Market Definition

The market refers to the sector involved in the production and supply of enzymes specifically used in the baking industry. These enzymes are integral to optimizing the production of bread and other baked goods by facilitating biochemical processes that enhance dough properties, fermentation efficiency, and the overall quality of the final product.

The report highlights key market drivers, major trends, regulatory frameworks, and the competitive landscape shaping the industry’s growth.

Baking Enzymes Market Overview

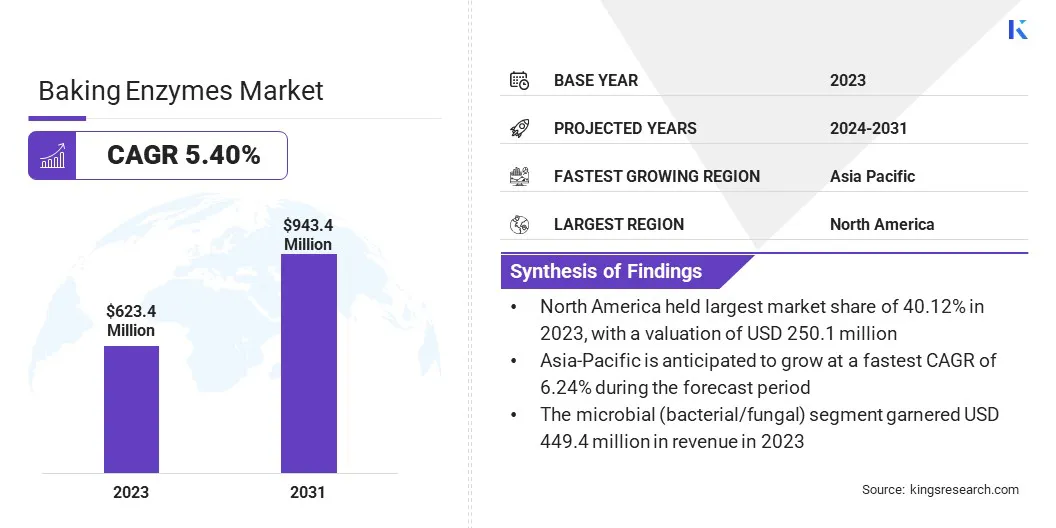

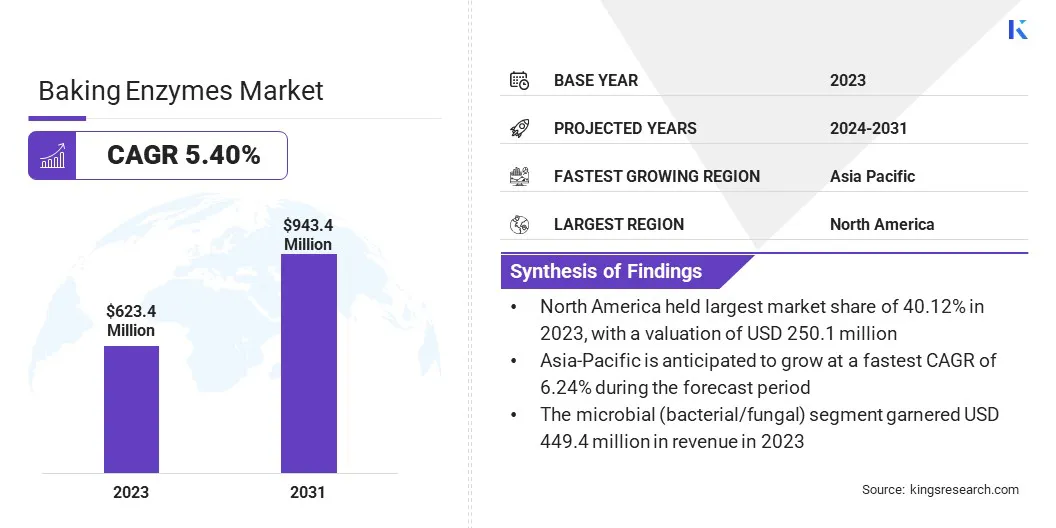

The global baking enzymes market size was valued at USD 623.4 million in 2023 and is projected to grow from USD 652.8 million in 2024 to USD 943.4 million by 2031, exhibiting a CAGR of 5.40% during the forecast period.

This growth is attributed to several factors, including the rising demand for high-quality, fresh, and clean label baked goods. The increasing adoption of enzyme-based solutions is enhancing the texture, shelf life, and overall quality of baked products.

Major companies operating in the baking enzymes industry are Advanced Enzyme Technologies, Aumenzymes, dsm-firmenich, SternEnzym GmbH & Co. KG, Novozymes A/S, Kerry Group plc, BASF, AB Enzymes GmbH, Maps Enzymes Ltd., Aumgene Biosciences, Amano Enzyme Inc., Biolaxi Enzymes Pvt Ltd, Caldic B.V., Calpro Food Essentials Pvt. Ltd., and Associated British Foods plc.

Moreover, innovations in enzyme formulations, the growing trend of healthier food options, and supportive regulatory frameworks that promote the use of natural and safe ingredients further support the expansion of this market. Moreover, innovations in enzyme formulations, the trend toward healthier foods, and supportive regulations promoting natural ingredients are driving market growth.

- In September 2024, Health Canada granted approval for the use of maltogenic alpha-amylase derived from Saccharomyces cerevisiae LALL-MA+ in bread, whole wheat flour, flour, and unstandardized bakery products. This approval allows its use under "Good Manufacturing Practice" conditions, after a comprehensive safety assessment that encompassed allergenicity, chemistry, microbiology, molecular biology, nutrition, technical data, and toxicology.

Key Highlights

Key Highlights

- The baking enzymes industry size was valued at USD 623.4 million in 2023.

- The market is projected to grow at a CAGR of 5.40% from 2024 to 2031.

- North America held a market share of 40.12% in 2023, with a valuation of USD 250.1 million.

- The amylase segment garnered USD 225.7 million in revenue in 2023.

- The microbial (bacterial/fungal) segment is expected to reach USD 670.7 million by 2031.

- The liquid segment is anticipated to witness the fastest CAGR of 6.83% during the forecast period.

- The bread segment garnered USD 271.7 million in revenue in 2023.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.24% during the forecast period.

Market Driver

"Increase in Artisanal and Specialty Baking"

The increase in artisanal and specialty baking is driving growth in the baking enzymes market. This is primarily fueled by the rising demand for unique, high-quality baked goods and healthier food options.

As consumers shift toward more personalized and health-conscious choices, there is a growing preference for gluten-free, organic, low-sugar, and functional foods, all of which require specialized enzyme solutions.

Enzymes play a crucial role in improving texture, fermentation, and overall quality, allowing manufacturers to meet the specific needs of these products, particularly in the production of artisanal and specialty items.

Enzymes also facilitate the production of baked goods with specific dietary needs, such as gluten-free bread, by enhancing dough handling and texture, which can be difficult to achieve without the proper enzyme formulations.

- In April 2023, International Flavors & Fragrances Inc (IFF) introduced the ENOVERA 2000 range in Europe, an advanced enzymatic dough strengthener capable of replacing up to 50% of vital gluten in whole wheat bread. This solution helps bakers reduce costs while maintaining product quality and volume, meeting both economic challenges and the growing consumer demand for healthier options.

Market Challenge

"Enzyme Stability and Performance"

One of the major challenges in the baking enzymes market is the instability of enzymes under varying production conditions, such as changes in temperature, pH, and humidity. Enzymes are highly sensitive to these environmental factors, which leads to inconsistent results in dough properties and final product quality.

Maintaining enzyme stability throughout the baking process, from dough mixing to baking, is critical to ensuring optimal performance. Additionally, enzymes degrade over time when stored in bulk or exposed to harsh conditions, which can reduce their effectiveness.

To overcome this challenge, manufacturers are exploring advanced enzyme stabilization methods, such as encapsulating enzymes in protective coatings or utilizing genetic engineering to create more resilient enzyme strains.

The ongoing research into enzyme formulations that maintain activity across a wider range of temperatures and pH levels is helping to improve their stability and performance during the baking process.

Furthermore, manufacturers are investing in better storage solutions and packaging technologies to protect enzymes from environmental factors that may cause degradation.

Market Trend

"Improved Product Quality and Shelf Life"

The baking enzymes market is evolving rapidly due to growing consumer demand for higher product quality and longer shelf life in baked goods. A key trend is the use of specialized enzyme blends, such as amylases, lipases, and proteases, to improve dough strength, texture, moisture retention, and overall freshness.

These innovations are helping manufacturers deliver baked products that stay softer and fresher for longer periods, reducing the reliance on artificial preservatives. In addition, enzymes play a crucial role in supporting clean label initiatives, aligning with consumer preferences for natural and minimally processed foods.

As the industry shifts toward healthier and more sustainable solutions, the ability of enzymes to enhance product quality while extending shelf life is becoming increasingly important. This trend is strengthening the role of baking enzymes in the global bakery sector and driving steady market growth.

- In May 2023, Novamyl BestBite builds on its predecessors by delivering superior fresh texture and optimizing recipes, enabling producers to reduce added sugars. Incorporated during baking, it enhances freshness, extends shelf life, and preserves the consumer's eating experience. Novamyl BestBite offers bakeries a strategic solution to meet evolving market demands for healthier, longer-lasting baked goods.

Baking Enzymes Market Report Snapshot

| Segmentation |

Details |

| By Enzyme Type |

Amylase, Protease, Lipase, Glucose Oxidase, Xylanase, and Others |

| By Source |

Microbial (bacterial/fungal), Plant-derived, Animal-derived |

| By Form |

Powder, Liquid |

| By Application |

Bread, Cakes & Pastries, Cookies & Biscuits |

| By Region |

North America: U.S., Canada, Mexico |

| Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

| Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

| Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa |

| South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Enzyme Type (Amylase, Protease, Lipase, Glucose Oxidase, Xylanase, and Others): The amylase segment earned USD 225.7 million in 2023 due to its widespread use in improving dough handling, enhancing texture, and extending the shelf life of baked goods.

- By Source (Microbial (bacterial/fungal), Plant-derived, Animal-derived): The Microbial (bacterial/fungal) segment held 72.09% of the market in 2023, due to its superior enzyme production efficiency, cost-effectiveness, and ability to meet clean label and sustainability demands.

- By Form (Powder, Liquid): The powder segment is projected to reach USD 588.9 million by 2031, owing to its longer shelf life, ease of storage and transportation, and better stability during processing.

- By Application (Bread, Cakes & Pastries, Cookies & Biscuits): The bread segment earned USD 271.7 million in 2023 due to the high global consumption of bread and the extensive use of enzymes to improve dough quality, texture, volume, and shelf life.

Baking Enzymes Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America baking enzymes market share stood around 40.12% in 2023, with a valuation of USD 250.1 million. The region's dominance in the market can be attributed to the increasing demand for bakery products, the growing preference for clean-label products, and the rising trend of healthier food alternatives.

North America baking enzymes market share stood around 40.12% in 2023, with a valuation of USD 250.1 million. The region's dominance in the market can be attributed to the increasing demand for bakery products, the growing preference for clean-label products, and the rising trend of healthier food alternatives.

Moreover, the presence of advanced food processing industry, and a robust consumer base further fuels the market growth in this region. Additionally, the presence of key market players and innovations in enzyme formulations are driving the growth of the market in North America.

Furthermore, the region benefits from a well-established regulatory framework that ensures product quality and safety, boosting consumer confidence in enzyme-enhanced bakery products.

- In November 2024, Health Canada approved the use of lipase derived from the Aspergillus niger strain PLR in the production of bread, flour, whole wheat flour, pasta, and other bakery items. This enzyme can be used within "Good Manufacturing Practice" limits, ensuring its safe application in food production.

The baking enzymes industry in Asia-Pacific is poised for significant growth at a robust CAGR of 6.24% over the forecast period. This growth is supported by rising consumer demand for convenience foods, rapid urbanization, and increasing disposable incomes across countries such as China, India, Japan, and South Korea.

Governments are implementing policies aimed at enhancing food safety standards and promoting healthier food options, thereby boosting investment in innovative food processing technologies.

The growing trend toward clean-label products and healthier bakery items is further driving the demand for baking enzymes in the region. Additionally, the rise of local bakery manufacturers and increasing consumer awareness regarding the benefits of enzyme-enhanced products are contributing to regional market expansion.

Regulatory Frameworks

- In the European Union, Regulation (EC) No 1332/2008 regulates the use of food enzymes, ensuring their safety for consumption. It mandates safety assessments by the European Food Safety Authority (EFSA) and requires proper labeling of enzyme products used in food production.

- In the United States, the FDA’s Guidance for Industry: Enzyme Preparations used in food processing regulates the use of enzymes in food production. It outlines the criteria for enzymes to be classified as Generally Recognized as Safe (GRAS) and provides guidelines for the safe use, labeling, and approval of enzyme products.

- In Canada, the use of food enzymes is regulated under the Food and Drugs Act and the Food and Drug Regulations. Health Canada conducts safety assessments and approves enzymes for use in food processing. The List of Permitted Food Enzymes specifies the enzymes authorized for use, and their conditions of use.

Competitive Landscape

The baking enzymes industry is characterized by key players focusing on strategic initiatives to strengthen market position and expand globally. Companies are heavily investing in research and development to enhance enzyme formulations and improve product efficiency, catering to the growing demand for healthier, clean-label bakery products.

Strategic partnerships with distributors and long-term supply agreements with bakery manufacturers help secure market share. Additionally, players are expanding production capacities and optimizing supply chains through automation and vertical integration to meet growing demand.

- In June 2023, Kerry Group plc launched Biobake EgR, a groundbreaking enzyme solution that can reduce egg usage by up to 30% in bakery products. This innovation allows European manufacturers to shift from caged to free-range or organic eggs without raising costs, addressing both economic and ethical concerns.

List of Key Companies in Baking Enzymes Market:

- Advanced Enzyme Technologies

- Aumenzymes

- dsm-firmenich

- SternEnzym GmbH & Co. KG

- Novozymes A/S

- Kerry Group plc

- BASF

- AB Enzymes GmbH

- Maps Enzymes Ltd.

- Aumgene Biosciences

- Amano Enzyme Inc.

- Biolaxi Enzymes Pvt Ltd

- Caldic B.V.

- Calpro Food Essentials Pvt. Ltd.

- Associated British Foods plc

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In July 2024, Brenntag S.p.A. entered into an exclusive distribution agreement with Lallemand to supply Nutrilife baking enzymes throughout Europe. This collaboration gives Brenntag’s customers in regions like DACH, Poland, France, Benelux, and Iberia exclusive access to Lallemand’s Nutrilife enzymes. These enzymes improve dough handling, flavor, texture, and shelf life in baked goods.

Key Highlights

Key Highlights North America baking enzymes market share stood around 40.12% in 2023, with a valuation of USD 250.1 million. The region's dominance in the market can be attributed to the increasing demand for bakery products, the growing preference for clean-label products, and the rising trend of healthier food alternatives.

North America baking enzymes market share stood around 40.12% in 2023, with a valuation of USD 250.1 million. The region's dominance in the market can be attributed to the increasing demand for bakery products, the growing preference for clean-label products, and the rising trend of healthier food alternatives.