Aviation Asset Management Market Size

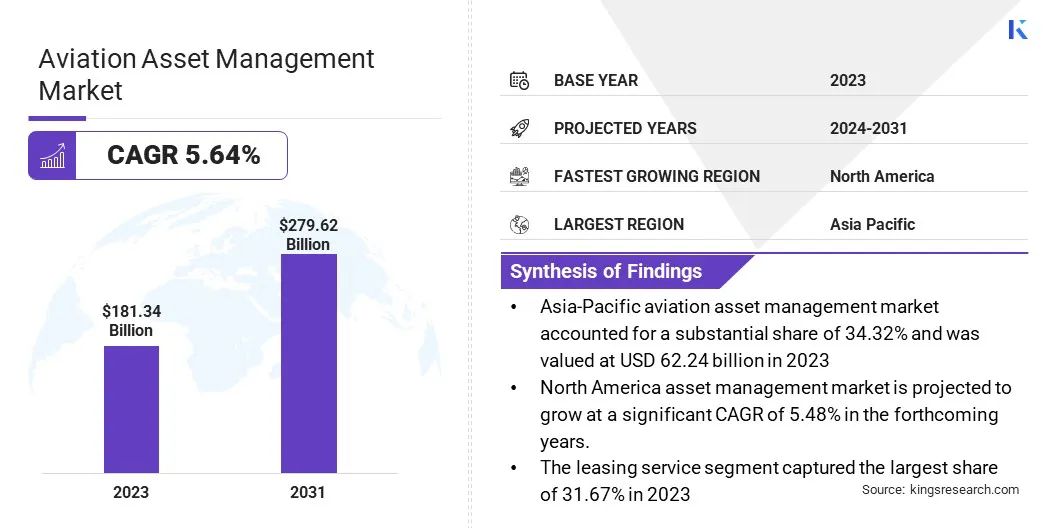

The global Aviation Asset Management Market size was valued at USD 181.34 billion in 2023 and is projected to grow from USD 190.44 billion in 2024 to USD 279.62 billion by 2031, exhibiting a CAGR of 5.64% during the forecast period. Rising fleet of aging aircraft and increasing adoption of digital asset management solutions in aviation are augmenting market development.

In the scope of work, the report includes services offered by companies such as Charles Taylor, The Boeing Company, ACC Aviation, IBA Group Ltd., AIRBUS, Avolon, AerData B.V., ST Engineering, AerCap Holdings N.V., Crestone Air Partners Inc., and others.

The development of AI-driven tools for enhanced asset management represents a significant opportunity for the expansion of the aviation asset management market. These tools are designed to optimize the management of aviation assets by leveraging artificial intelligence for data analysis, predictive insights, and decision-making.

AI can significantly improve efficiency by providing real-time monitoring of aircraft systems, tracking performance metrics, and predicting potential failures before they occur. This reduces downtime and enhances operational efficiency. Furthermore, AI-driven tools can streamline inventory management, fleet planning, and maintenance scheduling, ensuring that resources are utilized effectively.

The predictive capabilities of AI allow for more accurate forecasting of maintenance needs, preventing unexpected breakdowns and prolonging the lifespan of aviation assets.

- For instance, in October 2024, Jet.AI, a private aviation and AI firm, advanced its software offerings with CharterGPT and Reroute AI. CharterGPT's voice-integrated AI agent enhances the booking process by understanding and executing requests accurately and efficiently. This breakthrough accelerates operator response times, addressing a key challenge in chartering planes, and positioning Jet.AI for further growth in the private aviation sector.

- In November 2023, the Aeronautical Society of India recognized the transformative potential of AI and automation in aviation and aerospace. To promote this innovation, AeSI is committing to advancing research and development in these technologies, positioning India as a leader in the integration of AI within the aviation industry to enhance operational efficiency and safety.

This opportunity is becoming more relevant as airlines and asset managers seek to reduce costs and enhance operational sustainability. With the growing complexity of global aviation operations and the need for real-time data insights, AI-driven asset management tools provide companies with a competitive edge in this rapidly evolving market.

Aviation asset management refers to the strategic management and optimization of aviation-related assets, including aircraft, engines, spare parts, and other key infrastructure. The goal is to maximize the value, efficiency, and lifecycle of these assets through a combination of financial, technical, and operational services.

Aviation asset management services typically include aircraft acquisition, leasing, financial structuring, maintenance planning, fleet management, and end-of-life asset disposition.

These services are essential for airlines, leasing companies, financial institutions, and other stakeholders in the aviation industry to ensure efficient asset operation and compliance with safety regulations. Aviation asset management serves both commercial and private aviation sectors, facilitating large-scale airlineswith extensive fleets and smaller operators handling limited fleet.

Asset managers ensure aviation companies meet regulatory standards while optimizing operational costs, increasing asset value, and maintaining fleet reliability over time. Their expertise is crucial for effectively managing complex, high-value aviation assets.

Analyst’s Review

The aviation asset management market is witnessing a dynamic transformation due to technological advancements and shifting industry demands. Key market players are actively focusing on digital transformation strategies, such as predictive analytics, AI-powered tools, and blockchain technologies.

These innovations are revolutionizing asset management, by providing real-time data insights, optimizing maintenance schedules, and enhancing decision-making processes. Moreover, sustainability has emerged as a key focus in the industry, with companies adopting green practices, such as fuel-efficient fleet management and carbon offsetting initiatives to align with global environmental goals.

Current market growth is further propelled by the rising demand for aircraft leasing, especially in emerging markets, where fleet expansion is crucial for meeting increasing air traffic demand.

- For instance, in October 2023, EirTrade Aviation partnered with Acorn Growth Companies, securing an investment to strengthen its financial position. This collaboration aims to enhance EirTrade’s asset management capabilities and deepen relationships with customers, suppliers, and consignors, positioning the company as a major player in the aviation market.

However, managing aging fleets is essential for asset managers, requiring robust MRO (Maintenance, Repair, and Overhaul) strategies to extend asset lifecycles and ensure operational efficiency. By adopting these strategies, companies can optimize asset performance and remain competitive in an evolving aviation landscape.

Aviation Asset Management Market Growth Factors

The surge in air traffic and the growing demand for commercial aircraft are stimulating the growth of the market. As global travel recovers and expands post-pandemic, airlines are increasing their fleets to meet rising passenger demand. This growth is particularly noticeable in emerging markets, where rising incomes and urbanization are fueling air travel.

Additionally, the expansion of low-cost carriers has further contributed to this surge, making air travel accessible to a broader population. The increasing demand for commercial aircraft is propelled by the need for more fuel-efficient and environmentally friendly planes.

- For instance, in December 2023, IATA forecasted airline industry revenues to reach a record USD 964 billion in 2024. This milestone highlights the industry's recovery and growing demand for air travel, leading to further investments in aviation infrastructure, fleet expansion, and asset management opportunities.

Airlines are replacing outdated, inefficient models with newer aircraft that comply with stringent emission regulations and offer lower operating costs. This surge in air traffic and the consequent demand for new commercial aircraft create significant opportunities for aviation asset management firms.

They play a critical role in managing the lifecycle of these assets, ensuring optimal performance through fleet acquisition, maintenance, and lease management services to maximize profitability and efficiency in airline operations.

High implementation cost associated with advanced asset management solutions presents a considerable challenge to the development of the aviation asset management market. These solutions, which include AI-driven platforms, predictive analytics, and blockchain-based systems, require significant upfront investments in technology infrastructure, software development, and system integration.

For many smaller or regional aviation companies, this financial barrier can be prohibitive, limiting their ability to adopt cutting-edge tools that enhance asset management efficiency. Moreover, costs extend beyond the initial investment, as ongoing maintaininance and upgrades requires continuous financial resources.

Training personnel to effectively utilize these technologies adds an additional expense, compounding the cost challenge. However, despite the high implementation costs, the long-term benefits of advanced asset management systems, including reduced maintenance costs, increased asset longevity, and improved operational efficiency, are significant.

Companies can mitigate this challenge by adopting a phased implementation approach, prioritizing cost-effective solutions, and exploring financing options such as leasing technology or partnering with third-party service providers.

Aviation Asset Management Industry Trends

A growing focus on sustainability and green aviation practices is reshaping the aviation asset management market. Amid growing global environmental concerns, the aviation sector faces increased pressure to reduce its carbon footprint and adopt more eco-friendly operations. This has led to the adoption of sustainable aviation fuels (SAF), energy-efficient aircraft designs, and practices aimed at reducing emissions.

For aviation asset managers, this trend presents an opportunity to align their services with green initiatives. This includes managing fleets that prioritize fuel efficiency, optimizing aircraft maintenance to reduce waste, and promoting the use of aircraft that meet stricter environmental regulations.

- In April 2024, IATA, in collaboration with UCL, ATAG, ICCT, and MPP, released the Aviation Net Zero CO2 Transition Pathways Comparative Review. This report compares 14 leading roadmaps for achieving net zero aviation by 2050. It serves as a crucial guide for airlines, policymakers, and stakeholders, offering insights into the varied approaches to decarbonizing the industry.

- In September 2024, Avolon announced its acquisition of Castlelake Aviation Limited, to accelerate earnings growth through fleet expansion and attractive yields. With robust liquidity of USD 8.2 billion as of June 2024, this transaction enhances the company’s market position and boosts its ability to capitalize on growth opportunities in the aviation leasing sector.

Green aviation practices encompass end-of-life aircraft management, where asset managers ensure responsible disposal or recycling of aircraft components to minimize environmental impact. Furthermore, aviation companies are adopting carbon offset programs to mitigate emissions, thereby enhancing sustainability in their business models.

As sustainability becomes central to aviation strategies, asset managers play a critical role in helping companies meet these environmental goals while maintaining profitability.

Segmentation Analysis

The global market has been segmented based on service, end use, and geography.

By Service

Based on service, the aviation asset management market has been segmented into leasing service, technical service, regulatory services, and end-to-end. The leasing service segment captured the largest share of 31.67% in 2023, primarily attributed to the growing demand for flexible and cost-effective fleet management solutions.

Aircraft leasing has become a preferred option for airlines looking to expand their fleets without the significant upfront costs of purchasing new aircraft.

Leasing allows airlines to acquire modern, fuel-efficient aircraft and meet fluctuating passenger demand while avoiding long-term financial commitments. Furthermore, the increase in low-cost carriers and airlines in emerging markets has driven the demand for leasing services, as these companies prioritize operational flexibility and cost-efficiency over asset ownership.

Additionally, leasing enables airlines to respond quickly to changing market dynamics, such as sudden increases in air traffic or regulatory changes requiring newer, more efficient aircraft. The rising cost of aircraft, coupled with financial uncertainty in the aviation sector post-pandemic, has reinforced leasing as the preferred option for many operators.

Asset management firms are capitalizing on this trend by offering comprehensive leasing and lifecycle management services to support airlines' evolving needs.

By End Use

Based on end use, the market has been classified into commercial platforms and maintenance, repair and overhaul (MRO). The commercial platforms segment is poised to record a CAGR of 5.77% through the forecast period, largely due to the increasing adoption of digital platforms and solutions in the aviation industry.

These platforms provide a centralized hub for managing a wide range of aviation assets, including aircraft, spare parts, and maintenance operations, allowing airlines and asset managers to streamline their operations. Commercial platforms enable real-time monitoring of aircraft performance, predictive maintenance scheduling, and efficient inventory management, reducing operational costs and enhancing fleet performance.

The growing demand for data-driven decision-making in aviation has boosted the adoption of these platforms, which offer advanced analytics and AI capabilities to optimize asset utilization. Moreover, the shift toward digital transformation across industries, including aviation, is driving investments in commercial platforms as airlines seek to enhance efficiency, reduce downtime, and improve passenger experience.

The rise of e-commerce and digital solutions in aviation-related services, such as ticketing and cargo, further contributes to the growth of this segment.

Aviation Asset Management Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, MEA, and Latin America.

Asia-Pacific aviation asset management market accounted for a substantial share of 34.32% and was valued at USD 62.24 billion in 2023. This dominance is largely attributed to the rapid growth of air travel across countries such as China, India, and Southeast Asia. This growth is further supported by increasing disposable incomes, rapid urbanization, and expanding middle-class populations in Asia-Pacific.

The region has witnessed significant fleet expansion as airlines strive to meet rising passenger demand and improve connectivity across diverse markets.

- In April 2024, Charles Taylor enhanced its leadership team in Asia Pacific with strategic appointments, including Bob Battoo as managing director for aviation and Dennis San Jose as resident technical manager for aviation asset management. These appointments reflect the company’s commitment to strengthening its aviation services, ensuring sustained growth and enhanced service delivery.

Additionally, many airlines in Asia-Pacific are opting for leasing services to acquire new aircraft, enabling cost-efficient fleet expansion without large upfront capital investments. Furthermore, the region is seeing a boom in low-cost carriers, fueling the demand for aviation asset management services.

Moreover, Asia-Pacific is home to some of the world’s busiest airports, highlighting the need for efficient asset management to ensure timely maintenance, leasing, and fleet optimization. This strong growth trajectory, along with ongoing infrastructure investments in aviation, positions Asia-Pacific as a leading region in the global market.

North America asset management market is projected to grow at a significant CAGR of 5.48% in the forthcoming years. The resurgence of air travel post-pandemic, coupled with rising investments in modernizing aging fleets, is propelling the demand for aviation asset management services across the U.S. and Canada.

North American airlines are increasingly adopting advanced digital platforms, predictive maintenance tools, and AI-driven asset management solutions to optimize their operations, reduce downtime, and enhance cost-efficiency. Furthermore, the rise in aircraft leasing activities in the region, particularly for fuel-efficient and environmentally compliant aircraft, is aiding this growth.

North America is home to a considerable number of aircraft lessors and financial institutions engaged in leasing and managing aviation assets. The growing emphasis on sustainability, along with increased regulatory pressures, is prompting airlines to invest in greener technologies, leading to the increasing demand for efficient asset management solutions.

Competitive Landscape

The global aviation asset management market report will provide valuable insights with a specialized emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Aviation Asset Management Market

- Charles Taylor

- The Boeing Company

- ACC Aviation

- IBA Group Ltd.

- AIRBUS

- Avolon

- AerData B.V.

- ST Engineering

- AerCap Holdings N.V.

- Crestone Air Partners Inc.

Key Industry Developments

- July 2024 (Expansion): Airbus, in collaboration with partners such as Air France-KLM, Qantas, and Mitsubishi HC Capital, co-invested in a USD 200 million Sustainable Aviation Fuel (SAF) financing fund. The initiative, led by Burnham Sterling Asset Management, aims to accelerate SAF production. Airbus serves as the anchor investor, highlighting the industry's shift toward sustainable aviation solutions through the newly established Sustainable Aviation Fuel Financing Alliance (SAFFA).

- April 2024 (Expansion): AIP Capital launched Phoenix Aviation Capital, a global aircraft lessor focused on modern fleet financing. Phoenix, backed by a U.S.-based financial services firm with USD 11 billion in assets, is expected to enhance AIP’s market reach. The owner of Phoenix holds a 49% stake in AIP, with AIP’s management retains majority ownership, ensuring AIP’s continued strategic direction.

- January 2024 (Collaboration): Aergo Capital and Acumen Aviation collaborated to enhance aviation asset and investment management services. The partnership aims to provide comprehensive asset management solutions, leveraging their extensive industry knowledge to meet the evolving needs of investors in the aviation sector.

- August 2023 (Partnership): ST Engineering’s Aviation Asset Management division sold 11 narrowbody aircraft to Keystone Holdings, a joint venture with Sojitz Corporation. This transaction supports ST Engineering's strategy to expand its aviation asset management services and improved capital efficiency through lease novation, thereby expanding their asset lifecycle management offerings.

The global aviation asset management market is segmented as:

By Service

- Leasing Service

- Technical Service

- Regulatory Services

- End-to-end

By End Use

- Commercial Platforms

- Maintenance, Repair and Overhaul (MRO)

By Region

- North America

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America