Market Definition

The automotive front end module market involves the development and integration of key components at the front of a vehicle, including the grille, bumper, headlights, cooling systems, and sensors for advanced safety features. These modules enhance vehicle safety, functionality, and aerodynamics, while supporting crashworthiness reinforcing impact resistance.

Automotive Front End Module Market Overview

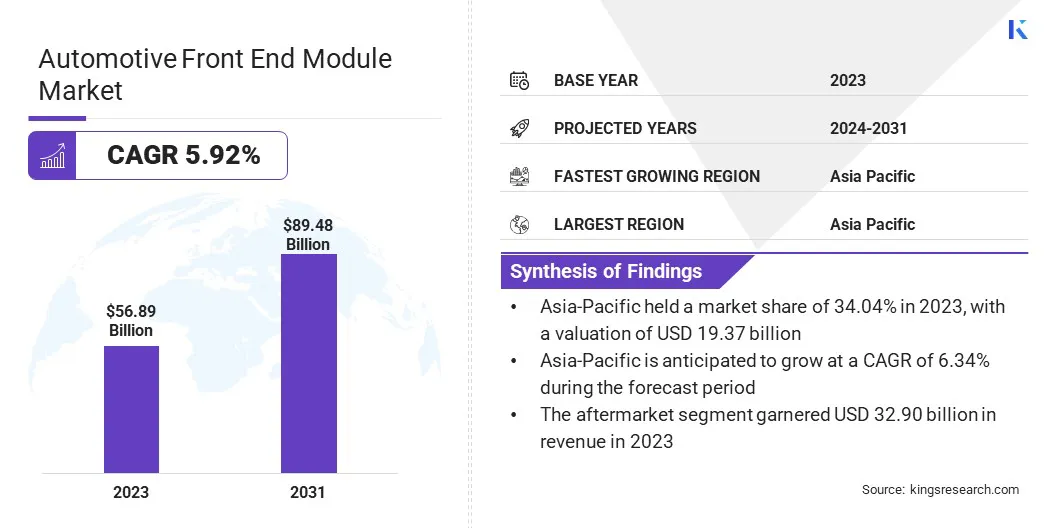

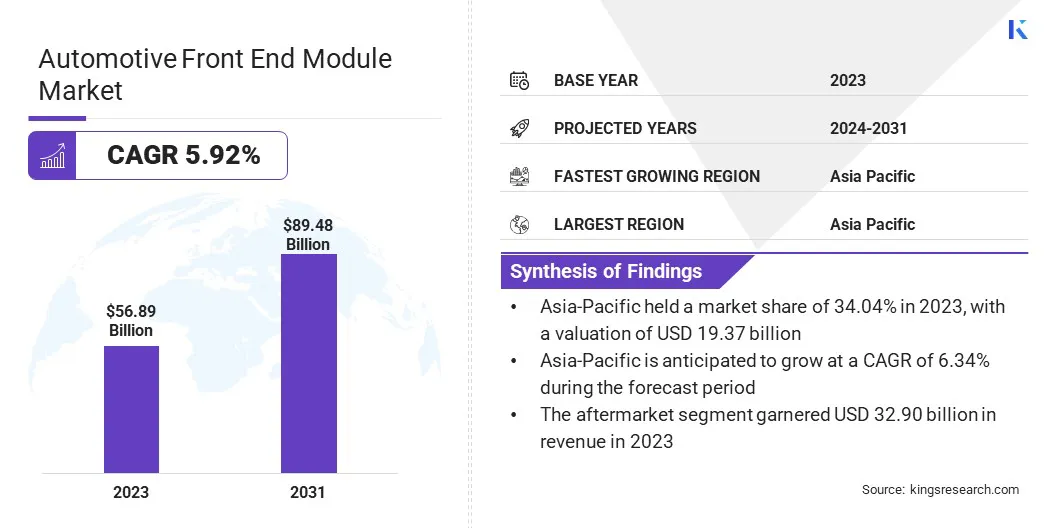

The global automotive front end module market size was valued at USD 56.89 billion in 2023 and is projected to grow from USD 59.82 billion in 2024 to USD 89.48 billion by 2031, exhibiting a CAGR of 5.92% during the forecast period.

This growth is driven by the increasing demand for lightweight materials, enhanced safety features, and the rising adoption of electric and autonomous vehicles. Advancements in automotive technologies such as smart sensors and modular design strategies by manufacturers further drive market expansion.

Major companies operating in the global automotive front end module industry are MAHLE GmbH, Continental AG, MOBIS INDIA LIMITED, FORVIA, OPmobility SE, DENSO CORPORATION., TOYOTA BOSHOKU CORPORATION, Montaplast GmbH, Valeo, Magna International Inc, SMRPBV, Murata Manufacturing Co., Ltd., Hanon Systems, ZF Friedrichshafen AG, and Marelli Holdings Co., Ltd.

The ongoing shift toward lightweight materials and fuel efficiency is driving automakers to develop more advanced and innovative front-end modules. In addition, stricter regulations and rising demand for safer, advanced vehicles drive innovation in front-end module design and integration.

- In September 2023, Magna International Inc. started production for its fift-generation (Gen5) front camera module system, developed for a European original equipment manufacturer (OEM). Magna International Inc. The Gen5 system is a scalable, one-box front camera module that offers long-range perception and side detection capabilities.

Key Highlights

- The global automotive front end module market size was recorded at USD 56.89 billion in 2023.

- The market is projected to grow at a CAGR of 5.92% from 2024 to 2031.

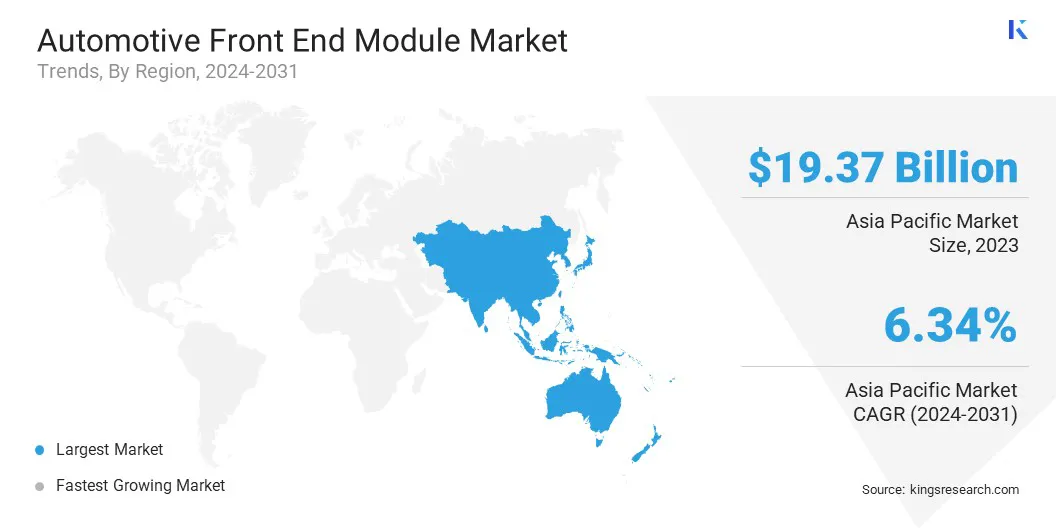

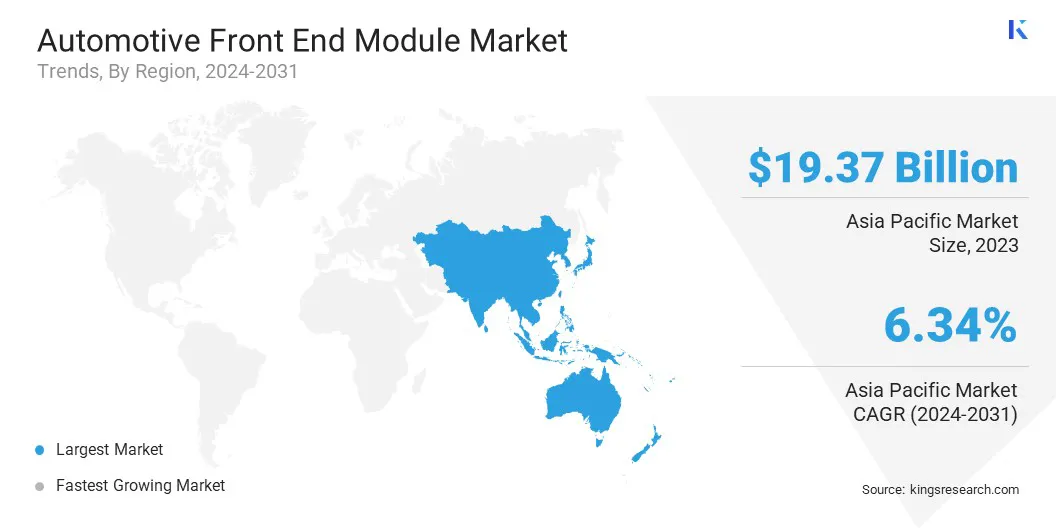

- Asia-Pacific held a market share of 34.04% in 2023, with a valuation of USD 19.37 billion.

- The composite segment garnered USD 18.15 billion in revenue in 2023.

- The headlight segment is expected to reach USD 24.46 billion by 2031.

- The heavy commercial vehicle segment is anticipated to witness fastest CAGR of 6.00% during the forecast period.

- The aftermarket segment garnered USD 32.90 billion in revenue in 2023.

- The market in Europe is anticipated to grow at a CAGR of 5.94% during the forecast period.

Market Driver

"Growing Automotive Production & Sales"

The growth in global automotive production and sales is a key driver of the automotive front-end module market, particularly in emerging economies such as China, India, and Brazil.

Increasing urbanization, rising disposable incomes, and improving transportation neyworks are contributing to higher vehicle ownership. Moreover, the increasing adoption of electric and hybrid vehicles is further driving demand for specialized front-end modules, which are optimized for aerodynamics and thermal management.

As consumers prioritize fuel efficiency, safety, and advanced features, key players are innovating front-end designs to improve aerodynamics, structural integrity, and crash performance, ensuring compliance with evolving regulations

- In July 2024, Infineon Technologies AG and Swoboda jointly develop and market high-performance current sensor modules for automotive applications. This collaboration combines Infineon's advanced current sensor integrated circuits (ICs) with Swoboda's expertise in sensor module development and industrialization, aiming to address the growing demand for sensing solutions in hybrid and electric vehicles.

Market Challenge

"High Initial Investment & Development Costs"

Designing and producing advanced front end module requires substantial research and development (R&D). This includes the use of lightweight materials, aerodynamic enhancements, and the integration of smart technologies like ADAS sensors and thermal management systems. The use of high-performance materials such as composites and thermoplastics increases manufacturing complexity and costs.

Automakers and suppliers are investing in new production techniques, tooling, and testing facilities to meet evolving safety and regulatory standards. These high upfront expenses create barriers for new entrants. They also put pressure on suppliers to balance cost efficiency with innovation.

Leveraging partnerships with material suppliers and technology firms can help reduce R&D expenses while accelerating innovation. Modular and scalable designs enable cost-efficient production across multiple vehicle models, maximizing production efficiency and cost savings.

Investing in advanced manufacturing technologies such as automation, 3D printing, and digital simulations can streamline development, reduce prototyping costs, and enhance production efficiency.

Market Trend

"Active Aerodynamics and Adaptive Features"

Active aerodynamics and adaptive features are key to improving vehicle performance and efficiency. Components like active grille shutters and adaptive cooling vents automatically adjust to driving conditions, optimizing airflow, reducing drag, and enhancing fuel efficiency. These systems are especially important for electric vehicles (EVs), where range optimization is crucial.

Active aerodynamics also improves vehicle stability at higher speeds by adjusting spoilers or flaps for downforce. These features boost energy efficiency and allow for sleeker, more dynamic designs, making the front-end module both functional and aesthetically appealing.

- In January 2025, Hyundai Mobis (KRX 012330) unveiled its ‘holographic windshield display’ technology at the CES 2025. This windshield display technology is able to transform the vehicle’s front windshield into a transparent, high-resolution screen, projecting real-time navigation, safety alerts, and driving information directly in the driver's line of sight. The technology enhances situational awareness, reduces distractions, and represents a significant step toward augmented reality integration in vehicles.

Automotive Front End Module Market Report Snapshot

|

Segmentation

|

Details

|

|

By Material

|

Steel, Composites, Plastic, Hybrid

|

|

By Component

|

Headlight, Fenders, Radiators & Cooling Fan, Condenser, Horn Assembly, Others

|

|

By Vehicle

|

Passenger Cars, Light Commercial Vehicle, Heavy Commercial Vehicle

|

|

By Distribution Channel

|

OEM, Aftermarket

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Material (Steel, Composites, Plastic, Hybrid): The composites segment earned USD 18.15 billion in 2023 due to their lightweight properties, enhancing fuel efficiency and meeting sustainability goals.

- By Component (Headlight, Fenders, Radiators & Cooling Fan, Condenser, Horn Assembly, Others): The headlight segment held 27.78% of the market in 2023, due to increasing demand for advanced lighting technologies like LED and adaptive headlights for improved safety and aesthetics.

- By Vehicle (Passenger Cars, Light Commercial Vehicle, Heavy Commercial Vehicle): The passenger cars segment is projected to reach USD 34.45 billion by 2031, owing to rising demand for advanced safety features, electric vehicle adoption, and enhanced fuel efficiency.

- By Distribution Channel (OEM, Aftermarket): The OEM segment anticipated to grow at a CAGR of 6.00% during the forecast period, driven by increasing demand for new vehicle models and technological advancements in front-end modules.

Automotive Front End Module Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific automotive front end module market share stood around 34.04% in 2023 in the global market, with a valuation of USD 19.37 billion. Asia Pacific's automotive front-end module market is expected to continue its dominance due to the region's rapid industrialization, growing automotive production, and increasing consumer demand for electric vehicles (EVs).

Countries like China, India, and Japan are major contributors to the market, with significant investments in automotive manufacturing. The region's strong supply chain infrastructure, coupled with the presence of leading OEMs and tier-1 suppliers, further supports market growth.

The automotive front end module industry in Europe is poised for significant growth at a robust CAGR of 5.94% over the forecast period, driven by the region's integration of driver assistance systems (ADAS), and increasing focus on EV production.

European countries, particularly Germany, France, and the UK, are leading the push for sustainable automotive solutions, with automakers investing heavily in advanced materials and green technologies.

The growing demand for autonomous driving features, coupled with the integration of smart sensors and active aerodynamics in vehicle designs, further contributes to the market's expansion. The rise in aftermarket services and vehicle upgrades presents new opportunities for growth in the region.

- In December 2023, Stellantis N.V. and Valeo unveiled the automotive industry's first remanufactured windshield-mounted video camera, developed at Valeo's Circular Electronics Lab in Nevers, France. This initiative aligns with both companies' circular economy strategies, aiming to reduce natural resource consumption by up to 99% compared to producing new cameras.

Regulatory Frameworks

- The Economic Commission for Europe of the United Nations (UN/ECE) Regulation No 94 Uniform provisions concerning the approval of vehicles with regard to the protection of the occupants in the event of a frontal collision.

- ISO (International Organization for Standardization) has established ISO 26262, a functional safety standard for automotive systems. This regulation focuses on ensuring the safety of electrical and electronic systems within vehicles, especially for safety-critical applications.

- The Economic Commission for Europe of the United Nations (UNECE) Regulation No 48 Uniform provisions concerning the approval of vehicles with regard to the installation of lighting and light-signalling devices.

Competitive Landscape

The global automotive front end module market is characterized by a number of participants. Key players are investing in R&D, forming strategic partnerships, and enhancing global supply chains to develop advanced solutions.

New entrants are introducing disruptive technologies, such as lightweight materials, smart sensors, and active aerodynamics. The growing demand for electric vehicles and sustainability goals is driving the development of eco-friendly and customized front-end modules.

As the market evolves, competition is expected to intensify, leading to more advanced and consumer-centric products. In February 2025, Magna announced the expansion of its long-term innovation partnership with Mercedes-Benz, aimed at advancing automotive technologies and sustainable mobility.

- In March 2025,pSemi Launches world's first high performance UltraCMOS PA-LNA-SW IoT front-end module This advanced solution features an industry-leading noise figure, enabling extended wireless range and enhancing the performance of connected experiences in a variety of applications.

List of Key Companies in Automotive Front End Module Market:

- MAHLE GmbH

- Continental AG

- HYUNDAI MOBIS

- FORVIA

- OPmobility SE

- DENSO CORPORATION.

- TOYOTA BOSHOKU CORPORATION

- Montaplast GmbH

- Valeo

- Magna International Inc

- SMRPBV

- Murata Manufacturing Co., Ltd.

- Hanon Systems

- ZF Friedrichshafen AG

- Marelli Holdings Co., Ltd.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In February 2025, MAHLE announced that it had received a series order to supply a cooling module for megawatt charging stations. This order marks a significant step in supporting the expansion of high-power charging infrastructure for electric vehicles (EVs), with MAHLE's advanced technology playing a crucial role in managing the heat generated during the rapid charging process. .

- In May 2024, In May 2024, Hyundai Mobis introduced its Front Face Integration Module, a next-generation system that combines multiple front-end components to enhance the efficiency and design flexibility of electric vehicles (EVs). The module integrates an active air flap and active aero hood to optimize cooling and reduce aerodynamic drag, while active wheel curtains and an active air skirt minimize turbulence.