Market Definition

The market encompasses the production and supply of pumps used in various vehicle systems to regulate fluid flow, pressure, and temperature. These pumps are essential for critical processes, including fuel injection, lubrication, coolant circulation, and transmission fluid management. Designed for internal combustion engines, hybrid, and electric vehicles, automotive pumps are formulated using durable materials to withstand extreme temperatures and pressures.

Key types include fuel pumps, oil pumps, coolant pumps, and vacuum pumps, each playing a vital role in enhancing engine efficiency, emissions control, and thermal management. Their applications extend across passenger cars, commercial vehicles, and off-highway vehicles.

Automotive Pump Market Overview

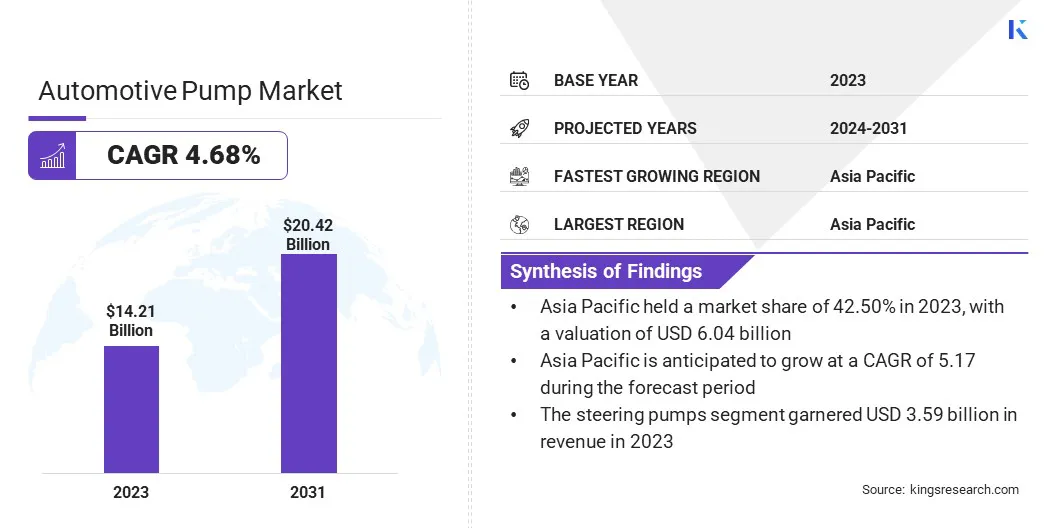

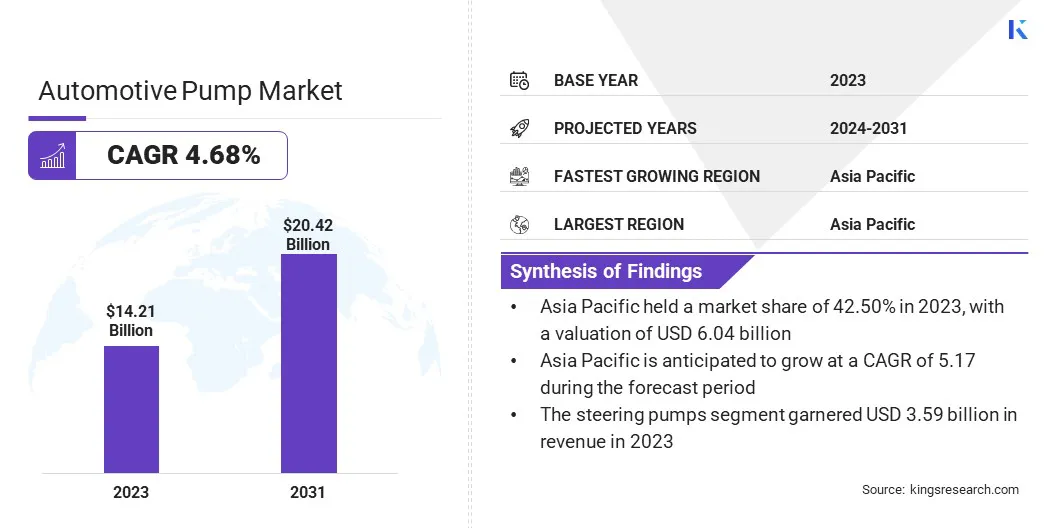

The global automotive pump market size was USD 14.21 billion in 2023 and is projected to grow from USD 14.83 billion in 2024 to USD 20.42 billion by 2031, exhibiting a CAGR of 4.68% during the forecast period. Market growth is driven by the rising adoption of fuel-efficient and electric vehicles, increasing demand for advanced pumping solutions in thermal and fluid management.

Additionally, stringent emission regulations are prompting automakers to integrate high-performance pumps that enhance engine efficiency and reduce environmental impact. The expanding aftermarket sector, fueled by rising vehicle maintenance needs, further contributes to market growth.

Major companies operating in the automotive pump industry are Valeo, Mitsubishi Electric Corporation, Continental AG, Johnson Electric Holdings Limited, Schaeffler Technologies AG & Co. KG, AISAN INDUSTRY CO., LTD., AISIN CORPORATION, GMB Corporation, Robert Bosch GmbH, DENSO CORPORATION., Magna International Inc., Rheinmetall AG, SHW AG, ZF Friedrichshafen AG, HELLA GmbH & Co. KGaA, and others.

The shift toward electric and hybrid vehicles is creating significant demand for automotive pumps. Electric vehicles require specialized pumps for battery cooling, thermal management, and transmission fluid circulation. The global transition to electrification, supported by incentives and subsidies, is compelling automakers to invest in electric vehicle technologies.

Efficient cooling and lubrication systems are essential for improving the longevity and performance of EV powertrains. Rising investments in EV infrastructure and increasing consumer preference for sustainable mobility are boosting demand for electric coolant and transmission pumps, creating new growth opportunities in the market.

- According to the International Energy Agency’s Global EV Outlook 2024, electric car sales continue to grow, with projections reaching approximately 17 million in 2024, accounting for over 20% of global car sales. In the first quarter of 2024, electric car sales increased by 25% year-over-year. In 2023, global EV sales approached 14 million, comprising 18% of total car sales, up from 14% in 2022. This represents a 35% year-on-year growth, with 3.5 million more units sold than in 2022.

Key Highlights:

- The automotive pump industry size was recorded at USD 14.21billion in 2023.

- The market is projected to grow at a CAGR of 4.68% from 2024 to 2031.

- Asia Pacific held a market share of 42.50% in 2023, with a valuation of USD 6.04 billion.

- The steering pump segment garnered USD 3.59 billion in revenue in 2023.

- The mechanical segment is expected to reach USD 13.24 billion by 2031.

- The passenger vehicle segment secured the largest revenue share of 70.83% in 2023.

- The aftermarket is poised for a robust CAGR of 5.67% through the forecast period.

- Europe is anticipated to grow at a CAGR of 4.61% during the forecast period.

Market Driver

"Rising Vehicle Production and Sales"

The global rise in vehicle production and sales is fueling the growth of the automotive pump market. Emerging economies, particularly in Asia-Pacific, are witnessing a surge in automobile manufacturing due to rising disposable income and improving infrastructure. Automakers are expanding capacities to meet the growing demand for passenger and commercial vehicles, highlighting the need for automotive pumps essential for fuel efficiency, cooling, and lubrication.

The expanding automotive sector, supported by government initiatives and investments, is leading to the widespread adoption of advanced automotive pumps.

- The Our World in Data 2024 report highlights that global new car sales reached 76.67 million in 2023, up from 72.86 million in 2022. This growth in vehicle sales is directly contributing to the expansion of the market, as automakers integrate advanced pump technologies to improve fuel efficiency, emissions control, and overall vehicle reliability.

Market Challenge

"High Production Costs and Supply Chain Disruptions"

The automotive pump market faces a significant challenge due to high production costs and supply chain disruptions. The rising prices of raw materials, including metals and electronic components, coupled with logistical constraints, have increased manufacturing expenses. Additionally, global semiconductor shortages and trade restrictions have disrupted the supply of essential components.

To address these challenges, companies are optimizing procurement strategies, investing in localized production facilities, and strengthening supplier partnerships. Advancements in automation and digital supply chain management are also being adopted to enhance efficiency and reduce dependency on external supply networks, ensuring stable production and market growth.

Market Trend

"Advancements in Automotive Technologies"

Technological advancements in automotive pump systems are influencing the market, with variable displacement pumps and electric pumps optimizing energy consumption and efficiency. Automakers are focusing on lightweight and high-performance components that improve fuel economy without compromising durability.

Smart and electronically controlled pumps are gaining traction due to their ability to enhance precision and reduce energy losses, aiding the expansion of the automotive pump market. Continuous research and development in automotive engineering are leading to the introduction of next-generation pumping solutions, shaping the market and catering to the evolving needs of modern vehicle designs.

- In August 2023, Nidec Power Train Systems Corporation successfully developed an advanced electric oil pump for automotive continuously variable transmission (CVT) systems. This pump is designed to maintain oil pressure in the CVT system during idling-stop mode while complementing the engine-driven mechanical oil pump.

Automotive Pump Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Fuel Pump, Water Pump, Steering Pump, Windshield Pump, Vacuum Pump, Transmission Oil Pump, Others

|

|

By Technology

|

Mechanical, Electric

|

|

By Vehicle Type

|

Passenger Vehicle, Commercial Vehicle

|

|

By Sales Channel

|

OEM, Aftermarket

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Fuel Pump, Water Pump, Steering Pump, Windshield Pump, Vacuum Pump, Transmission Oil Pump, and Others): The steering pump segment earned USD 3.59 billion in 2023 due to its essential role in power-assisted steering systems, ensuring precise control, enhanced maneuverability, and improved driving comfort across a wide range of vehicles, including passenger cars and commercial vehicles.

- By Technology (Mechanical and Electric): The mechanical segment held a share of 65.68% in 2023, fueled by its cost-effectiveness, widespread adoption in conventional internal combustion engine (ICE) vehicles, and reliable performance in fuel, lubrication, and cooling systems, making it the preferred choice for automakers prioritizing affordability and efficiency.

- By Vehicle Type (Passenger Vehicle and Commercial Vehicle): The passenger vehicle segment is projected to reach USD 14.88 billion by 2031, owing to increasing global production and sales of passenger cars, rising demand for fuel-efficient vehicles, growing adoption of electric and hybrid models, and emission regulations mandating advanced pump technologies.

- By Sales Channel (OEM and Aftermarket): The aftermarket segment is likely to grow at a CAGR of 5.67% through the forecast period, propelled by the rising demand for replacement parts due to increasing vehicle age, frequent maintenance requirements, and the expansion of automotive service industry, ensuring consistent sales across diverse vehicle categories.

Automotive Pump Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The Asia Pacific automotive pump market share stood at around 42.50% in 2023, valued at USD 6.04 billion. The increasing adoption of electric and hybrid vehicles in the region is accelerating the demand for specialized automotive pumps. Governments are introducing incentives, tax benefits, and subsidies to promote EV adoption, prompting automakers to develop advanced cooling and transmission pump systems.

The expansion of EV manufacturing in China, India, and Japan is creating a strong demand for electric coolant and battery thermal management pumps. With growing investments in EV infrastructure and battery technology, the regional market is witnessing significant growth opportunities.

- The East Asia Forum 2024 report highlights the Indo-Pacific’s growing EV adoption, transforming regional economies and power dynamics, with China leading in production and sales. In 2023, EVs accounted for 36% of new car sales in China, representing 57% of global EV sales. Chinese EV manufacturers are projected to reach an annual production capacity of up to 36 million units by 2025.

Additionally, the expanding automotive aftermarket in Asia-Pacific is contributing to the rising demand for replacement automotive pumps. The region's aging vehicle fleet is boosting demand for maintenance and aftermarket components. Independent service providers, repair shops, and OEM dealerships are witnessing higher sales of replacement fuel, water, and oil pumps. The availability of cost-effective aftermarket solutions is promoting component replacement, supporting the sustained growth of the market.

Europe is poised set to grow at a robust CAGR of 4.61% over the forecast period. Europe’s strict climate policies, including the EU Green Deal and Euro 7 emission standards, are compelling automakers to integrate energy-efficient and low-emission vehicle components. Regulations on fuel economy and carbon emissions are accelerating the adoption of advanced fuel injection pumps, electric water pumps, and variable displacement oil pumps.

Automakers are focusing on lightweight and smart pumping solutions to meet regulatory requirements. The increasing shift toward sustainable mobility is prompting manufacturers to develop eco-friendly pump technologies that enhance vehicle performance while reducing environmental impact.

Furthermore, Europe is home to leading automotive manufacturers and suppliers actively investing in research and development to enhance vehicle efficiency and performance. Major automakers such as Volkswagen, BMW, Mercedes-Benz, Renault, and Stellantis are integrating next-generation pump technologies into their vehicle models to improve energy efficiency and optimize fluid management.

The presence of leading automotive R&D centers in Germany, Italy, and France is fostering innovations in electric, variable displacement, and high-pressure fuel pumps. Advancements in vehicle technologies are boosting demand for high-performance automotive pumps in the region.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) enforces emission standards under the Clean Air Act. As of February 2025, the EPA has submitted the approval of California's plan to phase out gasoline-only vehicles by 2035 to Congress for review. This plan mandates that zero-emission vehicles constitute 35% of the 2026 model year and 68% by 2030, impacting the design and efficiency of automotive components, including pumps.

- In Europe, the EU enforces Euro 6 emission standards, setting strict limits on exhaust emissions from vehicles. These standards require advanced automotive pump technologies to comply with the prescribed emission levels.

- China has implemented the China 6 emission standards, aligned with Euro 6. These regulations require significant reductions in vehicle emissions, prompting manufacturers to enhance pump technologies for better fuel efficiency and lower emissions.

- Japan, under the Energy Conservation Act, implements the Top Runner Program, setting stringent fuel efficiency benchmarks that influence pump design.

- India adopted Bharat Stage VI (BS-VI) standards in April 2020, directly transitioning from BS-IV, fostering the demand for advanced emission control technologies in the automotive pumps industry.

Competitive Landscape:

Major players operating in the automotive pump market are actively forming strategic alliances with global automakers to enhance their supply capabilities and meet the growing demand for advanced automotive pumps. These collaborations enable manufacturers to integrate cutting-edge technologies, improve product efficiency, and align with evolving vehicle specifications, including electric and hybrid models.

By securing long-term supply agreements and co-developing innovative pump solutions, companies are strengthening their market presence while addressing stringent regulatory standards. Such partnerships enhance distribution networks and foster innovation, accelerating the adoption of fuel-efficient and electric vehicle-compatible pumps.

- In June 2024, Rheinmetall secured a major contract worth a low three-digit million-euro sum from a renowned global automaker for electric coolant pumps used in hybrid vehicles. Production is underway and is set to continue until 2030, with a service agreement extending until 2045.

List of Key Companies in Automotive Pump Market:

- Valeo

- Mitsubishi Electric Corporation

- Continental AG

- Johnson Electric Holdings Limited

- Schaeffler Technologies AG & Co. KG,

- AISAN INDUSTRY CO., LTD.

- AISIN CORPORATION

- GMB Corporation

- Robert Bosch GmbH

- DENSO CORPORATION.

- Magna International Inc.

- Rheinmetall AG

- SHW AG

- ZF Friedrichshafen AG

- HELLA GmbH & Co. KGaA

Recent Developments (Expansion/Agreements/Collaboration)

- In September 2024, Continental expanded its product portfolio by introducing a new range of spare parts, including components for chassis and steering, camera and radar sensors, and high-pressure fuel pumps. This expansion is set to add approximately 700 part numbers by 2025, increasing overall market coverage by an average of 50%. Additionally, high-pressure fuel pumps will be introduced for the first time in 2025.

- In February 2025, Rheinmetall secured a USD 27.29 million order from a prominent Asian engine manufacturer. The contract includes a low six-figure quantity of the CWA2000 high-voltage coolant pump, designed for an 800V fuel cell-based systems in small vans, trucks, and stationary power plants. The CWA2000 features a wet-running design with optimized bearings for minimal wear in cooling water applications. Production is set to begin in 2027 at the Hartha plant and continue until 2031.

- In July 2024, Cooper Standard, in collaboration with Saleri Group, introduced the eCoFlow Switch Pump, an integrated coolant control module combining an electric water pump and an electrically driven valve. This solution facilitates fluid flow switching, splitting, and regulation, addressing the glycol thermal management requirements of fully electric and hybrid vehicles.