recovery technologies contribute significantly to this growth.

Additionally, stringent environmental regulations and rising demand for corrosion inhibitors in various industrial applications further support the demand for BPS. The presence of key market players and innovation in chemical applications further solidifies North America's leading market position.

The Asia Pacific barium petroleum sulfonate industry is set to grow at a CAGR of 5.81% over the forecast period. This growth is fostered by rapid industrialization, increasing oil and gas exploration activities, and growing demand for petroleum-based products.

Countries such as China, India, and Southeast Asian nations are witnessing significant investments in oilfield infrastructure and energy production, creating a strong demand for BPS. Additionally, the rising need for sustainable and cost-effective solutions in oil extraction and refining, along with regulatory changes, is fueling this growth.

Regulatory Frameworks

- In India, the Petroleum and Natural Gas Regulatory Board (PNGRB) was established under he Petroleum and Natural Gas Regulatory Board Act, 2006. It aims to protect consumer interests, promote competitive markets, and regulate the refining, storage, and distribution of petroleum, petroleum products and natural gas.

- In the U.S., the Occupational Safety and Health Administration (OSHA) ensures worker safety in BPS production, setting exposure limits for chemicals and mandating protective measures to minimize health risks in industrial environments.

- In the EU, REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations require BPS producers to register the chemical, assess its environmental and health impact, and ensure compliance with safety standards across member states.

Competitive Landscape

Companies in the barium petroleum sulfonate market are increasingly focusing on innovation and sustainability to meet rising demand across various industries. They are investing in advanced technologies to enhance product quality, improve efficiency, and reduce environmental impact.

Many are exploring eco-friendly formulations and adopting green manufacturing practices to align with stricter environmental regulations. Additionally, companies are expanding their product portfolios, offering tailored BPS solutions for applications in oilfield operations, corrosion inhibitors, lubricants, and detergents, while strengthening their presence in emerging markets.

List of Key Companies in Barium Petroleum Sulfonate Market:

- Eastern Petroleum Pvt. Ltd.

- Ganesh Benzoplast Limited

- Ataman Chemicals

- GBL CHEMICAL LIMITED

- Royal Castor Products Limited

- TRANSASIA PETROCHEM PVT. LTD.

- Desire Chemical Pvt. Ltd.

- Goodway Chemicals Private Limited.

- Xinji Jinshi Shengrong Chemical Co., Ltd.

- Balaji Orgochem