Market Definition

The automotive embedded system market involves the integration of specialized computing systems within vehicles to control and manage various functions, such as infotainment, safety, navigation, powertrain, and autonomous driving.

This market is driven by the increasing consumer demand for connected, automated, and electric vehicles, as well as advancements in technology like AI, IoT, and sensors, which enhance vehicle performance and user experience.

Automotive Embedded System Market Overview

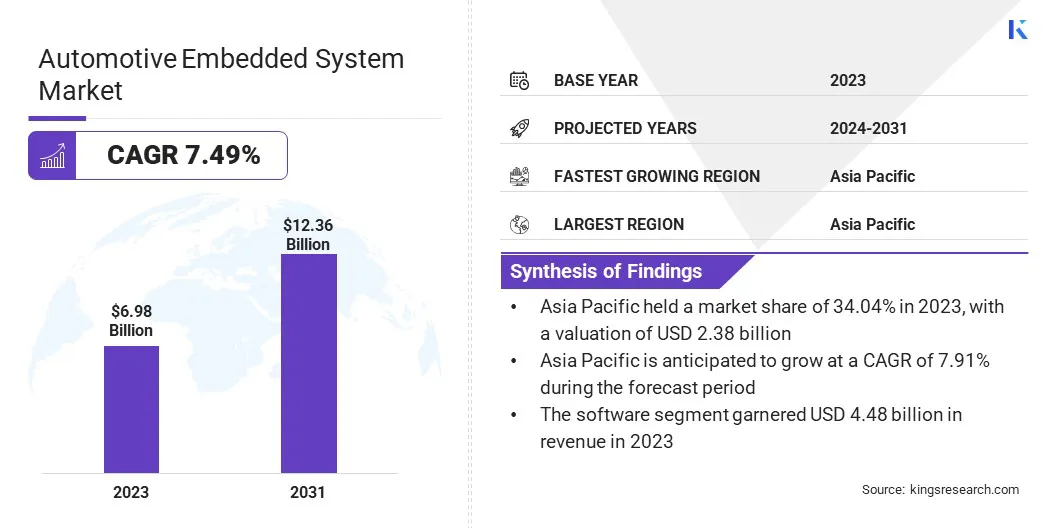

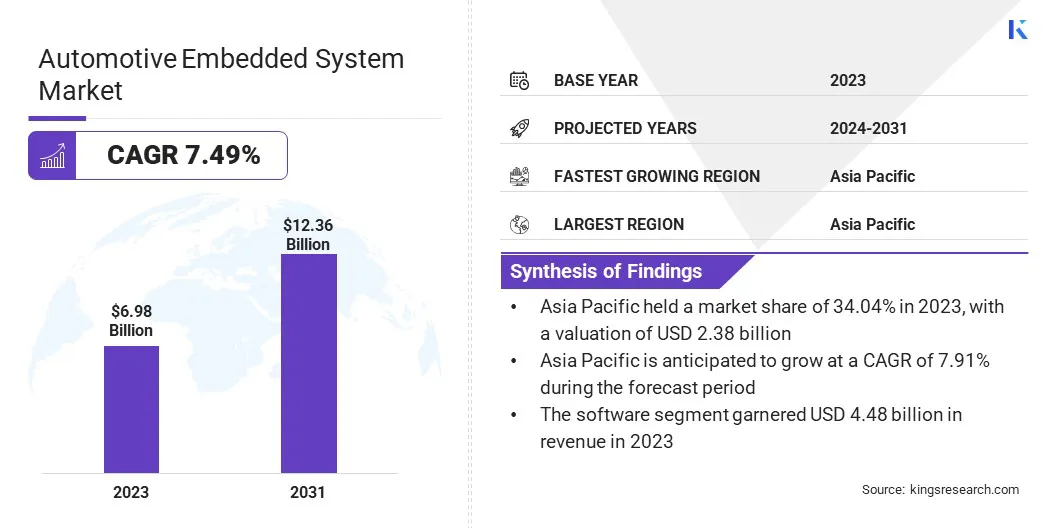

The global automotive embedded system market size was valued at USD 6.98 billion in 2023, which is estimated to be USD 7.45 billion in 2024 and reach USD 12.36 billion by 2031, growing at a CAGR of 7.49% from 2024 to 2031.

The rise of Advanced Driver-Assistance Systems (ADAS) is a major driver of the market. Embedded displays are crucial for visualizing real-time data from ADAS technologies, enhancing features like parking assistance, lane-keeping, and collision detection, improving safety and driving experience.

Major companies operating in the global automotive embedded system industry are NXP Semiconductors, Texas Instruments Incorporated, Continental AG, Robert Bosch GmbH, Mitsubishi Electric Corporation, N-iX LTD, Intellias, Softeq Development Corp., Sigma Software, MicroGenesis Tech Soft Pvt Ltd , HARMAN International, Quest Global, HCL Technologies Limited, Renesas Electronics Corporation., and Microchip Technology Inc.

The market is undergoing rapid advancements as vehicles become increasingly connected, intelligent, and automated. Embedded systems are integral to various vehicle functions, such as infotainment, safety, navigation, and ADAS.

The demand for these systems continues to rise with the growing adoption of electric, autonomous, and connected vehicles. Key players in the market are focusing on innovation to meet the evolving needs of the automotive industry, driving the integration of more advanced technologies into modern vehicles.

- In March 2025, Infineon Technologies introduced a new RISC-V-based automotive microcontroller family under its AURIX brand. This innovation aims to enhance software-defined vehicles (SDVs) by improving performance, security, and scalability, while reducing complexity and time-to-market.

Key Highlights:

- The global automotive embedded system market size was valued at USD 6.98 billion in 2023.

- The market is projected to grow at a CAGR of 7.49% from 2024 to 2031.

- Asia Pacific held a market share of 34.04% in 2023, with a valuation of USD 2.38 billion.

- The software technology segment garnered USD 4.48 billion in revenue in 2023.

- The passenger car segment is expected to reach USD 4.74 billion by 2031.

- The transceivers segment held a market share of 31.86% in 2023.

- The infotainment & telematics segment is anticipated to register a CAGR of 8.02% during the forecast period.

- The market in Europe is anticipated to grow at a CAGR of 7.52% during the forecast period.

Market Driver

"Rise of ADAS"

The rise of advanced driver-assistance systems (ADAS) is a major driver of the automotive embedded system market, particularly through embedded displays. These displays visualize real-time data from cameras, sensors, and radar, providing essential information for features like parking assistance, lane-keeping, and collision detection.

By enhancing driver awareness and vehicle safety, these displays make ADAS technologies more effective. As automakers increasingly integrate such systems into vehicles, the demand for high-quality embedded displays continues to grow, further driving the market.

- In November 2024, Wipro collaborated with FORVIA to enhance ADAS applications using cloud-native microservices and vehicle container architecture. This transformation improved vehicle safety features, reduced maintenance costs, and enabled efficient integration & development of ADAS functions for software-defined vehicles.

Market Challenge

"Cybersecurity Concerns"

As vehicles become more connected, cybersecurity concerns pose a significant challenge for the automotive embedded system market. The integration of advanced technologies like ADAS and infotainment systems exposes vehicles to potential cyberattacks, risking data breaches, system failures, or even vehicle hijacking.

Automakers and suppliers are adopting robust cybersecurity measures, such as end-to-end encryption, secure software updates, and intrusion detection systems. Collaboration with cybersecurity experts and the implementation of stringent protocols are essential to safeguard these embedded systems and maintain consumer trust.

Market Trend

"Rise of Software-defined Vehicles"

The rise of software-defined vehicles (SDVs) is a significant trend in the automotive embedded system market. As vehicles increasingly rely on software for functions such as safety, performance, and user experience, embedded systems are becoming the backbone of these innovations.

Software updates, real-time data processing, and system control are now managed through advanced embedded technologies. This shift allows for greater flexibility, faster updates, and enhanced customization, positioning embedded systems as critical components in the development of future vehicles.

- In March 2025, Synopsys and Vector Informatik announced a strategic collaboration to accelerate the development of SDVs. By integrating electronic digital twins and automated cloud-ready solutions, they aim to streamline software validation, reduce development costs, and improve productivity for OEMs and Tier 1 suppliers, driving the automotive industry's shift toward SDVs.

Automotive Embedded System Market Report Snapshot

|

Segmentation

|

Details

|

|

By Type

|

Hardware, Software

|

|

By Vehicle Type

|

Passenger car, Two-wheeler, Commercial Vehicles

|

|

By Component

|

Transceivers, Sensors, Memory Devices, Microcontrollers

|

|

By Application

|

Safety & Security, Infotainment & Telematics, Powertrain & Chassis Control, Body Electronics, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation:

- By Type (Hardware, Software): The software segment earned USD 4.48 billion in 2023, due to the increasing demand for advanced in-vehicle connectivity and autonomous features.

- By Vehicle Type (Passenger car, Two-wheeler, Commercial Vehicles): The passenger car segment held 38.43% share of the market in 2023, due to the rising consumer demand for enhanced safety and infotainment systems.

- By Component (Transceivers, Sensors, Memory Devices, Microcontrollers): The transceivers segment is projected to reach USD 3.92 billion by 2031, owing to the growing use of connected vehicles and vehicle-to-everything (V2X) communication.

- By Application (Safety & Security, Infotainment & Telematics, Powertrain & Chassis Control, Body Electronics, Others): The infotainment & telematics segment is anticipated to register a CAGR of 8.02% during the forecast period, driven by increased consumer preference for integrated digital experiences.

Automotive Embedded System Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a automotive embedded system market share of around 34.04% in 2023, with a valuation of USD 2.38 billion. Asia Pacific is the dominant region in the market, driven by the presence of leading automotive manufacturers, rapid adoption of advanced technologies, and increasing demand for connected and electric vehicles.

Countries like China, Japan, and South Korea are major contributors, due to their strong automotive industries, coupled with government initiatives supporting smart mobility and electric vehicle development. The region's focus on innovation, manufacturing capabilities, and large consumer base further solidifies its leadership in the global market.

- In November 2024, Cyient and Allegro MicroSystems expanded their partnership with the inauguration of a Center of Excellence in Hyderabad, India. This facility will focus on advancing magnetic sensors and power semiconductors, crucial for automotive embedded systems, enhancing innovation and development.

The automotive embedded system industry in Europe is poised for significant growth at a robust CAGR of 7.52% over the forecast period. The shift toward electric and autonomous vehicles, coupled with strong regulatory support, is propelling the demand for advanced embedded solutions.

Countries like Germany, France, and the UK are leading the way, investing heavily in automotive innovation. The European market is also registering a surge in partnerships between tech firms and OEMs, fostering rapid adoption of software-defined vehicles and other cutting-edge technologies in the automotive sector.

Regulatory Frameworks

- In the U.S., the National Highway Traffic Safety Administration (NHTSA) investigates safety defects in motor vehicles and governs vehicle safety, including electronic systems in vehicles.

- In the U.S., the Environmental Protection Agency (EPA) protects people and the environment from significant health risks, sponsors and conducts research, and develops and enforces environmental regulations.

- In the EU, Vehicle General Safety Regulation introduced a range of mandatory ADAS to improve road safety and established the legal framework for the approval of automated and fully driverless vehicles in the region.

Competitive Landscape

In the automotive embedded system market, companies are increasingly engaging in strategic acquisitions to enhance their technological capabilities, expand their product portfolios, and strengthen their market presence.

These acquisitions often focus on advanced technologies such as artificial intelligence, software-defined vehicles, autonomous systems, cybersecurity solutions, and semiconductor manufacturing. The goal is to stay competitive, address evolving market demands, and accelerate innovation in automotive electronics.

- In December 2024, Accenture’s acquisition of AOX strengthened its capabilities in developing software-defined vehicles. This move bolsters Accenture’s expertise in embedded software solutions, real-time operating systems, and high-performance computing, crucial for advancing automotive system architectures in the evolving market.

List of Key Companies in Automotive Embedded System Market:

- NXP Semiconductors

- Texas Instruments Incorporated

- Continental AG

- Robert Bosch GmbH

- Mitsubishi Electric Corporation

- N-iX LTD

- Intellias

- Softeq Development Corp.

- Sigma Software

- MicroGenesis Tech Soft Pvt Ltd

- HARMAN International

- Quest Global

- HCL Technologies Limited

- Renesas Electronics Corporation.

- Microchip Technology Inc

Recent Developments (Partnerships/New Product Launch)

- In November 2023, Sibros partnered with Accolade Electronics to enhance connected vehicle technology. This collaboration integrates Sibros' solutions with Accolade's embedded hardware, leveraging FreeRTOS for improved power efficiency, reduced costs, and faster deployment, addressing the automotive industry's evolving needs.

- In March 2025, GigaDevice showcased advancements in flash and MCU technologies at Embedded World, focusing on applications in automotive, edge AI, green energy, and IoT. Its innovations, including high-performance MCUs and secure connectivity solutions, target automotive and industrial sectors.

- In January 2024, Continental unveiled the world's first automotive display embedded in transparent Swarovski crystal at CES 2024. This innovative Crystal Center Display features cutting-edge microLED technology, offering exceptional brightness, contrast, and a floating appearance, blending luxury and technology seamlessly.